With an unstable market, many are wondering: which luxury stocks are best to bet on?

Below are eight American-based luxury companies to add your stock profile, recommended by The Street.

1. PVH Corp.

Rating: Buy, B-

Market Cap: $8.7 billion

Year-to-date return: -19%

PVH Corp is a clothing company, which owns and operates brands such as Tommy Hilfiger, Calvin Klein, Van Heusen, IZOD, Arrow as well as license brands such as BCBG, Max Azria, Sean John, MICHAEL Michael Kors, Michael Kors Collection, Ted Baker, Chaps and much more.

The clothing company reported significant earnings per share improvement in the most recent quarter compared to the same quarter one year ago. The company also increased its bottom line earrings by $5.27 vs. $1.71 last year.

PVH Corp net income also experienced significant growth. The net income increased by 237.5 percent (from -$37 million to $51.50 million) when it’s compared to the same quarter one year ago.

2. Ethan Allen Interiors

Rating: Buy, B

Market Cap: $802 million

Year-to-date return: -12.3%

Ethan Allen is a global furniture chain store with nearly 300 stores across America, Canada, United Kingdom, Asia and the Middle East. In addition to manufacturing furnisher, it also operates as an interior design company.

The company’s revenue has outperformed the industry by 0.3 percent. While the growth did not seem to affect the bottom line, the net operating cash flow increased by 149.96 percent to $3.65 million. The wholesale and retailer exceeded the industry’s average cash flow with a rate of 38.71 percent.

Additionally, the debt-to-equity ratio is below the industry average at 0.35.

According to The Street’s analysis team, compared to last year the company’s stock is operating at a higher level.

3. Luxottica Group SpA

Rating: Buy, B

Market Cap: $30.4 billion

Year-to-date return: 16.6%

Luxottica Group designs, manufactures and distributes luxury prescription and sports eyewear.

During the past fiscal year, Luxottica Group increased its bottom line by earning $1.62 vs. $1.58 in one year. The market expects an improvement in earnings from $1.62 to $1.99. The net income increased by 58.6 percent when compared to the same quarter of last year, growing from $48.40 million to $76.78 million.

While revenue dropped significantly faster than the industry average of 13.8 percent, the declining revenue has not hurt the company’s bottom line.

4. Michael Kors

Rating: Buy, B

Market Cap: $13.3 billion

Year-to-date return: -10.8%

Michael Kors is a luxury retail brand that produce accessories and ready-to-wear. The brand produces a range of products under the signature Michael Kors Collection and MICHAEL Michael Kors labels.

The revenue growth was higher than the industry’s average of 13.8 percent. Compared to the same quarter one year ago, revenues increased by 29.9 percent.

Michael Kors has improved earnings per share by 33.3 percent in the most recent quarter compared to the same quarter last year.

When compared to the same quarter one year ago, the net income increased by 32.2 percent, rising from $229.64 million to $303.68 million.

This fiscal year, Kors increased its bottom line by earning $3.21 vs. $1.97.

In addition, the company has a debt-to-equity ratio of zero.

5. Tiffany

Rating: Buy, B

Market Cap: $11.5 billion

Year-to-date return: -19%

Tiffany & Co. is known as a luxury jeweler and through subsidiaries, designs, manufactures, and retails jewelry worldwide.

Compared to the same quarter a year ago, Tiffany & Co. reported significant improvements in earnings per share. This past fiscal year, the company increased its bottom line earnings from $1.40 to $3.73.

The net income increased by 289.4 percent when compared to the same quarter last year, increasing from -$103.60 million to $196.18 million.

The current debt-to-equity ratio is at an industry low of 0.39.

The gross profit margin for the luxury jewelry company is currently at 64.66 percent, which is an industry high. In addition, the net profit margin of 15.26 percent also ranks above the industry average.

Net operating cash flow has significantly increased by 966.35 percent to $437.34 million.

6. VF Corp.

Rating: Buy, B

Market Cap: $32.2 billion

Year-to-date return: -0.7%

V.F. Corporation designs, manufactures, market and distribute outdoor apparel, footwear, equipment, accessories and more. Some of the brands owned under VF Corp. are The North Face, Timberland, Kipling, Napapijri, Jansport, Riders by Lee, 7 for all Mankind, Rock & Republic brands and more.

Though the revenue has increased, the company underperformed when compared to the industry average of 13.8 percent. Compared to last year, revenues slightly increased by 8.8 percent. However, the growth in revenue does not appear to have filtered down to the company’s bottom line.

While VFC’s debt-to-equity ratio is at a low of 0.26, it remains higher than the industry average.

Net operating cash flow has increased to $1,330.78 million or 22.31 percent when compared to the same quarter of last year. In addition, VF Corp. has immensely surpassed the industry average cash flow growth rate of -44.53 percent.

The gross profit margin for VF Corp is at a high. Currently it is at 50.57 percent.

7. Nordstrom

Rating: Buy, A+

Market Cap: $15.3 billion

Year-to-date return: 0.4%

Nordstrom is a high-end department store that sells luxury items such as clothing, shoes, and accessories for children, women and men. It operates in the U.S. and Canada.

The department stores’ revenue growth has slightly outperformed the industry average of 2.3 percent. Compared to the same quarter one-year ago, revenues faintly increased by 8.9 percent. However, the rise in revenue did directly affect the company’s bottom line. There was a decline in earrings per share.

Compared to its closing price last year, the company share price has increased by 27.72 percent, surpassing the performance of the overall market during that same period.

The gross profit margin is at 41.58 percent, which The Street considers to be strong.

When compared to the same quarter last year, net operating cash flow has increased to $704.00 million (or 16.94 percent).

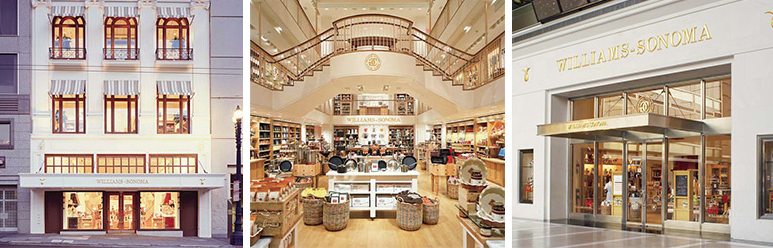

8. Williams-Sonoma

Rating: Buy, A+

Market Cap: $7.3 billion

Year-to-date return: 2.9%

Williams-Sonoma is a high-end retail company that sells kitchenware, furniture and linens, in addition to specialty foods, soaps and lotions.

While the company underperformed when compared to the industry average of 13.1 percent, revenues slightly increased by 5.2 percent. Growth in the company’s revenue appears to have improved the earnings per share.

The retailer has improved earnings per share by 13.8 percent in the most recent quarter compared to the same quarter in 2014.

The debt-to-equity ratio is at a 0.00 and is currently below the industry average.

This past fiscal year, the retailer increased its bottom line earnings to $3.26 versus $2.85 last year.

(Cover photo via Pvh Corp.)