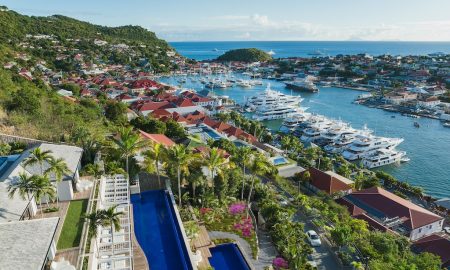

A new Barclays Wealth report indicates that wealthy investors aren’t giving up on real estate as an asset class, despite the unsteady market conditions.

A new report released by Barclays Wealth surveyed 2,000 individuals all over the world who had investable assets greater than $800,000 between August and September 2009. The report details how, despite the current market conditions, extremely wealthy investors are not giving up on real estate as an asset class.

According to the report, 35 percent of investors surveyed actually want to increase the proportion of real estate in their portfolios over the next two years, while 48 percent of those surveyed said they plan to maintain it. Barclays Wealth noticed that the wealthy investors who had $48 million or more in assets were the most involved in real estate, with an astounding 40 percent of individuals falling into this category “allocating more than half of their portfolios to real estate investments.”

Real estate remains a very attractive investment for the future to many people who have the means to maintain their status during financially tough times, like what we’ve seen over the past year. Out of those surveyed for the Barclays Wealth report, an impressive three-quarters said they want to invest in the residential market, while an equally impressive 68 percent said they are focusing more on the commercial market.

Via: The Real Deal