Financial Future: Executive Interview With tZERO’s David Goone, Alan Konevsky, And Ryan Zega

Amid seismic shifts in traditional finance and the digitization of financial assets and instruments writ large, it is the pleasure of Haute Living to feature an Executive Interview with Leadership at tZERO, an international enterprise democratizing markets and market access through cutting-edge innovation.

HL: Tell us about the tZERO distinction and relationship with the St. Regis Aspen Resort, which has become one of the leading hotels to offer blockchain-enhanced securities.

David: There are several parts to that question.

The first part is the St. Regis in Aspen was the leading hotel to fractionalize and securitize its ownership of the hotel, which they did back in late 2018, record ownership information on the blockchain and afterward began to provide continuous liquidity for its investors using tZERO ATS and technology.

So, there are two interesting things here: first, fractionalizing and securitizing real estate assets and, second, using blockchain technology or tokenizing it. This year, they came up with a concept which we’re involved in called RSRV, which is how can we take that to the next level and get more participation and give people more features in addition to just ownership in shares of the hotel.

The innovative aspect is you can buy fractionalized shares in the hotel, and in return, you get a range of benefits and exclusive club-like services. Most importantly, you can redeem those shares at a later date at a fixed rate of shares for a room, which allows you to lock in an inflation hedge. So, let me walk through it simply. Let’s say the price of a room is a thousand dollars, just hypothetically. If you bought shares through RSRV and through the tZERO platform in the St. Regis Aspen, you could redeem at a dollar share, let’s say they were listed at. You could redeem for 800 shares a room, and that rate is fixed forever. So, if in 10 years or 20 years, those rooms are $5,000 a night, you can still redeem just 800 shares.

So, essentially, it becomes an inflation hedge. In addition, we are a very active secondary market trading platform, probably the most active organized continuous platform for private securities outside of the over-the-counter market. And what it allows is for someone to be able to go buy those shares for, instead of $5,000 a night and $5 a share, if $4000 a night or $4 a share, in which case they would save money. So, on the secondary platform, people would be able to buy and sell the shares, which should, in concept, reflect the rate of increase in hotel prices. And if the hotel is even doing better, maybe it reflects the incremental value of the ownership stake beyond the utility function. But it’s just a very interesting concept to combine some of the aspects of what digital assets can provide. So, that’s interesting to us, and we’re excited about the RSRV platform with the St. Regis.

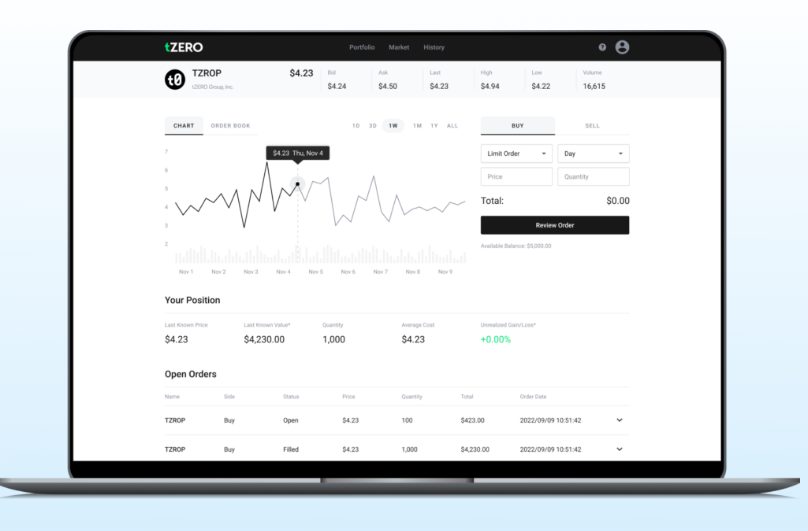

Photo Credit: t-ZERO

HL: What does it mean when your company suggests you can raise capital on your terms? Can you walk us through that process?

David: Let’s take an example. If you have an active website and a lot of people coming to it, We can put our platform on your website or white label it so it looks like you’re on the website, but it’s all going to meet the regulatory requirements of being on ours. You obviously can choose what type of regulatory aspect you want to use to raise your equity, whether it be a more institutional or accredited investor, which is a Reg D offering, or you can choose a Reg A offering, which is more retail and allows secondary trading immediately versus a Reg D where you have some time to wait. Or you could do a Reg CF like for crowdfunding where there is a little bit of restriction on the secondary trading for a short period of time.

What’s more, you get to pick which way you want to do it. You can put it on or off the blockchain. We give you the ability to choose that way. Or conversely, you could list it on our platform or not on your platform. So, we just give people a pretty big or a broad menu of aspects for them to raise. But like we tell people all along, the issuer or the person raising capital ultimately is the marketer and the person trying to raise the capital, and they get to choose the best way they see fit for that. Alan or Ryan, do you guys want to add anything to that?

Ryan: It’s basically when we work with these groups, it’s activating your fan base or client base to become investors, activating your investor base to become sort of deeper types of clients. And that’s something that resonates with the same Regis Aspen resort that trades on our platform because, in addition to those RSRVA shares, the current ASPD shares have ownership benefit programs.

A good example of that is that if you own a certain number of shares, they offer a tiered ownership benefit program where you’ll get discounts on your hotel stay, and they also have vendor-driven events with dealerships within the Aspen area as well as specific vendors within the hotel that may give some sort of incentive to those owners. So, that’s something that resonates not only within the hotel real estate industry but also in sports and entertainment, artwork, distilleries, and breweries. I mean, you name it.

Alan: When you decide to tap public capital markets and go through an IPO, in a sense, you make a long-term choice about the kind of company you are going to have and the kind of process you are going to follow – a choice you can’t always shape or customize. You are now part of a path, if you’re successful, that’s going to take you through an IPO and you’re going to become a public company and you’re going to be accountable to public equities markets, and that’s a very different existence.

What we give folks is a choice to diversify their capital structure, whether because you need capital, whether because you want more of your customers, more of your fans, to be equity owners and stakeholders and become even better customers, better fans because they have skin in the game in how well you do. Or whether you want to prepare yourself for being a public company at some point, or remain a private business, including because your company is not ready to be public yet or is the kind of company that should not r be a public company to begin with.

So, you can design the supply of that process and what your securities look like and link it with utility features that make it more interesting for you to couple with your customers and your users. That’s number one. You can be more flexible with the demand side – do you only tap into accredited investors (tZERO has a business called VerifyInvestor that can help with that, by the way)? Do you want to tap more retail investors? Do you want to tap non-US investors? You can be flexible in the structure of how you’re going to remain as a private company and what your ongoing exposure and obligations are going to be, including from a regulatory perspective. So, you don’t make very broad and deep changes in exchange for capital, which is what happens if you do an IPO – without sacrificing important features that come with being public, such as access to organized secondary liquidity.

David: We also allow customizable pathways to secondary trading of your shares, which not many people know about.

Photo Credit: t-ZERO

Alan: Yes, we give people a choice to raise capital and the choice for how their shareholders can have optionality without necessarily going for a full IPO and exchange listing, which may be premature to David’s point that some companies are IPO-ready, and others are not.

David: Not only do we raise capital, but we also give them the ability to trade it in the secondary market. Like a lot of people, you raise capital if you’re a private company, you get your shares, and you’re kind of just okay.

HL: How do holding shares within the tZERO marketplace become akin to joining a private club about access to unique experiences and discounts?

David: Let’s use the St. Regis as an example, but let’s say another hotel joins the RSRV platform where it’s the St. Regis. They can set a minimum threshold of several shares. For example, if you own a number, 100,000 shares, or 10,000 shares, you are entitled to as a holder of 10,000 shares, certain benefits. Whether that be private events or a private club if the hotel has it. In the case of St. Regis, perhaps it’s heli-skiing or access to concerts they hold there that would have perks that are akin to someone who’s joined a private club, but the benefit here is that you’re not just spending your money to get those perks.

You’re spending money to own shares, and the perks become a byproduct. As it goes to a private club, you can spend a lot of money to become a member of the private club, and then you have to spend money for all these events. This gives you a little added benefit. Then, the hotel operator/owner gets to have a more intimate relationship, and they know not only the shareholders but also how to contact them and market to them in a very easy way and build a stronger loyalty connection in doing so.

HL: What areas or sectors would you view as the next untapped opportunities for potential members of your marketplace?

David: I think there’s a lot of opportunity in non-traditional assets or products that people have not previously thought of as financial-type assets. You’re starting to see it for the higher net worth individuals, people who have a lot of money and can invest millions of dollars that you can invest in sports teams or players or art or movies. I think all those things can be tokenized and put up in a platform, and we say democratizing access or the average person with less capital to invest, but still capital can invest, can do it.

And back to Alan’s point earlier, if you look at the Gen Zs of the world, they’re much more akin to investing in whether it be art or NFTs; you see them investing in shoes and other assets, including cryptocurrencies. We think there’s a lot of opportunity using our infrastructure, our regulatory oversight, and the fact that we have a significant investment from the stock exchange, that we can bring these non-traditional assets to a large variety of new classes of assets to these investors. And there’s demand for it. I mean, you invest in what you know, and when people understand these things, whether it be movies, sports, entertainment, or music, I think all those things create great opportunities for us.

Ryan: The one thing to add is that the investor base can be both domestic and international, which could take some of these opportunities to a much broader audience, globally.

Photo Credit: t-ZERO

Photo Credit: t-ZERO

Alan: This is not a process; this is not a technology that’s asset-specific.

This is meant to provide freedom to a range of entrepreneurs, a range of projects, whether they’re real-world assets, and there are a lot of conversations around bringing the supply of real-world assets closer to retail investors at a micro level where people can participate in these real-world assets directly without having to go through a middleman if it’s at all possible. But that’s just one piece of it. I think private – there are a lot more private businesses than there are public businesses. And I think each one of them could find a feature here, whether it’s access to capital, whether it’s access to customers and fans, whether it’s utility features, whether it’s the ability to offer curated secondary liquidity to their investors.

That is going to be important for them at the point of gestation as a company, a business, or a project.

As David said, at some point, some issuers may decide to pursue an IPO and exchange listing while some businesses can and probably should stay private for the duration of their existence, including funds. And that’s an important piece as well, is the asset management industry, private equity, and venture capital funds. There’s a lot of appeal here, not just for their portfolio companies, but for funds themselves and the liquidity that can be provided in a controlled, curated way by sponsors to their limited partners that preserves the integrity of the fund capital structure and does not expose the net asset value focused valuation of these fund assets to the unfiltered vicissitudes of some types of trading.

Written in partnership with Amsterdam Group