A special needs trust is a critical legal tool designed to hold funds for a person with a disability, but it does so in a way that doesn’t jeopardize their eligibility for essential government benefits like Medicaid and Supplemental Security Income (SSI). Think of it as a financial safety net that pays for things public aid won’t, dramatically enhancing their quality of life. It’s how you ensure your loved one is supported long after you’re gone.

Why Special Needs Trust Planning Is Essential

Planning for the future of a disabled family member can feel daunting, but a Special Needs Trust (SNT) is one of the most powerful instruments at your disposal. It effectively creates a protective shield around assets, making them invisible to government agencies that enforce strict income and asset limits for benefit eligibility.

Without an SNT, a direct inheritance or a well-intentioned gift could accidentally disqualify your loved one from the very programs they depend on for healthcare and daily support.

It’s a common and heartbreaking scenario: a grandparent leaves $50,000 directly to their grandchild with a disability. While the gesture comes from a place of love, that inheritance pushes the grandchild over the typical $2,000 asset limit for SSI. As a result, their benefits are cut off until every last dollar is spent down, often on basic needs that SSI would have covered in the first place.

Effective special needs trust planning completely sidesteps this disastrous outcome.

Moving Beyond The Basics

The real power of an SNT isn’t to cover basic food and shelter—that’s what benefits are for. Instead, its purpose is to fund the “supplemental” needs that truly enrich a person’s life. This can include a huge range of expenses that promote well-being, independence, and happiness.

Here’s a quick overview of what these trusts are all about.

Quick Overview of Special Needs Trusts (SNTs)

| Core Concept | Primary Goal | Key Benefit |

|---|---|---|

| A legal arrangement holding assets for a person with disabilities. | To provide financial support without disrupting eligibility for government aid. | Enhances quality of life by funding needs beyond what public benefits cover. |

This structure is what makes an SNT so valuable, giving you a way to provide for life-enhancing extras.

Some of the key areas an SNT can cover include:

- Medical and Dental Care: Paying for costs not covered by Medicaid, such as specialized therapies, treatments, or extensive dental work.

- Personal Care: Funding for a personal care attendant, in-home health aide, or other support staff.

- Education and Recreation: Covering tuition for special programs, hobbies, vacations, computers, and other electronics.

- Transportation: Purchasing and maintaining a vehicle, especially one adapted for their specific needs.

By legally structuring how funds are held and distributed, an SNT lets you provide for these crucial quality-of-life expenses. It’s the difference between merely surviving on benefits and truly thriving with the support you’ve put in place.

Despite these clear advantages, far too many families are unprepared. A 2025 Trust & Will Estate Planning Report revealed that only 11% of Americans have any kind of trust in place, and a shocking 55% have no estate planning documents whatsoever. This gap underscores a critical need for awareness and decisive action.

Ultimately, this type of planning is an indispensable part of any comprehensive estate strategy. To see how it fits into the bigger picture, you might find it helpful to read our guide on how trust and estate planning can protect your assets today. It provides peace of mind, ensuring the resources you leave behind will be managed by someone you trust and used exactly as you intend—to secure your loved one’s future and well-being for a lifetime.

Choosing the Right Type of Special Needs Trust

When setting up a special needs trust (SNT), the single most important question you need to answer is this: Whose money is funding it? Getting this right is everything.

The answer to that question determines which type of trust you need, and choosing the wrong one can unravel your entire plan, potentially disqualifying your loved one from the very benefits you’re trying to protect. The source of the funds dictates the rules, the structure, and what happens to the money down the road.

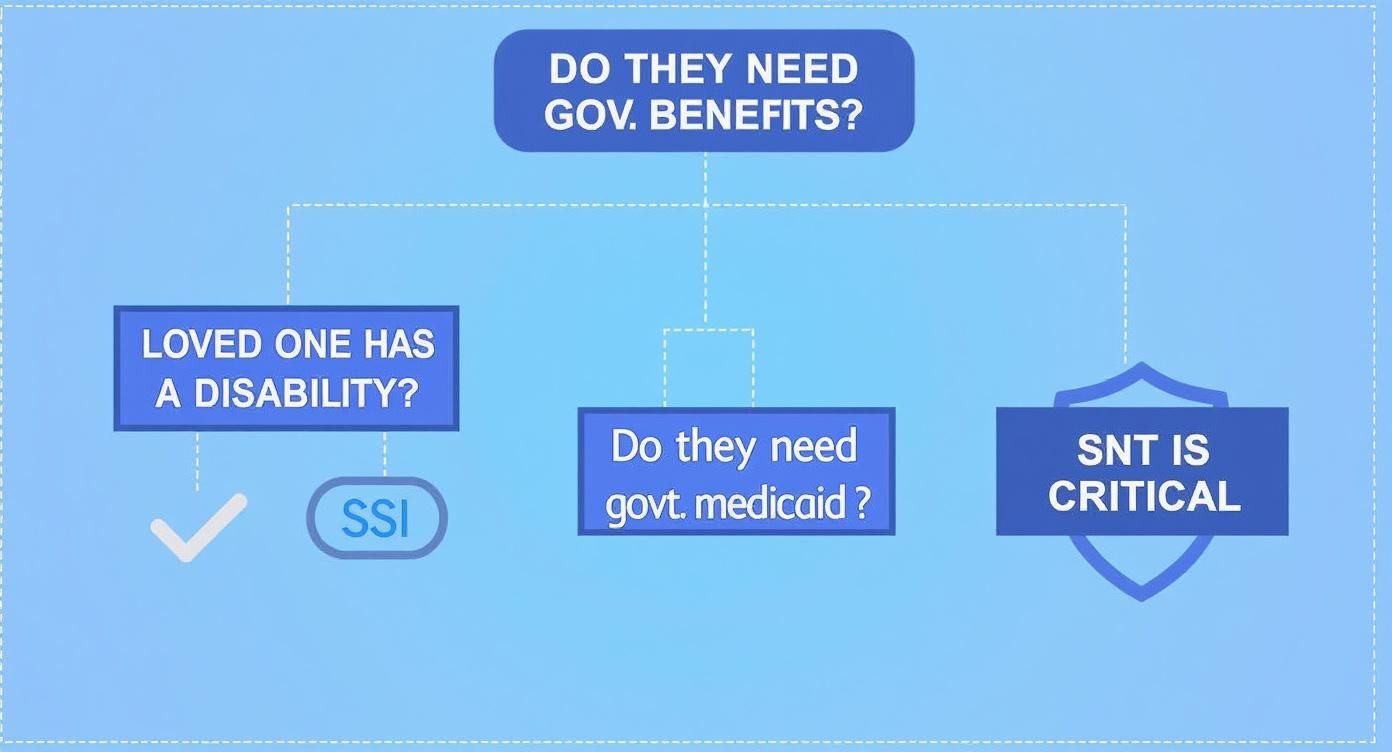

This decision tree gives you a quick visual on when an SNT is truly necessary.

As you can see, if a person with a disability relies on government aid like SSI or Medicaid, an SNT isn’t just a good idea—it’s essential for their long-term financial stability.

Understanding Third-Party Special Needs Trusts

The third-party SNT is the most common tool we use for parents, grandparents, and other family members who want to leave an inheritance to a loved one with a disability. You are the “third party,” and you’re funding the trust with your assets, often through your will or as the beneficiary of a life insurance policy.

The key benefit here is massive: any money left in a third-party SNT when the beneficiary passes away is not subject to a Medicaid payback. This means you get to decide where the remaining funds go. You can name your other children, grandchildren, or a charity as successor beneficiaries, ensuring your assets stay in the family or support a cause you care about.

Think of a couple who leaves their estate to a third-party SNT for their son, who receives SSI due to his autism. After they’re gone, the trust assets can pay for his therapy, a new computer, or even a vacation—all without jeopardizing his benefits. When he eventually passes away, whatever is left in the trust goes directly to his sister, exactly as his parents intended.

A third-party SNT is a forward-thinking legacy tool. It allows you to provide for your loved one with a disability while protecting the remainder of your estate for other family members, free from government claims.

When a First-Party Trust Is Necessary

On the other side of the coin is the first-party SNT, sometimes called a self-settled trust. This trust is used when the money already belongs to the individual with the disability. We see this happen frequently with personal injury settlements, a direct inheritance left the wrong way (not to a trust), or a lump-sum of Social Security back-pay.

Unlike a third-party trust funded by others, a first-party trust holds the beneficiary’s own assets and must be established before they turn 65. And this is the critical difference: this trust comes with a mandatory Medicaid payback provision. It’s a non-negotiable federal rule.

What does that mean? When the beneficiary dies, the state must be reimbursed from the trust for every dollar Medicaid spent on their behalf during their lifetime. Only after that lien is fully paid can any remaining money go to other heirs.

For instance, a young woman is awarded a $200,000 settlement after a car accident leaves her with a disability. To keep her Medicaid, her attorney places the funds into a first-party SNT. Years later, she passes away. The state of Florida then presents a bill for $185,000 in medical expenses paid by Medicaid. The trust must pay that first, leaving just $15,000 for her family.

To help clarify, here’s a table breaking down the fundamental differences between these two trust types.

Comparing First-Party vs. Third-Party Special Needs Trusts

This table offers a direct comparison to help you understand the critical differences between the two main types of SNTs, focusing on funding sources and Medicaid rules.

| Feature | First-Party SNT (Self-Settled) | Third-Party SNT |

|---|---|---|

| Funding Source | Funded with the beneficiary’s own assets (e.g., settlement, inheritance). | Funded with assets from someone else (e.g., parents, grandparents). |

| Establishment Age | Must be established before the beneficiary turns 65. | Can be established at any time, typically through an estate plan. |

| Medicaid Payback | Required. The state must be reimbursed for Medicaid costs upon death. | Not required. Remaining funds can pass to successor beneficiaries. |

| Primary Use Case | Protecting a beneficiary’s own assets to maintain benefit eligibility. | Allowing family to leave an inheritance without disrupting benefits. |

Understanding these distinctions is crucial, as they have significant, long-term implications for the beneficiary and any other heirs. You can explore more detailed comparisons about trust structures to dig deeper into the legal nuances.

Pooled Trusts as a Practical Alternative

For some families, the cost of setting up a private trust or the difficulty of finding a capable trustee can be a major hurdle. In these cases, a pooled special needs trust is a fantastic solution.

These trusts are run by nonprofit organizations that “pool” assets from many different families for investment purposes, which helps lower costs. Each beneficiary, however, has their own separate sub-account for distributions.

Pooled trusts are an excellent fit for:

- Smaller Estates: They offer professional management without the high fees of a corporate bank trustee.

- Lack of a Trustee: The nonprofit serves as the trustee, which is perfect when you don’t have a family member or friend who can take on the responsibility.

- First-Party Funds: They are often used to hold first-party assets, especially for individuals over 65 who are no longer eligible to create their own first-party SNT.

Choosing the right structure is the foundational step. It ensures the trust works the way it’s supposed to, protecting your loved one for years to come.

Selecting the Right Trustee for Your Trust

Make no mistake: choosing a trustee is the single most critical decision in your entire special needs trust planning process. This person or institution acts as the operational heart of the trust. They’re tasked with managing its assets and making distributions that genuinely enrich the beneficiary’s life—all without jeopardizing their essential government benefits.

It’s a role that demands so much more than simple honesty. A great trustee needs to be a unique blend of savvy financial manager, meticulous bookkeeper, and compassionate advocate. They must navigate a labyrinth of government regulations, make sound investment decisions, and handle sensitive family dynamics, always keeping the beneficiary’s best interests front and center.

The Great Debate: Family Member vs. Professional Trustee

The first instinct for most families is to name a close relative, like a sibling or a favorite aunt, as trustee. This choice comes from a place of love and deep personal connection, but it’s crucial to weigh those emotional benefits against the very real, practical demands of the job.

A family member knows the beneficiary on a profound level—their quirks, their joys, and their dreams. That insight is priceless. However, they often lack the financial acumen to manage a large investment portfolio or the specialized legal knowledge to avoid catastrophic compliance mistakes with SSI and Medicaid rules.

On the other side of the coin, a professional or corporate trustee—think a bank’s trust department or a specialized attorney—brings immediate expertise and impartiality. They live and breathe the intricate rules governing SNT distributions and have bulletproof processes for accounting, tax filing, and investment management. The trade-off? A lack of personal connection and, of course, their fees.

Sometimes, a hybrid approach offers the best of both worlds:

- Co-Trusteeship: Appoint a family member and a professional to serve together, blending personal insight with technical know-how.

- Trust Protector: Name a family member as a “trust protector,” giving them the power to oversee the professional trustee and even replace them if necessary.

A Real-World Pitfall: The High Cost of a Small Mistake

Here’s a scenario I’ve seen play out too many times: Uncle Joe, named trustee for his niece, Sarah, wants to do something special for her birthday. He writes her a $500 check directly from the trust. A lovely gesture, right?

Wrong. That well-intentioned gift is treated as unearned income by the Social Security Administration. As a result, Sarah’s SSI check for that month is reduced dollar-for-dollar, wiping out a huge portion of her benefits. Joe’s simple mistake, born from kindness, ended up directly harming Sarah’s financial stability. A professional would have known to pay the party venue or caterer directly, sidestepping the cash distribution entirely.

The role of a trustee is not just to say “yes” to requests, but to find creative, compliant ways to meet the beneficiary’s needs. It’s a job that requires both a firm grasp of the rules and a compassionate understanding of the person.

This is exactly why finding a professional with the right background is so important. For expert help in identifying top-tier legal advisors in this space, you can learn more about how to find the best estate planning lawyers who specialize in these complex trust arrangements.

Core Duties and Essential Skills of a Trustee

An effective trustee must wear many hats. As you go through your special needs trust planning, you need to vet every potential candidate to ensure they can handle these critical responsibilities.

Key Trustee Responsibilities:

- Investment Management: Prudently investing trust assets to ensure long-term growth and stability for the beneficiary’s entire life.

- Distribution Decisions: Skillfully evaluating requests and making payments for supplemental needs in a way that never interferes with benefits.

- Record Keeping: Maintaining flawless, audit-proof records of all income, expenses, and distributions.

- Tax Compliance: Filing the annual fiduciary income tax returns for the trust accurately and on time.

- Advocacy: Communicating with government agencies and acting as a fierce advocate for the beneficiary.

When you evaluate a potential trustee, look for a combination of hard and soft skills. They must be financially sharp and obsessively organized, but also empathetic, patient, and a stellar communicator. This single decision will echo for decades, profoundly impacting your loved one’s security and quality of life. Choose wisely.

Funding the Trust and Crafting a Letter of Intent

A perfectly drafted special needs trust is a powerful legal instrument, but on its own, it’s just an empty shell. The real work in special needs trust planning begins when you start funding it, transforming your intentions into a tangible financial resource that will one day support your loved one. This isn’t just about writing a check; it requires a strategic plan to ensure assets flow into the trust correctly, typically after you’re gone.

The most critical rule is to channel funds into the trust without ever putting them directly in the beneficiary’s name. A common, and frankly devastating, mistake is naming your child with special needs as a direct beneficiary in your will or on a life insurance policy. Doing so can immediately jeopardize their eligibility for government benefits, completely undermining the very protections the trust was designed to provide.

Instead, you must name the Special Needs Trust itself as the beneficiary. This legal distinction makes all the difference.

Smart Strategies for Funding Your SNT

There are several effective ways to fund a third-party SNT, and the right mix will depend on your unique financial picture and overall estate plan. Most families find that a combination of these strategies builds the most robust financial safety net.

Common funding sources include:

- Life Insurance: This is often the most cost-effective method. For a relatively low monthly premium, you can purchase a policy that names the SNT as the primary beneficiary, creating a substantial trust fund down the road.

- Retirement Accounts: Naming the trust as the beneficiary of your 401(k), IRA, or other retirement plan is a powerful tool. However, this move requires careful coordination with an attorney to navigate some pretty complex tax implications.

- Wills and Revocable Trusts: You can direct a portion of your estate—or specific assets—to be transferred into the SNT upon your death through your will or living trust. This ensures any inheritance is properly shielded.

- Real Estate and Investments: Other assets, like property or a brokerage account, can also be used to fund the trust, though this may involve more complex legal and tax considerations.

The most important takeaway here is precision. When you update beneficiary designations, you must use the exact legal name of the trust, something like “The John Smith Special Needs Trust dated January 1, 2024.” Any ambiguity can create a legal headache, leading to challenges and delays.

This process is a core piece of a much larger family financial strategy. To see how these elements fit together, this practical guide to estate planning for families offers a broader look at the topic.

The Letter of Intent: The Heartbeat of the Plan

While funding provides the financial fuel for the trust, the Letter of Intent (LOI) provides its soul. This isn’t a legally binding document, but in many ways, it’s just as important as the trust itself. The LOI is your personal guide to the trustee—a detailed instruction manual filled with your intimate, firsthand knowledge of the beneficiary.

Think of it as a conversation with the person who will one day step into your shoes. You are essentially downloading decades of personal experience, insight, and love into a document that will guide their decisions. It’s where you articulate your hopes, dreams, and specific wishes for your loved one’s care.

A strong LOI is a living document that you should revisit and update every few years. It’s meant to capture the essence of the person you love, ensuring their care is always personalized and compassionate.

Key details to include in your Letter of Intent:

- Daily Routines: Describe their typical day. What helps them feel secure? What are their morning habits or bedtime rituals? What things trigger anxiety?

- Medical Information: List all doctors, therapists, medications, dosages, and allergies. Be sure to include contact information and a brief summary of their medical history.

- Personal Preferences: This is the fun part. Detail their favorite foods, activities, music, and places to visit. Don’t forget to also note their dislikes and fears.

- Social Connections: Who are the important people in their life? Mention supportive family members, friends, and community figures the trustee should encourage contact with.

- Hopes for the Future: Share your vision for their life. Do you hope they can live in a particular type of housing, participate in certain activities, or continue a beloved hobby?

This document gives a trustee the critical context they need to make choices that truly honor your wishes and, more importantly, honor the unique individual the trust was created to protect. It’s an invaluable part of successful special needs trust planning.

Navigating Legal Rules and Ongoing Administration

Getting a special needs trust established is a massive milestone, but it’s just the starting line. Think of it like building a high-performance car; now you need a skilled driver and a meticulous maintenance schedule to keep it running for the long haul.

This is where the real work of special needs trust planning begins. The ongoing administration demands precision and a deep, practical understanding of a very specific set of rules.

The trust document itself is your foundation. This is not a DIY project or a job for a general practice attorney; it must be drafted by a lawyer who lives and breathes this area of law. Generic trust language just won’t fly. Your SNT needs very specific clauses that are non-negotiable to satisfy the strict regulations of the Social Security Administration (SSA) and Medicaid. One wrong phrase and the entire structure could be invalidated, putting essential benefits at risk.

The Trustee’s Core Administrative Duties

Once the ink is dry on a legally sound trust, the trustee’s job kicks off. This role is so much more than just cutting checks. A trustee is a fiduciary, legally obligated to act only in the best interest of the beneficiary. Their duties are complex and require constant attention.

Here’s a glimpse of what that responsibility looks like day-to-day:

- Meticulous Accounting: Every single dollar that comes in or goes out must be tracked with painstaking detail. This isn’t just good bookkeeping; it’s a legal mandate. Agencies like the SSA can, and often do, ask for a full accounting to make sure funds are being used correctly.

- Annual Tax Filings: Special needs trusts are their own legal entities. That means they generally have to file their own annual income tax returns (Form 1041). The trustee is on the hook for getting these prepared correctly and filed on time.

- Prudent Investing: The trustee has a legal duty to manage the trust’s assets responsibly. This isn’t about hitting home runs in the stock market. It’s about creating a sound investment strategy that balances growth with capital preservation to make sure the money lasts for the beneficiary’s entire life.

Dropping the ball on any one of these tasks can trigger serious legal and financial headaches. It really underscores why choosing a capable trustee is one of the most critical decisions you’ll make.

The Sole Benefit Rule and Common Compliance Traps

The single most important—and most frequently misunderstood—rule is the “sole benefit” rule. In simple terms, every dollar spent from the trust must be for the primary benefit of the person with the disability. No one else.

Sounds easy, but it gets complicated fast.

For instance, can the trust pay for a vacation? Absolutely, but only for the beneficiary’s share of the costs. If a caregiver is medically necessary for the trip, their essential travel expenses can usually be covered too. But paying for the whole family to tag along? That’s a clear violation of the sole benefit rule.

This is where so many well-intentioned trustees trip up. Here are the most common compliance traps to watch out for:

- Giving Cash Directly to the Beneficiary: This is the cardinal sin of SNT administration. Any cash handed to the beneficiary is counted as unearned income by the SSA and will almost always trigger a dollar-for-dollar reduction in their SSI payment.

- Paying for Food or Shelter: When a trust directly pays for what the SSA calls “in-kind support and maintenance” (ISM)—things like rent, mortgage, utilities, or basic groceries—it can cause a reduction in SSI benefits. While the penalty isn’t as severe as the cash rule, it’s still a financial hit that smart planning can often avoid.

- Co-Mingling Funds: The trust’s money must be kept completely separate from anyone else’s assets, including the trustee’s personal funds. A dedicated bank account for the trust isn’t a suggestion; it’s a requirement.

A savvy trustee learns to think creatively. Instead of giving cash for groceries, they might buy a gift card to a specific supermarket. Rather than paying rent directly to a landlord, they might explore funding an ABLE account, which can be used for housing expenses without impacting SSI.

Your best defense against government scrutiny is an impeccable paper trail. The trustee should keep detailed receipts and notes for every single expenditure, explaining how it directly benefited the individual with the disability. This diligence is your shield. If an audit ever happens, you’ll be able to prove full compliance, protecting both the trust and your loved one’s irreplaceable benefits.

Answering Your Key Questions About Special Needs Trusts

Even the most well-thought-out plan will spark questions along the way. Planning for a loved one with special needs is a detailed process, and getting clear answers is essential for peace of mind. Let’s tackle some of the most frequent questions that come up.

What Can Trust Funds Actually Pay For?

Think of the trust as a resource for life-enhancing expenses, not basic survival. The money is strictly for “supplemental needs”—anything that improves the beneficiary’s quality of life beyond what government aid provides.

The cardinal rule is to avoid paying for basic food and shelter or giving cash directly to your loved one. Doing so could jeopardize their eligibility for crucial benefits like Supplemental Security Income (SSI).

Instead, the trust can cover a vast range of expenses that make life richer and more comfortable:

- Medical and Dental Care: This includes costs not covered by Medicaid, like specialized therapies, experimental treatments, or higher-quality dental work.

- Personal Support: Funds can pay for a personal care attendant, an in-home health aide, or a professional advocate to help navigate the social services maze.

- Education and Recreation: Think tuition for special programs, art classes, summer camps, vacations, or adaptive sports equipment.

- Technology and Transportation: The trust can purchase a computer, assistive technology, or even a modified, accessible vehicle.

Critically, the trustee makes these payments directly to the vendor or service provider. This structure ensures the funds never count as the beneficiary’s personal income.

Should a Parent Act as the Trustee?

While you can legally serve as the trustee of a third-party trust you set up for your child, it’s often a move that creates more problems than it solves. The emotional connection you have as a parent can conflict with the strict, impartial judgment required of a fiduciary.

Imagine having to deny a request from your child, even if you know it’s not a wise use of the trust’s assets. That’s a tough spot for any parent. Appointing a professional trustee, a capable sibling, or another trusted relative creates a necessary buffer.

A highly effective strategy is naming co-trustees: you pair a family member who knows the beneficiary’s needs intimately with a professional who understands the intricate financial and legal rules.

For a first-party trust (funded with the beneficiary’s own assets), the rule is absolute: the beneficiary can never serve as their own trustee.

What Happens to Money Left in the Trust?

This is one of the most important distinctions in trust planning, and the answer depends entirely on the type of trust.

For a Third-Party SNT, you—the person who created the trust—decide where any remaining funds go. You simply name successor beneficiaries in the trust document, which could be your other children, grandchildren, or a charity. Medicaid has no claim to this money.

The rules for a First-Party SNT are completely different. Because this trust was funded with the beneficiary’s own money (like from a settlement), federal law mandates that the state Medicaid agency gets paid back first for all services provided during the beneficiary’s life. Only after that debt is settled can any leftover money go to other heirs.

How Is an ABLE Account Different?

ABLE (Achieving a Better Life Experience) accounts are another fantastic tool, but they don’t replace an SNT. An individual whose disability began before age 26 can open an ABLE account to save money without it counting against their benefit limits. Its main advantage is giving the beneficiary more direct control over day-to-day spending.

Here’s how they stack up:

| Feature | Special Needs Trust (SNT) | ABLE Account |

|---|---|---|

| Contribution Limit | No limit on contributions. | Annual contribution limits apply. |

| Asset Limit | No asset limit inside the trust. | Funds over $100,000 can suspend SSI. |

| Housing Payments | Paying for housing can reduce SSI. | Can pay for housing without SSI reduction. |

| Medicaid Payback | Only required for First-Party SNTs. | Required for all ABLE accounts. |

These two tools are designed to work in tandem. An SNT can hold a significant inheritance, and the trustee can make periodic distributions into the ABLE account. This strategy protects the core assets while giving the beneficiary financial independence for daily needs.

Finding the right legal expert is the most important step in creating a plan that truly protects your loved one. The Haute Lawyer Network connects you with a curated list of the nation’s most respected attorneys who specialize in complex areas like special needs trust planning. Ensure your family’s future is in the hands of a proven professional.

Find a top-tier attorney on the Haute Lawyer Network.