Lasting Wealth for Generations: Why Family Communication is Key

Conversations around wealth often extend far beyond finances, touching on values, relationships, and how families prepare for the future together. When approached thoughtfully, these discussions can become an opportunity for connection, shared understanding, and long term alignment across generations.

To explore how families can navigate these conversations with intention and care, Haute Living spoke with Stacy Allred, Head of Family Engagement and Governance at J.P. Morgan Wealth Management. Allred has dedicated her career to working closely with individuals and families as they navigate the complexity and promise of wealth. Through the facilitation of family meetings, her work focuses on governance and decision making, family dynamics, the learning and development of the rising generation, philanthropy, and transition planning.

In the conversation that follows, Allred shares insight into how open communication can support stronger family engagement, help clarify shared goals, and create a more thoughtful approach to wealth across generations.

HAUTE LIVING: An estimated $105 trillion in wealth is set to transfer to the next generation by 2048, yet many families avoid financial discussions altogether. What are the primary reasons money remains such an uncomfortable topic?

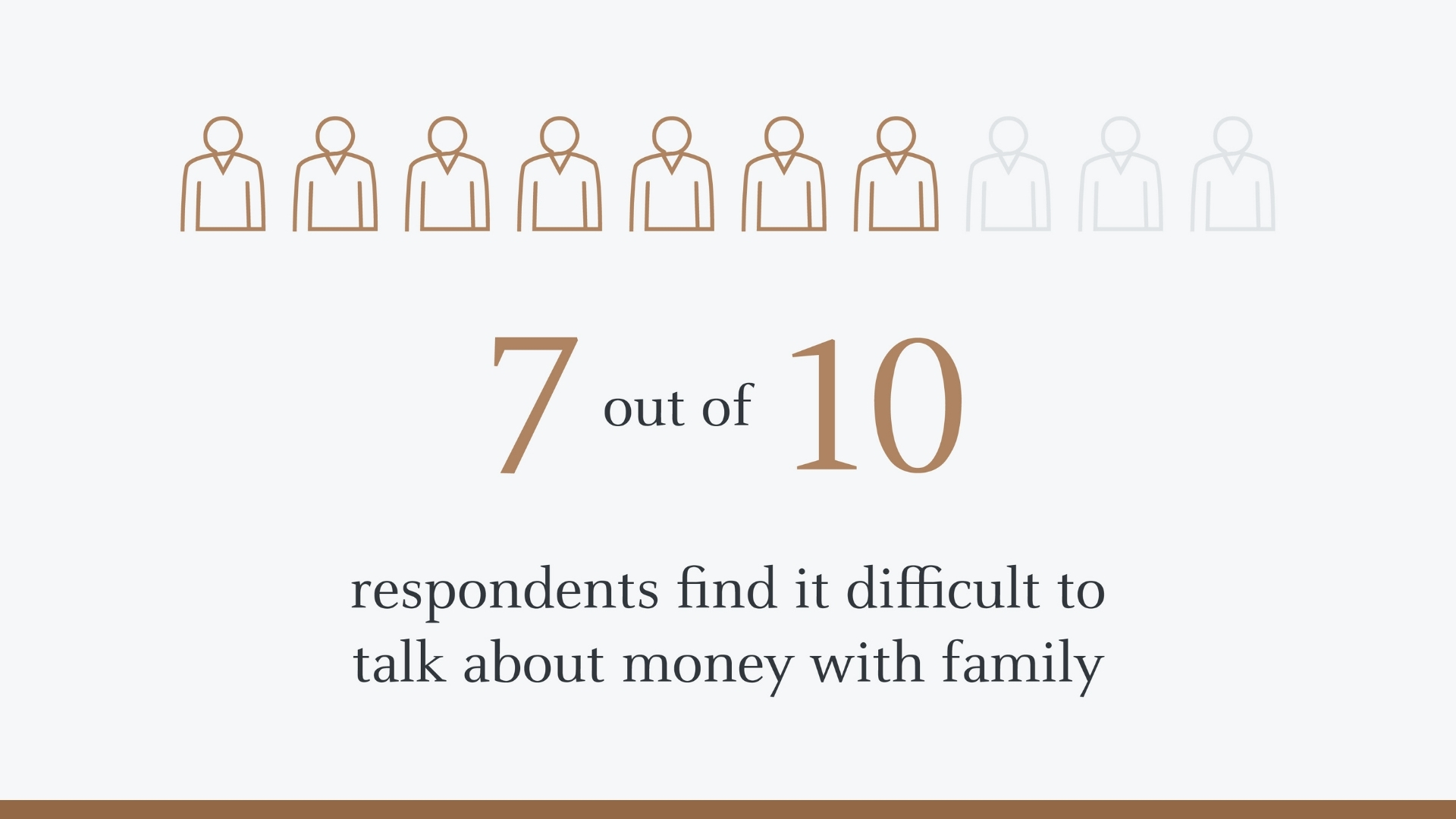

STACY ALLRED: The combination of not knowing where to start and emotional factors such as stress, anxiety or fear of conflict can create the perfect storm that makes financial conversations challenging. The J.P. Morgan Family Wealth Institute just published its first-ever report on this topic. Our research found that 7 in 10 family members surveyed find it difficult to talk about money with each other. And as a result, many families avoid the topic altogether.

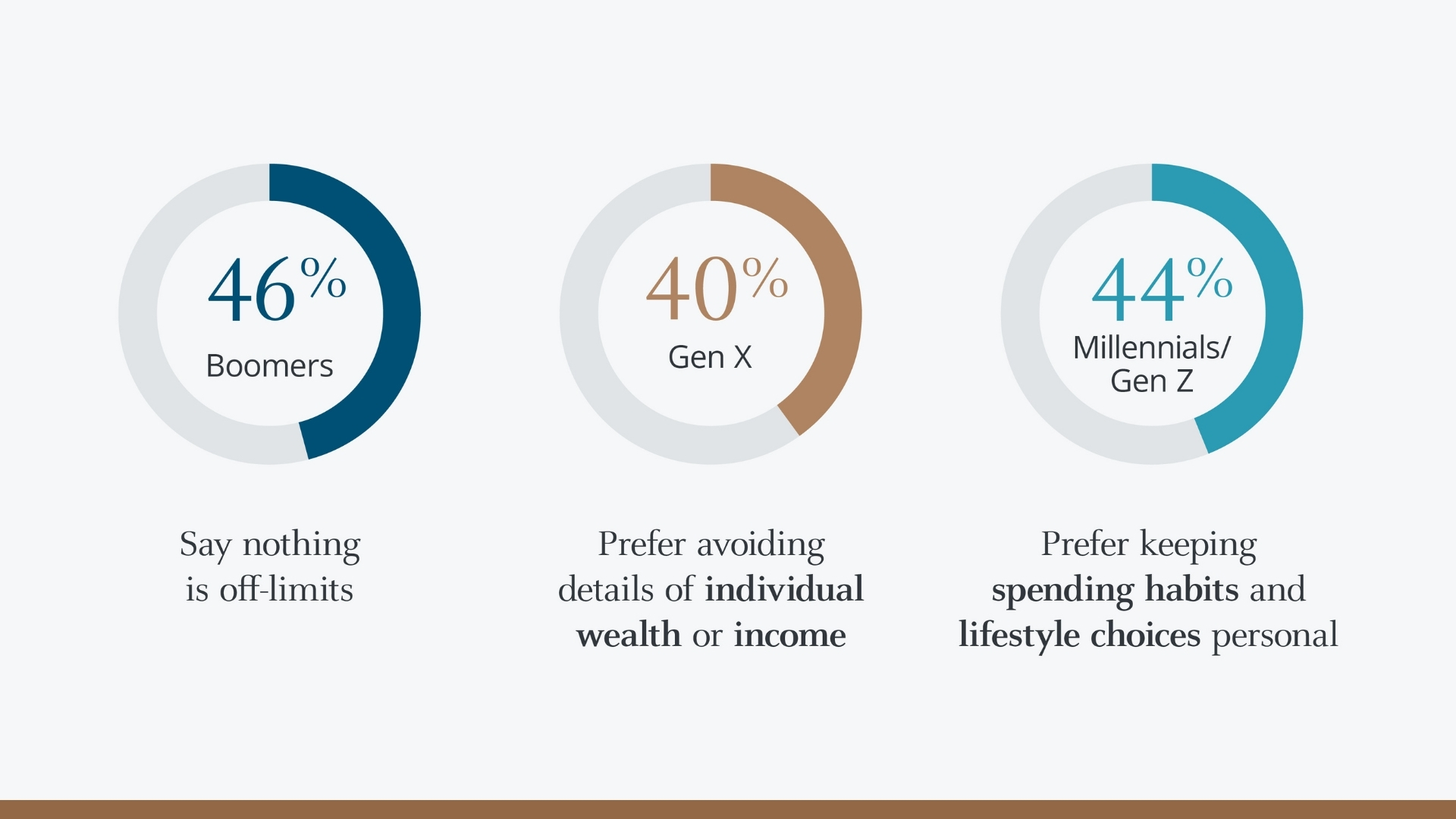

We also learned that each generation draws a different line on which topics are off limits. Our research found that 46% of Boomer respondents say nothing is off limits, 40% of Gen X respondents prefer to avoid details of individual wealth or income and 44% of Millennials/Gen Z respondents keep spending habits and lifestyle choices personal. This adds extra layers of nuance when it comes to approaching these discussions.

For many wealthy families, avoidance is further fueled by a fear that giving the younger generation knowledge on family money will undermine motivation. However, receiving large gifts or an inheritance with limited preparation often results in suboptimal outcomes. Loved ones can feel overwhelmed and underprepared to manage this sudden wealth. The stakes are high.

HL: For families ready to break the silence, what practical steps can they take to initiate these conversations in a way that feels open, non-judgmental, and productive rather than overwhelming?

SA: First, let’s break the myth that a money conversation starts with a big reveal. Instead, families can view it as a series of thoughtful conversations to share the right amount of information at the right time. It can help to frame the dialogue as a learning conversation: I have something to share and am also open and curious to hear what you think (versus a “telling” conversation).

Consider what works best for you and your family. Some families prefer to keep the first conversation low-key. Maybe they take an hour before dinner over a family vacation. Other families prefer to bring in a facilitator as a neutral third party to help bridge gaps and keep conversations productive. If you work with a financial advisor, you can engage them as a thinking partner to help you design that first conversation.

It’s important for families to strive to find common ground. That starts with really listening to each other, without judgment. No single generation holds all of the answers. Embracing the different perspectives within your family and finding consensus where you’re able to can help make these conversations more productive.

HL: Beyond a single discussion, what best practices do you recommend for establishing ongoing communication about wealth, values, and family governance to ensure connectivity across generations?

SA: Having effective money conversations is a skill, and skills require doing. There are some core practices we suggest to families. One of them is to have wealth conversations rooted in shared experiences, not only in transactional moments. For example, this could be a multigenerational holiday trip or shared philanthropy project. We encourage families to have ongoing conversations during those consistent touchpoints and prioritize connection.

It’s also important to define your family’s values. This is the shared common vision or mission for your family. Maybe that’s education or a specific philanthropic cause. It’s personal to each family. Our Family Wealth Services team has various exercises to help families create a written values framework, which includes values in general, as well as values on the earning, saving, spending, investing and sharing of money. This framework can help guide your family’s financial, lifestyle and estate planning decisions.

For many families, it can be helpful to bring in a trusted third party for these conversations. This could be an advisor, coach or facilitator who can help ease tensions and keep the conversations on track.

HL: How does aligning family members through regular dialogue help preserve not just financial assets but the overall family legacy, and what role does it play in preventing future conflicts or unexpected challenges?

SA: Regular dialogue helps to build trust, clarity and emotional connection. When families communicate openly, they reduce secrecy and anxiety, making it easier to align on their opportunities and responsibilities and the impact they want to have in the world.

This not only preserves financial assets but also strengthens the family’s legacy and values. Ongoing conversations help prevent misunderstandings, resentment and future conflicts by ensuring everyone feels heard, involved and prepared for their roles.

I worked with one family who adopted the saying that “money is a two-way street.” Along with the privileges of family money come responsibilities, and they articulated what those responsibilities are. When issues and topics arose, they tackled the time-sensitive issues head on and kept a list of the others to explore at their annual summer family meeting. Each year, they build clarity around what family money means for them and each of their individual roles.

HL: In your experience at J.P. Morgan Wealth Management, what are some common pitfalls families encounter when they delay or avoid these wealth-transfer conversations, and how can early alignment mitigate those risks?

SA: Many wealth creators hesitate to share specifics out of fear of conflict within the family or undermining motivation in the rising gen. But our research found that the younger generation is eager to be involved. Eighty-seven percent of Millennial and Gen Z respondents value discussing family wealth and financial matters.

We’ve heard from many family members who only learned key information after a crisis or significant life event. Suddenly learning major information in these moments can be difficult to process. The family member may be unprepared to take on the financial responsibilities as they’re navigating a crisis. Transparency and proactive conversations about family wealth are key to preventing surprises.

Remember, intent is invisible. If your intentions aren’t clearly articulated, family members may create their own stories around them. In addition to conversations, consider documenting your intentions with written materials, such as family meeting summaries or a “letter of wishes” for your wealth. These can help prevent misunderstanding or conflict down the road.

HL: Looking ahead, how can families integrate communication about wealth with broader topics like philanthropy, purpose, and shared values to build a more resilient and unified generational legacy?

SA: Families can build a unified legacy by connecting their wealth to purpose. For many, philanthropy is a key component. Bringing the younger generation into the ongoing dialogue and giving them an active role can help create a feeling a responsibility and stewardship. Following each conversation, consider giving each family member actionable next steps, so they individually feel involved in preserving the family legacy.

HL: Any parting advice?

SA: The most successful families treat wealth conversations as an ongoing journey, not a one-time event. Leaning into these conversations with a lens of curiosity, respecting generational differences and fostering open dialogue, can help families sustain both their financial prosperity and family harmony for generations to come.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.