Oeno Group Transforms Wine Investment With Unmatched Offers And Global Reach

Photo Credit: Courtesy of Oeno Group

Photo Credit: Courtesy of Oeno Group

Throughout centuries, wine and whisky have been synonymous with celebration and camaraderie. Today, these timeless beverages are recognized for their potential to yield impressive financial returns.

Oeno Group, founded in 2015, offers a comprehensive suite of services catering to novices and experts curious about this alternative investment. The London-based company provides a personalized experience that differentiates it from competitors, including investment advisory, hospitality trading, and retail. Its team of experts, including master of wine and seasoned financial analysts, helps clients receive top-tier advice and access to prestigious wines.

“We want to make the wine and whisky market accessible to all investors, regardless of their prior exposure or experience,” says Michael Doerr, chief executive officer and founder of Oeno Group. Doerr is one of Spear’s 500’s top wine advisers in 2024.

Photo Credit: Courtesy of Oeno Group

Photo Credit: Courtesy of Oeno Group

Tailored Wine Collections for Every Investor

Collectors of wine and whisky will appreciate Oeno Group’s incredible ability to tailor assets to meet specific goals. Whether clients want to diversify their portfolios or seek long-term capital appreciation, the company’s extensive network and market insights can help curate the ultimate collections that align with each investor’s preferences.

“Our clients appreciate the personalized touch we bring to their investment journey,” Doerr explains. “We take the time to understand their goals and craft portfolios that meet and exceed their expectations.”

Through this strategy, Oeno Group earned a loyal client base and numerous accolades, including Best Global Wine Investment Firm for three consecutive years.

Photo Credit: Courtesy of Oeno Group

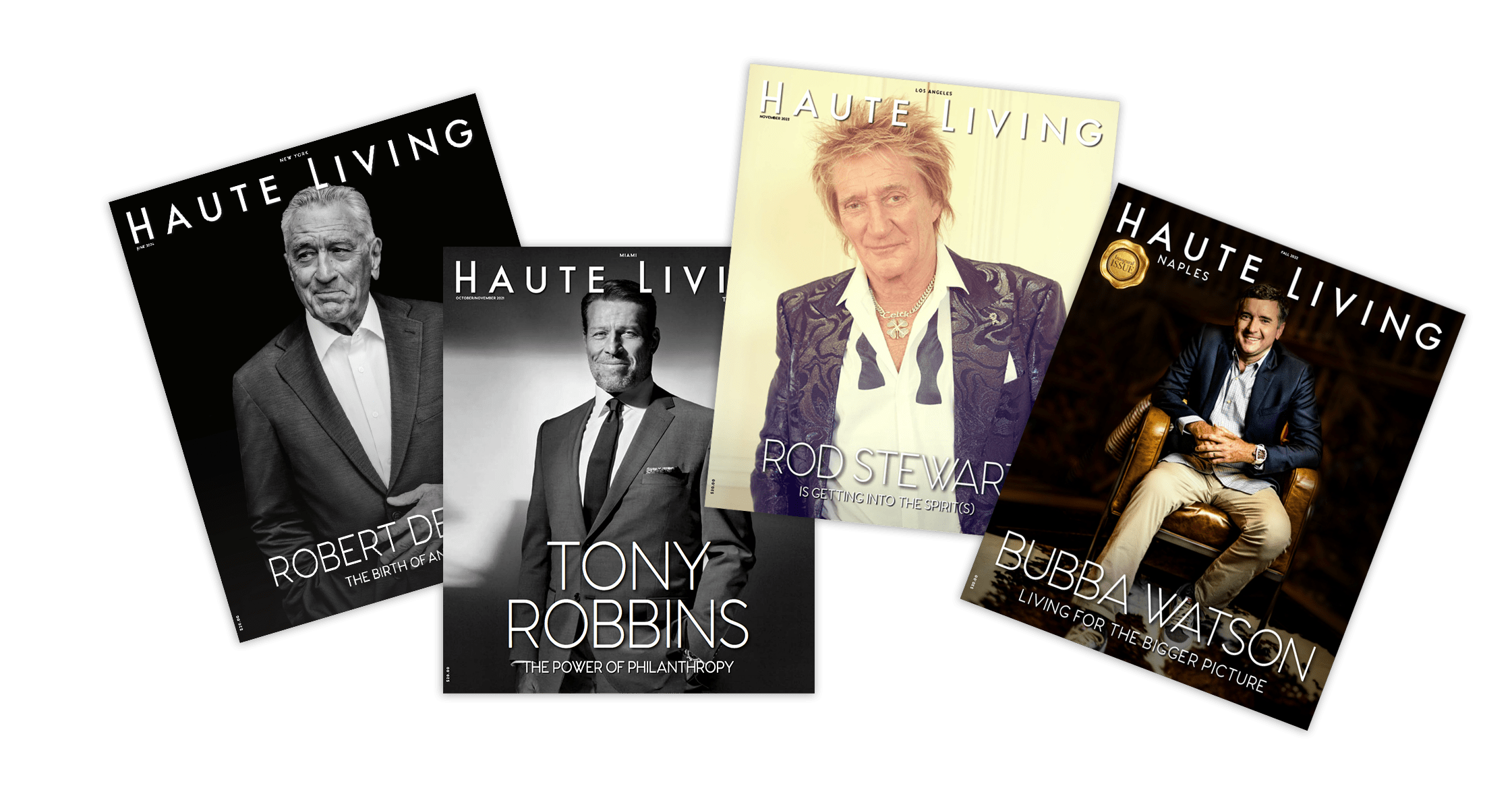

Exclusive Events and Client Engagement

Oeno Group enhances the investment experience through exclusive tasting events and trade engagements. These events deepen clients’ understanding of their portfolios and the fine wine market.

Regular tasting sessions at the luxurious OenoHouse boutique in The Royal Exchange,

London allows investors to sample rare and exquisite wines in an intimate and welcoming setting. Aside from tastings, this fine wine and whisky merchant organizes trade events that connect investors with top restaurants and hospitality clients to enhance the client experience and provide profitable liquidation pathways for investors.

“Our events are designed to educate and engage our clients, making their investment journey both enjoyable and rewarding,” says Doerr.

Photo Credit: Courtesy of Oeno Group

Photo Credit: Courtesy of Oeno Group

Global Presence and Market Expertise

With offices in Portugal, Spain, and North America, the company has a global footprint that easily handles diverse markets. This extensive presence also gives clients much-needed access to the best wines worldwide. Investors can also take excursions to these locations.

According to Doerr, the company has built strong relationships with producers and trade clients to stay ahead of market trends and deliver impressive returns to its clients.

The company’s rigorous selection process has resulted in significant capital appreciation for its investors. “Our client’s success is our success,” Doerr emphasizes. “We are proud of the exceptional results we have achieved for our investors and their trust in us.”

The company is set to explore new markets, including potential boutique locations in major cities. These expansions aim to bring Oeno Group’s unique investment model to a broader audience and further solidify its market leadership.

Want to have a taste of the finer things in life? Check out Oeno’s investment solutions.