From Market Flux To Luxury Boom: Jonathan Campau’s Blueprint For Miami’s Real Estate Renaissance

Photo Credit: Jonathan Campau

Photo Credit: Jonathan Campau

The Miami real estate market continues to draw attention both nationally and internationally. Known for its tropical climate, vibrant culture, and strategic location, Miami has long been considered an ideal place to live and invest. Recently, significant changes in market dynamics, particularly regarding down payments and buyer-seller behavior, have emerged.

One of the most notable trends in the Miami real estate market is the significant reduction in average down payments. According to a report from ATTOM Data Solutions, Florida has seen a decline in down payments, with Miami experiencing one of the sharpest drops. As of the first quarter of 2024, the average down payment in Miami fell to 12.8 percent of the purchase price, down from 18.4 percent in the same period the previous year.

This decline can be attributed to several factors. The influx of domestic and international buyers has heightened competition for properties, leading buyers to leverage more financing options. Relatively low interest rates have made borrowing more attractive, allowing buyers to minimize upfront costs. Additionally, lenders have introduced more flexible mortgage products, which makes homeownership more accessible and reduces the necessity for large down payments.

The reduction in down payments has coincided with an influx of buyers into the Miami market. According to the National Association of Realtors, Miami’s housing market saw a 15 percent year-over-year increase in sales volume as of May 2024. This rise in buyers is largely due to relocation trends and international interest. The COVID-19 pandemic has made Miami an attractive destination for professionals from high-tax states, such as New York and California. Additionally, Miami remains a hotspot for international investors, particularly from Latin America and Europe, drawn by political stability, economic opportunities, and favorable exchange rates.

Current market conditions have also impacted sellers. Low inventory levels have created a seller’s market. According to Zillow, the median listing price in Miami increased by 9.2 percent year-over-year, reaching $540,000 in May 2024. Sellers are capitalizing on high demand and investment opportunities.

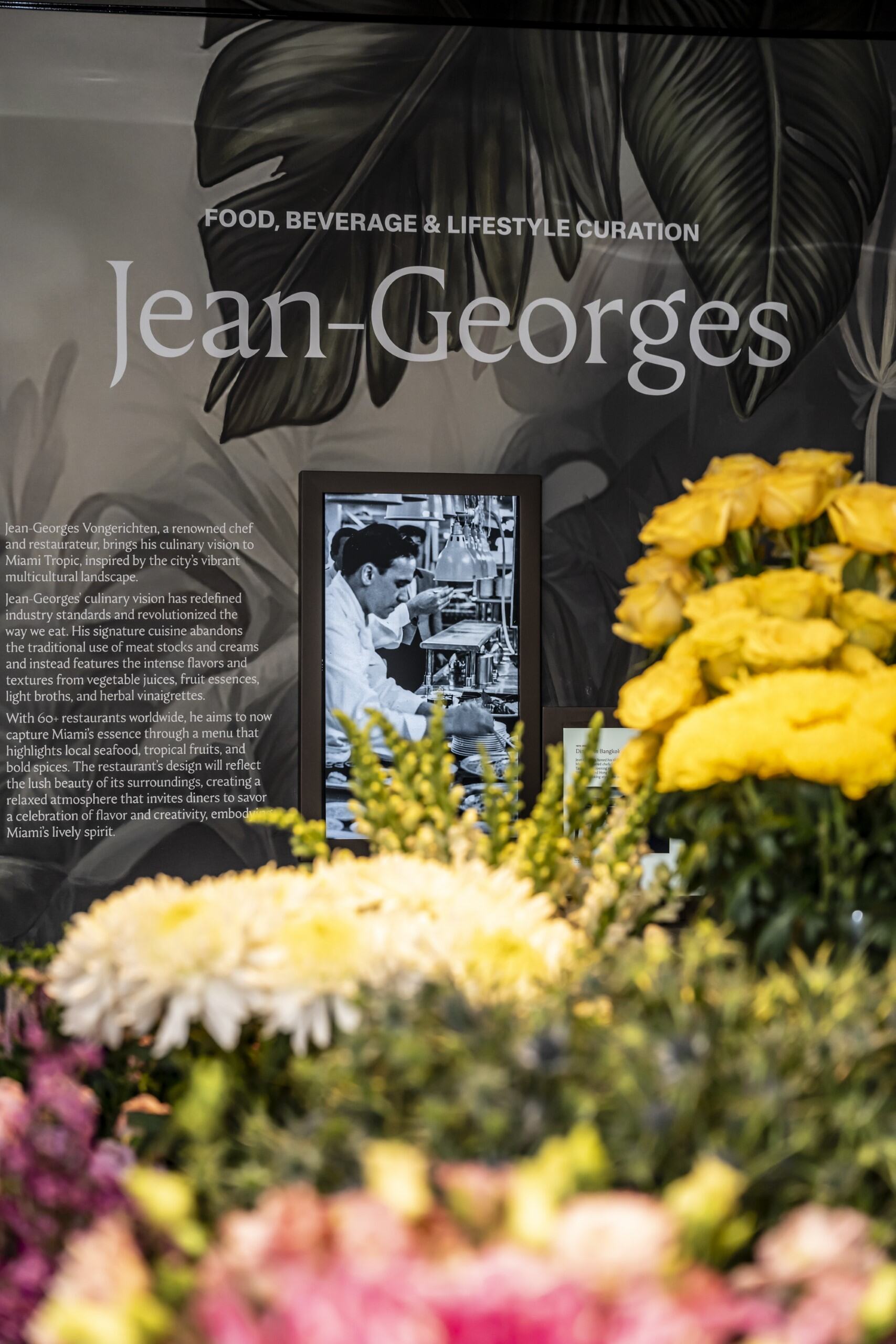

Through Luxuri International Real Estate Miami, CEO Jonathan Campau and business partner Larry Shinbaum offer innovative solutions that capitalize on these market trends. The Brokerage specializes in identifying and transforming luxury waterfront properties into profitable short-term rentals. This approach meets the growing demand for flexible living options while maximizing potential returns on investment for property owners. Investors and owners are able to enjoy their investment while monetizing it in the interim. Campau sees this growth rate increasing at an increasing rate once interest rates come down, even if it is only by 1 point. By adapting to the fluid real estate landscape, Campau and his clients have managed to thrive amidst changing market conditions. “Hold, do not sell”.

Campau’s approach to real estate is setting new benchmarks in the luxury market segment. “My confidence stems from years of excellence in my field,” says Campau. “We deliver top-quality and luxury services at competitive rates. With 18 years of experience, I believe there’s no one better suited for this than me. I love what I do and enjoy training my team to perform at the highest levels. I know this next chapter is going to be transformative.”

Campau’s activities in the Miami real estate market reflect a keen understanding of current market dynamics. His leadership at Luxuri Management and Luxuri International demonstrates a proactive approach to leveraging market trends, offering innovative solutions that cater to the evolving needs of luxury property buyers and investors.

Written in partnership with Benjamin Alex