After his Monday arrest, U.S. federal prosecutors on Tuesday accused Sam Bankman-Fried of committing fraud and violating campaign finance laws, leaving the founder and former CEO of FTX facing a myriad of charges by U.S. regulators.

Photo Credit: Shutterstock

Photo Credit: Shutterstock

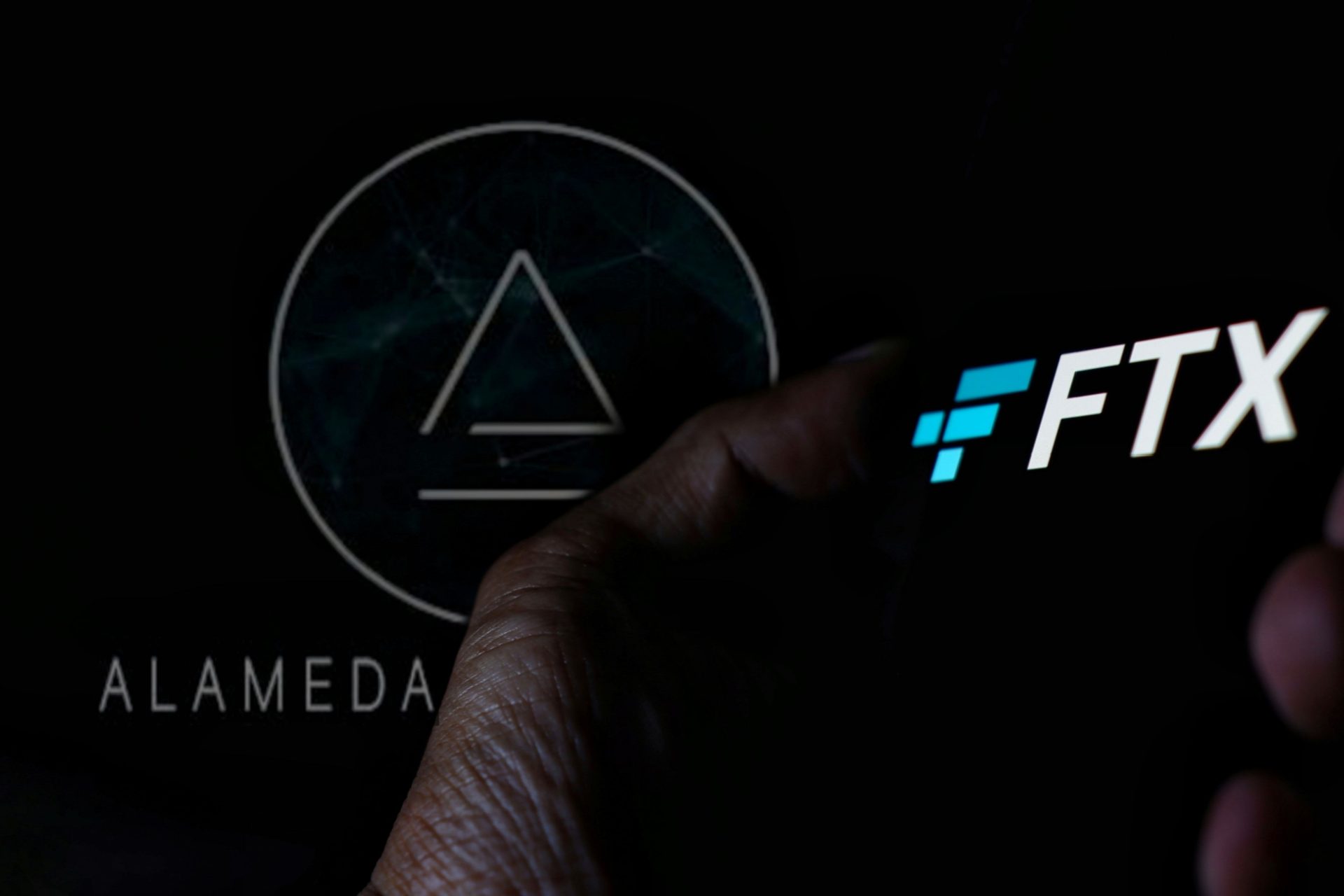

In the indictment, prosecutors said Bankman-Fried engaged in a plot to defraud FTX’s customers by misappropriating their deposits to pay for personal expenses and debts as well as to make investments on behalf of his crypto hedge fund, Alameda Research LLC.

He then defrauded lenders to Alameda by providing them with false information about the hedge fund’s processes and conditions. Prosecutors also said that he attempted to disguise the money he earned from committing wire fraud.

Both the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) filed lawsuits against Bankman-Fried Tuesday, alleging his actions constituted fraud.

“While he spent lavishly on office space and condominiums in The Bahamas, and sank billions of dollars of customer funds into speculative venture investments, Bankman-Fried’s house of cards began to crumble,” the SEC filing said.

The CFTC sued Bankman-Fried, Alameda, and FTX on Tuesday, alleging fraud involving digital commodity assets.

Dating back to May 2019, FTX collected more than $1.8 billion from equity investors while Bankman-Fried concealed that FTX was diverting customer funds to its affiliated crypto hedge fund, Alameda Research LLC, the SEC claimed. While those customers sent billions to FTX, the SEC says he continued to divert FTX customer funds even as it was increasingly clear that Alameda and FTX could not make customers whole.

Bankman-Fried publicly apologized to customers and acknowledged the oversight failures of FTX, but noted that he doesn’t personally think he has any criminal liability.

After founding FTX in 2019 and riding a cryptocurrency boom, the exchange became one of the world’s largest. Following this growth, Forbes pegged his net worth at $26.5 billion, and he became a substantial donor to U.S. political campaigns, media outlets and other philanthropic causes.

FTX filed for bankruptcy on Nov. 11, leaving an approximated 1 million investors facing losses in the billions of dollars. The collapse echoed across the crypto world and sent digital asset values crashing. The liquidity crunch allegedly came after Bankman-Fried secretly used $10 billion in customer funds to support his proprietary trading firm, Alameda Research.

The Bahamas’ attorney general’s office claimed it expected him to be extradited to the United States very quickly. Bahamas law enforcement said he was arrested due to “various Financial Offences against laws of the United States, which are also offences” in the Bahamas.

Bankman-Fried resigned as FTX’s CEO the same day as the bankruptcy filing.

Read more articles from Haute Lawyer, visit https://hauteliving.com/hautelawyer

Source: https://www.reuters.com/legal/bankman-fried-appear-bahamas-court-us-unveil-charges-2022-12-13/