When you’re facing a divorce, the 401k often stands out as one of the largest and most emotionally charged assets on the table. The only way to properly divide it is with a specialized court order called a Qualified Domestic Relations Order, or QDRO. This is the non-negotiable legal tool that lets you split the account without setting off a bomb of immediate tax penalties.

Why Your 401k Is a Divisible Asset

It’s easy to think, “My name is on the account, so it’s my money.” That’s a common, but legally incorrect, assumption. The courts view a marriage as a financial partnership. Any retirement savings—contributions, employer matches, and investment growth—accumulated from the day you said “I do” until the date of legal separation are generally considered marital property.

This means both spouses have a legal claim to the wealth built during that time. This principle is what ensures financial fairness, especially for a partner who may have stayed home to raise children or earned a lower income but contributed to the marriage in other essential ways.

The Marital Portion vs. Separate Property

Getting this distinction right is the first real step in the negotiation. You have to isolate what’s actually up for grabs.

- Marital Portion: This is everything that went into the 401k—and all the growth it experienced—from your wedding day to your separation date. This is the pot you’ll be dividing.

- Separate Property: This includes the account balance you had before you got married, plus any growth directly tied to those specific pre-marital funds. This slice of the pie typically stays with the original account holder.

Let’s say you walked into the marriage with $50,000 in your 401k. Over the next ten years, the account ballooned to $300,000. The marital portion is the $250,000 increase in value. That’s the figure you and your ex-spouse will be focused on splitting. Your original $50,000 (plus its own growth) is yours to keep.

The Role of a Qualified Domestic Relations Order

Here’s where many people get tripped up. Your divorce decree can state that the 401k will be split 50/50, but that document has zero power to actually make it happen. It’s just an agreement between you and your ex.

Only a QDRO can legally compel the plan administrator to transfer the funds.

It’s a court-approved order that bypasses early withdrawal penalties and taxes. For example, a QDRO lets the non-employee spouse (the “alternate payee”) roll their awarded share directly into their own IRA without any immediate tax hit. If they choose to cash it out later before age 59 ½, they’ll likely owe a 10% penalty on top of income taxes. But the initial transfer is protected.

Key Takeaway: A divorce decree is the “what” and “why.” The QDRO is the “how.” Without a properly executed QDRO, the 401k plan administrator will not—and legally cannot—divide the account.

Understanding this legal distinction is critical. The division of retirement funds requires a specific kind of legal and financial expertise, which is why figuring out your approach between divorce mediation vs. litigation early on can save you an enormous amount of time, money, and stress.

Key Terms for Your 401k Divorce Split

The process of splitting a 401k comes with its own vocabulary. Getting familiar with these terms will help you understand what your attorney and financial advisor are talking about and empower you to make more informed decisions. Here’s a quick-reference guide to the essential jargon.

| Term | What It Means for Your Divorce | Why It’s Important |

|---|---|---|

| Participant | The spouse who owns the 401k account through their employer. | This is the person whose retirement plan is being divided. |

| Alternate Payee | The non-employee spouse who is receiving a portion of the 401k funds. | This term will be used throughout the QDRO to identify the receiving spouse. |

| Plan Administrator | The company or individual responsible for managing the 401k plan (e.g., Fidelity, Vanguard). | They are the gatekeeper. The QDRO must be approved by them before any funds can be moved. |

| Valuation Date | The specific date used to determine the total value of the account’s marital portion. | This date is crucial for calculating a fair split, as market fluctuations can change the account value daily. |

| Segregated Account | A separate account created for the Alternate Payee to hold their awarded funds temporarily. | This is often the first step the plan administrator takes after approving the QDRO, before the funds are rolled over. |

These definitions are your starting point. As you move forward, each term will play a role in the precise execution of your asset division, ensuring the final split aligns with what was agreed upon in your settlement.

Valuing Your 401(k) and Identifying the Marital Portion

Before you can even begin talking about splitting a 401(k), you need a precise, defensible number. This isn’t as simple as logging into your account and grabbing the current balance. The real work is in accurately valuing the account and—more importantly—carving out the “marital portion” from any money you had before the wedding.

This is often the most complex and contentious part of the entire process.

First things first: you have to establish a clear valuation date. This is the specific day used to calculate the value of the 401(k) earned during the marriage. While it’s often the date of legal separation, it can be negotiated or set by state law. This date is critical. Retirement accounts fluctuate daily with the market, and agreeing on a fixed date prevents endless arguments over gains or losses that happen while the divorce is pending.

Tracing Pre-Marital Contributions and Growth

If you walked into the marriage with an existing 401(k) balance, that initial amount is your separate property. But here’s where a lot of people make a mistake: simply subtracting that starting balance from today’s total isn’t accurate. You’re also entitled to all the growth that your pre-marital funds generated over the years. This is where the detective work begins.

To do this, you or a financial expert will need to perform a “tracing” analysis. This means digging up old account statements—sometimes from a decade or more ago—to track a few key data points:

- Pre-Marital Balance: The exact value of the account on the date you were married.

- Contributions: Every single employee and employer contribution made during the marriage.

- Investment Gains/Losses: The market performance of both the pre-marital funds and the new marital contributions over time.

This can be a painstaking process. Let’s say you had $25,000 in your 401(k) when you got married. Over a 15-year marriage, you and your employer added $100,000, and the account grew to $400,000. The marital portion isn’t just the $100,000 you added; it also includes the substantial investment growth that occurred on those marital funds. A financial analyst can calculate the precise growth attributable to your separate property versus the marital property.

Expert Insight: Failing to properly trace the growth on separate property is a costly error. Many people mistakenly believe only the pre-marital principal is theirs, leaving thousands—or even tens of thousands—of dollars in investment gains on the negotiating table.

How Your State’s Laws Impact the Calculation

Where you live dramatically changes how the marital portion of your 401(k) is divided. The legal framework of your state sets the rules of the game.

Community Property States (like California or Texas) operate under the assumption that all assets acquired during the marriage are owned equally by both spouses. In these states, the marital portion of the 401(k) is almost always split right down the middle, 50/50.

Equitable Distribution States, which include most other states, aim for a “fair” but not necessarily equal division. A judge will look at multiple factors, like the length of the marriage, each spouse’s income, and future earning potential. The division of retirement assets like a 401(k) is governed by this principle, and the final split might not be 50/50. For instance, if one spouse has a $150,000 401(k) and the other has $50,000, a court might order the spouse with the larger account to transfer $50,000 to equalize their retirement holdings. You can find out more by reading this in-depth legal perspective.

When to Call in a Financial Expert

While it might seem tempting to save a few bucks by calculating the marital portion yourself, the complexity of tracing and valuation usually demands professional help. This is where a Certified Divorce Financial Analyst (CDFA) becomes invaluable.

A CDFA specializes in the financial intricacies of divorce and can:

- Accurately trace pre-marital assets and their associated growth.

- Prepare detailed financial reports that will hold up in negotiations or court.

- Analyze the long-term tax implications of different settlement options.

- Provide an unbiased, third-party valuation that helps prevent disputes.

Hiring an expert might feel like another expense in a costly process, but their precision can easily save you far more than their fee. They ensure you don’t overpay or, just as importantly, receive less than you are rightfully owed. Their work provides the solid financial footing you need before moving on to the legal mechanics of the split.

The Qualified Domestic Relations Order (QDRO): Your Legal Key to the 401(k)

Think of your divorce decree as the blueprint for your settlement. It can say you’re entitled to half of a 401(k), but it can’t actually unlock the account and move the money. For that, you need a very specific legal key: a Qualified Domestic Relations Order, or QDRO.

Without a QDRO, any attempt to split a retirement account is seen by the IRS as a simple withdrawal. That means it’s treated as a taxable distribution, and if you’re under 59 ½, you’ll also get hit with a painful 10% early withdrawal penalty.

A QDRO is a separate, highly detailed court order sent directly to the 401(k) plan administrator. It’s the only legal instrument that instructs the plan on exactly how to divide the assets between the employee spouse (the “participant”) and the former spouse (the “alternate payee”) while protecting the money’s tax-deferred status.

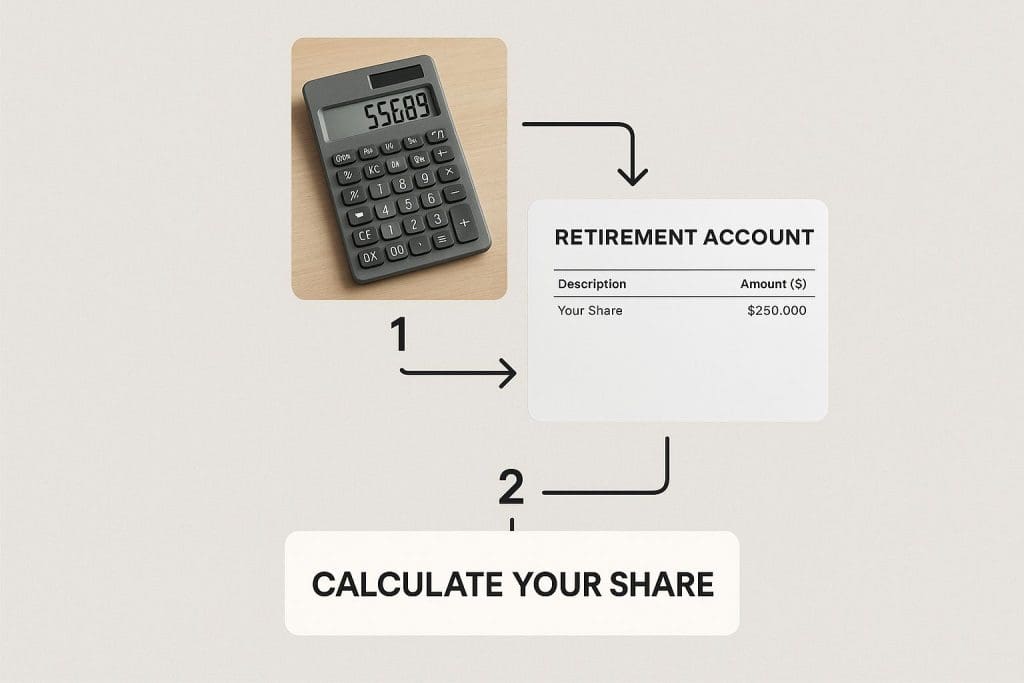

This visual guide offers a clear breakdown of how to calculate your share before you even start drafting legal documents.

As the graphic shows, getting the numbers right from the start is foundational. Precision in determining the marital portion is everything.

What Must Be in a QDRO?

A QDRO isn’t some generic, fill-in-the-blank form. It’s a precise legal document that has to be tailored to both federal law and the unique rules of that specific 401(k) plan. Vague language is the fastest way to get a QDRO rejected by a plan administrator.

For a QDRO to even be considered valid, it must include these non-negotiable details:

- Full legal names and last known addresses for both spouses.

- The exact, official name of the retirement plan being divided.

- The specific dollar amount or percentage of the benefits awarded to the alternate payee.

- The number of payments or time period the order covers.

An order that just says “50% of the marital share” without defining the valuation date or how market gains and losses will be handled is dead on arrival. It will almost certainly be sent back for clarification, causing months of frustrating—and expensive—delays.

The Real-World QDRO Process

Getting a QDRO from a draft on a lawyer’s desk to a finalized division of assets is a multi-step journey. Patience and precision are key. If you miss a step, you can find yourself right back at square one.

- Drafting the Order: An attorney, often one who specializes in QDROs, prepares the document based on the terms you agreed to in your divorce settlement.

- Pre-Approval Submission: This is a crucial step that, shockingly, is often skipped. The draft QDRO is sent to the 401(k) plan administrator for a preliminary review to confirm the language meets their internal requirements.

- Judicial Signature: Once the plan administrator gives the thumbs-up, the QDRO goes to the court for a judge’s signature, turning it into an official order.

- Final Service: The signed, court-certified QDRO is then formally served back to the plan administrator, who finally executes the division of assets.

Expert Insight: Pre-approval is your best defense against rejection. A plan administrator has the authority to reject a judge-signed QDRO if it violates their plan rules. Getting their feedback before it goes to the judge saves an immense amount of time, money, and stress.

Why This Is Absolutely Not a DIY Project

The sheer complexity of drafting a QDRO that satisfies both strict legal standards and hyper-specific plan rules makes this a terrible candidate for a do-it-yourself project. The financial stakes are simply too high to risk it.

Here are just a few common mistakes that get QDROs rejected every day:

- Incorrect plan name: Using the parent company’s name (“MegaCorp Inc.”) instead of the specific plan name (“The MegaCorp Employee Savings Plan”).

- Ambiguous instructions: Failing to specify how to handle investment gains or losses that occur between the valuation date and the actual distribution date.

- Requesting unallowable benefits: Asking for a lump-sum payment or a type of distribution that the plan simply does not offer.

A single minor error can invalidate the entire document, leaving your assets in limbo and forcing you to start the whole expensive process over. This is one area of divorce where specialized legal knowledge is paramount. Working with an attorney who focuses on this niche ensures the order is drafted correctly the first time. For those seeking such specialized counsel, a curated directory is often the best place to find experienced family law attorneys who have the specific skillset to manage these intricate financial instruments.

Thinking Beyond a 50/50 Split

When a 401(k) comes up in a divorce, most people immediately assume it will be chopped right down the middle. While a 50/50 division is definitely common, it’s not your only move. The smartest negotiations look beyond a single account to the entire financial landscape, often leading to a creative settlement that serves you better both today and thirty years from now.

It’s less about one account and more about the entire portfolio of marital assets you’ve built together.

The Power of an Asset Trade-Off

One of the most powerful strategies I’ve seen is the “asset trade-off,” sometimes called a buyout. Instead of splitting the 401(k), one spouse keeps it entirely. In exchange, the other spouse gets another asset of equal value. The classic example is trading retirement funds for the equity in the family home.

Let’s say a couple has two major assets: a 401(k) worth $400,000 and $400,000 in home equity. Rather than splitting both, one spouse could walk away with the fully funded 401(k), and the other could take full ownership of the house. This is where you can get creative and tailor a solution that fits real-life needs.

Comparing a 401k Split vs an Asset Buyout

Deciding between splitting the retirement account or trading it for another asset like the house isn’t a simple choice. Each path has significant financial implications that depend entirely on your personal goals, age, and risk tolerance. This table breaks down the core differences to help you think through what’s right for you.

| Consideration | Splitting the 401k with a QDRO | Trading for Other Assets (e.g., Home Equity) |

|---|---|---|

| Immediate Cash Access | Low. Funds are for retirement; early withdrawals face taxes and penalties. | High. Selling the home or another asset provides immediate, post-tax cash. |

| Long-Term Growth | High. The funds remain invested, benefiting from tax-deferred compound growth. | Low. Home equity grows more slowly and doesn’t compound in the same way. |

| Market Risk | High. The account value is tied to stock market performance and can fluctuate. | Low. A physical asset like a home is generally more stable than the market. |

| Tax Implications | Complex. Withdrawals in retirement are taxed as ordinary income. A QDRO avoids immediate taxes. | Simpler. The asset (like a primary residence) may have capital gains exemptions upon sale. |

| Stability & Lifestyle | Provides future financial security for retirement. | Provides immediate lifestyle stability, especially if children are involved. |

Ultimately, the right choice is about balancing your need for long-term security against your need for immediate stability and cash. There’s no one-size-fits-all answer here.

Weighing the Pros and Cons

Let’s dig a little deeper. What works perfectly for one person could be a financial disaster for another. It all comes down to your personal circumstances.

Reasons to Keep the 401(k):

- Continued Tax-Deferred Growth: This is the big one. The money stays in the market, working for you without a tax hit until retirement.

- Retirement Security: For someone nearing retirement, keeping their nest egg intact provides enormous peace of mind and financial stability.

- Future Liquidity: While you can’t touch it now without a penalty, a 401(k) is far more liquid than a house when you eventually need the funds.

Reasons to Trade for the House:

- Immediate Stability: Keeping the family home can be a godsend, providing consistency for kids and avoiding the chaos of a forced move.

- Avoiding Market Volatility: A house is a tangible asset you can see and touch, insulating you from the daily swings of the stock market.

- Access to Cash: If the plan is to sell the house, you get a lump sum of cash to start over. For many, that’s more valuable than a retirement account they can’t access for decades.

Crucial Consideration: You absolutely must look at these options through a post-tax lens. $200,000 in a pre-tax 401(k) is not the same as $200,000 in cash from selling your home. That 401(k) money will be taxed when you withdraw it, shrinking its real-world value.

Understanding the Legal and Tax Implications

State laws have a massive say in these negotiations. Community property states, for example, typically start with the presumption of an equal split of all assets acquired during the marriage. In a state like California, the marital portion of a 401(k) is generally considered to be owned 50/50. To work around this, couples use these exact kinds of trade-offs to balance the total value while keeping retirement accounts intact. You can find more details about California’s approach to 401k division on Sullivan-Law.com.

This level of financial strategy is precisely why sophisticated legal advice is non-negotiable, especially when the asset portfolio is complex. It’s a key reason why ultra-wealthy families need sophisticated family law counsel to protect their interests during a divorce.

The decision to split a 401(k) or negotiate a buyout demands a serious look at your finances, future plans, and what keeps you up at night. Working with a Certified Divorce Financial Analyst (CDFA) can bring the clarity you need to make the right choice for your new financial life.

Managing Your Funds After the 401k Split

After all the legal wrangling, the Qualified Domestic Relations Order (QDRO) is finally approved. This is a massive milestone. The 401(k) plan administrator now has the legal green light to carve out your portion of the retirement funds. But while it feels like the end, it’s actually the beginning of a critical financial chapter.

As the receiving spouse—known formally as the “alternate payee”—you’ve arrived at a major financial crossroads. The decisions you make right now will have a lasting impact on your long-term security. This isn’t just about getting a check; it’s about making a significant asset work for your new life.

Your Three Main Choices

Once the plan administrator gives you the go-ahead, you essentially have three paths you can take. Each one has profoundly different consequences for your immediate cash flow and future wealth, so getting this right is your top priority.

- Direct Rollover to an IRA: This is the most common route, and for good reason—it’s often the most financially sound. You simply open an Individual Retirement Account (IRA) and have the 401(k) funds transferred directly into it.

- Transfer to Your Own 401k: If your current employer’s 401(k) plan accepts them, you might be able to roll the funds into your own account. It’s less common, but worth looking into if your plan has great investment options or exceptionally low fees.

- Take a Cash Distribution: This means asking the plan administrator to cut you a check for the entire amount.

This isn’t a trivial choice. A quick decision made under stress can trigger a massive, and entirely avoidable, tax bill that could set your retirement goals back for years.

The Rollover: The Tax-Smart Path

For the vast majority of people, a direct rollover into a new IRA is the smartest play. The process is clean and, most importantly, it is not a taxable event. The money simply moves from one tax-deferred retirement account to another, where it can keep growing for your future without an immediate tax bite.

An IRA also puts you in the driver’s seat. Unlike an employer’s 401(k) with its limited menu of investment funds, an IRA gives you access to a nearly infinite universe of stocks, bonds, mutual funds, and ETFs. You can work with an advisor to build a portfolio that truly fits your personal risk tolerance and new timeline.

Key Takeaway: The QDRO gives you a special, one-time pass on the 10% early withdrawal penalty. However, it does not get you out of paying income tax. Cashing out means the entire amount is treated as ordinary income for the year, which can easily push you into a much higher tax bracket.

The Cash-Out: A Costly Convenience

Taking the cash can feel incredibly tempting, especially when you’re facing the real-world expenses of setting up a new household. While the QDRO lets you sidestep the 10% penalty if you’re under 59 ½, you absolutely cannot escape income taxes.

Let’s put it in perspective. Say your share is $150,000. If your income puts you in the 24% federal tax bracket, you’ll immediately owe the IRS a staggering $36,000, and that’s before state taxes. Your $150,000 asset instantly shrinks to $114,000.

What’s even more damaging is the lost opportunity. That original $150,000, if left invested, could grow to over $400,000 in 20 years with a modest 5% annual return. Cashing out sacrifices all of that future potential.

Actionable Steps for a Smooth Transfer

To make sure your rollover goes off without a hitch and you don’t make any expensive mistakes, follow a clear game plan. This is how you protect your money during the final leg of the journey.

- Choose Your Financial Institution: First, do your homework. Select a reputable brokerage firm like Fidelity, Vanguard, or Charles Schwab to open your new IRA.

- Open the Rollover IRA: Get the paperwork done to open the account. It’s critical that it’s specifically set up as a “Rollover IRA” to keep its tax-deferred status intact.

- Coordinate with the Plan Administrator: Get in touch with your ex-spouse’s 401(k) plan administrator. They will have their own distribution forms for you to fill out. You’ll need to provide your new IRA account details and give them explicit instructions for a direct rollover.

- Address Any 401k Loans: This is a complication that trips up a lot of people. If your ex-spouse had an outstanding loan against the 401(k), the QDRO must spell out how that debt is handled. Usually, the loan balance is subtracted from the total before the split, which means you’ll get less. Confirm this with the administrator so there are no surprises with the final transfer amount.

Common Questions About Splitting a 401k in Divorce

When clients first learn how to split a 401k in a divorce, it’s natural for a flood of questions to surface. The process is governed by specific legal and financial rules that can feel overwhelming at first. Below are clear, direct answers to the most common points of confusion we see, designed to help you move forward with more confidence.

Can My Spouse Just Take My 401k?

A common fear is that an ex-spouse can simply drain a 401k account. The reality is far more structured and secure than that. Your spouse has no direct access to withdraw funds from your account.

Instead, they are legally entitled to a share of the marital portion of your 401k—that’s the value built from the date of marriage to the date of legal separation. This division is executed through a Qualified Domestic Relations Order (QDRO), a court-approved document that provides explicit instructions to the plan administrator on how to transfer the funds legally and safely.

Your 401k is protected from unilateral withdrawals during a divorce. The division is a formal legal process, not a free-for-all.

Will I Have to Pay Taxes on the 401k Money I Receive?

This is a critical question, and the answer depends entirely on what you do with the funds after the transfer. There is a specific pathway to receive your share completely tax-free at the time of the division.

You will not owe taxes or penalties if you roll the funds directly into another qualified retirement account, such as an IRA. The money maintains its tax-deferred status, allowing it to continue growing for your future. Taxes only become due when you begin taking distributions from that new account in retirement.

However, if you opt to receive the money as a cash payout, it will be treated as ordinary income for that year. You will then owe federal and state income taxes on the entire amount, which can be a significant and often avoidable financial hit.

Who Pays for the QDRO Preparation?

Drafting a QDRO requires specialized legal expertise, and it isn’t free. Costs can range from a few hundred to a couple of thousand dollars. So, who foots the bill?

The responsibility for this cost is entirely negotiable. There is no fixed rule.

We typically see a few common arrangements:

- Splitting the cost 50/50: This is a frequent and straightforward approach.

- One spouse covers the entire fee: Sometimes, one party will agree to pay for the QDRO as part of the broader settlement negotiations.

- The receiving spouse pays: In some cases, the person receiving the funds (the alternate payee) agrees to cover the cost.

It is vital to have this agreement clearly documented in your final divorce decree to avoid future disputes. Clarifying this point upfront ensures a much smoother process when it’s time to actually divide the account.

Navigating the complexities of asset division requires precise legal expertise. For high-net-worth individuals seeking top-tier representation, the Haute Lawyer Network provides a curated directory of the nation’s most respected attorneys, ensuring you connect with a professional who can protect your financial future. Find elite legal counsel.