The moments right after a car crash are a blur of confusion, shock, and adrenaline. It’s tough to think clearly, but what you do in these first few minutes is absolutely critical. Your actions set the foundation for your physical recovery, your insurance claim, and any potential legal action down the road.

Your First Moves at the Accident Scene

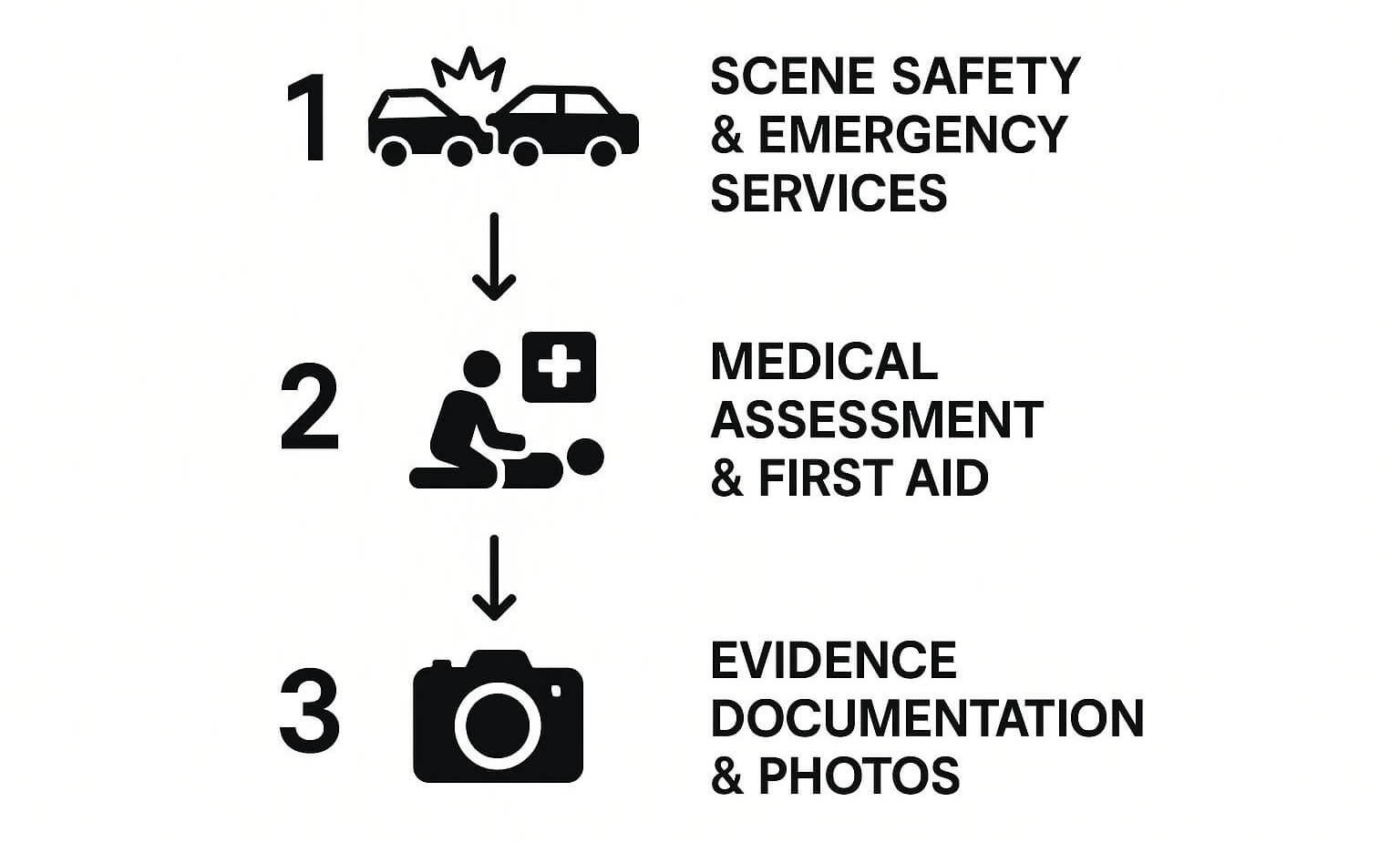

Think of the crash scene as the first chapter of your recovery story. Getting it right from the start makes everything that follows much, much easier. Your priorities are simple and in this order: safety, medical care, and gathering the facts.

First things first: check on yourself and anyone else in your car. Adrenaline is a powerful painkiller and can easily hide serious injuries. If you feel any pain, dizziness, or confusion, or if the crash involved significant damage, call 911 right away. Don’t hesitate. Ask for both police and an ambulance.

Securing the Scene and Gathering Information

Once you’ve addressed immediate medical needs, your next job is to prevent another accident. If your car is drivable and you can do so safely, move it out of the flow of traffic to the shoulder or a nearby lot. Flip on your hazard lights. This small step can prevent a bad situation from getting much worse.

No matter what, stay at the scene. Leaving the scene of an accident, especially one where people might be hurt, can lead to serious legal trouble. While you wait for the police to arrive, this is your prime opportunity to gather essential information from the other driver.

You’ll need to collect:

- Driver Information: Full name, address, and a good contact phone number.

- Insurance Details: The easiest way is to snap a clear photo of their insurance card. Make sure you get the insurance company’s name and the policy number.

- Vehicle Specifics: Note the make, model, color, and license plate number of their car.

It’s human nature to want to apologize, but it’s important to resist the urge. Stick to the facts of what happened. Admitting fault, even if you think you were responsible, can be used against you later by the insurance companies. Right now, you’re just a reporter gathering information.

Documenting Everything with Your Phone

Your smartphone is your best friend at an accident scene. Use it. Start taking photos of everything you can think of. Get shots of the damage to both cars from every angle—get close up to see the details, then step back to show the cars in relation to each other.

The goal is to paint a complete picture of what happened in those crucial moments.

This process isn’t just about the vehicles. Photograph the surrounding area, too. Capture any skid marks on the pavement, nearby traffic signs or signals, the road conditions, and even the weather. Every little detail helps build a clear, factual account of the accident, which will be invaluable for your claim.

To help you remember these steps when you’re under stress, here’s a quick checklist.

Post-Crash Immediate Action Checklist

| Action | Why It’s Critical | Details to Note |

|---|---|---|

| Check for Injuries | Your health is the #1 priority. Adrenaline can mask pain. | Note any pain, dizziness, or visible injuries for yourself and passengers. |

| Call 911 | Creates an official record and gets medical help on the way. | Request both police and ambulance if anyone is hurt or cars are undrivable. |

| Secure the Scene | Prevents further accidents and protects everyone involved. | Move cars if safe, turn on hazard lights, and use flares if you have them. |

| Exchange Information | Essential for filing an insurance claim. | Get the other driver’s name, contact, insurance, and vehicle info. |

| Document Everything | Photographic evidence is incredibly powerful and hard to dispute. | Take pictures of vehicle damage, the scene, road conditions, and injuries. |

| Wait for Police | The official police report is a key piece of evidence. | Give the officer a factual statement; avoid speculating or admitting fault. |

Having this checklist in mind can bring a sense of order to a chaotic situation, ensuring you don’t miss a step that could impact your health or your case.

Why Seeing a Doctor Is a Non-Negotiable Step

After the dust settles and the shock of a car crash begins to fade, it’s easy to fall into a common trap. You might do a quick self-check, feel a bit shaken but otherwise okay, and think, “I’m fine.” Deciding to skip a trip to the doctor based on that initial feeling is one of the biggest mistakes you can make—for your health and for any potential insurance claim down the road.

The reason is simple biology. Your body’s reaction to a traumatic event is to pump out adrenaline. This is your “fight or flight” response, and it’s an incredible natural painkiller. It can completely mask serious injuries, giving you a false sense of security. The pain from a concussion, whiplash, or even internal damage might not show up for hours, or in some cases, days.

What often happens is that these delayed symptoms creep up on you, turning what felt like a minor ache into a significant, ongoing problem. Gambling with your health is never a good bet.

The Dangers of Hidden Injuries

Many of the most common injuries from a car accident aren’t the obvious ones, like cuts or broken bones. They’re the invisible kind that lurk beneath the surface and only reveal themselves later through persistent pain, stiffness, or neurological issues.

Some of the most frequent culprits include:

- Whiplash: This is a classic car accident injury, caused by your head snapping back and forth. You might not feel it right away, but symptoms like neck pain, stiffness, and headaches often take 24 hours or more to fully develop.

- Concussions: You don’t have to hit your head to get a mild traumatic brain injury. The violent jolting alone can be enough. Be on the lookout for dizziness, confusion, memory gaps, or sudden sensitivity to light.

- Soft Tissue Damage: This is a broad term for the sprains, strains, and tears in your muscles, ligaments, and tendons. Your back and shoulders are especially vulnerable.

- Internal Bleeding: This is a life-threatening emergency that can start with subtle signs like abdominal pain or lightheadedness.

These incidents aren’t just minor fender-benders; their global impact is massive. Worldwide, road traffic crashes claim about 1.19 million lives each year. On top of that, somewhere between 20 and 50 million people sustain non-fatal injuries, many of which lead to long-term disabilities. You can get a better sense of the scale of this issue by reading the full CDC report on global transportation safety.

Building Your Medical Paper Trail

Getting checked out by a doctor isn’t just about your physical well-being; it serves a crucial secondary purpose. It starts creating an official record of your injuries. Think of it like this: every doctor’s visit, every x-ray, and every prescription is another piece of evidence for your case.

Each medical report, diagnosis, and treatment plan builds an undeniable bridge connecting the accident to your injuries. Without this “paper trail,” an insurance company has an open door to argue that your injuries weren’t caused by the crash or weren’t serious enough to warrant medical care.

Seeing a doctor right away demonstrates that you took your injuries seriously from the start. This single act can dramatically strengthen your claim, making it incredibly difficult for an insurance adjuster to minimize what happened to you. It shifts the conversation from your word against theirs to a discussion grounded in hard, medical facts.

Navigating the Insurance Claims Maze

Once the immediate shock of a crash wears off, you’re thrown into a whole new world: insurance claims. It can feel like a labyrinth of unfamiliar terms and procedures, but a little knowledge goes a long way in putting you back in control. The very first thing you need to do is report the accident to your own insurance company, even if the other driver was clearly at fault.

Don’t wait. Most policies have a clause requiring you to give them a heads-up promptly. Putting off that call can create unnecessary headaches down the line. Before you dial, grab your policy number, the police report number, and all the notes and photos you took at the scene.

Understanding the Insurance Adjuster’s Role

After you file a claim, your case will land on the desk of an insurance adjuster. This is where things get tricky. It is absolutely crucial to understand who they work for—and it isn’t you. The adjuster’s job is to protect their company’s bottom line by settling the claim for as little money as possible.

They might be perfectly pleasant on the phone, but their goal is to find reasons to minimize your payout. They’re trained to listen for anything that could suggest you share some of the blame or that your injuries aren’t as severe as you say. For this reason, they’ll often ask for a recorded statement about the accident.

A Quick Word of Warning: You are almost never required to give a recorded statement to the other driver’s insurance company. Adjusters can expertly twist your words or take them out of context. It’s best to politely decline until you’ve consulted with a car accident attorney.

Your Policy or Theirs? First-Party vs. Third-Party Claims

When it comes to getting compensation, you generally have two routes you can take. Which one is best depends on your specific situation, your coverage, and your state’s laws.

- First-Party Claim: This is when you file with your own insurer. If you have collision coverage for your car, this is often the quickest way to get it fixed. In “no-fault” states, you’ll also go through your own policy for initial medical bills, no matter who caused the wreck.

- Third-Party Claim: Here, you’re going directly after the at-fault driver’s insurance company. You’re making a claim against their policy to cover your damaged property, medical bills, lost income from missing work, and other losses.

No matter which path you take, meticulous organization is your best friend. Get a folder—physical or digital—and make it the dedicated home for everything related to the accident. We’re talking copies of the police report, every medical bill, receipts for prescriptions or rental cars, and detailed notes from every phone call.

Jot down the date, time, the name of the person you spoke with, and a summary of the conversation. This paper trail is invaluable. It becomes your evidence, protecting you from disputes and proving the facts of what happens after a car crash. It’s how you stay organized, stay in control, and fight for a fair outcome.

Knowing When You Need a Lawyer on Your Side

For a minor fender-bender where everyone walks away unharmed, you can probably handle the insurance claim on your own. But when the stakes are higher, going it alone is a risky gamble. You’re essentially stepping into a professional arena to face people trained to protect their company’s bottom line.

It’s crucial to recognize the signs that you’re out of your depth. The insurance adjuster might sound friendly, but their job isn’t to be your friend—it’s to minimize how much the insurance company has to pay. A lawyer, on the other hand, has only one duty: to protect you and fight for every dollar you deserve.

Clear Signals to Call an Attorney

Some situations are immediate red flags, signaling that the complexity of your claim just went way up. If any of these sound familiar, it’s time to get a legal professional in your corner.

- Serious Injuries: If the accident resulted in a hospital stay, surgery, or requires long-term physical therapy, you need a lawyer. This is especially true for any injury that causes a permanent disability or significant scarring.

- Disputed Fault: What if the other driver is blaming you? Or maybe the police report is vague or even wrong about who caused the crash. An attorney can dig in, gather evidence, and build a case to prove what really happened.

- Lowball Settlement Offers: Insurance companies love to throw out a quick, low offer, hoping you’ll take the money and run before you understand the true cost of your injuries. A good lawyer knows what your claim is actually worth and won’t let you get shortchanged.

- Uninsured or Underinsured Motorist: It’s a nightmare scenario—the person who hit you has no insurance or not enough to cover your bills. Getting the compensation you need in these cases is a legal maze that requires an expert guide.

These are just a few of the potential complications. You can find more insights from legal experts who focus specifically on personal injury law.

The moments following a crash are just the beginning of a long journey. An experienced attorney acts as your guide, managing every detail from evidence collection to negotiating with insurers, allowing you to focus completely on your recovery.

How Contingency Fees Work for You

One of the first things people worry about is how they can possibly afford a lawyer. This is where the contingency fee system comes in, and frankly, it’s a game-changer for regular people.

Here’s how it works: you pay absolutely nothing upfront. Your lawyer only gets paid if they win your case, either by securing a settlement or winning a verdict at trial. Their fee is simply an agreed-upon percentage of the money they recover for you.

If they don’t win, you don’t owe them a dime for their work. This system levels the playing field, ensuring that anyone can get top-tier legal help, no matter their financial situation. It also means your attorney is 100% motivated to get you the best possible result.

How to Document and Calculate Your Total Losses

After the dust settles from a car crash, the true cost often goes far beyond a crumpled fender. Getting fair compensation means you have to become a meticulous bookkeeper for your own life, tracking every single loss, big and small. The insurance company isn’t going to do this for you; it’s up to you to paint a clear and undeniable picture of your damages.

The best way to start is by sorting your losses into two distinct categories. Think of them as two different buckets you need to fill with evidence. The first bucket holds the tangible, receipt-based costs, while the second one deals with the more personal, human impact of the crash.

Tallying Your Economic Damages

Economic damages are simply all the direct financial hits you’ve taken because of the accident. These are the losses with a clear price tag—the ones you can prove with a receipt, an invoice, or a pay stub. The absolute best thing you can do is keep a dedicated folder, physical or digital, for all these documents.

Here’s what you should be collecting:

- Medical Bills: This is everything from the ambulance ride and ER visit to ongoing physical therapy, medications, and any recommended future surgeries.

- Lost Wages: If your injuries kept you out of work, you’re entitled to that lost income. You’ll need pay stubs or a letter from your employer to back this up.

- Property Damage: This mainly covers the cost to repair or replace your vehicle. But don’t forget other personal items damaged in the crash, like a laptop, phone, or even a child’s car seat.

- Out-of-Pocket Expenses: All those smaller costs add up. Track everything—rental car fees, parking for doctor’s appointments, or hiring someone for lawn care because you physically can’t do it.

The goal here is to build an exhaustive list of every single dollar the accident has cost you. No expense is too small to document, as they collectively reveal the true financial burden of the crash.

It’s easy to overlook some of the less obvious expenses. It’s worth learning more about the hidden costs of personal injury to make sure you’re not leaving money on the table.

Valuing Your Non-Economic Damages

This is where things get a bit more personal and, frankly, harder to put a number on. Non-economic damages are meant to compensate you for the human cost of the accident—the impacts that don’t come with a neat invoice. These losses are just as real and significant, and they deserve to be recognized.

While it’s trickier to calculate, these damages are a critical part of your claim.

- Pain and Suffering: This accounts for the actual physical pain, discomfort, and limitations your injuries have caused.

- Emotional Distress: This covers the psychological fallout, like the anxiety, depression, fear, or insomnia that often follows a traumatic event.

- Loss of Enjoyment of Life: If your injuries stop you from playing with your kids, going for a run, or engaging in hobbies you once loved, this aims to compensate for that profound loss.

Placing a value on these damages is complex. It often involves multiplying the total economic damages by a “multiplier” that reflects the severity of your injuries and the long-term impact on your life. This is where having a skilled attorney becomes invaluable—they know how to effectively argue what your pain and suffering are truly worth.

To help you understand the full scope of what you can claim, it’s useful to see all the potential damages laid out.

Types of Compensation in a Car Accident Claim

Here’s a breakdown of the different categories of damages you can pursue after a car crash.

| Damage Category | Description | Examples |

|---|---|---|

| Economic Damages | Direct, verifiable financial losses resulting from the accident. | Medical bills, lost wages, vehicle repair/replacement costs, physical therapy, rental car fees. |

| Non-Economic Damages | Intangible losses that affect your quality of life and well-being. | Pain and suffering, emotional distress, loss of enjoyment of life, disfigurement, loss of consortium. |

| Punitive Damages | Awarded in rare cases to punish the at-fault party for extreme negligence or malice. | A driver who was street racing or intentionally caused the crash. |

Understanding these categories is the first step toward ensuring you account for every aspect of your loss, from the medical bills you can hold in your hand to the personal suffering that can’t be itemized on a receipt.

Even as some statistics show improvement, the risks on the road are still very real. Recent US data showed a drop in traffic fatalities, with 17,140 in the first half of a recent year, a decrease of 8.2% from the year before. However, the overall fatality rate remains a serious concern, reminding us just how dangerous our daily commutes can be.

Common Questions After a Car Crash

After a wreck, your mind is probably spinning with a million questions. The initial shock quickly turns into a flood of “what-ifs” and “what nows.” This section is here to give you straight, clear answers to those pressing concerns, hopefully giving you a foothold when everything feels uncertain.

One of the first things on everyone’s mind is, “How is fault determined?” It’s not just one person’s opinion. Insurance adjusters, and sometimes even the courts, piece together the story using several key clues. They’ll look at the official police report, any witness accounts, photos you took at the scene, and even where the dents are on the cars involved. Keep in mind that different states play by different rules. Many use a system called comparative negligence, which means you can be found partly at fault but still receive compensation—though the amount might be reduced.

Understanding Timelines and Communication

Another big worry is how long this whole ordeal will take. Unfortunately, there’s no magic number. A simple claim where fault is obvious and the only issue is car damage might wrap up in just a few weeks. But if you’re dealing with serious injuries or the other driver is fighting the claim, it could easily stretch out for many months, or even over a year.

Patience is a virtue here, but that doesn’t mean you should sit back and wait. Be proactive. Keep a log of every single conversation you have with insurance adjusters. A great habit to get into is sending a quick follow-up email after a phone call to recap what you talked about. This simple step creates a paper trail and keeps things crystal clear.

Remember, every conversation you have with an insurance adjuster or a lawyer carries weight. Anything you say to your own attorney is protected, which is a massive advantage for your case. It’s worth understanding the specifics of what attorney-client privilege is so you can be completely open and honest with your legal team.

Common Concerns and Quick Answers

Let’s run through a few more questions that almost always come up when you’re figuring out what happens after a car crash:

- Should I cash the first check the insurance company sends me? Hold on. Cashing that check is often legally seen as accepting their offer as the final settlement. If you do that before you know the true cost of your medical treatments or lost time at work, you could be giving up your right to any more money.

- What if the other driver doesn’t have insurance? This is exactly why you have your own policy. If you carry Uninsured/Underinsured Motorist (UM/UIM) coverage, your own insurance provider will cover your damages and injuries, right up to your policy’s limits.

- Will my insurance rates go up? It really depends on who was at fault and your insurer’s specific rules. If the other driver was 100% responsible, your rates should stay put. If the accident was your fault, though, you should probably expect an increase.

Getting solid answers to these questions early on can help you navigate this difficult time with more confidence.

Navigating the legal complexities after an accident requires expert guidance. For attorneys seeking to connect with clients who need them most, Haute Lawyer Network offers an elite platform to enhance visibility and build a distinguished brand. Elevate your practice and stand out as a leader in your field by joining our curated network. Learn more and apply to join Haute Lawyer Network today.