A solid lawyers business plan is far more than a document—it’s the strategic blueprint that separates a thriving firm from one that just gets by. It’s what translates your legal expertise into a focused, profitable business that actually stands out in an incredibly crowded market.

This foundational plan is where you define your firm’s identity, pinpoint your ideal clients, and map out your path to real profitability.

Defining Your Niche and Value Proposition

Everything starts here. This is the moment you move beyond generic practice areas and start carving out a specific, defensible space in the legal market. It’s all about identifying a client you genuinely want to serve and crafting a message that speaks directly to their most pressing needs.

Identify a Profitable Niche

Let’s be honest: generalist law firms struggle to get noticed. The key to breaking through the noise is to specialize. Instead of just offering “business law,” you could focus on IP litigation for early-stage tech startups. Rather than broad “family law,” you might specialize in high-net-worth divorce cases involving complex asset division and family offices.

This level of specificity turns you into the go-to expert. A narrow focus doesn’t limit your potential; it concentrates your marketing firepower and builds a powerful reputation much faster. Look for underserved markets or emerging legal needs nobody else is properly addressing.

- Example Niche 1: Navigating data privacy and CCPA/GDPR compliance for direct-to-consumer e-commerce brands.

- Example Niche 2: Sophisticated estate planning for families with special needs children, focusing on supplemental needs trusts.

- Example Niche 3: Representing freelance creative directors and designers in high-stakes contract negotiations with Fortune 500 companies.

Craft a Compelling Value Proposition

Once your niche is locked in, you have to articulate why a client should choose you over everyone else. Your value proposition is a sharp, concise statement communicating the unique benefit you deliver. It must hit on your ideal client’s biggest pain point.

For instance, that firm specializing in IP for startups might have this value proposition: “We secure your core intellectual property with predictable flat-fee packages, giving you budget certainty while you focus on scaling your business.” That single sentence tackles two huge anxieties for founders: protecting their IP and avoiding runaway legal bills.

A strong value proposition answers the client’s unspoken question: “Why is your firm the best possible choice for my specific problem?” It’s not just what you do, but how you do it differently and better than anyone else.

Conduct a Lean Market Analysis

You don’t need a 100-page market research report, but you absolutely need to understand the competitive landscape. A lean analysis helps you spot opportunities and threats without getting bogged down in weeks of research.

First, identify three to five direct competitors in your chosen niche. Then, get forensic. Analyze their:

- Services and Pricing: What exactly do they offer, and how do they charge? Is it all hourly billing, or do they use flat fees, subscriptions, or retainers?

- Marketing Channels: How are they getting clients? Dig into their website, social media, SEO performance, and online reviews.

- Target Audience: Who are their marketing materials really speaking to? Does their messaging seem to attract the same clients you want?

This quick analysis will reveal gaps in the market. Maybe your competitors have clunky, outdated websites. Perhaps they lack transparent pricing, or they’re completely ignoring a profitable sub-segment of your ideal client base. These are the openings your firm can exploit.

Your lawyers business plan must show that you understand this landscape and have a clear strategy to outperform the competition. This groundwork ensures your firm is built on a solid foundation, ready for sustainable growth.

Structuring Your Services and Pricing Models

How you package your legal services—and what you charge for them—is more than just a line item on an invoice. It defines your firm’s identity, shapes client relationships, and ultimately dictates your profitability. It’s time to move beyond the billable hour, a model that often pits your efficiency against your earnings and creates needless friction with clients.

The goal here is to think like a product designer, not just a lawyer. You’re not selling hours; you’re selling solutions. Instead of a vague “Corporate Law” offering, consider a “Startup Formation Package.” This could bundle entity formation, founder agreements, and a standard SAFE note review into one clear, predictable price. It’s a tangible product with a defined outcome, which is exactly what clients want.

Choosing the Right Pricing Model for Your Firm

There’s no magic bullet for legal pricing. The best model for your firm will depend entirely on your niche, the type of clients you serve, and the complexity of the work itself. The real key is to anchor your price to the value you deliver, not just the time it takes.

- Flat Fees: Perfect for predictable, repeatable work. Think uncontested divorces, basic will drafting, or trademark applications. Clients love flat fees because it removes the anxiety of a running clock and puts the focus squarely on the result.

- Retainers: These are a fantastic fit for clients with ongoing legal needs. A growing business, for example, might engage you on a general counsel retainer, giving them consistent access to your advice for a fixed monthly cost. Getting this right is crucial, so it’s worth exploring what an average retainer fee for a lawyer looks like to stay competitive yet profitable.

- Subscription Services: This is the modern evolution of the retainer. A real estate firm could offer a tiered “Landlord Protection Plan” that includes a set number of lease reviews, eviction notices, and compliance check-ins for a recurring monthly fee.

- Hybrid Models: Don’t feel boxed in by a single structure. You could offer a flat fee for the initial discovery and filings in a litigation case, then switch to an hourly rate if it proceeds to a complex trial. This gives clients upfront cost certainty while protecting your firm from an unpredictable workload down the road.

Your pricing strategy is one of your most powerful marketing tools. When you offer transparent, value-based pricing, you immediately stand out from firms still clinging to the billable hour.

Implement Flexible Payment Solutions to Boost Revenue

Making your services financially accessible isn’t just a nice thing to do for clients—it’s a proven way to grow your firm’s revenue. How many potential clients have walked away not because they didn’t need you, but because they couldn’t handle a large, upfront fee? Flexible payment options remove that barrier.

Simply offering payment plans can dramatically change your firm’s financial picture by allowing clients to manage the cost of high-value legal work over time.

The data backs this up. The 2023 Legal Trends Report revealed that firms offering payment plans collect 49% more monthly revenue per lawyer than those that don’t. The impact is even more significant for solo attorneys, who see a stunning 71% revenue increase. This isn’t a minor tweak; it’s a fundamental component of a modern lawyers business plan built for financial health and sustainable growth.

Building Your Client Acquisition System

A meticulously crafted business plan is nothing without its engine—a predictable and sustainable system for bringing in new clients. Your legal acumen is why you win cases, but a steady stream of the right kind of clients is what builds a firm. This means moving beyond occasional, hope-for-the-best referrals and engineering a multi-channel strategy that delivers real, measurable results.

While traditional networking will always have its place, the modern client acquisition battle is won online. Your potential clients aren’t just asking colleagues for recommendations anymore; they are searching for solutions on Google, vetting attorneys on LinkedIn, and looking for tangible signs of your expertise long before they ever pick up the phone.

Master Your Referral Networks

Referrals are the lifeblood of many firms, but they shouldn’t be left to chance. A proactive approach is the only way to turn a trickle of referrals into a consistent flow. It goes far beyond simply hoping other lawyers send business your way.

Think strategically about who interacts with your ideal client before they need legal help. For a family law attorney, this might be financial planners, therapists, or accountants. For a corporate lawyer specializing in startups, it could be venture capitalists or incubator managers.

- Establish Reciprocal Value: Don’t just ask for referrals; offer them. Create a small, trusted circle of non-competing professionals where you can confidently send your own clients for related services.

- Stay Top of Mind: A simple monthly newsletter with relevant legal updates or a quarterly check-in call keeps your network engaged and reminds them of your specific expertise when a need arises.

- Track Your Sources: Add one simple question to your intake form: “How did you hear about us?” The data you collect is invaluable for understanding which relationships are actually bearing fruit.

Dominate Your Digital Presence with SEO

Your firm’s online visibility is no longer optional. The reality is that a significant 57% of potential clients now begin their search for legal help online, making a prominent Google ranking absolutely critical. It’s an investment that pays dividends, with SEO generating an average 7.5% conversion rate—more than three times higher than typical pay-per-click advertising.

Search Engine Optimization (SEO) is the long-term play for consistent, high-quality lead generation. When a potential client searches for “high-asset divorce lawyer near me,” you want your firm to be one of the first results they see.

Getting there involves a few key tactics:

- Local SEO: Claim and fully optimize your Google Business Profile. This includes your firm’s name, address, phone number, and a detailed list of services. Most importantly, encourage satisfied clients to leave positive reviews, as these are a major ranking factor.

- Content Marketing: Create high-value blog posts and guides that answer the specific questions your ideal clients are asking. A post titled “3 Common Mistakes to Avoid When Selling a Business in California” positions you as an expert and attracts highly qualified traffic.

- On-Page Optimization: Ensure your website’s pages are structured correctly, load quickly, and use keywords naturally in titles, headings, and throughout the text.

Your website is your digital storefront. SEO is the prime real estate location that ensures a steady flow of foot traffic. Neglecting it is like building a brilliant firm on a back street with no sign.

To help visualize where to focus your efforts, here’s a breakdown of common digital channels for law firms.

Digital Marketing Channel Effectiveness Comparison

| Channel | Average Conversion Rate | Best For | Key Consideration |

|---|---|---|---|

| Local SEO | 5-10% | Firms serving a specific geographic area (e.g., family law, real estate). | Results are long-term; requires consistent effort on content and reviews. |

| Paid Search (PPC) | 2-4% | Generating immediate leads for high-intent keywords (e.g., “DUI lawyer”). | Can be expensive; requires careful budget management and keyword targeting. |

| Content Marketing | 3-6% | Building authority in a niche and attracting sophisticated clients. | A slow build that pays off over time; requires high-quality, expert content. |

| 1-3% | B2B practices, corporate law, and building referral networks. | Focus on building relationships and sharing insights, not direct sales pitches. |

As the table shows, there’s no single “best” channel. A strong strategy combines the long-term authority building of SEO with more targeted approaches like PPC or professional networking, depending on your practice area.

Leverage Professional and Social Platforms

Platforms like LinkedIn offer a direct line to potential clients and referral partners, but not in the way most people think. It’s not about broadcasting your services; it’s about establishing your authority and building professional relationships at scale.

Share insightful commentary on recent legal developments in your niche, publish articles on relevant topics, and engage thoughtfully in industry-specific groups. Consider this: a real estate attorney who consistently posts about changes in commercial leasing regulations. When a local business owner needs to renegotiate their lease, that attorney is already top of mind as a credible expert. This is a core part of a modern client acquisition system.

For attorneys looking to refine their approach, exploring essential attorney marketing strategies can provide further valuable insights. Building a system that combines referrals, a powerful digital presence, and targeted professional networking creates a resilient and predictable pipeline of new business, ensuring your firm’s long-term health and growth.

Designing Your Operations and Tech Stack

A killer client acquisition strategy gets clients in the door, but a finely tuned operational model is what actually makes the business profitable. The daily grind—from that first client call to the final invoice—is where firms either thrive or die.

This section of your lawyers business plan is all about the ground game. Forget the high-level theory; this is about how you’ll manage your work, your team, and your tech to build a practice that’s both scalable and resilient.

Mapping Your Core Workflows

Before you can improve anything, you have to know how it works right now. Trace the entire client journey, step by step, and map out every critical stage. A chaotic, inconsistent process doesn’t just frustrate clients—it bleeds billable hours.

- Client Intake and Onboarding: How do you handle that first phone call? What does your conflict check really look like? A seamless onboarding process, with crystal-clear communication and a simple way to pay the retainer, sets a professional tone from the get-go.

- Case Management: Once they’re a client, how do you track deadlines, organize documents, and log every communication? This system needs to be airtight. One missed deadline or lost document can lead to a malpractice claim.

- Billing and Collections: Let’s be honest, this is where things often get awkward. Your workflow needs clear invoicing, dead-simple payment options, and a firm process for chasing down late payments.

Think of your operational workflows as the internal product you deliver to your team. A clean, efficient system cuts down on administrative drag, slashes errors, and frees up your lawyers to focus on high-value, billable work.

Building Your Team and Tech Stack

For a solo practitioner or a small firm, every hire and every software subscription is a massive decision. The goal is simple: invest only in resources that directly boost efficiency or drive revenue.

When it comes to staffing, look for the tipping point. If you’re spending more than 25% of your day on non-billable admin tasks, it’s probably time to hire a paralegal or legal assistant. The cost is easily offset by the high-value legal work you can now take on.

Technology is your force multiplier. The right tools can automate the boring stuff, lock down client data, and give you insights that used to be reserved for the big firms. This is where a small firm can punch well above its weight.

Essential Tech Stack Components:

| Category | Purpose | Example Software |

|---|---|---|

| Practice Management | Your firm’s central nervous system for cases, contacts, and billing. | Clio, MyCase, PracticePanther |

| Document Management | Securely store, organize, and share every client file. | Google Drive, Dropbox for Business |

| Client Communication | Professional email and a secure portal for client interaction. | Google Workspace, Microsoft 365 |

| Accounting | Track every dollar and manage your trust accounts meticulously. | QuickBooks Online, Xero |

The Role of Artificial Intelligence in Modern Law Firms

AI is no longer some sci-fi concept; it’s a practical tool that is actively reshaping legal operations. For smaller firms, it’s a game-changer, automating routine tasks that used to eat up countless hours and resources. You can see the bigger picture of how artificial intelligence is revolutionizing legal practice across the industry.

Today’s AI tools can help with document review, legal research, and even drafting initial client communications. This allows you to produce work faster and more affordably, which directly impacts your bottom line and the value you offer clients.

Solo attorneys are actually leading the way here. Recent data shows that around 40% of solo firms are planning to adopt AI technology within the next six months. That adoption rate is nearly 10% higher than their larger firm counterparts, proving that solos are aggressively using tech to build smarter, more efficient businesses. A forward-thinking tech strategy isn’t just an add-on; it’s a critical piece of any modern lawyer’s business plan.

Forecasting Your Finances and Key Metrics

The story of your firm’s success isn’t written in legal briefs—it’s told in spreadsheets. Financial planning can feel a world away from practicing law, but mastering the numbers is what gives you the freedom to actually focus on your clients and build a sustainable practice.

This section of your lawyers business plan is where vision meets reality. It’s about building a realistic financial model that not only guides your launch but also serves as your firm’s operational GPS for years to come. We’ll break down the essentials, from startup costs to the key metrics that show you what’s really working.

Projecting Startup and Operational Costs

Before you earn your first dollar in revenue, you need to know exactly what it will cost to open your doors and keep them open. Be brutally honest here; overlooking even small expenses can put your new firm in a precarious position from day one.

Your costs generally fall into two buckets:

- One-Time Startup Costs: These are the initial investments needed to get off the ground.

- Firm Registration and Licensing: Fees for your LLC or PLLC, state and local business licenses, and bar association dues. Don’t forget these.

- Hardware and Equipment: Quality laptops, printers, scanners, and essential office furniture that won’t need replacing in a year.

- Initial Software Subscriptions: The first-year hit for your practice management, accounting, and document management software.

- Website and Branding: The cost to design and launch a professional website that doesn’t look like a template from 2005.

- Recurring Monthly Expenses (Operating Costs): These are the ongoing costs of doing business—the bills that will arrive every single month.

- Office Space: Rent or mortgage for a physical office, or fees for a co-working space.

- Salaries and Benefits: Your own draw (pay yourself!) plus any staff you plan to hire from the start.

- Software Subscriptions: The ongoing monthly or annual fees for your entire tech stack.

- Malpractice Insurance: This is absolutely non-negotiable. Budget for it.

- Marketing and Advertising: Your budget for SEO, paid ads, content creation, or networking events.

Building Your Financial Statements

With your costs tallied, it’s time to project your revenue and profitability. You’ll do this with two core financial documents: the Profit and Loss (P&L) Statement and the Cash Flow Forecast.

Your P&L Statement, or income statement, is a forward-looking projection of your firm’s profitability, typically for the first one to three years. It subtracts your total projected expenses from your total projected revenue to show your anticipated net profit or loss. This is the document that tells you whether your business model is actually viable on paper.

The Cash Flow Forecast, however, is arguably even more critical for a new firm. It tracks the actual cash moving in and out of your business every month. Profitability on a P&L statement doesn’t mean you have cash in the bank to make payroll. This forecast helps you anticipate lean months and ensures you have the liquidity to operate smoothly.

A firm can be profitable on paper but go under due to poor cash flow. Think of your cash flow forecast as an early warning system. It helps you manage client payment cycles and plan for big expenses without running your accounts dry.

Conducting a Break-Even Analysis

The break-even analysis is one of the most powerful calculations in any lawyers business plan. It tells you the exact amount of revenue you must generate each month just to cover your costs. This is your baseline for survival—the point where you stop losing money.

Knowing this number, whether it’s $15,000 or $50,000 a month, transforms your goals from abstract ambitions into tangible, weekly targets. It answers the most critical question of all: “How many cases do I need to sign this month just to keep the lights on?”

Identifying Your Key Performance Indicators

Finally, to manage your firm’s growth, you have to track the right numbers. Key Performance Indicators (KPIs) are the vital signs of your business. Don’t get lost in vanity metrics; focus on the data that directly impacts profitability and sustainability.

Here are a few essential ones to start with:

- Client Acquisition Cost (CAC): How much do you spend in marketing and sales efforts to land one new client?

- Realization Rate: What percentage of the time you bill is actually collected from clients? A low rate might signal problems with your billing habits or client satisfaction.

- Collection Rate: Of the invoices you send out, what percentage do you collect within your stated payment terms (e.g., Net 30)?

- Revenue Per Lawyer: This classic metric helps you understand the productivity and earning potential of your legal team as you grow.

Tracking these KPIs allows you to spot problems early, double down on what’s working, and make strategic adjustments to ensure your firm is not just surviving, but thriving.

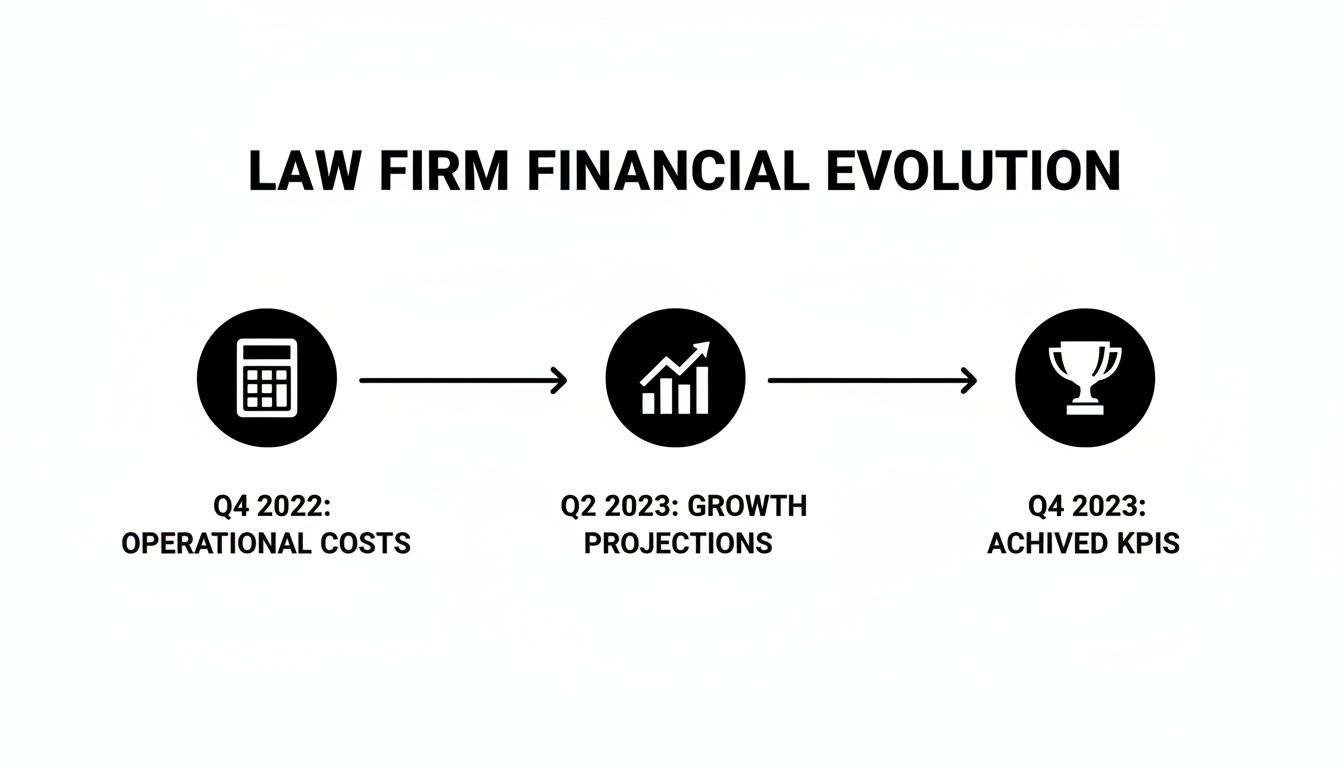

Putting Your Business Plan into Action

A brilliant lawyers business plan is nothing more than an academic exercise until you translate its strategies into tangible action. This isn’t a document to be filed away and forgotten. It needs to become a living, breathing roadmap that guides every decision you make, turning your vision for a profitable law firm into a reality.

The key is breaking down your big, year-one goals into a clear, sequential timeline. Forget vague ambitions. We’re talking about concrete deliverables with deadlines, moving methodically from foundational setup to aggressive growth.

Setting Your First-Year Milestones

A generic to-do list won’t cut it. You need to structure your launch with specific, time-bound objectives. This is how you build momentum and create clear benchmarks to measure success against.

- Quarter 1 (Days 1-90): The Foundation. Your entire focus should be on the legal and operational backbone of your firm. This means officially forming your legal entity (PLLC, S-Corp, etc.), securing an EIN, opening your IOLTA and operating accounts, and locking in your malpractice insurance. This is also when you finalize your core tech stack—your practice management and accounting software are non-negotiable from day one.

- Quarter 2 (Days 91-180): Brand & Digital Rollout. With the operational framework in place, you pivot to marketing. Launch your professional website. Optimize your Google Business Profile for local search. Start publishing the first pieces of expert content that will establish your authority. The goal is to build a digital presence before you’re desperate for clients.

- Quarters 3 & 4 (Days 181-365): Client Acquisition & Refinement. Now it’s time to fire up the client acquisition engine. You’ll start executing the marketing strategies detailed in your plan, from targeted networking with referral sources to launching your first digital ad campaigns. This period is all about bringing in those first critical clients and meticulously tracking your key performance indicators (KPIs).

Think of your business plan as a hypothesis. That first year of operation is the experiment. You have to diligently track your progress against your initial financial projections and marketing goals to see what’s working and what’s just burning cash.

This journey—from initial cost analysis to growth projections and finally tracking KPIs—is the disciplined progression required for success.

Successful execution isn’t about blind faith in the plan; it’s about a disciplined cycle of planning, acting, and measuring.

Reviewing and Adapting Your Plan

Your business plan is not carved in stone. Schedule a formal, no-excuses review at the end of every single quarter.

Compare your actual results—revenue, client intake numbers, case values, and expenses—against the projections you made. This regular check-in forces you to confront the reality of the market.

Did you overestimate how much business your referral network would send? Maybe you discovered your SEO efforts are delivering much higher-quality leads than you ever expected. This process of tracking, reviewing, and adapting is what separates successful firms from the ones that quietly close up shop. It ensures your firm not only launches effectively but remains agile enough to thrive for years to come.

Lingering Questions About Your Law Firm Business Plan

Even after you’ve mapped out every detail, a few key questions often come up. Let’s tackle them head-on so you can move forward with absolute clarity.

How Often Should I Update My Business Plan?

Think of your business plan as a living document, not a stone tablet. You can’t just write it, file it away, and expect it to guide you for years.

A quarterly check-in is a great rhythm to get into. This is your chance to see how you’re tracking against your KPIs. Then, once a year, block off time for a major overhaul. That said, don’t wait for a calendar invite to pop up if something big happens—a major shift in the market, a new technology that changes how you practice, or a pivot in your core services all demand an immediate plan review.

What Is the Biggest Mistake Lawyers Make?

By far, the most common pitfall is a vague, underfunded client acquisition plan. I’ve seen countless attorneys meticulously detail their legal expertise but get fuzzy on exactly how they’ll land their first 20 clients. It’s a critical oversight.

They consistently underestimate the time, money, and sheer persistence it takes to build a real marketing engine.

Your plan isn’t complete without a specific, funded, and actionable strategy to attract a steady stream of your ideal clients. Brilliant legal skills are worthless if nobody knows you exist.

Why Is a Competitive Analysis So Important?

Your competitive analysis is where you find your edge. It forces you to look outside your own four walls and understand the world your clients live in.

By digging into what other firms offer, how they price their services, and where they find their clients, you can spot the gaps in the market. This is how you stop being just another lawyer and become the lawyer for a specific type of client with a specific type of problem. Without that insight, you’re just noise in an already crowded room.