In the chaotic moments after a car accident, your first instinct must be safety. It’s a disorienting experience, but the initial actions you take are critical—not just for your well-being, but for protecting your legal and financial interests down the road.

Your First Steps at the Scene of the Accident

Adrenaline and confusion are a given. The key is to channel that energy into a calm, methodical approach. The first 15 minutes are foundational for any future insurance claims or legal action, so what you do—and what you don’t do—matters immensely.

Your immediate priority is to secure the scene, check on everyone’s condition, and start documenting what happened without making statements that could be twisted later. This isn’t just a checklist; it’s a framework for clear thinking under intense pressure.

Prioritize Safety and Call for Help

Before anything else, conduct a quick assessment. Are you or your passengers injured? Shock can easily mask pain, so do a thorough check. If anyone appears seriously hurt, don’t move them unless there’s an immediate danger like a fire. Wait for emergency medical professionals to arrive.

Calling 911 is non-negotiable, even if the collision seems minor. A police report creates an official, unbiased record of the incident, which is invaluable.

The National Highway Traffic Safety Administration (NHTSA) consistently emphasizes the importance of securing the scene. Their data shows that an estimated 17,140 people died in traffic crashes in the first half of 2025 alone. To avoid becoming another statistic, move your vehicle out of the flow of traffic if it’s safe and possible to do so. This simple act can prevent a far more dangerous secondary collision.

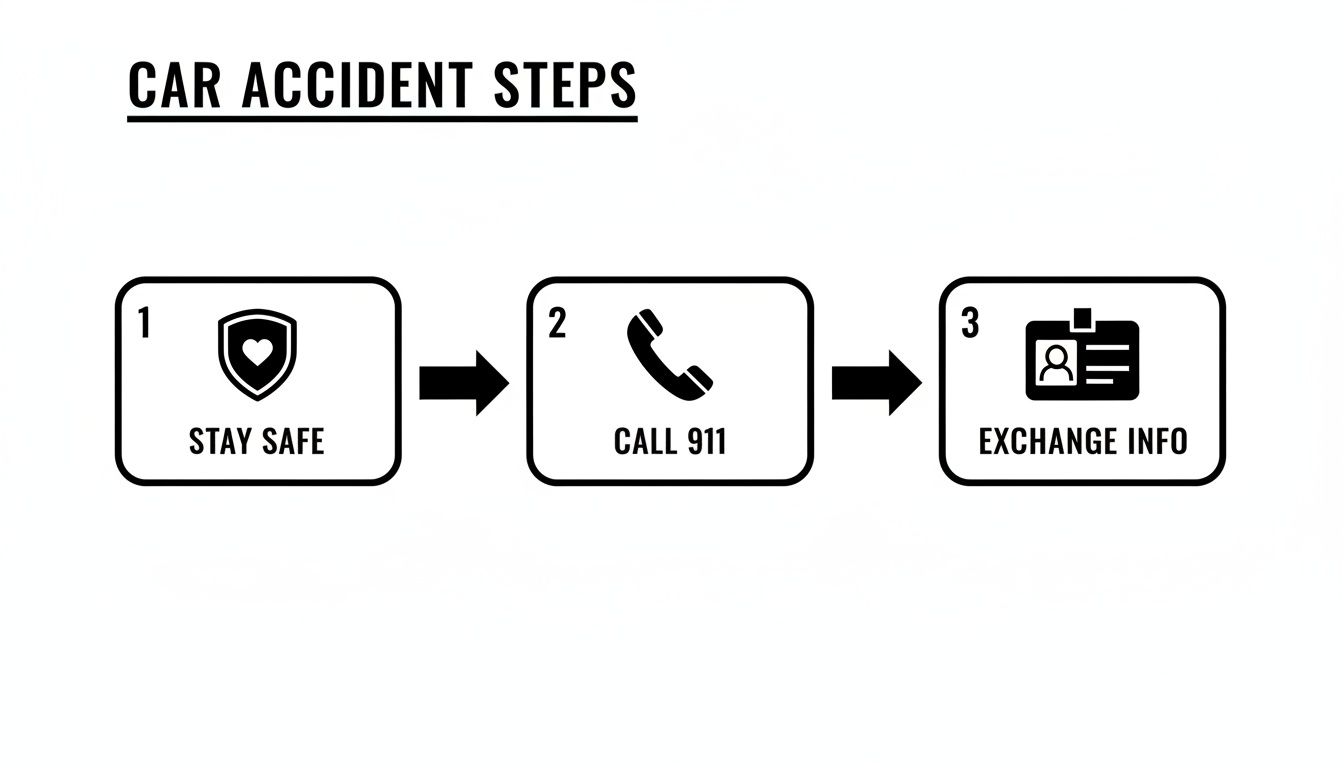

This three-step process—stay safe, call for help, and exchange information—is the bedrock of a sound post-accident response. Each step logically follows the last, creating a clear path forward through the initial confusion.

To simplify these critical first moments, here is a quick reference table.

Immediate Post-Accident Checklist

| Action Item | Why It Matters | Key Considerations |

|---|---|---|

| Check for Injuries | Your health is the top priority. Shock can hide serious injuries. | Assess yourself and passengers. Don’t move anyone who is severely injured unless absolutely necessary. |

| Call 911 | This summons medical help and law enforcement to create an official report. | Report your location and any known injuries. Do this even for “minor” accidents. |

| Secure the Scene | Prevents secondary accidents and protects evidence. | If possible, move vehicles to the shoulder. Turn on hazard lights. |

| Exchange Information | This is legally required and necessary for insurance claims. | Collect names, contact info, insurance details, and license plate numbers. |

| Avoid Admitting Fault | An apology can be used against you by insurance companies. | Stick to the facts. Do not say “I’m sorry” or speculate on what happened. |

| Document Everything | Photos and notes create a visual record before the scene is cleared. | Photograph vehicle damage, skid marks, road conditions, and the surrounding area. |

Following this checklist ensures you’re not only safe but also proactively protecting your rights from the very start.

Exchange Information Carefully

Once you’ve ensured everyone is safe and help is on the way, you’ll need to exchange information with the other driver. Approach this as a business transaction—be professional, calm, and direct. Critically, do not discuss fault or apologize. A simple “I’m sorry” can be interpreted as an admission of guilt, complicating your claim significantly.

Here’s the essential information to gather from the other party:

- Full Name and Contact Information: Get their phone number and home address.

- Insurance Company and Policy Number: The easiest way to do this is to take a clear photo of their insurance card.

- Driver’s License Number and License Plate Number: Again, a quick photo of both is the most accurate method.

- Vehicle Details: Make a note of the make, model, and color of their car.

Remember, your interaction at the scene is about gathering facts, not debating fault. Stick to the essentials and let the police and insurance adjusters determine liability later. This disciplined approach protects your legal standing from the very beginning.

When the police arrive, give them a clear and factual account of what happened. If you aren’t sure about something, like the exact speed, don’t guess. Just state what you know and what you observed. Before they leave, make sure you have the officer’s name, badge number, and the police report number. This report will become a central piece of evidence for your case.

How to Document the Scene and Preserve Evidence

Once everyone is safe and the necessary calls have been made, your focus must pivot from immediate crisis management to evidence preservation. What you collect in the first few minutes after a crash can become the entire foundation of your claim. Your smartphone is no longer just a phone; it’s a powerful tool for creating an undeniable record of what happened. This is precisely what separates a clean, straightforward claim from a drawn-out, painful dispute.

This kind of meticulous documentation is absolutely critical for high-value claims, where insurance companies will scrutinize every detail to minimize their payout. Your goal is to build a narrative so comprehensive that it leaves no room for ambiguity.

Your Smartphone Is Your Best Investigator

Start by taking far more photos than you think you need. You simply cannot over-document an accident scene. Modern phones automatically time-stamp every image, creating a precise and valuable timeline of events.

Begin with wide shots to capture the full context. Get pictures of all the vehicles involved, where they came to rest, nearby traffic signals or signs, and the general layout of the road. These images help establish the big picture for anyone—an adjuster, a lawyer, a jury—reviewing the case later.

Next, get close. Photograph the damage to every vehicle from several angles, not just your own. Capture the dented panels, the shattered glass, the paint scrapes. This is also the time to document any contributing factors you see: skid marks on the pavement, debris scattered from the collision, or even poor weather conditions like heavy rain or fog.

Your photos should tell a story on their own. They need to show not just what happened, but how it likely happened, providing visual proof that is incredibly difficult for an insurance adjuster to argue against.

Finally, if you have any visible injuries—cuts, bruises, anything—photograph them right there at the scene. Injuries can look very different hours or days later, so having that immediate record is crucial. These initial photos provide a baseline for all medical and legal documentation to come.

Capturing Environmental and Witness Details

Beyond the vehicles, look for other critical pieces of information. If the police are filing a report, make sure you get the officer’s name, badge number, and the official report number before you leave. That report is a cornerstone piece of official documentation.

Witnesses are another invaluable asset. A neutral third-party account can be incredibly persuasive. Approach anyone who might have seen the accident—other drivers, pedestrians, even people working in nearby buildings. Politely ask for their full name and phone number. Most people are willing to help if they see someone handling a difficult situation calmly and professionally. Don’t press them for their story right then and there; just secure their contact information so your attorney or insurer can follow up properly.

This level of documentation is your first line of defense. The stakes are high, especially when you consider the prevalence of serious accidents. With SUVs involved in a 106.6% rise in fatal crashes over the past decade, leading to 96,982 incidents, having indisputable evidence is non-negotiable. This meticulous record-keeping is your best tool to counter potential insurance denials and protect the integrity of a high-value claim. You can explore more about these critical accident trends and see how comprehensive data supports strong legal cases.

Organizing Your Evidence for Maximum Impact

As soon as you are safely away from the scene, your final task is to organize this information. Create a dedicated folder on your computer or in cloud storage and upload every photo immediately.

Think of it as building a case file. Here’s what it should contain:

- Photographs: Wide-angle shots of the scene, close-ups of all vehicle damage, pictures of skid marks, road conditions, and any visible injuries.

- Driver Information: A clear photo of the other driver’s license, their insurance card, and their license plate.

- Witness Contacts: A clean list of names and phone numbers for anyone who saw what happened.

- Official Details: The police report number and the name of the responding officer.

Taking these steps transforms post-accident chaos into a clear, compelling narrative. An organized evidence file empowers your legal team and ensures you are in the strongest possible position as you navigate the next steps of what to do after a car accident.

Navigating Conversations with Police and Insurers

After the initial shock of an accident wears off, you’ll find yourself in conversations that can define the outcome of your case. What you say to law enforcement and insurance representatives—and just as importantly, what you don’t say—becomes part of the permanent record.

Handling these interactions with a clear head is essential. This isn’t about being deceptive; it’s about precision.

Both police officers and insurance adjusters are trained professionals gathering facts. Every word matters. A single misstatement can create costly complications weeks or months later.

Speaking with the Responding Officer

When police arrive, your sole objective is to provide a factual, dispassionate account. The officer’s report is often the first and most influential document in a case, so its accuracy is paramount.

Stick to what you know for certain. If you were traveling at 45 mph, state that. If you’re unsure, it’s far better to say, “I was moving with the flow of traffic,” than to guess. Speculation introduces doubt and potential inaccuracies.

Here’s how to frame the conversation:

- Be Objective: Describe events without emotion. “The other car entered the intersection against a red light and struck my vehicle” is a fact. “That maniac blew through the light and T-boned me!” is an emotional reaction that can undermine your credibility.

- State Facts, Not Opinions: Avoid guessing about the other driver’s state of mind or condition. Your opinion isn’t evidence. Let the officer conduct their own investigation.

- Confirm Your Details: Before the officer leaves, ensure they have your correct information and ask for their name, badge number, and the police report number.

It’s also wise to understand your rights during any police interaction. Knowing the rules around vehicle searches, for instance, is valuable information. You can learn more about when a police officer can search your car to be fully prepared.

Making the Initial Insurance Report

You are required to notify your own insurance carrier promptly. This first call, however, should be brief and factual—nothing more.

Provide only the essential details: your name, policy number, the date and location of the crash, and the basic type of incident. You are not obligated to give a detailed narrative of your injuries or the cause of the accident at this stage.

Crucial Tip: You are not required to give a recorded statement to the other driver’s insurance company. In fact, we strongly advise declining this request until you have spoken with an attorney.

Insurance adjusters are skilled negotiators. Their goal is to minimize their company’s financial exposure. A recorded statement is a tool they use to find inconsistencies in your account or to get you to make admissions that weaken your claim.

Why You Should Consult an Attorney First

Before engaging in any substantive discussion with an insurance adjuster—even your own—it is critical to seek legal counsel. An experienced personal injury attorney serves as a vital shield between you and the insurance companies.

A skilled attorney will:

- Handle all communications with insurers on your behalf.

- Advise you on exactly what information to provide.

- Protect you from inadvertently accepting partial fault or downplaying your injuries.

- Compile the necessary evidence to build a powerful case for full and fair compensation.

Consider this common scenario: An adjuster calls and opens with a friendly, “How are you feeling today?” The polite, automatic response is, “I’m doing okay.” That seemingly harmless phrase is immediately noted in your file and can be used later to argue your injuries were not severe. An attorney will coach you on how to respond to these loaded questions factually, without jeopardizing your claim.

Prioritizing Your Health and Tracking Medical Care

In the moments after a collision, adrenaline is a powerful anesthetic. It can easily mask serious injuries, convincing you that you’re just shaken up. Downplaying the incident and skipping a medical evaluation is a common—and costly—mistake.

Your health is your primary asset. Injuries like whiplash, concussions, and even internal damage often have delayed symptoms. What feels like minor stiffness at the scene can evolve into chronic, debilitating pain if left unchecked.

Seeking an immediate medical evaluation is non-negotiable. It does more than just protect your well-being; it creates an official, time-stamped record linking your injuries directly to the accident. This is the kind of hard evidence that insurance companies can’t easily dispute. Any delay gives them an opportunity to argue that your injuries happened sometime after the crash.

The Importance of Immediate Medical Attention

Even a seemingly minor fender-bender can subject the body to violent forces. The abrupt jolt can cause significant soft tissue damage to the neck and spine—the classic “whiplash”—that may not become fully apparent for hours or even days.

A prompt, thorough medical check-up accomplishes two critical goals:

- Diagnostic: A physician can spot hidden injuries that you can’t feel yet, getting you on the right treatment path immediately.

- Documentary: This visit establishes a crucial baseline for your physical condition in the immediate aftermath, forming the foundation of any future injury claim.

Your health is invaluable. Treating it as an afterthought is a risk you cannot afford. A complete medical work-up not only safeguards your physical recovery but also fortifies your position for any compensation claims that follow.

Think of this initial medical report as the cornerstone of your entire claim. Without it, you’re asking an insurer to simply take you at your word, a strategy that rarely results in a fair outcome.

Building Your Comprehensive Medical File

After your initial evaluation, your next role is that of a meticulous archivist. Every document related to your medical care becomes a vital piece of evidence that illustrates the full extent of your damages. For high-value claims, this level of organization isn’t just helpful—it’s essential.

Start a dedicated folder, whether physical or digital, for all accident-related paperwork. This file will become an indispensable tool for your attorney.

Be sure to collect and organize:

- All Medical Bills and Invoices: From the emergency room and specialists to physical therapy and chiropractic care, every bill is part of the story.

- Receipts for All Related Expenses: Don’t forget prescription medications, pain relievers, and any medical devices you had to purchase, like a brace or crutches.

- Physician’s Notes and Diagnoses: Always request copies of your medical records. They contain the official diagnosis and a professional assessment of your injuries.

This detailed accounting helps recover your out-of-pocket expenses, but it’s also critical to understand the hidden costs of personal injury that receipts alone can’t capture.

Documenting the Human Impact of Your Injuries

Bills and invoices quantify the financial burden, but they fail to tell the whole story. To truly convey how the accident has impacted your life, you need to document the daily, personal toll of your injuries. This narrative is often the most persuasive element in securing compensation for pain and suffering.

Keep a simple journal and spend just a few minutes writing in it each day.

Here’s what to track:

- Pain and Symptom Levels: Use a 1-to-10 scale to rate your pain. Note where it is and what activities make it better or worse.

- Daily Life Disruptions: List the things you can no longer do, or can only do with difficulty. This could be anything from playing tennis or attending board meetings to lifting your child or sitting comfortably at your desk.

- Emotional and Mental State: Make note of any anxiety, trouble sleeping, or frustration you experience. The psychological trauma is a very real and compensable component of your claim.

This personal log translates abstract medical jargon into a compelling, real-world narrative. It shows an insurance adjuster that a “cervical sprain” isn’t just a term on a chart—it’s the reason you can no longer enjoy your weekend passions or maintain focus at work. This is how you build a case for a settlement that truly makes you whole.

When to Hire a Car Accident Attorney

The conventional wisdom after a collision is to “call a lawyer,” but this advice often misses the crucial context of why and when. For a minor fender-bender with no injuries, bringing in counsel might be overkill. But as the stakes climb, the decision to hire an attorney shifts from a recommendation to a strategic necessity.

It’s about recognizing the tipping point—the moment a standard insurance claim starts to look more like a complex legal matter that requires a professional to protect your financial and personal well-being.

Obvious Signs You Need Legal Counsel

Certain scenarios should immediately trigger a call to an experienced attorney. Trying to navigate these situations alone exposes you to significant financial and legal risks. If your accident involves any of the following, professional guidance is non-negotiable.

- Any Serious Injury: If the crash led to broken bones, hospitalization, surgery, or any injury requiring ongoing care, you need a lawyer. The true cost of these injuries—including future medical treatments, diminished earning capacity, and chronic pain—is incredibly difficult to calculate, and you can be sure the insurer’s goal is to undervalue it.

- Disputed Fault or Liability: When the other driver denies responsibility, or the police report is vague about who was at fault, a legal battle is almost inevitable. An attorney begins gathering evidence, interviewing witnesses, and building a compelling argument to establish liability from day one.

- Multiple Parties Involved: Accidents involving more than two vehicles, commercial trucks, or government entities are notoriously complex. Untangling liability and navigating the claims process with multiple insurance companies is a specialized skill.

In these situations, an attorney isn’t just an advisor; they become your advocate, investigator, and negotiator, working to level the playing field against powerful insurance corporations.

An experienced attorney immediately takes control of all communications, shielding you from the tactics of insurance adjusters. Their job is to get you to settle quickly and for the lowest possible amount. Your lawyer’s job is to ensure you receive the maximum compensation you are rightfully owed.

Subtle Indicators It Is Time to Act

Not every reason to hire a lawyer is as dramatic as a multi-car pileup. Sometimes, the warning signs are much more subtle, appearing during your initial interactions with the insurance company.

For example, an adjuster who seems overly friendly and pushes for a quick settlement is a classic red flag. This is a common tactic to close the case before the full scope of your injuries becomes clear. That early, lowball offer might seem tempting, but accepting it forfeits your right to seek further compensation, even if your medical condition deteriorates.

Here are other subtle but critical signs you need legal help:

- The insurance company is delaying your claim without a clear reason.

- You are being pressured to provide a recorded statement about the accident.

- The settlement offer doesn’t even cover all your medical bills and lost wages.

- You simply feel pressured or overwhelmed by the claims process.

Hiring an attorney sends a clear message to the insurer: you are serious about protecting your rights. This single action can dramatically change the dynamic of the negotiations, forcing the company to deal with a professional who understands the law and the true value of your claim. The legal aftermath is complex, and understanding the nuances of a potential car accident lawsuit can provide critical insight into the road ahead.

The Tangible Value an Attorney Provides

Bringing in a lawyer is about more than just legal advice; it’s about securing an outcome that fully accounts for every dimension of your loss. A skilled attorney meticulously builds your case from the ground up, ensuring no detail is overlooked.

Key Roles of a Car Accident Attorney

| Service Provided | How It Protects You | Practical Example |

|---|---|---|

| Case Investigation | Gathers all evidence, including police reports, medical records, and expert testimony. | Reconstructs the accident scene using engineering experts to prove the other driver was at fault. |

| Damage Calculation | Assesses all current and future damages, including medical bills, lost income, and pain and suffering. | Consults with medical and financial experts to project the lifetime cost of a permanent injury. |

| Negotiation with Insurers | Manages all communication and leverages evidence to negotiate a fair settlement. | Rejects an initial $25,000 offer and counters with a fully documented demand for $150,000. |

| Litigation | If a fair settlement cannot be reached, they will file a lawsuit and represent you in court. | Prepares the case for trial, putting maximum pressure on the insurer to settle favorably beforehand. |

Ultimately, the decision of what to do after a car accident directly impacts your recovery. By recognizing when professional legal help is needed, you transform a stressful, uncertain process into a managed one where your interests are fiercely and effectively protected.

Common Questions After a Serious Accident

Once the initial shock of a crash wears off, a different kind of uncertainty sets in. In the following days and weeks, you’ll be confronted with critical decisions about insurance, legal timelines, and unexpected complications. Getting direct, sophisticated answers is non-negotiable for protecting your assets and making the right choices.

This is the point where strategy must replace reaction. The questions you face now will profoundly impact the financial and personal outcome of your situation.

Should I Accept the Insurance Company’s First Settlement Offer?

It can be tempting to take the first check the insurance company dangles in front of you. It seems like a fast end to a stressful ordeal, but this is almost always a costly mistake. An insurer’s initial offer is merely their opening move in a negotiation—not a fair assessment of your claim’s true value. It’s a number calculated to close your file for the lowest amount possible.

Once you accept that offer, the door closes forever. You forfeit your right to seek any more compensation for that accident. If your injuries turn out to be more severe than you thought or require long-term care, you’ll have no recourse. That check is a full and final settlement.

An insurer’s first offer is a reflection of their business model, not your actual damages. It almost never accounts for the full scope of future medical expenses, lost earning capacity, or the very real impact of pain and suffering.

You should never even consider an offer until it has been reviewed by an experienced personal injury attorney. A skilled lawyer will accurately value your claim by consulting with medical and financial experts, ensuring you pursue the substantial settlement you are rightfully owed.

What if the Other Driver Has No Insurance or Not Enough?

Learning that the at-fault driver is uninsured—or underinsured—can feel like a gut punch. This is precisely why your own insurance policy contains specific, crucial coverages. It’s a scenario that puts a spotlight on the quality of your own protections.

If the liable driver has no insurance at all, your Uninsured Motorist (UM) coverage is designed to step in. In effect, it allows you to bring a claim against your own insurance company for the damages the other driver should have paid.

These coverages work in tandem to protect you:

- Uninsured Motorist (UM) Coverage: Protects you when you’re hit by a driver with zero liability insurance.

- Underinsured Motorist (UIM) Coverage: Applies when the at-fault driver has insurance, but their policy limits are too low to cover the full extent of your medical bills and other major losses. Your UIM coverage can bridge the gap, up to your own policy’s limits.

Filing a UM or UIM claim can put you in an adversarial position with your own carrier. They may shift their focus to minimizing your payout, just as any other insurer would. This is a critical juncture where having a lawyer is vital to ensure your own insurance company honors its obligations to you.

How Long Do I Have to File a Claim?

Every state has a strict deadline for filing a lawsuit after a car accident. This time limit is known as the statute of limitations. Missing it almost certainly means forfeiting your right to pursue compensation forever.

These deadlines vary dramatically by state. For personal injury claims, the window can be as short as one year or as long as six, though two or three years is common. Crucially, the deadline for a property damage claim may be different from the one for your injuries.

You absolutely must know the specific deadline in the state where the accident happened. This isn’t a detail you can afford to be wrong about. Consulting with an attorney immediately is the only surefire way to clarify your state’s laws, protect your legal rights, and ensure every document is filed correctly and on time. An attorney removes the risk of a simple clerical error costing you your entire claim.

Navigating the legal complexities after an accident requires expertise and a trusted advocate. For high-net-worth individuals who demand excellence in every aspect of their lives, finding the right legal representation is paramount. Haute Lawyer Network provides a curated selection of the nation’s most respected attorneys, ensuring you connect with a professional who can protect your interests with skill and discretion. Explore our network to find the elite legal counsel you deserve.

Learn more about the Haute Lawyer Network