Legal ethics aren’t just about following the letter of the law. They’re about navigating the often-blurry line between what you can do and what you should do. This gray area creates a maze for even the sharpest legal minds, forcing a constant negotiation between professional standards and black-and-white legal requirements.

Navigating the Modern Maze of Legal and Ethical Challenges

In the legal field, what is legally defensible can sometimes be ethically disastrous. It’s a tension that creates a complex environment where attorneys must constantly weigh their actions against both written rules and the unwritten principles of integrity. That challenge has only grown as business goes global and new technology creates dilemmas no one saw coming.

The professional landscape isn’t a fixed map with clear borders anymore. Think of it as a dynamic, shifting terrain, constantly being reshaped by powerful forces:

- Technological Leaps: The explosion of AI, cloud data, and instant global communication has opened a Pandora’s box of potential privacy breaches and unforeseen conflicts of interest.

- Borderless Markets: Operating across different countries means juggling a patchwork of laws, cultural norms, and ethical expectations. One misstep can have international consequences.

- Shifting Public Expectations: Society now holds professionals and corporations to a higher standard of transparency and accountability. Reputational risk has become a critical, front-and-center concern.

The Growing Burden of Compliance

This shifting ground puts immense pressure on law firms and their clients. It’s not just a feeling; the numbers back it up. A recent survey found that a staggering 85% of compliance professionals feel regulations have become significantly more complex over the past three years.

This isn’t just about more paperwork. Fully 90% of compliance officers have seen their duties expand, and 82% of companies admit these mounting demands are hurting their ability to innovate and grow. You can dig deeper into these compliance statistics to see the full picture.

Navigating today’s legal and ethical issues requires more than just a rulebook. It demands a proactive, principles-based mindset that anticipates risk and prioritizes integrity over mere compliance. Success isn’t just about following the law anymore; it’s about building a foundation of trust that can withstand intense scrutiny.

To help with that, we’ve broken down the core challenges attorneys and clients face today. By understanding the major domains where legal and ethical landmines are buried, you can learn to spot them before they turn into full-blown crises.

Legal and ethical issues manifest across several key areas of professional practice. The table below outlines the core domains where these challenges are most likely to surface, giving you a quick reference for the primary legal and ethical concerns in each.

Core Domains of Modern Legal Ethical Issues

| Domain | Primary Legal Concern | Primary Ethical Concern |

|---|---|---|

| Confidentiality | Protecting client information from unauthorized disclosure as required by law. | Upholding the sacred trust between attorney and client. |

| Conflict of Interest | Avoiding situations where duties to different clients are at odds. | Ensuring undivided loyalty and impartial judgment for every client. |

| Professional Competence | Maintaining the necessary knowledge and skill to represent clients effectively. | Committing to lifelong learning and recognizing the limits of one’s expertise. |

| Billing & Fees | Ensuring all billing practices are transparent and legally compliant. | Charging fair and reasonable fees that reflect the value of the work performed. |

| Advertising & Solicitation | Adhering to state bar rules governing how legal services can be marketed. | Avoiding misleading or coercive tactics that could exploit potential clients. |

Understanding these domains is the first step toward building a practice that is not only legally compliant but also ethically sound. It’s about creating a culture where doing the right thing is second nature.

Understanding Your Professional Responsibilities

At the core of any professional relationship is a set of promises. These aren’t just abstract ideals; they are tangible, enforceable duties that form the very foundation of trust between a professional and their client. Think of them as the unspoken terms of your agreement—the pillars holding up the entire structure of your professional integrity.

When these duties are honored, trust deepens and relationships get stronger. But when they’re ignored, the fallout can be disastrous, quickly turning a simple ethical lapse into a serious legal fight. Getting a handle on these core duties is the first critical step in navigating the often-tricky world of legal ethics.

The Foundational Duties of Care and Loyalty

The duty of care is the absolute baseline. It simply means you must act with reasonable skill and diligence, bringing the right level of competence to a client’s case and applying it consistently. Imagine hiring a surgeon who isn’t up-to-date on modern surgical techniques—their failure to apply the standard of care in their field would be a clear breach.

In the same vein, the duty of loyalty demands that you act purely in your client’s best interests, without any competing influences clouding your judgment. This means your decisions can’t be swayed by your own financial stake, your obligations to another client, or your relationships with anyone else. A hidden conflict of interest, for instance, is a direct assault on this principle.

These duties aren’t just suggestions; they are hard-and-fast rules. Dropping the ball can lead to:

- Malpractice Claims: A failure to meet the standard of care is the very definition of professional negligence and can land you in court.

- Loss of Licensure: Professional boards have the authority to suspend or even revoke licenses for serious ethical violations.

- Reputational Damage: Even without legal action, a reputation for being disloyal or incompetent can be a career-killer.

“A professional’s primary allegiance is to the client. Every decision, every action, must be filtered through the lens of what best serves their interests, untainted by personal gain or external pressures. This is the essence of professional ethics.”

The Unbreakable Seal of Confidentiality

Perhaps the most sacred responsibility of all is the duty of confidentiality. This principle is what allows clients to share their most sensitive information without the fear of it ever being revealed. It’s far broader than most people think, covering nearly all information related to the professional relationship, not just the “secret” stuff.

This ethical duty is the bedrock for the powerful legal doctrine of attorney-client privilege. While confidentiality is an ethical rule that prevents you from voluntarily sharing information, privilege is a legal shield that protects those communications from being compelled in court. To get a better grasp of this crucial protection, it’s worth exploring resources that explain what attorney-client privilege is and how it works in the real world.

A breach of confidentiality can happen in shockingly simple ways—a casual conversation in a coffee shop, an unsecured email, or discussing a case with a spouse. The consequences are immediate and severe, destroying client trust and potentially causing them significant harm.

In fact, a 2023 study found that 64% of data breaches were caused by simple human error, a stark reminder of the need for constant vigilance. These slip-ups don’t just violate ethical standards; they can trigger legal action under various privacy laws, turning a momentary lapse in judgment into an expensive legal nightmare.

Protecting Client Data in the Digital Age

The duty of confidentiality has always been a cornerstone of legal practice. It used to be simple: lock the file cabinet. Today, it’s about securing a digital fortress against an endless barrage of cyber threats. Every email, cloud document, and video call is a potential weak point.

This modern reality turns the abstract principle of confidentiality into a minefield of pressing legal ethical issues. A data breach isn’t just an embarrassing slip-up; it’s a direct violation of professional duties that can lead to malpractice claims, disciplinary action, and a shattered reputation. The challenge is balancing the incredible convenience of new technologies with the non-negotiable obligation to keep client information ironclad.

The New Frontiers of Data Privacy

The digital age brought powerful tools, but it also brought significant risks. Cloud storage platforms, third-party practice management software, and even simple messaging apps can expose sensitive data if they aren’t managed with precision. One weak password or an unencrypted file transfer can unravel years of a client’s trust.

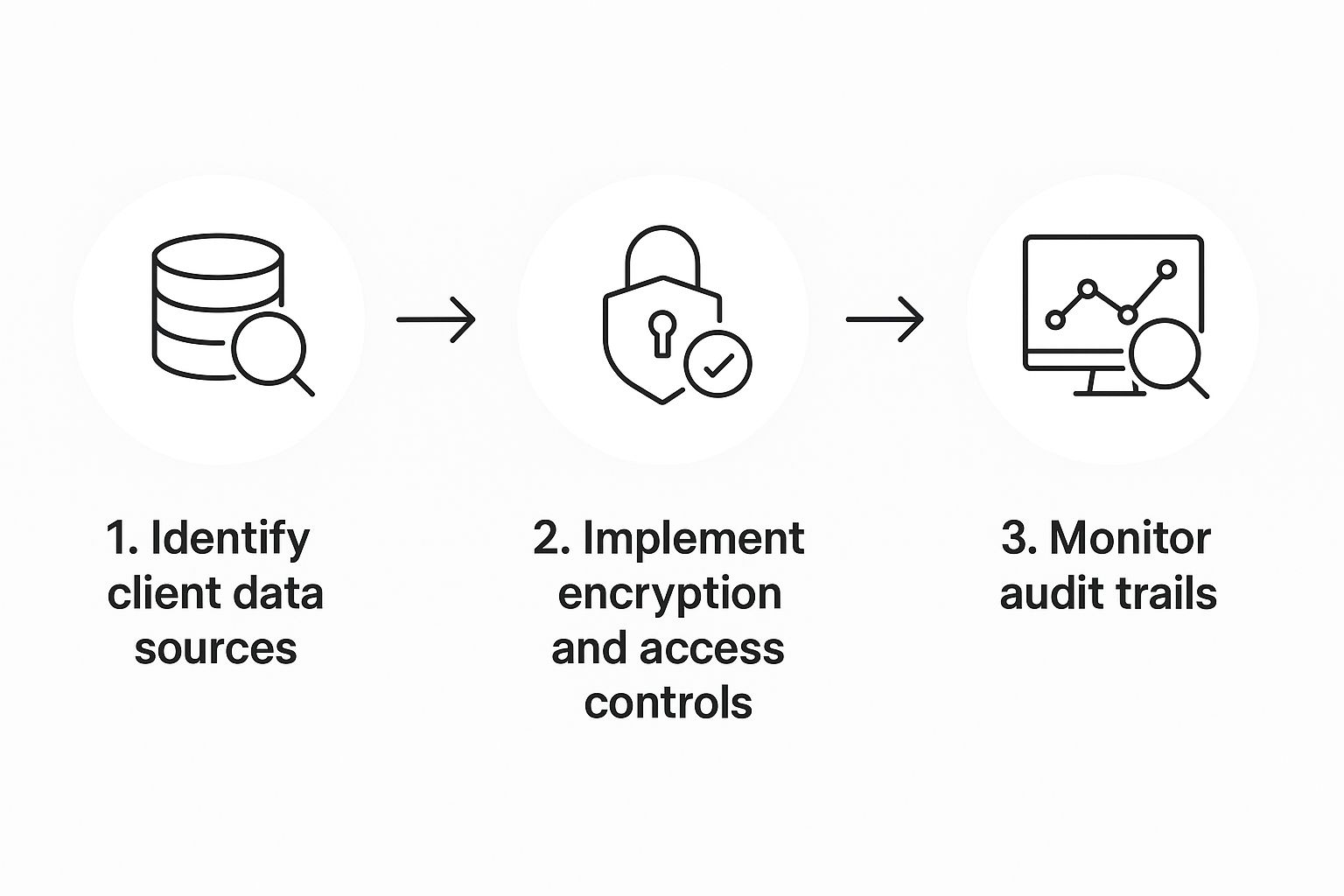

This constant threat demands a proactive, not reactive, approach to data security. A truly comprehensive data protection strategy involves several critical steps, from mapping out where all your data lives to implementing robust, multi-layered controls. The process below lays out a foundational framework for safeguarding client information in the real world.

This isn’t a one-and-done setup. As the visual guide shows, real data protection is a continuous cycle of identification, implementation, and vigilant monitoring. Each step is essential for building a resilient security posture that can adapt as new threats emerge.

Navigating Global Data Regulations

Adding another layer of complexity is the tangled web of data privacy laws that now govern how personal information is handled. Regulations like Europe’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) have set a new global standard with serious, far-reaching consequences for law firms.

These laws give individuals significant rights over their personal data, including the right to know how it’s being used and to demand its deletion. For legal professionals, this boils down to a few key principles:

- Data Minimization: Only collect and hold onto data that is absolutely essential for a client’s case.

- Purpose Limitation: Use client data strictly for the reasons it was collected, and nothing else.

- Informed Consent: Get clear, explicit permission before processing personal information in certain ways.

A data breach under GDPR can trigger fines of up to €20 million or 4% of a firm’s global annual revenue—whichever is higher. That figure alone underscores the massive financial and reputational risk of non-compliance. It’s no longer just an IT issue; data privacy is a core business function.

The Ethical Tightrope of Artificial Intelligence

The rapid rise of artificial intelligence in the legal field presents one of the most significant modern legal ethical issues. AI tools hold incredible potential for analyzing mountains of discovery, drafting documents, and even predicting case outcomes. But they also raise profound ethical questions about data usage and client trust.

A recent IBM survey revealed that 80% of consumers are worried about how their personal data is used by AI, and over 60% don’t trust organizations to use it ethically. This widespread mistrust is a major hurdle for any professional looking to adopt these new technologies.

When you feed sensitive client information into an AI platform, a host of questions immediately surface. Who owns that data now? How is it being used to train the model? What’s in place to prevent bias or a breach? Exploring how artificial intelligence is revolutionizing legal practice is critical for any forward-thinking firm, but it demands extreme ethical caution.

Ultimately, protecting client data is about more than just technology or compliance checklists. It’s a fundamental expression of the duties of loyalty and confidentiality. In an age of constant connectivity, maintaining that trust requires a vigilant, informed, and ethically grounded approach to every single piece of information a client shares.

Managing Conflicts of Interest Effectively

Conflicts of interest are one of the most insidious and damaging legal ethical issues a professional can face. They act like a slow poison, quietly eroding the trust that serves as the bedrock of any client relationship. The moment your personal interests or your duties to someone else clash with your obligations to a client, your judgment is at risk of being compromised—even if you don’t realize it.

Think about a consultant hired by two different startups, both scrambling to dominate the same niche market. She helps Startup A craft a brilliant, game-changing marketing plan. A month later, Startup B brings her on for the exact same task. If she uses any of the proprietary insights she gained from Startup A to give Startup B a leg up, she’s crossed a bright red ethical line and betrayed them both.

That’s a pretty clear-cut example of a direct conflict. In the real world, though, these situations are rarely so black and white. They often start as subtle possibilities before snowballing into full-blown ethical nightmares.

Spotting Potential Versus Actual Conflicts

Mastering the art of risk management here starts with understanding the crucial difference between a potential conflict and an actual one.

An actual conflict is happening right now—your professional duties are actively being undermined. The consultant advising two direct competitors at the same time is a textbook case.

A potential conflict, on the other hand, is a situation that could easily turn into an actual conflict down the road. For instance, imagine an attorney representing a client in a big real estate transaction while personally holding a financial stake in the development company. Their judgment might be perfectly fine at the moment, but the risk that it could be swayed is massive. And that risk has to be managed.

The one rule that is absolutely non-negotiable is this: the client’s interests must always, always come first. Even the appearance of a conflict can torpedo your reputation, which is why you have to be proactive about navigating these tricky ethical waters.

A professional’s duty of loyalty is absolute. It demands undivided allegiance, completely free from any competing interests that could dilute impartial judgment or betray a client’s trust. Ignoring this principle is a fast track to professional ruin.

A Framework for Managing Conflicts

When you spot a potential or actual conflict, you can’t just cross your fingers and hope it goes away. You need a structured, deliberate response to protect both your client and your own integrity. The following framework provides a clear path forward.

For organizations looking to formalize this process, a clear, step-by-step guide is essential.

Conflict of Interest Management Framework

This table outlines a practical, step-by-step guide for identifying, assessing, and resolving potential conflicts of interest in any professional setting.

| Step | Action Required | Key Consideration |

|---|---|---|

| 1. Identify | Implement a robust screening process for every new client and matter. | The goal is to spot issues before any substantive work begins. Check for personal, financial, or prior professional ties. |

| 2. Disclose | Immediately and transparently inform all affected clients of the conflict. | Your disclosure must be detailed, explaining the nature of the conflict and the specific risks it poses to them. |

| 3. Get Consent | Obtain clear, written, and informed consent from the client to proceed. | “Informed” is the critical word. The client has to truly understand the situation and voluntarily agree to waive the conflict. |

| 4. Withdraw | If the conflict is too severe to be waived, you must decline or withdraw from the representation. | Protecting your professional integrity is always more valuable than any single fee. Know when to walk away. |

By consistently applying this framework, professionals can navigate these complex situations ethically, ensuring that client trust remains the top priority. It’s not just about avoiding discipline—it’s about upholding the very foundation of your professional duty.

Preventing Financial Misconduct and Corruption

Of all the potential legal ethical issues an organization can face, financial misconduct is one of the most destructive. A single bad decision involving bribery, fraud, or money laundering can unravel a company, ruin careers, and erode public trust in an instant. These aren’t just abstract white-collar crimes; they have real-world consequences that can cripple economies and land executives behind bars.

It almost never starts with a massive criminal conspiracy. Instead, it’s a classic “slippery slope.” The trouble often begins with a seemingly minor compromise—an undocumented expense to “grease the wheels” on a contract or a slightly aggressive revenue projection to satisfy shareholders. These small lapses slowly chip away at an organization’s ethical foundation, creating a culture where bigger and bolder transgressions don’t just seem possible, but normal.

Before you know it, those minor indiscretions have snowballed into full-blown criminal conduct, leaving devastating financial and reputational damage in their wake.

The scale of this problem is hard to overstate. Just recently, a major bank was forced into a $3 billion settlement after it admitted its anti-money laundering (AML) systems were completely inadequate. That failure allowed criminals to process an estimated $670 million in illegal funds. On a global scale, the United Nations reports that corruption siphons $1.26 trillion from developing countries every single year.

Understanding Global Anti-Corruption Laws

For any company with an international footprint, navigating the maze of anti-corruption laws isn’t optional—it’s essential for survival. At the top of that list is the U.S. Foreign Corrupt Practices Act (FCPA), a powerful piece of legislation that makes it illegal for American companies to bribe foreign officials to gain a business advantage.

The FCPA’s reach is incredibly broad. It’s not just about stopping briefcases full of cash. The law covers anything of value offered to improperly influence a foreign official, which could be anything from extravagant gifts and first-class travel to a strategically timed charitable donation. Critically, companies aren’t just on the hook for their employees’ actions; they are also liable for the misconduct of third-party agents or consultants acting on their behalf.

The penalties for violating the FCPA are severe, including staggering corporate fines and long prison sentences for the individuals involved. This reality makes a rock-solid compliance program non-negotiable, especially as federal investigations target more executives in the rise of white-collar criminal enforcement.

Building a Strong Defense Against Misconduct

The most effective way to fight financial crime isn’t with a team of lawyers after the fact. It’s by building a proactive, deeply ingrained culture of integrity long before trouble ever starts. This means going far beyond a dusty policy manual and turning ethical principles into everyday, non-negotiable business practices.

A truly effective prevention strategy is built on a few key pillars:

- Robust Internal Controls: Put clear, practical financial safeguards in place. Things like requiring two signatures for major payments or conducting regular, unannounced audits aren’t just busywork—they are practical barriers that make it much harder for misconduct to fly under the radar.

- Strong Whistleblower Protections: Employees are your first line of defense. You have to create safe, completely confidential channels for them to report suspected wrongdoing without the slightest fear of retaliation. A trusted reporting system is one of the most powerful tools for catching fraud in its early stages.

- Vigilant Third-Party Due Diligence: You need to know who you’re in business with. That means thoroughly vetting every vendor, agent, and partner, especially when operating in high-risk countries. Your company can be held responsible for their actions, so due diligence is essential.

Integrity has to be modeled from the very top. When senior leadership consistently proves their commitment to doing the right thing—even when it’s hard or expensive—it sends a powerful message that shapes the entire organization. This is the ultimate safeguard against financial and reputational ruin.

Ultimately, stopping financial misconduct comes down to creating an environment where integrity is the only path forward. It demands constant vigilance, clear rules, and a leadership team that doesn’t just talk about ethics but actually lives them out. That unwavering commitment is the best shield any company can have.

Building a Lasting Culture of Integrity

Tackling the intricate web of legal ethical issues isn’t just a defensive chore or some box-ticking exercise. It’s a proactive strategy for building a resilient, trusted organization from the inside out. A true culture of integrity isn’t born from a policy manual gathering dust on a shelf; it’s forged through consistent, visible actions that weave abstract principles into the fabric of your daily business.

The goal is to embed ethical conduct so deeply into your organization’s DNA that it becomes second nature. This is the critical difference between merely avoiding penalties and actively building a powerful competitive advantage—one that attracts top talent, earns unshakable client loyalty, and ensures sustainable success.

The Cornerstones of an Ethical Framework

This kind of culture rests on a few essential pillars. Think of these as the non-negotiable elements that provide the structure for every ethical decision your team makes, from the front lines to the C-suite. Without them, even the best intentions can crumble under pressure.

An effective ethical framework demands:

- Clear and Continuous Training: Don’t stop at a one-time onboarding session. Regular, scenario-based training keeps ethics top-of-mind and gives employees the practical tools to navigate those tricky real-world gray areas.

- Safe and Accessible Reporting Channels: Your team needs a confidential, straightforward way to raise concerns without any fear of retaliation. A trusted whistleblower system is one of the most powerful early-warning signals you can have.

- Unwavering Leadership Commitment: Integrity has to start at the top. When leaders consistently do the right thing—especially when it’s hard—it sends an unmistakable message that ethics are not optional.

Ultimately, a strong ethical culture acts as an organization’s immune system. It identifies and neutralizes threats before they can cause systemic damage, protecting the long-term health and reputation of the entire enterprise.

From Compliance to Competitive Advantage

When you shift your focus from simply complying with rules to cultivating genuine integrity, the entire dynamic changes. Your organization stops reacting to legal ethical issues and starts proactively shaping an environment where they are far less likely to happen in the first place.

This commitment becomes a powerful differentiator in a marketplace that demands accountability. Clients want to partner with professionals they can trust implicitly. The best people want to work for organizations whose values align with their own.

By building a lasting culture of integrity, you’re not just managing risk—you are making a strategic investment in a future defined by trust, resilience, and enduring success.

Common Questions on Professional Conduct

It’s one thing to understand the rules of professional conduct in theory, but applying them in the real world raises a lot of questions. Here are some of the most common dilemmas professionals face and how to think through them.

What’s the Real Difference Between a Legal Problem and an Ethical One?

The simplest way to think about it is to look at who makes the rules and who enforces them.

Legal issues are about black-and-white laws passed by the government. If you break one, you’re facing formal, state-enforced consequences like fines, civil penalties, or even jail time.

Ethical issues, on the other hand, are about the professional standards and moral principles of your specific field. An action can be perfectly legal but still get you disbarred or stripped of your license. It’s a breach of trust with your profession and your clients, and the fallout can destroy your reputation just as surely as a legal conviction.

Consider this: a lawyer might use a clever, perfectly legal loophole to financially exploit a vulnerable client. They haven’t broken a law, so they won’t go to jail. But they’ve committed a massive ethical violation that could end their career. At the end of the day, every illegal act is also unethical, but not every unethical act is illegal.

How Can a Small Business Build a Real Ethics Program Without a Big Budget?

You don’t need a corporate compliance department to build a culture of integrity. For a small business, it’s about putting practical, high-impact steps in place.

- Create a Simple Code of Conduct: This shouldn’t be a dense legal document. Start with a single page that clearly states your firm’s non-negotiables on honesty, client care, and avoiding conflicts of interest. Write it in plain English so it’s a useful guide, not a forgotten file.

- Set Up a Clear Reporting Channel: People need a safe, confidential way to flag concerns without fearing they’ll be penalized. It can be as simple as a dedicated email address or a designated, trusted manager. The key is that it feels safe and straightforward.

- Lead from the Top: This is the most important part. When the partners and senior leaders are seen living by the code every single day, it sends a powerful message. Ethical behavior becomes the expected standard for everyone.

For a smaller firm, the goal isn’t to mimic a massive corporation’s compliance checklist. It’s about creating a genuine culture where doing the right thing is instinctive and everyone feels responsible for upholding it.

What Should I Do If I See Unethical Conduct at My Firm?

Witnessing misconduct is a tough spot to be in. It can be incredibly stressful, but a measured, methodical response is the best way to handle it while protecting yourself.

First, document everything you see. Be meticulous. Write down the specific actions, who was involved, and the dates and times. Keep your notes purely factual—no opinions, no assumptions, just what you observed.

Next, find your firm’s internal policy on reporting misconduct. It should tell you exactly who to go to, whether that’s a managing partner, HR, or a dedicated ethics officer. Following the official process is your first and most important step.

If you’re worried about retaliation or if the problem seems to be systemic, it’s smart to get confidential advice from an outside employment lawyer. They can walk you through your rights, explain your protections, and help you map out your next steps before you make any internal moves.

Elevate your professional presence and connect with a high-net-worth clientele. The Haute Lawyer Network is a curated visibility platform designed for top attorneys who want to stand out. Learn more and apply for membership at Haute Lawyer Network.