Trying to save a few dollars on legal fees early on is one of the most expensive mistakes a founder can make. Too many entrepreneurs treat legal counsel as a defensive cost—a shield to grab when trouble is already brewing. This is a fundamental misunderstanding of their role.

The right legal counsel isn’t just an expense; it’s a strategic investment in your company’s future valuation and scalability.

Why Legal Counsel Is Your Startup’s Co-Pilot For Growth

Think of your startup as a high-performance race car. As the founder, you’re the driver, eyes fixed on the finish line, focused on speed and execution. Your lawyer is the chief engineer. They’re not just in the pit crew waiting for something to break; they designed the car to meet regulations, optimized its engine for endurance, and ensured its chassis could handle the stress of the track.

This is the shift in mindset that separates thriving startups from those that stumble. An elite legal partner is your co-pilot for growth, enabling you to move faster by ensuring the foundation is solid.

Transforming Costs Into Strategic Assets

Every major milestone in a startup’s life has a critical legal component that directly impacts its trajectory and ultimate value. Making the right choices here isn’t just about avoiding problems; it’s about creating strategic advantages. You can explore many of these foundational concepts in our founder’s guide to corporate and business law.

Consider a few key moments where expert counsel is a non-negotiable asset:

- Company Formation: Choosing between a C-Corp and an LLC isn’t just paperwork. It has massive implications for your ability to raise venture capital, your tax exposure, and your personal liability. Getting this wrong can derail fundraising before it even starts.

- Fundraising: A term sheet isn’t a standard form. An experienced attorney can spot predatory terms in SAFEs or convertible notes, protecting your equity and ensuring you don’t unknowingly surrender control of the company you’re building.

- Intellectual Property Strategy: Your IP is often your single most valuable asset. A lawyer ensures the company—not an individual founder or a freelance developer—unambiguously owns every line of code, every patent, and the brand itself. This is what safeguards your competitive edge.

A proactive legal strategy is not an expense—it is a fundamental pillar of sustainable growth. By anticipating challenges and building a solid legal foundation, you unlock opportunities and increase your company’s valuation.

Setting The Stage For Scalability

When investors write seven-figure checks, they’re betting on a clean, scalable business. A disorganized cap table, murky IP ownership, or poorly drafted employee agreements are immediate red flags that can kill a deal on the spot.

Getting your legal house in order from day one isn’t about bureaucracy. It’s about building an attractive, investment-ready asset that can withstand the intense scrutiny of due diligence and scale without imploding.

What a Startup Lawyer Actually Does for You

Forget the stereotype of lawyers as just problem-solvers you call when something’s broken. For a startup, an elite lawyer is the architect of your company’s future. They don’t just react to fires; they build the foundation, frame, and systems that allow your business to scale, raise serious capital, and survive the intense scrutiny of VCs and acquirers. Their real work happens long before any crisis.

A top-tier startup lawyer’s role is deeply strategic. They are involved in shaping your company’s DNA, making sure that from day one, your venture is built to support massive growth. This isn’t about boilerplate documents; it’s about navigating complex decisions that will impact your equity, your control, and your ability to attract investment for years to come.

Building Your Corporate Blueprint

One of the first, most critical moves your counsel will make is establishing the right legal entity. This isn’t just paperwork—it’s a foundational strategic decision.

Think of it like building a skyscraper. Would you pour a foundation meant for a single-family home, or one engineered to support 100 floors? Your legal entity is that foundation.

- C-Corporation (C-Corp): This is the gold standard for most tech startups with ambitions to raise venture capital. Investors understand its structure, it allows for different classes of stock (like the preferred stock VCs demand), and it’s a prerequisite for powerful tax incentives like Qualified Small Business Stock (QSBS).

- Limited Liability Company (LLC): While flexible and offering pass-through taxation, LLCs are often a red flag for institutional investors. Their operating agreements and tax structures are notoriously complex for venture funds. An experienced attorney will explain why saving a little now on an LLC could cost you a funding round later.

Getting this right from the start avoids expensive and messy conversions down the road. More importantly, it signals to investors that you’re serious and have been properly advised from the outset.

Managing Equity and Ownership

Your company’s equity is its most valuable currency. Your lawyer’s job is to manage it with the precision of a Swiss watchmaker, ensuring every share is accounted for and allocated according to a legally airtight strategy. This all comes together in the capitalization table, or “cap table.”

A clean cap table is a pristine ledger of who owns what. A messy one—riddled with verbal promises and undocumented grants—is one of the fastest ways to kill an investment deal. Your counsel ensures this never happens by:

- Drafting Founders’ Agreements: Creating binding documents that nail down equity splits, roles, responsibilities, and vesting schedules among co-founders. This is the single best defense against the internal disputes that sink so many promising startups.

- Establishing Stock Option Plans: Setting up formal plans to grant equity to early employees and advisors, making sure you comply with securities laws while creating powerful incentives for your team to build long-term value.

- Modeling Dilution: As you raise money, they’ll model precisely how much ownership you and your team are giving up, so you understand the true cost of that capital.

A well-managed cap table is more than a spreadsheet; it’s the official story of your company’s ownership. It provides the absolute transparency and confidence that investors demand before they’ll even consider writing a check.

Navigating Fundraising and Essential Contracts

Securing investment is a minefield of highly specialized legal documents. Your lawyer acts as both your guide and your negotiator, translating dense legalese into clear business outcomes. They will review and negotiate term sheets, SAFEs (Simple Agreements for Future Equity), and convertible notes to protect your control and valuation.

Beyond fundraising, they draft the critical contracts that underpin your entire business. This isn’t just customer agreements and vendor contracts. It’s employment agreements and, most crucially, intellectual property assignment agreements. A single freelance developer who never properly signed over their code can create a multi-million dollar IP ownership nightmare during a future acquisition.

As a startup matures, the legal function transforms into a strategic business partnership. In today’s high-growth tech companies, 53% of General Counsels now oversee compliance and 43% manage privacy, with their compensation reflecting a role that goes far beyond managing risk. You can dig into more data on the evolving role of in-house legal leaders and their compensation in recent industry reports. A great startup lawyer lays the groundwork for this evolution from the very beginning.

The Right Time to Hire Your First Lawyer

There’s a dangerous myth circulating in the startup world: wait to hire a lawyer until you’ve raised capital or a legal problem is staring you in the face. This is like waiting until your engine is on fire to find a mechanic. Proactive legal counsel isn’t a luxury you can put off; it’s a foundational requirement for building a company that’s even capable of getting to a funding round.

The right time to bring in legal expertise is almost always sooner than you think. Your startup journey is marked by specific inflection points that should act as flashing red lights, signaling the need for professional legal advice. Ignoring these moments opens the door to significant, often irreversible, risks that can cripple your company before it ever gets off the ground.

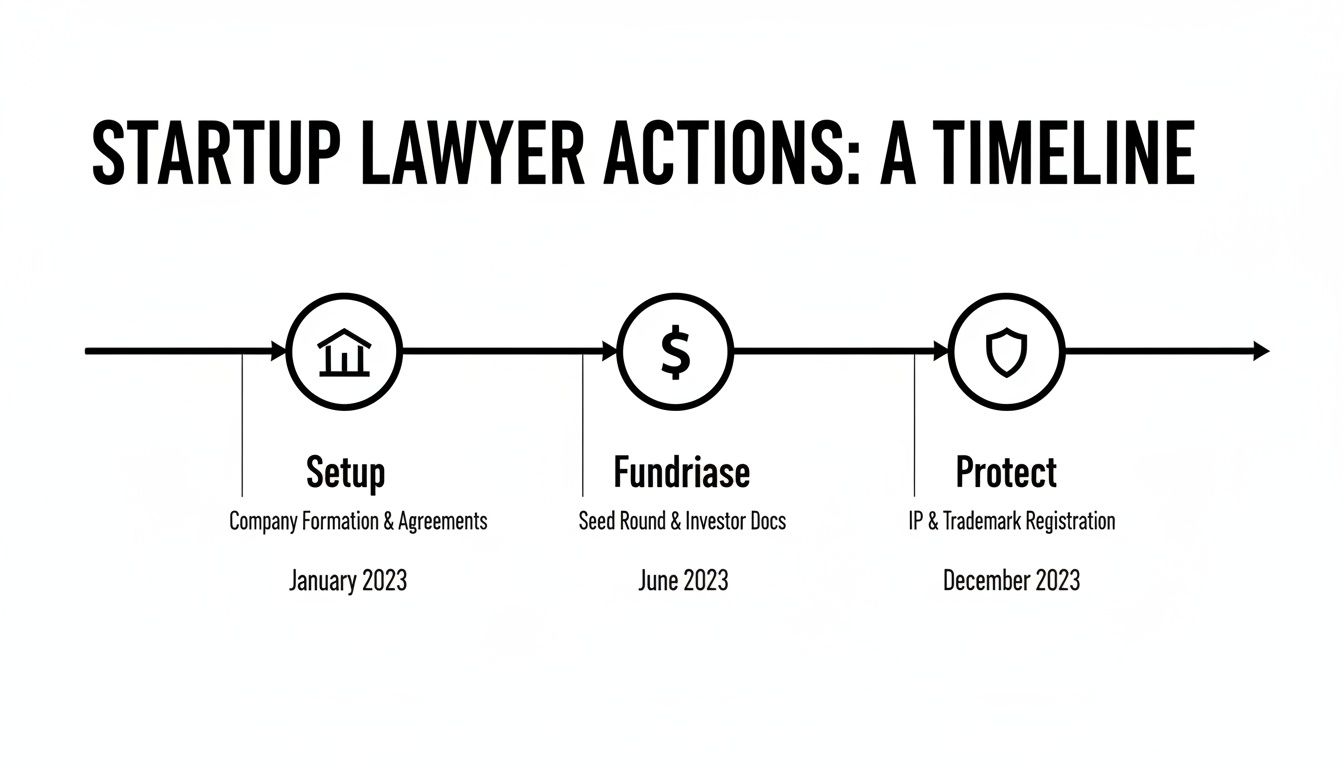

The timeline below maps out the key moments when a lawyer goes from being a good idea to an absolute necessity.

As you can see, your legal needs quickly evolve from basic setup to complex fundraising and intellectual property protection, with each stage demanding specialized guidance.

Before Formalizing a Co-Founder Partnership

The “agreement on a napkin” between co-founders is a classic startup story—and a ticking time bomb. Handshake deals on equity splits, roles, and who owns the IP are unenforceable and pave the way for company-killing disputes later on.

Before you write a single line of code together, you need a lawyer. Their first order of business will be to draft a Founders’ Agreement, a critical document that puts everything in writing, including:

- Equity Ownership: Who gets how many shares, spelled out precisely.

- Vesting Schedules: Equity is earned over time, protecting the company if one founder decides to walk away early.

- Roles and Responsibilities: A clear definition of who owns what, preventing operational chaos.

- Intellectual Property Assignment: This ensures all the work product created belongs to the company, not the individuals.

Before Issuing the First Share of Equity

The moment you grant equity—to a co-founder, an early advisor, or your first employee—you are dealing in securities. This is a space heavily regulated by both federal and state laws. One wrong move can lead to severe penalties or create a “toxic” cap table that will send sophisticated investors running for the hills.

Your lawyer’s job is to ensure every share issued is documented correctly and complies with securities laws, protecting both the company and the person receiving the equity.

Waiting until you have money to formalize equity is completely backward. No investor will fund a company with a messy, unclear, or legally compromised ownership structure. A clean cap table from day one is table stakes.

Before Hiring Your First Employee

Bringing on your first team member is an exciting milestone, but it also throws open the door to a whole new world of legal obligations. It’s far more complicated than just adding someone to payroll. An attorney helps you navigate this complex terrain, creating the right documents and advising on crucial distinctions.

This involves:

- Drafting legally sound employment offer letters and contracts.

- Putting confidentiality and IP assignment agreements in place to protect your company’s assets.

- Advising on the critical difference between an employee and an independent contractor—a distinction with massive tax and liability implications.

Getting this wrong can trigger audits, painful fines, and IP ownership battles. A lawyer helps you build your team on a solid legal footing, letting you stay focused on growth. By anticipating these needs, you turn potential crises into strategic advantages.

Understanding Startup Legal Costs and Budgets

Let’s be honest: for any founder, cash flow is king. The thought of adding legal bills to your burn rate can feel overwhelming. But it doesn’t have to be.

Think of it this way—you’re hiring a master architect to build your company’s legal foundation. You wouldn’t pour concrete without a clear budget and payment plan. The same goes for your legal counsel. Getting comfortable with the numbers is the first step toward a healthy, long-term partnership with your attorney.

Common Legal Fee Structures

When you start talking to lawyers, you’ll run into a few standard ways they bill for their time. Each model has its place, and knowing the difference helps you match your legal spend to your immediate business goals.

- Hourly Rates: The classic model. You pay for the exact time an attorney spends on your work. It’s flexible and great for unpredictable issues or ongoing strategic advice, but it can create budget anxiety if the project scope isn’t tightly defined.

- Flat Fees: A single, all-in price for a specific job, like incorporating your company or drafting a standard employment agreement. This is a founder’s best friend for routine tasks because it gives you cost predictability.

- Deferred Payments: Some forward-thinking, startup-focused firms will agree to push back a portion of their fees until you close your next funding round. This can be a lifeline for a pre-revenue company, but read the fine print—you need to be clear on any interest or premiums that apply.

The real strategy is to match the fee structure to the task. Use flat fees for predictable projects to lock in costs, and keep the hourly model for complex negotiations or surprise challenges where the scope is a moving target.

Comparing Legal Fee Structures for Startups

Choosing the right payment model is crucial for managing your startup’s budget effectively. This table breaks down the common options to help you decide what fits your company’s stage and needs.

| Fee Model | Best For | Key Advantage | Potential Downside |

|---|---|---|---|

| Hourly Rate | Ongoing advisory, unpredictable issues, complex negotiations. | Maximum flexibility for evolving legal needs. | Lack of cost predictability; can become expensive. |

| Flat Fee | Standardized tasks like incorporation, trademark filing, contract templates. | Budget certainty. You know the exact cost upfront. | Less flexibility if the project scope expands unexpectedly. |

| Deferred Fee | Pre-revenue startups with strong funding prospects. | Preserves critical cash flow in the early days. | May include premiums; payment becomes due at a critical time. |

| Equity-for-Fees | Startups needing deep strategic partnership, not just legal work. | Aligns the law firm’s success with your own; no cash outlay. | Dilutes founder equity; creates a long-term stakeholder. |

Ultimately, the best structure aligns your legal costs with your business milestones, ensuring you have the expert guidance you need without crippling your runway.

Innovative and Alternative Billing Models

The legal world is finally catching up to the fast-paced needs of startups. A few modern approaches are making elite legal counsel more accessible than ever by ditching the old-school, transactional mindset.

Subscription services are a game-changer. Instead of calling a lawyer and starting the clock, you pay a fixed monthly or quarterly fee for ongoing access to a legal team. This model is exploding in popularity because it encourages proactive legal health instead of reactive problem-solving.

Another option gaining traction is equity-for-fees, where a law firm takes a small stake in your company instead of cash. This can be an incredible way to preserve capital, but it requires serious thought. You’re not just hiring a lawyer; you’re giving up a piece of your company. This arrangement should be reserved for firms that bring massive strategic value—think introductions to VCs and key partners—that goes far beyond legal paperwork. For a deeper look at this, our guide on how much a lawyer costs explores these alternative arrangements in greater detail.

How to Find the Right Startup Attorney

Finding the right legal counsel for your startup isn’t like picking a name from a directory. Think of it as a high-stakes recruitment process for a key strategic partner—someone whose advice will shape your company’s trajectory for years. This isn’t about hiring someone to just draft documents; it’s about bringing on a business advisor with a law degree.

A common mistake founders make is getting hung up on credentials alone. While a top-tier education is great, it’s just the starting point. The best startup attorneys have a specific mix of deep industry experience, a powerful network, and a commercial mindset that general corporate lawyers simply don’t possess.

Look Beyond the Law Degree

Your ideal lawyer should feel like an extension of your founding team. They need to get the pressures, the breakneck speed, and the unique ambition of a high-growth venture. It’s a different world.

When you’re vetting potential attorneys, these criteria are non-negotiable:

- Deep Venture-Backed Experience: Have they guided dozens of companies from seed funding through Series A and beyond? A lawyer who primarily handles real estate or family law won’t grasp the nuances of a SAFE agreement or a venture debt term sheet.

- Specific Industry Knowledge: If you’re building a SaaS company, your lawyer needs to live and breathe recurring revenue models and data privacy laws. For a biotech startup, a firm grasp of FDA regulations and clinical trial agreements is critical. This specialized knowledge prevents catastrophic—and expensive—mistakes.

- A Strong Investor Network: Top startup lawyers are hubs in the investment community. They know the key players at venture capital firms and can often make valuable introductions when you’re ready to raise. Their reputation alone can add serious credibility to your company during due diligence.

Vetting Candidates with the Right Questions

Once you have a shortlist, the initial consultation is your chance to see if you’re talking to a true business advisor or just a service provider. Your questions should cut through the noise and get to their strategic thinking.

Forget the basic inquiries. Ask questions that reveal how they think about partnership:

- “Can you describe a time you advised a founder against taking a term sheet that looked good on the surface?” This tests their strategic judgment and whether they prioritize your long-term interests over closing a quick deal.

- “How will you help us model the economic impact of this financing round on our cap table and future fundraising?” This separates document drafters from partners who actually understand the math and can help you visualize dilution and control.

- “What are the three biggest legal mistakes you see startups in our specific industry make?” Their answer instantly reveals their industry-specific expertise and whether they’re proactive or reactive.

The goal of your initial consultations is to find a lawyer who talks less about what they do and more about the outcomes they help their clients achieve. You’re looking for a partner who is obsessed with your success.

Tapping Into Curated Networks and Specialized Firms

The old way of finding legal help—relying on a friend’s random referral—is inefficient and risky. This is where curated networks and specialized firms deliver a massive advantage. Platforms like the Haute Lawyer Network pre-vet attorneys for excellence and venture experience, connecting you directly with elite professionals who understand the high-growth journey.

This approach saves you critical time and dramatically increases your odds of finding the perfect fit. The legal industry itself is also changing. Nimble solo and small law firms specializing in startup counsel are using technology to deliver exceptional, partner-level service more efficiently.

Recent data shows that growing solo firms handle 37% more cases than their peers without expanding staff, while small firms manage 25% more cases and achieve double the revenue growth of industry averages. These tech-forward practices often provide the focused attention that startups desperately need. You can find more details on this trend in a recent analysis of the legal industry.

Choosing a lawyer from a curated network or a specialized boutique firm ensures you’re partnering with someone who is not just an expert, but also deeply embedded in the startup ecosystem.

Building a Bulletproof Legal Foundation for Your Venture

Running a startup is an exercise in navigating uncertainty. Market dynamics shift and product roadmaps pivot, but your legal integrity must be an anchor. The most successful founders learn early that treating legal counsel for startups as a strategic investment—not just a reactive cost—is one of the most powerful moves they can make to protect their vision.

Think of your company as a complex architectural blueprint. A great lawyer doesn’t just scan for errors. They ensure the entire structure is engineered for exponential growth, capable of supporting ambitious fundraising rounds, shielding valuable IP, and attracting top-tier talent. Building without this foundation is like putting up a skyscraper on sand. It’s not a question of if it will collapse, but when.

From Blueprint to Reality

Throughout this guide, we’ve walked through the core components of building a legally sound business. It all comes down to knowing what a startup lawyer does, when you need to bring one in, and how to select an elite partner who truly gets your vision. The message is simple: proactive legal work is a direct investment in your company’s future valuation and long-term survival.

The right legal partnership turns regulatory complexity into a genuine competitive advantage. You’ll be perpetually ready for the intense scrutiny of due diligence, protected from common founder disputes, and properly structured for whatever scale you achieve.

Here’s the ultimate takeaway: The single best time to secure expert legal counsel was yesterday. The second-best time is right now. Making the right legal choices early is the bedrock upon which lasting companies are built.

Your Immediate Next Steps

Confidence comes from clear, actionable steps. Use this checklist to start building your bulletproof legal foundation today.

- Formalize Founder Relationships: If you haven’t, draft and sign a comprehensive Founders’ Agreement. This must explicitly detail equity splits, vesting schedules, roles, and IP ownership. No ambiguity.

- Assess Your Current Legal Health: Pull together all existing contracts, equity grants, and corporate documents for review. To get a clear picture of the essentials, explore our detailed guide on small business legal requirements made simple.

- Schedule Consultations: Identify three potential law firms or attorneys that specialize in venture-backed companies. Use the vetting questions from this guide to assess their strategic fit, not just their résumés.

Startup Legal Counsel: Your Questions Answered

For founders, navigating the legal side of a new venture can feel like learning a new language. But getting these early decisions right is non-negotiable. Here are a few of the most common questions we hear, with straightforward answers to give you the clarity you need.

Think of this as the essential briefing every founder should have before making their first legal hire.

Can I Just Use an Online Legal Service Instead of a Lawyer?

Online legal platforms are fantastic for highly standardized, simple tasks. Need a basic privacy policy for your first landing page or a boilerplate NDA? They can be a perfectly sensible, low-cost option. They’re like a good software template—great for the basics.

But where they fall short is strategy. That platform can’t negotiate a tough term sheet from a top-tier VC, structure a complex IP licensing deal, or navigate a messy co-founder breakup. They generate documents; they don’t provide tailored advice or fight in your corner.

For anything that demands real negotiation, strategic thinking, or a nuanced understanding of your specific goals, you need an experienced startup lawyer. An online service is a tool, but legal counsel for startups is a strategic partnership.

What’s the Single Biggest Legal Mistake Founders Make?

Hands down, it’s failing to formalize the co-founder relationship in writing from day one. Handshake agreements about who owns what percentage, what the vesting schedule looks like, and who contributes what IP are a ticking time bomb.

It seems simple when everyone is excited and aligned, but memories diverge and circumstances change. This one mistake has been the root cause of countless promising companies imploding. When a founder leaves or a serious disagreement erupts, the absence of a clear agreement paralyzes the business, making it nearly impossible to raise money or even operate.

Your Founders’ Agreement is the legal bedrock of your entire company. It’s not a formality you can skip. Any serious investor will ask to see it, and having a weak one—or none at all—is a massive red flag.

How Much Equity Is Fair to Give a Law Firm?

Trading equity for legal services can be a smart way to preserve cash when you’re just getting started. But you have to be incredibly careful. You’re giving away a piece of your company’s future, and that’s not a decision to take lightly.

Typically, you’ll see these arrangements fall somewhere between 0.25% and 1% of the company’s total equity. This grant usually vests over two to four years, just like an early employee’s stock options would.

If you’re considering this path, here are a few hard-and-fast rules:

- Cap the Value: The agreement must have a clear dollar cap on the value of legal services the equity covers. This is critical to prevent the firm from owning an outsized piece of your company if your valuation explodes.

- Get a Second Opinion: Always have another independent attorney—one who has no skin in this specific game—review the equity-for-fees agreement. They can tell you if it’s fair and aligns with market standards.

- Reserve It for True Partners: This kind of deal should be reserved for firms that bring more than just legal paperwork to the table. We’re talking deep investor connections, specialized industry knowledge, or true strategic guidance—not just routine filings.

Choosing the right legal partner is one of the most critical decisions you’ll make in your startup’s journey. To find elite, pre-vetted attorneys who specialize in guiding high-growth companies, explore the Haute Lawyer Network.