Fine Wine Investing During Uncertain Times

Fine wine’s track record offers stability and diversification during market crises

Fine wine investments have enjoyed a sustained bull run. The Liv-ex 1000, an index that tracks 1,000 of the world’s most-traded fine wines, gained 28.2% over the 18 months through the end of February. Many of the top wines in Burgundy have posted growth far higher price growth.

But global financial markets find themselves in turmoil once again in early 2022. When macro events such as the Global Financial Crisis (GFC), the COVID-19 outbreak or the ongoing conflict in Ukraine rock global markets, there is often no clear path on how to protect your investments. While recognizing this high level of uncertainty, we believe fine wine’s track record of stability and low correlation to equity markets means it can offer a useful investment option during market volatility and over the long term.

Fine wine in the near term

The impact of the sudden market crisis on fine wine markets has often been less severe than they have on equity or other mainstream financial assets. Most recently, the Liv-ex 1000 climbed 1.6% in February. While the wider impact from Ukraine could interrupt or moderate performance in the weeks ahead, we don’t expect to see significant week-by-week market swings as we might in other assets.

This is because fine wine is characterized by a degree of separation from sudden shifts in the macro-environment. Fine wine held up relatively well during the GFC and the initial COVID-19 outbreak. At its lowest point at the end of 2008, the Liv-ex 1000 had fallen by 10.5% compared to drops of close to 30% or more in major equity markets[1]. During the initial COVID-19 downturn, the Liv-ex 1000 had only lost 3.1% at its lowest point (30 Apr 2020) compared to many double digits declines in equities.

Fine wine’s defensive nature stems in part from the fact it is less liquid than stocks or bonds. Assets that cannot typically be sold as quickly amid a market shock help insulate them from sharp price drops. Consequently, they can form a more reliable store of value than highly liquid assets.

Low volatility and healthy returns

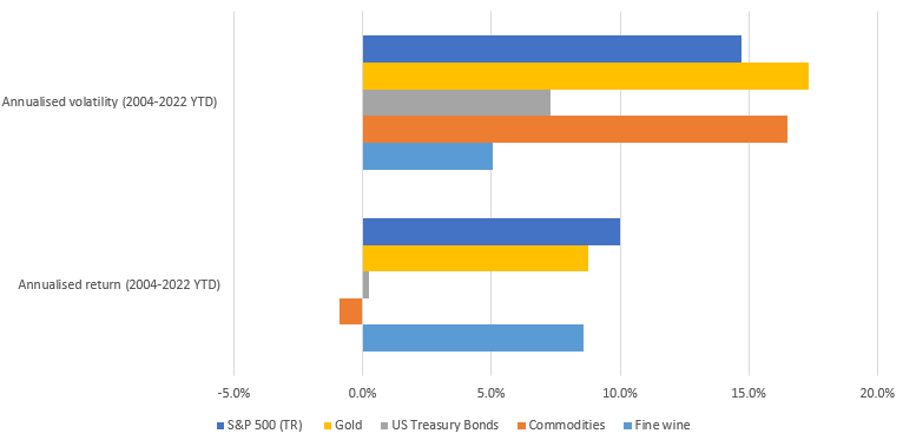

Annualized volatility and returns of fine wine vs other assets

Source: Liv-ex, investing.com as of 28 Feb 2022. Fine Wine = Liv-ex 1000; US Treasury Bonds = iShares 7-10 US Treasury Bond; Commodities = Bloomberg Commodity index; Gold = USD/ounce. Volatility is calculated as the annualized standard deviation of monthly returns. Past performance is not a guarantee of future returns.

Looking ahead

We view fine wine investing as a long-term endeavor that Fine wine can also provide an important long-term source of diversification through different market backdrops. This is because fine wine has a low historical correlation to equity markets due to its internal supply-demand dynamic being the primary driver of prices. We believe holding diverse sources of potential returns becomes even more important amid an unprecedented backdrop when the outlook for all assets, from equities through to alternatives, is unclear.

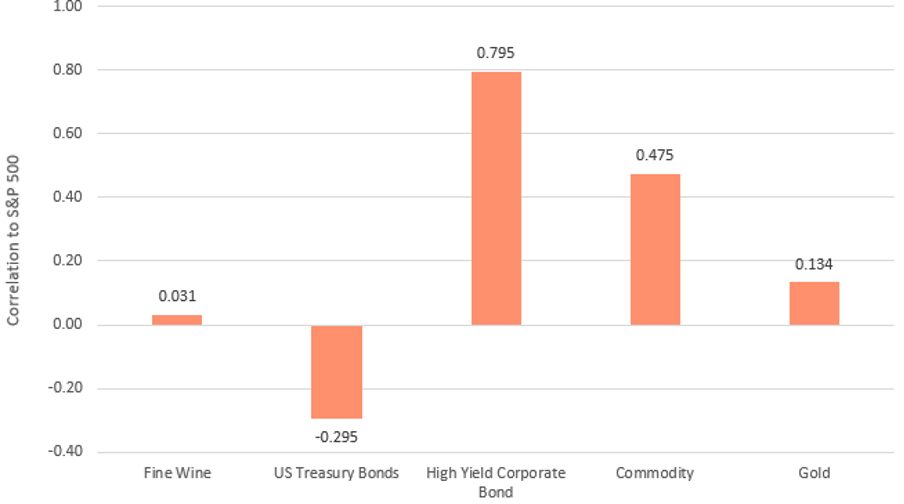

Fine wine’s low equity correlation

Correlation levels of major asset classes vs S&P 500 (28 Feb 2017 – 28 Feb 2022)

Source: Fine wine = Liv-ex 1000; Government Bonds = iShares 7-10 US Treasury Bond; High Yield Corporate Bonds = iShares High Yield Corporate Bond; Commodities = Bloomberg Commodity index; Gold = USD/ounce. Source: Liv-ex, investing.com as of 28 Feb 2022. Past performance is not a guarantee of future returns.

Fine wine is also an asset that investors do not need to shift in and out of depending on the inflation backdrop. Cautious investors might find comfort in fine wine’s favorable long-term real returns through different inflationary backdrops. In 2021, fine wine’s performance, as measured by the Liv-ex 1000, accelerated as inflation in most major economies hit multi-year highs last in the year. When inflation jumps, fine wine’s status as a real asset with limited supply levels can typically support sustained demand, which can keep inflation-adjusted performance in positive territory.

Current trends in the fine wine market

Top wines from Burgundy and California have played leading roles in the current fine wine rally. Many Champagnes have also posted some sparkling growth figures, as the region asserts itself as a core wine investment alongside its status as the world’s celebratory drink of choice.

We recognize that the economic impact of the current conflict could moderate the rally, especially among the wines that have seen the biggest price jumps in recent months. Instead, buyers might seek more stability by seeking regions, producers, and wines that may be undervalued. A shift to regions overlooked during 2021 could play a bigger role in the year ahead.

Bordeaux, still the largest wine investment region by trade share, has delivered solid returns in recent years but not to the degree seen in Burgundy and Champagne. The coming months could be when this steady stalwart of fine wine returns to the forefront of the market. Wines from the Italian regions of Tuscany and Piedmont also appear undervalued in many cases and could offer growth potential with less downside.

* Past performance is not indicative of future success; the performance was calculated in GBP and will vary in other currencies. Any investment involves the risk of partial or full loss of capital. The Cult Wines Index is a hypothetical tool. The results depicted here are not based on actual trading and do not account for the annual management fees that may be charged to a Cult Wines customer which range from 2.25% to 2.95% depending on the size of the portfolio, and there is no guarantee of similar performance with an investor’s particular portfolio.

Written in partnership with Cult Wines