When you’re about to make a major acquisition, you don’t just take the seller’s word for it. You bring in the experts. Due diligence is that critical, investigative phase—a professional background check on a business to make sure everything under the hood is what it claims to be. It’s about confirming the facts, spotting hidden risks, and verifying that the numbers on the spreadsheet match reality.

Before any significant capital is committed, this process ensures an investor or buyer knows exactly what they’re getting into.

What Is the Due Diligence Process

Think of it like buying a house. You wouldn’t put in an offer for millions based on glossy photos alone. You’d hire an inspector to crawl into the attic, check the foundation for cracks, and test the plumbing. That inspection report gives you the confidence to either sign on the dotted line, renegotiate the price based on needed repairs, or walk away from a potential money pit.

The due diligence process is the business world’s equivalent of that home inspection, just on a much larger scale. It’s a systematic, deep-dive investigation that answers one fundamental question: Is this deal as good as it looks on paper?

The Core Purpose of Due Diligence

At its heart, due diligence is a risk management tool. It’s designed to validate all the assumptions you’ve made about a target company and expose any liabilities before the transaction is legally binding. When done right, it protects buyers from disastrous surprises that could cripple the investment after the deal closes.

The findings from this investigation give the buyer the leverage and information needed to make a fully informed decision.

The primary objectives are to:

- Verify Financial Health: Confirm that the seller’s reported earnings, assets, and liabilities are accurate and not just creative accounting.

- Uncover Hidden Risks: Identify skeletons in the closet, like looming legal disputes, regulatory compliance failures, or major operational weaknesses.

- Validate the Purchase Price: Make sure the company’s valuation is truly justified by its financial health, market position, and future potential.

- Plan for Integration: Get a real feel for the company’s operations and culture to map out a smooth post-merger integration.

A thorough due diligence process transforms uncertainty into calculated risk. It provides the clarity and hard evidence needed to either proceed with confidence, adjust the terms of the deal, or avoid a costly mistake altogether.

This isn’t just a box-ticking exercise; it’s the foundation of any successful merger, acquisition, or major investment. Without it, you’re flying blind and exposing yourself to massive financial and legal blowback. This guide will walk you through each stage, providing a clear roadmap to navigate this essential business practice.

Why Due Diligence Is More Critical Than Ever

The world of business investigations has been completely upended. What used to be a straightforward checklist is now a complex, strategic deep dive into the very soul of a business before anyone signs on the dotted line.

Due diligence is no longer just about verifying the numbers.

Today’s market is flooded with high seller valuations, putting immense pressure on buyers. To justify paying a premium, an investor has to leave no stone unturned. You have to move beyond the financials and conduct what is essentially a philosophical evaluation of the target company, scrutinizing everything from its operational resilience to its cultural DNA.

This new level of intensity is a direct result of a volatile global economy. Hidden liabilities—from lurking regulatory infractions to fragile supply chains—can easily torpedo an otherwise promising deal.

The New Timeline for Diligence

Forget the old timelines. Before 2020, a typical due diligence period after signing a Letter of Intent (LOI) might have been about 45 days. Today, that window has stretched to 60 to 90 days.

This isn’t about slowing down deals; it’s about digging deeper to match the complexity of modern transactions. Buyers are now allocating serious time and resources, often bringing in third-party specialists to ensure every single angle is covered.

This shift signals a fundamental change: checkbox-style reviews are officially obsolete. The focus now is on sniffing out hidden risks and meticulously planning for a smooth post-transaction integration.

A Broader Scope of Investigation

The modern due diligence process now casts a much wider net. It’s simply not enough to audit the financial statements anymore. Today’s investigations have to tackle a more intricate web of concerns that can make or break a company’s long-term value.

Key areas of this expanded focus include:

- Regulatory Risks: Compliance demands are exploding, from data privacy laws to anti-bribery legislation. With federal investigations targeting executives on the rise, rigorous legal vetting has become a non-negotiable part of the process.

- Operational Resilience: How durable is the company’s supply chain? Are its technology systems secure and, more importantly, scalable? These are now central questions in assessing a target’s stability.

- Cultural Alignment: A mismatch in company cultures can doom a merger from the start. You have to assess leadership styles, employee morale, and workplace dynamics to ensure a successful integration.

In essence, due diligence has transformed from a financial audit into a holistic business assessment. It’s an essential strategic tool for protecting capital and ensuring a transaction’s lasting success in an unpredictable world.

Ultimately, this deeper, more comprehensive approach isn’t optional—it is the new standard. It provides the clarity needed to navigate complex deals, validate high valuations, and build a solid foundation for future growth. The thoroughness of the modern process just reflects the reality that in today’s market, you can’t afford any surprises.

The Core Areas of a Due Diligence Investigation

A proper due diligence investigation isn’t a single, monolithic task. It’s more like a series of specialized audits, with each one digging into a different facet of the target company.

Think of it as a team of medical specialists evaluating a patient. One checks the heart (financials), another the nervous system (legal), and another the skeleton (operations). Only by pulling all their findings together can you get a complete, accurate picture of the patient’s overall health.

In the business world, each area of diligence contributes a critical piece to the puzzle. These investigations work in concert to build a comprehensive, multi-dimensional view of the target business before any deal is signed.

Financial Due Diligence

This is usually where things start and is often the most critical component. Financial due diligence is the painstaking process of verifying a company’s financial health and performance claims. It goes way beyond just glancing at an income statement; it’s about confirming the numbers are real, sustainable, and haven’t been inflated by creative accounting.

The main goal here is to validate everything the seller has claimed about revenue, profitability, and growth. Investigators pore over historical financial statements, tax returns, and cash flow records to spot any inconsistencies or red flags.

Key activities include:

- Quality of Earnings (QoE) Analysis: This is a deep dive to assess how sustainable and accurate a company’s reported earnings really are, stripping out any one-time windfalls or non-recurring items that make the numbers look better than they are.

- Balance Sheet Review: An exhaustive examination of assets and liabilities to uncover hidden debts or find assets that have been overvalued.

- Working Capital Analysis: This determines the actual amount of cash needed to run the business’s day-to-day operations without a hiccup.

Legal Due Diligence

While the financial team is crunching numbers, the legal team is focused on the company’s legal structure and potential liabilities. Legal due diligence is an exhaustive review of every legal document to ensure the company is in good standing and not tangled up in disputes that could become expensive nightmares down the road.

This is where a sharp legal team proves its worth. A poorly reviewed contract in a major deal, like a real estate transaction, can lead to staggering financial losses. It’s a stark reminder of why every transaction needs a thorough legal review.

This investigation covers a wide swath of territory:

- Corporate Structure: Verifying the company was legally formed and is compliant with all registration requirements.

- Contracts and Agreements: Reviewing critical contracts with customers, suppliers, and employees to identify any unfavorable terms or clauses that could be triggered by a change of control.

- Litigation History: Uncovering any past, present, or pending lawsuits that could pose a financial or reputational threat.

- Intellectual Property (IP): Confirming the company actually owns its patents, trademarks, and copyrights and that they are valid.

Operational and Commercial Due Diligence

This is where the investigation moves from historical data to the company’s real-world functionality and its position in the market. Operational due diligence looks at how the business actually works day-to-day. It examines the efficiency of core processes, the stability of the supply chain, and the quality of its technology.

At the same time, commercial due diligence evaluates the company’s place in its industry. This involves analyzing the competition, customer concentration, and market trends to see if the company’s growth story and business model hold up to scrutiny.

Together, these two areas answer a fundamental question: Does this business have a sustainable competitive advantage and the operational muscle to maintain it?

The Rise of ESG Due Diligence

A newer but increasingly critical area is Environmental, Social, and Governance (ESG) due diligence. This investigation looks at a company’s performance on non-financial factors that can have a very real impact on its long-term value and reputation.

Investors now understand that things like poor environmental practices, ongoing labor disputes, or unethical governance can create significant risks. ESG diligence examines a company’s sustainability policies, ethical standards, and compliance history to make sure it aligns with modern expectations for corporate responsibility.

The table below breaks down these key areas, giving you a clearer view of what each investigation is looking for.

Key Areas of the Due Diligence Process

| Type of Due Diligence | Primary Focus | Key Documents & Information Reviewed |

|---|---|---|

| Financial | Verifying financial health, profitability, and stability. | Audited financial statements, tax returns, cash flow projections, quality of earnings reports. |

| Legal | Identifying legal risks, compliance issues, and contractual obligations. | Corporate records, contracts, litigation history, intellectual property filings, permits, licenses. |

| Operational | Assessing the efficiency and scalability of core business processes. | Supply chain maps, IT infrastructure audits, production facility reports, internal process documents. |

| Commercial | Analyzing market position, competitive landscape, and customer base. | Market research reports, competitor analysis, customer surveys, sales pipeline data. |

| ESG | Evaluating sustainability, ethical practices, and corporate governance. | Environmental compliance reports, labor audits, corporate governance policies, diversity metrics. |

By methodically working through each of these areas, you move from having a surface-level impression of a company to a deep, evidence-based understanding of its true strengths and weaknesses.

A Step-by-Step Guide to the Due Diligence Workflow

Once a Letter of Intent (LOI) is signed, the real work begins. The due diligence process officially kicks into high gear, transforming a potential deal from a handshake agreement into a forensic investigation. This is the moment where the question shifts from can this deal happen to should it happen.

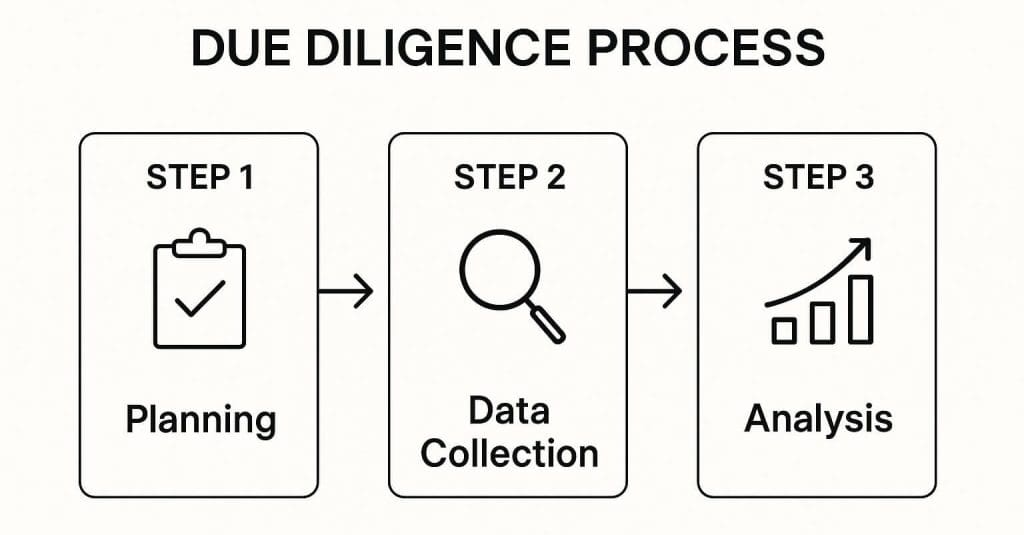

The entire workflow is designed to function like a systematic funnel. It starts wide, capturing a massive volume of information, then progressively narrows its focus down to the critical risks and opportunities that will ultimately make or break the transaction.

Phase 1: Initial Planning and Information Request

The first step isn’t just diving into a pile of documents; it’s about crafting a strategic roadmap. The buyer’s team—a carefully assembled group of lawyers, accountants, and industry consultants—collaborates to build a comprehensive due diligence request list.

This is no generic template. It’s a highly customized checklist tailored specifically to the target company’s industry, size, and the unique risks the buyer anticipates. This request list can run hundreds of items long, covering every conceivable facet of the business. It’s the blueprint for the whole investigation.

Phase 2: Data Collection and the Virtual Data Room

With the request list delivered, the ball is in the seller’s court. Their primary job is to populate a Virtual Data Room (VDR). A VDR is nothing more than a secure online repository where thousands of sensitive corporate documents are uploaded for the buyer’s team to review.

This stage is often a logistical marathon for the seller, demanding they collect and organize a staggering amount of information, including:

- Financial Records: Years of audited statements, tax returns, and detailed projections.

- Legal Documents: All contracts, corporate records, litigation files, and intellectual property registrations.

- Operational Information: Supply chain agreements, internal process manuals, and IT infrastructure reports.

- Human Resources Files: Employee contracts, compensation plans, and compliance records.

This structured flow—from planning to analysis—is absolutely essential for managing the complexity of the deal and ensuring a thorough, organized investigation.

Phase 3: Analysis and Reporting

Once the VDR is populated, the buyer’s team begins the most intensive phase: analysis. This is where raw data is converted into actionable intelligence. Specialists from different fields work in parallel, each zeroing in on their area of expertise.

Accountants scour financial statements for inconsistencies, lawyers review contracts for hidden liabilities, and operational experts assess the nuts-and-bolts efficiency of the business. This stage goes far beyond just reading documents; it includes management interviews, site visits, and even discreet conversations with key customers or suppliers.

All findings, both positive and negative, are meticulously documented. Any potential issue, from a minor compliance gap to a major undisclosed lawsuit, is flagged as a “red flag” that demands deeper investigation.

The culmination of this effort is the final due diligence report. This document summarizes every key finding, assesses the severity of all identified risks, and provides a clear recommendation to the decision-makers. It is this report that empowers the buyer to act with confidence.

The discoveries can lead to renegotiating the purchase price or even walking away entirely. This happens more often than you’d think, as seen in many high-stakes M&A deals where sophisticated legal counsel uncovered deal-breaking risks that less experienced teams might have missed.

Armed with the report, the buyer can finally make an informed decision—whether that means proceeding with the original terms, adjusting the price to account for newly discovered liabilities, or strategically planning for post-merger integration to address weaknesses from day one.

The Global Impact and Scale of Due Diligence

Due diligence isn’t just a box to check on a deal-making checklist. It’s a massive global industry—the very bedrock that underpins the world economy. The sheer size and rapid growth of this sector reveal just how critical it is for facilitating secure, transparent, and intelligent transactions across international markets.

Think of it as the core verification and risk assessment engine that allows capital to flow with confidence, whether it’s a high-stakes merger in New York or a cross-border investment in Singapore. Without this systematic vetting, global commerce would be a far riskier and more uncertain game.

A Multi-Billion Dollar Global Market

The economic footprint of due diligence is not just big; it’s exploding. The global market for these services was valued at roughly USD 15.2 billion in 2023 and is on track to nearly double, hitting an estimated USD 28.9 billion by 2032.

This isn’t just steady growth; it’s a clear signal of powerful global demand for thorough, reliable business investigations. You can dive deeper into the numbers with Dataintelo’s comprehensive report on the due diligence services market. This trend confirms that as business becomes more interconnected, the need for a formal due diligence process only gets stronger.

Regional Drivers and Growth Hotspots

While the need for due diligence is universal, the market itself looks quite different from one region to the next, shaped by unique economic pressures and regulatory climates.

- North America: This region dominates the market, commanding roughly 35% of the global share. Its lead is fueled by a high volume of M&A activity and a famously stringent regulatory environment. In the U.S. and Canada, comprehensive vetting isn’t just a good idea—it’s a standard, non-negotiable part of doing business.

- Europe: Following closely, Europe accounts for about 30% of the market. The continent’s tough governance standards, particularly strict EU regulations in powerhouse economies like Germany and France, make in-depth due diligence absolutely essential for compliance and risk management.

- Asia-Pacific: This is where the most explosive growth is happening. The Asia-Pacific region is the fastest-growing market, with a compound annual growth rate (CAGR) of around 8.5%. This surge is powered by expanding economies, a massive influx of foreign investment, and a rising tide of cross-border deals, especially in major hubs like China, India, and Japan.

These figures paint a clear picture: robust due diligence is not a Western business quirk but a universal necessity. From established financial centers to emerging economic powerhouses, it is the bedrock of informed decision-making and secure global transactions.

Ultimately, the global scale of the due diligence industry proves its fundamental importance. As regulatory complexity and cross-border investments continue to climb, the demand for expert-led investigations will only accelerate, cementing its role as an essential safeguard in the international economy.

How Technology Is Transforming Due Diligence

The days of lawyers sifting through mountains of paperwork in dimly lit conference rooms are officially over. The due diligence process has entered a new era, powered by technology that makes investigations smarter, faster, and far more accurate.

This isn’t just about scanning documents into a PDF. It’s about using sophisticated tools to uncover insights that would be impossible for a human team to find alone.

The Rise of AI and Advanced Analytics

Artificial intelligence (AI) and advanced data analytics are at the forefront of this shift. Modern platforms can now automatically scan thousands of pages in minutes, flagging specific risks, identifying contractual inconsistencies, and highlighting potential compliance issues.

Think of it as a super-powered legal assistant who can read every single document and instantly point out the clauses that need a closer look. This frees up human experts to focus on strategic analysis rather than getting bogged down in tedious manual review.

This kind of automation is essential for helping deal teams manage the extended timelines and growing complexity we see in today’s M&A landscape. By automating data analysis and risk scoring, technology gives decision-makers actionable insights far quicker than traditional methods ever could.

Automation and Intelligent Workflow Management

Beyond just analyzing data, technology is also streamlining the entire workflow. Modern due diligence platforms offer powerful tools for managing the process with an efficiency that was unthinkable just a decade ago.

These systems provide:

- Centralized Data Rooms: Secure, organized virtual spaces where all documents are stored and tracked.

- Real-Time Risk Flagging: AI algorithms that automatically detect anomalies and potential red flags as documents are uploaded.

- Automated Questionnaire Analysis: Tools that can spot inconsistencies or overly optimistic responses in due diligence questionnaires, providing a more objective view of the target company.

Technology has fundamentally changed the equation. It allows for a deeper, more complex investigation without sacrificing speed, transforming due diligence from a reactive checklist into a proactive, data-driven strategic function.

This integration is becoming standard practice as global compliance demands continue to grow. For instance, companies now use platforms that blend real-time risk signal flagging with powerful analytics to improve the accuracy of questionnaire reviews.

Recent data from Asia-Pacific markets shows this technology enables teams to handle extended due diligence timelines of 30 to 50 additional days without losing efficiency. This is critical as frameworks increasingly incorporate complex data privacy, anti-bribery, and ESG (Environmental, Social, Governance) considerations. You can discover more about how technology is upgrading due diligence strategies for modern business demands.

Ultimately, technology empowers businesses to conduct a more thorough and intelligent due diligence process. It ensures greater accuracy, improves speed, and provides the deep insights needed to manage risks effectively in today’s demanding regulatory environment.

Common Questions About the Due Diligence Process

As any deal progresses from friendly handshakes to the fine print, a flood of practical questions always emerges. Understanding the real-world timeline, costs, and key players is critical to keeping the process smooth and managing everyone’s expectations. Here are some of the most common questions that come up.

How Long Does a Typical Due Diligence Process Take?

There’s no magic number here. The timeline is dictated entirely by the deal’s complexity. A small, clean transaction might wrap up in just a few weeks.

However, for most significant mergers and acquisitions, you should plan for 60 to 90 days. This isn’t just bureaucratic padding; it’s the necessary time to conduct a deep dive into every financial, legal, and operational corner of the business. The clock can speed up or slow down based on the size of the target company, how cooperative the seller is with documents, and just how deep the buyer needs to dig.

Who Performs the Due Diligence?

Due diligence is a team sport, combining the buyer’s internal knowledge with specialized outside experts. While your own finance and legal teams will lead the charge, bringing in objective third parties is almost always a necessity for a truly thorough review.

A typical diligence team looks like this:

- Accounting Firms to run the numbers, handling the critical financial due diligence and Quality of Earnings (QoE) analysis.

- Law Firms to manage the legal deep dive, poring over contracts, and flagging potential litigation landmines.

- Specialized Consultants who are brought in for niche areas, like environmental assessments, IT infrastructure audits, or a sophisticated analysis of the commercial market.

What Happens if Major Problems Are Discovered?

Finding a “red flag” doesn’t mean the deal is dead. In fact, it’s one of the main reasons you do due diligence in the first place. Uncovering a serious issue simply gives the buyer information and, more importantly, leverage.

The discovery of a serious issue doesn’t automatically kill a deal. Instead, it opens a new phase of negotiation where the buyer can adjust the terms to fairly reflect the newfound risk, ensuring the investment remains sound.

When a significant problem surfaces, the buyer has a few powerful options:

- Renegotiate the Purchase Price to reflect the financial hit from the newly discovered risk.

- Require the Seller to Fix the Problem before the deal closes—a common path for compliance or operational gaps.

- Add Protective Clauses to the contract, like indemnification, which makes the seller financially responsible for specific liabilities after the sale.

- Walk Away from the Deal if the problems are so fundamental they destroy the value or logic of the investment.

Is It Ever Okay to Skip Due Diligence?

In a word: no. Skipping or rushing due diligence to close a deal faster is one of the riskiest moves a buyer can make. It’s like buying a house without an inspection—you might save a bit of time and money upfront, but you’re exposing yourself to hidden problems that could cost you millions down the road.

Proper due diligence isn’t a hurdle; it’s your primary risk management tool. It protects your investment, validates the price you’re paying, and makes sure you aren’t about to inherit a mess you can’t clean up. It is the absolute cornerstone of any sound transaction.

Navigating the complexities of M&A, real estate, or corporate litigation requires elite legal counsel. The Haute Lawyer Network connects you with the nation’s most respected attorneys, vetted for their professional excellence and showcased through a powerful media ecosystem. When the stakes are high, ensure you have the best legal representation by exploring our curated network.