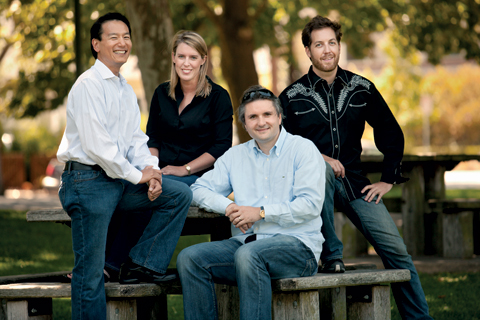

By Kristen Philipkoski

Photography by Chris Hardy

You’d be hard pressed to choose which of these top Silicon Valley investors you’d rather spend an evening with. Whether you wanted to sell your elevator pitch or just to chill with someone whose off-the-clock lifestyle includes running Ironman triathlons, kite surfing, racing cars, or imbibing the world’s finest wine, any of these A-list financiers would make fascinating dinner companions. They’ve provided seed money to Silicon Valley’s most successful start-ups-yes, including Google and Facebook-and they’re just getting started. Here they share their secrets to success, which happens to involve being generally extreme.

Ron Conway

Ron Conway, otherwise known as the Godfather of Silicon Valley, has probably made more Web 2.0 (social media) investments than anyone else. In just three years during the late 1990s, he famously invested in more than 240 startups. As the founder and managing partner of Angel Investor LP funds, he invested in companies that are now household names. One even became a commonly used verb. You guessed it: Google. Others are AskJeeves, PayPal (which sold to eBay in 2002 for $1.5 billion), and Brightmail. He has made investments for superstars including Shaquille O’Neal, Arnold Schwarzenegger, Tiger Woods, and Henry Kissinger. And now, post-dotcom downturn, he continues to show his knack for picking winning teams. His latest investments include Facebook, Twitter, Digg, AdMob, Mint, and RockYou. Conway was sixth on the Forbes list of top dealmakers in 2006, and he has invested in more than 500 companies in his career.

The secret to Conway’s success? “Ron probably has the best pattern recognition and gut instinct of anyone,” says David Lee, an investment partner of Conway’s. The most important thing they look for in a startup is passionate founders who are overall good people. “He’s not gonna back mercenaries,” Lee said. “He wants to back people who he would hang out with or who he finds to be honorable.”

Conway recently relocated from Silicon Valley to San Francisco with his wife and three sons. He’s built quite a roster of philanthropies that he supports: He’s vice chairman of the UCSF Medical Foundation, a board member of SF Homeless Connect, and he’s on the Benefit Committee of The Tiger Woods Foundation, Ronald McDonald House, College Track, and the Black Eyed Peas PeaPod Academy Foundation.

Chris Sacca

Before becoming an investor, Chris Sacca had a pretty awesome gig at Google as “head of special initiatives.” In that role he helped create citywide WiFi access in Mountain View, California (home base for Google), and spearheaded many of the company’s M&A activities. Why give up a dream gig like that? “It got to be a little big for me,” he says. “I’m a startup guy.” Sacca wanted to be a stakeholder in the companies he was working with, so he broke out on his own with Lowercase Capital. If his first investment-Twitter-is any indication, he’s on the right track. “I’m a huge fan of those guys and I think they have the potential to-and already are-changing the world,” Sacca says. “I’m thrilled and feel really lucky to be working with them.” He works out of Twitter’s offices one day per week as an advisor.

Sacca’s career hasn’t always been rosy. He suffered through the dotcom bust in the early 2000s as a lawyer at Fenwick and West, working with companies that had unfortunate fates, including Excite@Home and Exodous Communications. He went from “huge and high-flying” to “literally doing anything for money” (within reason of course) in a short time after being laid off. It was a humbling time, and he says he “learned a ton about being scrappy and lean” before he was eventually hired by Google, which was a “pretty fantastic and life-changing experience.”

Also life-changing, one would imagine, is flying through the air, over the ocean, hanging from a giant kite. Kite surfing is one of the Bay Area pastimes that Sacca enjoys, along with regular old surfing. He lives part time in Truckee so he can ski as much as possible and be near the mountains and wide-open spaces. As for nightlife? He prefers to stay home with friends and “go nuts with the truffles and break out some sick wines.” That way he doesn’t have to break from his uniform, which is currently an embroidered cowboy shirt and jeans. (To avoid facing unnecessary decisions, he chooses a new uniform every few years. Previous was a zip-neck sweater, T-shirt, and jeans). But it’s not all about him. Sacca recently returned from a trip to Ethiopia where he was working with a group called Charity: Water, which helps bring clean drinking water to developing nations.

David Shen

David Shen left Yahoo! in late 2004 after nearly nine years at the company. He was ready to break out on his own and raise a venture fund. But he quickly found that was easier said than done. People were touchy when it came to letting someone with no venture capital experience invest their money. So instead he started his own angel investing firm, David Shen Ventures. And it turns out he loves answering only to himself. “I’m rewarded not only with money, but I get to work with great entrepreneurs and smart people who want my help batting around ideas,” Shen says. “That itself is fascinating to me. And it’s hugely satisfying when you make the right call.”

Shen says he likes angel investing because he gets his fingers dirty doing a variety of tasks rather than just one. Some of the companies where he’s currently soiling his digits are Ideeli, a members-only shopping community, bit.ly, a URL shortener, and Adnectar, a social product placement platform.

When he’s not advising young companies, Shen takes advantage of the Bay Area weather to train for triathlons. “The Bay Area is probably the best training area anywhere,” says Shen, who lives in Palo Alto. “You can go out and ride and run without worrying about the weather.” He competed in the Escape From Alcatraz triathlon in June, as well as the Coeur d’Alene Ironman Triathlon in Utah. Shen tries to do one Ironman per year; this is his 6th.

Andrea Zurek

If you want Silicon Valley street cred, Andrea Zurek has it in spades. Item 1: she was a very early employee at Google. Item 2: She’s a founding partner with XG Ventures, which invests seed money in Internet startups and is comprised of ex-Google staffers. Item 3: She has raced cars alongside Eddie and Alex Van Halen. (She has the Facebook photos to prove it!)

In June, Zurek completed the first annual Gold Rush Rally-a race on California and Nevada freeways from San Francisco to Los Angeles to Las Vegas-in her Porsche. It was inspired by the Gumball 3000, a larger race that Zurek participated in 2007 in Europe. For that, she drove across the entire continent covering 18 countries. Racers enter at their own risk and are responsible for any run-ins with highway patrol. “I earned every speeding ticket I got,” Zurek says.

When she’s not dodging the CHP, she’s sniffing out the best up-and-coming startups in the consumer Internet, mobile, and online media sectors. One of the companies XG Ventures is currently working with that Zurek is excited about is Tabulous, which is like Guitar Hero for your iPhone. “It’s very easy to use, simple to learn and highly addictive,” Zurek says. “These guys have elegantly integrated the use of the iPhone and also have leveraged a lot of hot bands,” including Coldplay, Dave Matthews Band, Katy Perry, and Lady Gaga.

Zurek loves calling the Bay Area home-she has a place in San Francisco’s Pacific Heights neighborhood and her main home in Mountain View-not just for the many days of good driving weather. She also loves the wineries (Rombauer in St. Helena and Thomas Fogarty in Woodside in particular) and restaurants. A new favorite is Madera at the recently opened Rosewood Hotel in Menlo Park. “Silicon Valley, especially around Sand Hill Road, has a real need for more restaurants,” Zurek says. Hear that, restaurateurs?

“Through hard work with entrepreneurs and following my gut as to what might be an interesting investment, I’ve become one of the brand names.”

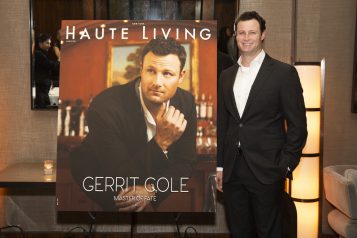

Jeff Clavier

For the past five years, Jeff Clavier has been funding very-early-stage Internet consumer companies. He’s helped sell six of them, leading to success for the founders and enviable profits for him. Clavier began investing his own money in early stage companies in 2004, making a grand total of 24 angel investments in amounts ranging from $35,000 to $100,000 in very-early-stage companies. In 2007, he raised a $15 million venture fund, named it SoftTech VC, and with that has invested sums ranging from $100,000 to $500,000 in companies including Mint.com and Foodzie.com. He’s made a grand total of 64 investments so far in his career.

“Five years ago I was pretty much a nobody in terms of early stage Internet investing,” Clavier says. “But through hard work with entrepreneurs and following my gut as to what might be an interesting investment, I’ve become one of the brand names.” Indeed, in 2008, BusinessWeek named him a “Web 2.0 Kingmaker” and one of the “25 Most Influential People on the Web.”

And if you think this French kingmaker, born in Tours in the Loire Valley, lives a glamorous life, you’d be correct, although he denies it. The image of the venture capitalist doing all of his deals on the golf course is mostly a myth, he says. But appreciation for the good life becomes apparent when Clavier talks about wine; when he moved to the United States, he brought his wife, his kids, and his wine cellar. “I have a bunch of old French wines which I still cherish and appreciate,” he says. “But I’m actually very eclectic for a Frenchman,” meaning he doesn’t pooh-pooh New World wines like those from California, Chile, Argentina and South Africa. He prefers the small wineries of Sonoma and Dry Creek to the bigger names in Napa (his favorite is A. Rafanelli). “It reminds me of the small producers in France.”