Drafting a will is how you create a legally binding map for your legacy—dictating how assets are distributed, debts are settled, and minor children are cared for. It’s a formal process: you’ll need to inventory your assets, name your beneficiaries and an executor, draft the document according to precise state laws, and sign it correctly before witnesses.

First Steps in Writing Your Will

Before you get into the weeds of asset allocation and complex trusts, you have to understand the foundational legal framework that gives a will its authority. This isn’t just a list of who gets what; it’s a formal declaration the court system must recognize. For high-net-worth families, mastering these basics is your first line of defense against future disputes and ensures your legacy is protected exactly as you envision.

At its heart, a will involves a few key players, each with a distinct and legally defined role. Any confusion here can cause significant—and expensive—complications when it’s time to administer your estate.

Defining the Key Roles in Your Will

The person creating the will is the testator. That’s you. Every decision in the document flows from your expressed wishes. The people or entities you choose to inherit your assets are the beneficiaries. Finally, the executor is the person or institution you appoint to carry out your will’s instructions, from paying final tax bills to distributing assets.

Think of your executor as the project manager for your entire estate. Their duties are significant:

- Locating your will and filing it with the correct probate court.

- Identifying and securing all estate assets, from real estate to investment accounts.

- Paying all outstanding debts and taxes from the estate’s funds.

- Distributing the remaining property to your beneficiaries according to your precise instructions.

Choosing an executor is a critical decision. You need someone with unimpeachable trustworthiness, sharp financial acumen, and the emotional intelligence to navigate what can be a very charged family dynamic.

A common myth is that a will completely avoids probate. In reality, a will is a set of instructions for the probate court. A well-drafted will makes the probate process smoother and far less contentious, but it doesn’t eliminate it entirely.

The Consequences of Dying Intestate

When someone dies without a valid will, it’s known as dying intestate. In this scenario, you completely forfeit your right to decide who inherits your property. The state’s intestacy laws take over, distributing your assets based on a rigid, one-size-fits-all formula of familial relationships.

For example, if you die intestate with a spouse and children, state law might automatically give half your estate to your spouse and the other half to your children. This could force the sale of a family home or a controlling interest in a business—outcomes you almost certainly never intended.

For families with significant or complex assets, the consequences are even more severe. Dying intestate often leads to prolonged legal battles, feuding heirs, and staggering, unnecessary tax burdens. Drafting a will is the only way to ensure your specific wishes are legally honored.

Mapping Your Assets and Naming Beneficiaries

At its heart, an effective will does two things: it meticulously catalogs everything you own and dictates precisely who gets what. This isn’t just about making a list. For high-net-worth families, this process is a critical blueprint designed to eliminate ambiguity, head off potential disputes, and ensure your final wishes are honored to the letter.

An incomplete or vaguely worded inventory is a recipe for disaster. It can lead to valuable assets being overlooked or, far worse, becoming the subject of protracted and costly legal battles. This foundational work is what gives the rest of your will its power and authority.

Creating a Comprehensive Asset Inventory

Your first move is to conduct a thorough audit of your entire estate. Think of it as a personal balance sheet, capturing the full scope of your wealth with precision. This inventory needs to be detailed and organized so your executor can locate and manage every asset without a hitch.

Start by breaking down your holdings into clear categories:

- Real Estate: List every property—primary residence, vacation homes, investment properties. Include the full address and specify how the title is held (e.g., sole ownership, joint tenancy with rights of survivorship).

- Financial Accounts: This covers everything from checking and savings accounts to certificates of deposit (CDs) and brokerage accounts. Document the financial institution and account numbers for each.

- Business Interests: Detail any ownership in private companies, partnerships, or LLCs. Note the business name, your ownership percentage, and key contacts like partners or C-suite executives.

- Personal Property: This is a broad but often highly valuable category. It includes vehicles, fine art, jewelry, antiques, and other significant collectibles. For items of substantial value, a formal appraisal is non-negotiable.

There’s some good news on the estate planning front. The UK Wills & Probate Consumer Research Report recently found that 41% of UK adults now have a will, a notable increase from 38%. While this means over 22 million have taken this vital step, a staggering number of people—especially younger individuals—still haven’t, often citing simple inertia. You can explore the full findings on these trends in their full 2025 report.

The Art of Naming Your Beneficiaries

With a clear inventory of your assets in hand, the next phase is deciding who inherits them. This requires more strategic thinking than just jotting down names; you’re building a resilient plan that anticipates life’s curveballs. Your designations will fall into three main categories.

Understanding these distinctions is fundamental to drafting a will that works exactly as you intend.

1. Specific Beneficiaries A specific bequest is a direct gift of a particular asset to a named person or entity. Think leaving your vintage Rolex to your son or gifting $50,000 to your charitable foundation. The language here has to be airtight.

Vague instructions like, “I leave my car to my nephew,” are a problem waiting to happen. Be precise: “I leave my 2023 Tesla Model S, VIN [insert number], to my nephew, John D. Smith.”

2. Residuary Beneficiaries After all specific gifts are made and all debts and estate expenses are settled, what’s left is called the residuary estate. The residuary beneficiary is the person (or people) who inherits this remainder. This clause acts as a crucial safety net, ensuring every last asset is accounted for and distributed.

A standard residuary clause looks something like this: “I give all the rest, residue, and remainder of my estate, of whatever kind and wherever located, to my spouse, Jane Doe, if she survives me.”

3. Contingent Beneficiaries Life is unpredictable. What if a primary beneficiary dies before you do? This is precisely what a contingent (or alternate) beneficiary is for. This designation names a second-in-line to inherit if your first choice cannot. Without it, the gift could “lapse” and fall back into the residuary estate, possibly ending up with someone you never intended.

For instance: “I leave my investment portfolio at Morgan Stanley to my sister, Emily White. If Emily White does not survive me, I leave said portfolio to her son, Michael White.” This simple provision creates a clear line of succession, fortifying your estate plan against the unexpected and securing your legacy.

Choosing Your Executor and Guardian

Deciding who will manage your estate and, if you have young children, who will raise them, are arguably the most consequential decisions you’ll make in this entire process. These aren’t roles you give to someone as an honor. They are demanding jobs.

Your executor is tasked with the complex administration of your assets, while a guardian is entrusted with your children’s future. These roles require a rare combination of integrity, financial sophistication, and the emotional fortitude to act decisively during a difficult time. A poor choice here can ignite family conflict, lead to costly mismanagement, and undo all your careful planning.

Selecting the Right Executor

The executor is the fiduciary responsible for carrying out the instructions in your will. For a high-net-worth estate—often involving business interests, intricate investments, and significant tax implications—this is far from a ceremonial post. You’re essentially choosing between an individual, like a trusted family member, or a corporate professional, such as a bank or trust company.

Each option comes with a distinct set of trade-offs.

Appointing a Family Member or Friend

- Pros: They have a personal connection to your family, understand your values, and will often waive the executor fees that professionals charge.

- Cons: They may lack the financial acumen to navigate a complex estate, become overwhelmed by the administrative burden, and face intense pressure or conflicts of interest from other beneficiaries.

Using a Corporate Executor

- Pros: Professional executors offer impartiality, deep expertise in estate administration and tax law, and the infrastructure to manage sophisticated assets. Their neutrality alone can be worth the fee, preventing family disputes before they start.

- Cons: They charge for their services, typically a percentage of the estate’s value, and they won’t have the personal history or connection that a family member brings.

For many substantial estates, the optimal strategy is a hybrid approach: naming a trusted family member as a co-executor alongside a corporate trustee. This model gives you the best of both worlds—personal insight balanced with professional, impartial management.

Choosing an executor isn’t a popularity contest. Prioritize competence, trustworthiness, and impartiality above all else. A well-intentioned but ill-equipped executor can inadvertently cause more harm than good.

Appointing a Guardian for Minor Children

If you have minor children, this is the single most important decision you will make. If you fail to name a guardian, a court will make the choice for you—a scenario that should be avoided at all costs. The person you appoint will be responsible for everything from your children’s daily welfare to their education and moral upbringing until they are adults.

This choice goes far beyond simply picking someone you love and trust. It requires a practical assessment.

Consider these factors with a clear head:

- Parenting Philosophy and Values: Do they share your fundamental beliefs on education, discipline, religion, and life in general?

- Financial Stability: Even with the resources from your estate, can they realistically handle the financial responsibility of raising your children without undue hardship?

- Age and Health: Are they young and healthy enough to handle the long-term physical and emotional demands of raising a child to adulthood?

- Existing Family Dynamics: How would your children integrate into their current family? Do they have a positive relationship with the potential guardian’s spouse and their own children?

You must have a frank, detailed conversation with your intended guardian before you name them in your will. Make sure they understand exactly what they are agreeing to and are genuinely willing and able to take on the role. This isn’t a surprise you want to leave for later.

The Critical Role of Alternates

Life is unpredictable. What happens if your chosen executor predeceases you, becomes incapacitated, or simply declines the role? What if your named guardian’s circumstances change, and they can no longer care for your children? Without a backup, your estate is left in limbo, forcing a court to step in and appoint someone.

This is why naming alternate (or successor) executors and guardians is non-negotiable for a well-drafted will. Always name a second choice, and if possible, a third. This simple step creates a vital safety net, ensuring your wishes are carried out seamlessly and protecting both your family and your assets from unnecessary chaos and legal intervention.

Integrating Trusts and Tax Strategies

For high-net-worth families, a will is a critical starting point, but it’s rarely the complete picture. Think of a will as the foundation; sophisticated estate planning builds upon it with more robust tools designed for privacy, asset protection, and tax efficiency.

A will directs assets through the public probate process. A truly strategic plan, however, incorporates structures like trusts to operate alongside the will, ensuring your legacy is transferred privately and with minimal tax erosion. This is where basic estate planning graduates to multi-generational wealth preservation.

Using Trusts to Bypass Probate and Enhance Control

A trust is essentially a private legal agreement that holds and manages assets for your chosen beneficiaries. Unlike a will, which becomes a public document after your death, a trust keeps your family’s financial affairs completely confidential—a significant advantage for prominent families.

The most common tool in this arena is the revocable living trust. While you are alive, you transfer key assets—real estate, investment portfolios, business interests—into the trust. You remain in full control as the trustee. When you pass, your designated successor trustee steps in to manage and distribute the assets according to your private instructions, entirely outside the supervision of a probate court. To see how this works in practice, our guide explains more about what a living trust is and its strategic benefits.

For more specialized objectives, other trusts are essential:

- Irrevocable Life Insurance Trust (ILIT): An ILIT owns your life insurance policy, removing the death benefit from your taxable estate. This provides your heirs with a source of tax-free cash to cover estate taxes or other immediate expenses.

- Special Needs Trust (SNT): If a beneficiary relies on government assistance, a direct inheritance could disqualify them. An SNT holds their inheritance for their benefit without disrupting eligibility for crucial programs like Medicaid.

Despite their power, these advanced tools are surprisingly underutilized. A recent Wills and Estate Planning Study revealed that only 13% of respondents have a living trust. This highlights a massive gap between standard planning and the sophisticated strategies required to protect significant wealth. You can see more data from the full wills and estate planning report to understand these trends.

When comparing a will to a revocable living trust, it’s clear they serve different, though complementary, roles.

Will vs Revocable Living Trust Key Differences

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Probate | Requires court-supervised probate process. | Avoids probate for assets held in the trust. |

| Privacy | Becomes a public record after death. | Remains a private document. |

| Effective Date | Only effective upon death. | Effective immediately upon creation and funding. |

| Asset Management | Does not manage assets during your lifetime. | Can manage assets if you become incapacitated. |

| Cost & Complexity | Generally simpler and less expensive to create. | More complex and costly to set up and fund. |

| Control | Names a guardian for minor children. | Cannot name a guardian for minor children. |

Both instruments are vital. A will is necessary to name guardians and handle any assets left out of the trust, while the trust provides the heavy lifting for privacy and probate avoidance.

Strategic Tax Planning and Charitable Giving

The federal estate tax exemption is high as of 2024, but it’s scheduled to be cut nearly in half in the near future. For affluent families, this makes proactive tax planning a non-negotiable part of preserving wealth.

One of the most effective and straightforward strategies is the annual gift tax exclusion. This allows you to gift a specific amount to any number of individuals each year, tax-free, systematically reducing your taxable estate over time.

Key Takeaway: A will directs your legacy, but a trust protects it. Integrating a trust into your plan offers privacy, control, and the ability to bypass the probate process, making it an indispensable tool for complex estates.

Charitable giving can also offer powerful tax advantages. Instead of a simple bequest in your will, a Charitable Remainder Trust (CRT) allows you to transfer appreciated assets, receive an income stream for life, and claim an immediate charitable deduction. When the trust term ends, the remainder goes to your chosen charity, and the assets are removed from your estate for tax purposes.

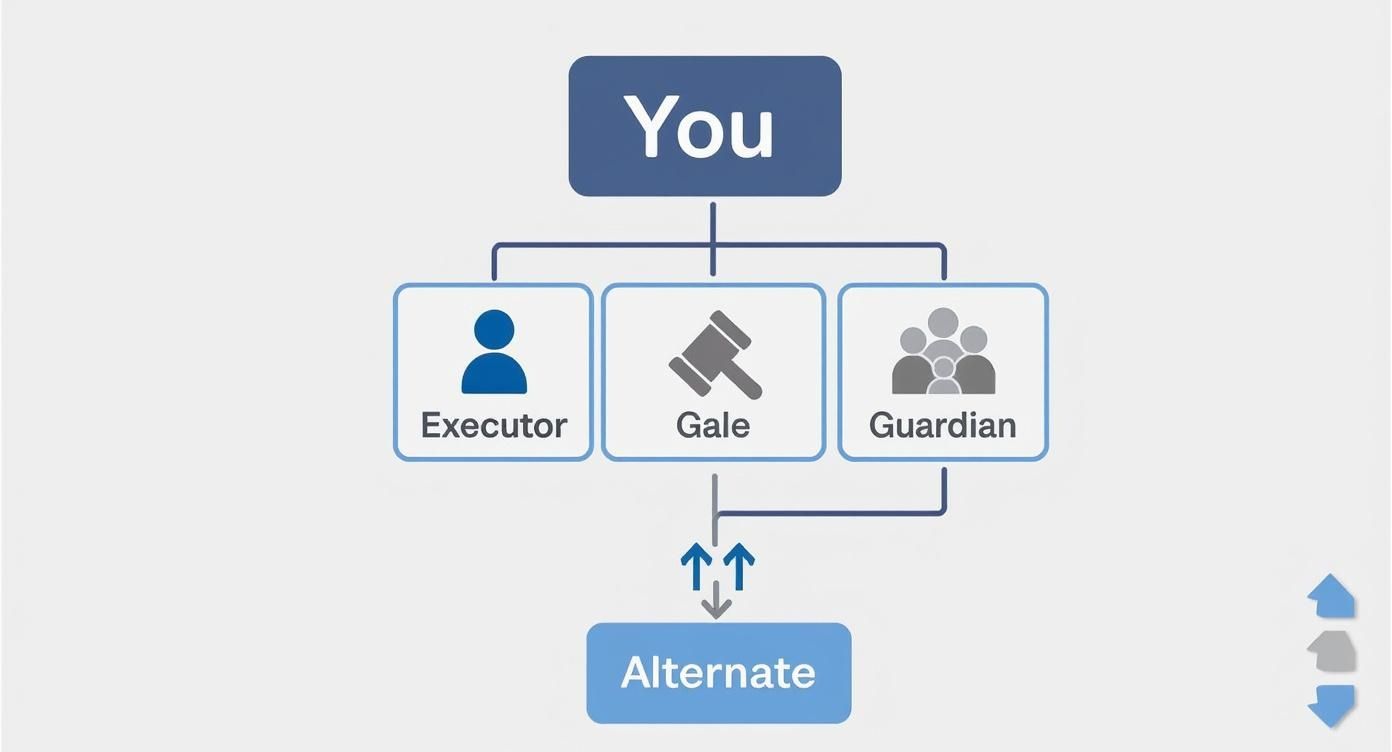

This flowchart below illustrates the essential roles—like executor and guardian—that you must define in your plan.

As the diagram shows, naming alternates for every key position is a crucial best practice. A resilient estate plan anticipates contingencies. By combining these clearly defined roles with sophisticated trust and tax strategies, you create a comprehensive framework that protects your family and your legacy for generations.

Finalizing Your Will and Managing Digital Assets

A meticulously drafted will is just a stack of paper until it’s properly executed. The formal signing ceremony, known as attestation, is what breathes legal life into the document, transforming your wishes into a binding directive.

Fumbling this final step is one of the most common—and entirely avoidable—reasons a will gets challenged and potentially thrown out during probate. This isn’t just about scribbling a signature. State laws are incredibly specific, and even a minor slip-up can create a legal nightmare for your heirs. For a high-net-worth estate, absolute precision here is non-negotiable.

Our detailed guide explains how to probate a will, and it underscores just how critical getting the initial signing ceremony right really is.

Executing Your Will with Legal Precision

The signing ceremony needs to be conducted with surgical care. Generally, you (the testator) must sign your will in the presence of at least two disinterested witnesses. “Disinterested” is a legal term meaning they aren’t beneficiaries and have absolutely nothing to gain from the will’s contents.

Here’s how to ensure a smooth, legally sound signing:

- Select the Right Witnesses: Choose adults who are reliable and likely to be around years from now. They may need to attest in court that they witnessed you sign the document.

- Sign in Their Presence: This is crucial. You must sign the will—or acknowledge your existing signature—while both witnesses are physically present and watching you do it. They, in turn, must sign in your presence.

- Make a Verbal Declaration: While not always required, it’s a best practice to state clearly to your witnesses, “This is my last will and testament.” This removes any ambiguity.

Many states also allow for a self-proving affidavit. This is a separate statement you and your witnesses sign in front of a notary public. It creates a legal presumption that the will was executed correctly, which can dramatically speed things up in probate court.

Key Insight: The entire point of the witness requirement is to guard against fraud and undue influence. Having objective third parties watch you sign creates a powerful legal shield against anyone who might later challenge the will’s validity.

Planning for Your Digital Legacy

In our hyper-connected world, a huge chunk of your estate might not exist in the physical realm at all. Digital assets—cryptocurrency wallets, social media accounts, online businesses, valuable domain names—are too often forgotten in traditional estate planning.

Without a clear plan, these assets can become locked away or lost forever.

The first step is to create a detailed digital asset inventory. This is a document kept separate from your will that lists your important accounts, usernames, and instructions for access. Never put passwords in your will itself; it becomes a public document once filed with the court.

Your inventory should cover:

- Online Financials: Think PayPal, Coinbase, online brokerage accounts.

- Social & Email: LinkedIn, Facebook, and personal email accounts.

- Business Assets: E-commerce storefronts, domain names, cloud storage holding intellectual property.

- Personal Files: Digital photos, videos, and essential documents stored in services like Dropbox or Google Drive.

This is no longer a niche concern. The National Wills Report shows that 39% of adults now include or plan to include their digital legacy in their estate plans. This trend highlights just how vital these assets have become. The full 2025 National Wills Report offers more insight into how digital estate planning is evolving.

To give your executor the power they need, you must include specific language in your will granting them authority over your digital property. This gives them the legal standing required to deal with tech companies and carry out your wishes for your digital afterlife.

Answering Key Questions About Your Will

Once you’ve drafted the core of your will, a few practical questions almost always come up. Think of this as the final checkpoint—clearing up the common uncertainties and making sure you know how to maintain your plan effectively for years to come. Getting these final details right is what transforms a document into a durable, powerful tool for your legacy.

A will isn’t a static piece of paper; it’s a living plan that needs to breathe and adapt right alongside your life.

How Often Should I Update My Will?

A will is definitely not a “set it and forget it” document. Your life will change, and if your will doesn’t change with it, you risk creating unintended and often costly consequences for your family. As a general rule, it’s wise to review your will every three to five years to confirm it still aligns with your wishes.

However, some events are so significant they should trigger an immediate review. These are the moments that can completely alter the landscape of your estate plan.

- Marriage or Divorce: A shift in your marital status has massive legal implications, fundamentally changing inheritance rights under state law.

- Birth or Adoption of a Child: You’ll obviously want to include new family members, but just as importantly, this is when you must name a legal guardian.

- Significant Financial Changes: Did you just sell a business, come into a large inheritance, or see your portfolio grow substantially? Any major swing in your net worth demands a fresh look at how your assets are divided.

- Death of a Key Person: If the person you named as your executor, a guardian for your children, or a major beneficiary passes away, you have to appoint a successor to avoid a critical gap in your plan.

Failing to make these updates can create genuine turmoil—an ex-spouse could accidentally inherit a fortune, or a child born after the will was signed could be unintentionally overlooked. Regular reviews are your best defense against these painful and expensive mistakes.

Do I Really Need a Lawyer?

Yes, DIY will kits and online services are everywhere, but they’re built for the simplest, most straightforward estates imaginable. For anyone with a high net worth, complex assets like business interests, real estate holdings, or blended family dynamics, using a generic template is an enormous gamble.

An experienced estate planning attorney provides far more than a fill-in-the-blank document. They deliver strategic counsel custom-fit to your financial picture and family situation.

An attorney’s real value is their foresight—the ability to anticipate challenges years down the road and structure a plan that’s resilient enough to withstand them. They navigate intricate tax laws, use trusts to shield assets from creditors and legal challenges, and draft airtight language to minimize the risk of a dispute.

Even the most carefully drafted will isn’t completely immune to a challenge from a disgruntled relative. It’s smart to understand when a will can be contested so you can work with your counsel to fortify your plan against those very risks. Hiring a professional is your strongest line of defense.

How Much Does It Cost to Write a Will?

The investment required to create a will varies dramatically. You can find a basic template from an online service for a few hundred dollars. For a sophisticated, comprehensive estate plan tailored to a high-net-worth individual, however, the cost will be significantly higher.

Attorneys typically charge either a flat fee for a complete package of documents or bill hourly. For a flat-fee plan that includes not just a will but also powers of attorney and perhaps a revocable living trust, you can expect to invest anywhere from a few thousand to several thousand dollars, depending on the complexity of your assets and goals.

While that might seem like a substantial upfront cost, it’s crucial to reframe it as an investment in protecting your wealth. The price of professional estate planning is a tiny fraction of the potential legal fees, estate taxes, and lost assets that a poorly drafted plan—or no plan at all—can inflict on your heirs. Investing in expert advice now will almost certainly save your estate a fortune later.

Finding the right legal expert is the most critical step in protecting your legacy. The Haute Lawyer Network is a curated directory of the nation’s top attorneys, selected for their excellence and trusted by high-net-worth individuals. Connect with a premier estate planning professional who can provide the sophisticated guidance your assets deserve. Visit us at https://hauteliving.com/lawyernetwork.