Protecting your assets from nursing home costs is all about proactive legal planning. One of the most common and effective strategies is moving assets into an irrevocable trust at least five years before you might need care. This move legally separates your wealth from your name, shielding it from Medicaid’s strict spend-down rules and preserving your family’s financial legacy. Without a plan like this, a lifetime of savings can be wiped out with shocking speed by the high cost of long-term care.

The Financial Reality of Long-Term Care

Facing the potential cost of long-term care can be unsettling, but for high-net-worth families, it’s a necessary reality check. This isn’t about causing worry; it’s about being financially realistic. The hard truth is that without a solid defensive strategy, a carefully built estate can be picked apart in just a few years.

The numbers are pretty sobering. If you’re turning 65 today, there’s a nearly 70% chance you’ll need some type of long-term care in your lifetime. With the median annual cost for a private room in a nursing home now at $116,800 as of 2025, a stay of several years can easily liquidate a seven-figure nest egg. You can learn more about the rising costs of long-term care to see the full financial picture.

Medicaid and the Asset Spend-Down

For many families, Medicaid eventually becomes the only way to pay for care, but qualifying comes at a steep price. To be eligible, your income and assets have to fall below very low state-mandated thresholds. This forces you into what’s known as a “spend-down,” where you have to systematically liquidate your own wealth on care costs until you’re poor enough to qualify.

During a spend-down, you’ll burn through:

- Checking and savings accounts

- Stocks, bonds, and mutual funds

- Vacation homes and other non-primary real estate

You are essentially forced to pay for your own care until you have almost nothing left. This is the exact outcome that smart asset protection planning is designed to prevent.

Let’s be clear: this isn’t about “gaming the system.” It’s about responsible, forward-thinking legal planning. The goal is to ensure you can get high-quality care without being forced to go broke in the process, preserving the assets you worked your whole life to build for your family.

Urgency Is Your Greatest Ally

When it comes to long-term care costs, procrastination is the biggest enemy of your financial legacy. Many of the best legal tools, especially irrevocable trusts, are subject to Medicaid’s five-year look-back period. This means your planning must be fully in place a full 60 months before you apply for benefits.

Waiting for a health crisis to strike is a terrible idea. It drastically narrows your options and often leads to devastating financial losses. The best time to act is now, while you’re healthy and have time on your side. That’s when you have the most flexibility and can put the strongest protections in place. Just thinking about how to protect assets from a nursing home is the crucial first step toward securing your family’s future and your own peace of mind.

Decoding the Five-Year Medicaid Look-Back Period

If there’s one rule you absolutely must understand to protect your assets from nursing home costs, it’s the five-year Medicaid look-back period. This isn’t a soft guideline; it’s a hard-and-fast rule that can completely unravel your financial security if you ignore it. It’s the government’s mechanism for preventing people from simply giving everything away right before they need care.

Think of it as a 60-month financial audit. The moment you apply for long-term care through Medicaid, the state agency will ask for a complete financial history for the preceding five years. They will pour over every bank statement, investment report, and property deed, looking for one thing in particular: uncompensated transfers.

That’s just the official term for any asset you gave away, gifted, or sold for less than it was actually worth.

What Triggers a Penalty

This is where so many families get tripped up. Seemingly innocent and well-meaning financial decisions can become landmines during the Medicaid application process.

Here are a few classic examples that I see all the time:

- Gifting money to your kids. That $50,000 you generously gave your son for a down payment on his first home? Medicaid sees that as a $50,000 gift that you should have kept for your own care.

- “Selling” property for $1. Transferring the family vacation cabin, worth $200,000, to your daughter for a dollar is a common move. Unfortunately, Medicaid views it as a $199,999 uncompensated transfer.

- Paying for a grandchild’s college. While this can be a smart move for federal gift tax purposes, Medicaid doesn’t care. It’s still a gift that counts against you.

- Making large charitable donations. Your generosity is wonderful, but significant donations made within that five-year window are also flagged as disqualifying transfers.

The fallout from these actions isn’t just a denied application. It’s a penalty period.

Understanding the Penalty Period

This is where the real financial pain begins. Medicaid tallies up the total value of all your uncompensated transfers. Then, they divide that number by a state-specific figure called the “penalty divisor”—basically, the average monthly cost of nursing home care in your area. The result is the exact number of months you are disqualified from receiving benefits.

Let’s walk through a real-world scenario. Say your state’s average monthly nursing home cost is $9,000. If you gifted a total of $180,000 to your children four years ago, the math looks like this:

$180,000 (total gifts) ÷ $9,000 (monthly cost) = 20 months

This means that even if you’re broke and need immediate care, Medicaid will not pay a dime for 20 months. Your family is now left to cover that cost out-of-pocket, a bill that could easily climb past $180,000.

The look-back period exists for one reason: to force people to plan ahead. It’s designed to stop last-minute asset shuffling. This is why proactive planning isn’t just a good idea—it’s the only way to make these strategies work.

Failing to plan for this five-year window almost always leads to a catastrophic spend-down. Without the right legal structures in place, you’ll be forced to liquidate nearly everything you own. Single applicants often must burn through their life savings until they have only $2,000 left to their name, while married couples might be left with as little as a combined $3,000-$4,000. We’re talking about selling the family home, cashing in retirement accounts, and watching decades of hard work evaporate. You can learn more about how to avoid this devastating outcome with expert legal guidance from McElroy Law. This rule makes it crystal clear: you have to act long before a health crisis hits.

The Irrevocable Trust: Your Cornerstone Strategy

When it comes to creating a solid defense for your family’s wealth, the irrevocable trust is the strongest tool in the shed. More specifically, the Medicaid Asset Protection Trust (MAPT) is widely considered the gold standard for high-net-worth families who want to shield their legacy from the staggering costs of long-term care.

A MAPT is a highly specialized legal instrument with a very clear purpose: protecting your assets so you can qualify for Medicaid if the need ever arises, without having to liquidate everything you’ve worked for.

So, how does it work? In essence, you (the grantor) legally transfer assets—your home, investment accounts, rental properties—into the trust. A person or institution you choose (the trustee) then manages those assets. The crucial part is this: once those assets are in the trust, they are no longer legally yours.

This clean legal separation is everything. Because the assets are out of your name, they don’t count towards Medicaid’s notoriously low asset limits. This is the single most effective way to protect your assets from a nursing home, allowing you to get the care you need without a forced, and often devastating, spend-down.

How a MAPT Works in the Real World

Let’s walk through a common scenario. Think of a couple, Robert and Susan, both in their late 60s. They own a home valued at $950,000 and hold a $1.2 million investment portfolio. Worried about what long-term care costs could do to their estate, they consult an elder law attorney and establish a MAPT.

First, they re-title their home and their investment accounts into the name of the trust. Legally speaking, the MAPT now owns these assets, not Robert and Susan.

Next, they appoint their financially responsible daughter, Olivia, as the trustee. It’s now Olivia’s job to manage the trust’s assets based on the rules laid out in the trust document.

They also included a key provision: the right for both of them to continue living in their home for the rest of their lives, even though the trust is the legal owner. The trust can even be structured to pay for property taxes, insurance, and maintenance from the funds it holds.

As long as they established and funded this trust at least five years before either of them needs to apply for Medicaid, that $2.15 million is completely protected. A nursing home can’t touch it, and Medicaid can’t count it. The five-year look-back clock started ticking the moment they made the transfer.

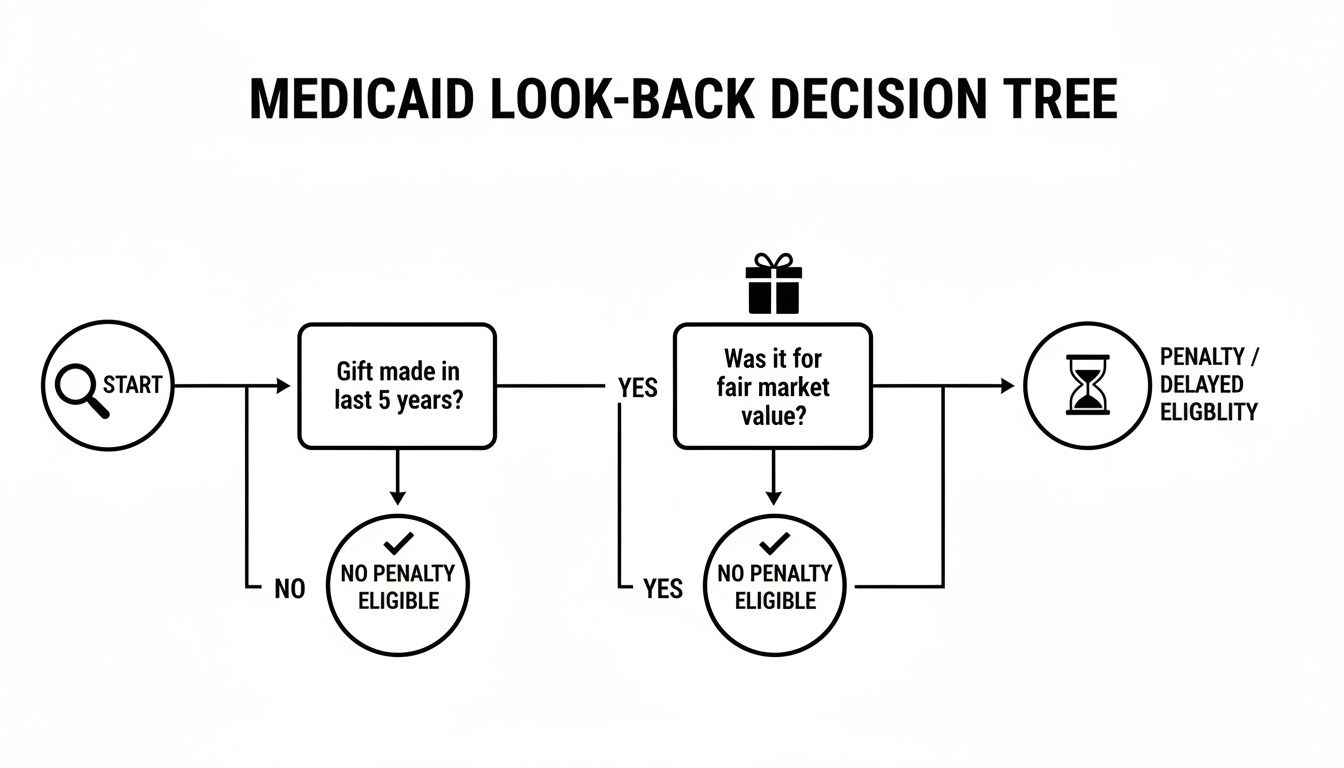

The flowchart below shows just how critical that timing is.

As you can see, successfully navigating this look-back period is often the deciding factor between preserving your family’s assets and having to liquidate them for your care.

The Critical Difference: Revocable vs. Irrevocable Trusts

This is where many people make a costly mistake. It’s a point of massive confusion that can have catastrophic financial consequences. You might already have a standard revocable living trust as part of your estate plan. While these are fantastic tools for avoiding probate, they offer zero protection from nursing home expenses.

Why not? The reason is right in the name: “revocable.” You can alter or even dissolve a revocable trust at any time. You maintain total control. Since you can pull assets out whenever you want, Medicaid considers them 100% available to you and fully countable.

A simple way to think about it: A revocable trust is like moving money to a different pocket—it’s still your money. An irrevocable trust is like giving it to a trusted friend to hold for your kids under a strict set of rules—it’s no longer in your direct control.

To help clarify this distinction, here’s a direct comparison of how a standard revocable trust stacks up against an irrevocable MAPT for asset protection.

Revocable Trust vs. Irrevocable MAPT Comparison

| Feature | Revocable Living Trust | Irrevocable MAPT |

|---|---|---|

| Asset Control | Grantor retains full control. | Grantor gives up direct control to the trustee. |

| Ability to Modify | Can be changed or revoked at any time by the grantor. | Cannot be easily changed or revoked by the grantor. |

| Nursing Home Protection | None. Assets are fully countable by Medicaid. | Full protection after the 5-year look-back period. |

| Probate Avoidance | Yes, a primary benefit. | Yes, assets in the trust avoid probate. |

| Grantor as Trustee | Yes, the grantor is typically the trustee. | No, the grantor cannot be the trustee. |

| Income Rights | Grantor controls and receives all income. | Grantor can be entitled to receive income generated by trust assets. |

Only an irrevocable trust, where you fully relinquish direct control, creates the necessary legal distance to shield your assets from long-term care costs.

Understanding the Trade-Off: You Give Up Direct Control

The immense protective power of a MAPT comes with a non-negotiable trade-off: loss of direct control. As the grantor, you cannot serve as your own trustee. You can’t just decide to sell a trust-owned property on a whim or withdraw cash for a vacation. The trustee you appoint is legally bound to manage the assets for the benefit of your designated beneficiaries (usually your children).

This is a serious hurdle for many, especially if you’re used to actively managing your own wealth. However, “irrevocable” doesn’t mean you give up all influence. You can still build in important rights for yourself, such as:

- The right to live in any real estate owned by the trust.

- The right to receive the income the trust generates (e.g., dividends, interest, rent).

- The power to change the trustee if you are dissatisfied with their performance.

- The power to change who the ultimate beneficiaries will be.

For most families facing this dilemma, the trade-off is well worth it. By giving up direct control over the principal, you ensure your core assets are preserved for the next generation, safe from being wiped out by long-term care bills. It’s a purely strategic move to secure your legacy.

Going Beyond the Basics: More Sophisticated Asset Protection Tools

While an irrevocable trust is the cornerstone of any solid asset protection plan, it’s not the only tool in the shed. Certain situations, especially for married couples or when a crisis hits and you need a last-minute plan, require more specialized legal instruments. Getting familiar with these options will help you have a much more productive conversation with your attorney about what truly fits your family’s unique financial landscape.

One of the most powerful strategies in “crisis planning”—that’s what we call it when a nursing home stay is right around the corner and the five-year clock has run out—is the Medicaid-Compliant Annuity (MCA). This is not your typical investment annuity meant to grow your retirement nest egg. An MCA is a very specific financial product designed to do one thing: convert a large, countable asset into a non-countable, fixed income stream for the healthy spouse still living at home (the “community spouse”).

How a Medicaid Compliant Annuity Actually Works

Let’s walk through a real-world scenario. Imagine a husband suddenly needs to enter a nursing home. He and his wife have $300,000 in savings, far more than Medicaid allows. Without a plan, they’d have to burn through about half of that money paying for his care out-of-pocket before he could qualify for any assistance. It’s a devastating financial blow.

Instead, their elder law attorney steps in and helps them purchase a Medicaid-Compliant Annuity with $150,000 of that savings. Here’s what makes it work:

- The annuity must be irrevocable and non-assignable, which means it can’t be cashed out or sold.

- It must name the state Medicaid agency as the beneficiary, but only up to the amount of benefits Medicaid pays for the institutionalized spouse.

- The payout term must be shorter than the owner’s life expectancy, based on standard actuarial tables.

In an instant, that $150,000 is no longer a countable asset. It has been transformed into a monthly income payment for the wife. This allows the husband to qualify for Medicaid almost immediately, preserving a huge chunk of their life savings for his wife to live on.

An MCA is a powerful legal maneuver that essentially makes a “countable” asset disappear from Medicaid’s balance sheet by turning it into an income stream. This is crisis planning at its best, used when you simply don’t have five years to wait.

This strategy is especially crucial for married couples. While the rules offer some protection for the community spouse, it’s often not enough. In 2024, the community spouse can typically keep a portion of the couple’s assets—often capped around $157,920 in many states—but even that can evaporate quickly when you’re facing nursing home bills that run well into six figures annually. You can discover more insights about spousal protection rules on CommonsLLC.com to see just how critical this kind of proactive planning can be.

Using a Life Estate to Protect Your Home

Another specialized tool I often discuss with clients is the Life Estate, which is a way to protect a primary residence or a beloved family vacation home without using a trust. It’s done with a special deed. You transfer ownership of the property to your children (who are called the “remaindermen”) but legally keep the right to live in and use the property for the rest of your life (as the “life tenant”).

Once that deed is signed and the five-year look-back period passes, the value of the home is shielded from Medicaid. You still get to live there and call it your own, but you’ve given up the right to sell or mortgage the property without getting permission from all your children.

Life Estates can work, but I always caution clients about the significant downsides.

- You lose control. You can’t just decide to sell the house and downsize if your kids don’t agree. And if one of your children runs into financial trouble, gets divorced, or is sued, their share of your home could be vulnerable to their creditors.

- Serious tax implications. When your children eventually sell the property after you pass away, they could be hit with a massive capital gains tax bill that could have been completely avoided if the home were in a properly structured trust.

- They’re inflexible. Life is messy. What if one of your children passes away before you? Their share of the property automatically goes to their heirs, not back to you or to their siblings, which can create a tangled mess of ownership.

A Life Estate can be a simple, effective tool for a specific purpose, but it’s a bit of a blunt instrument. It lacks the flexibility, control, and comprehensive protection you get with a well-drafted Medicaid Asset Protection Trust. It works best in very straightforward, stable family situations where the only goal is to make sure the house passes to the next generation.

Pairing Legal Strategies with Funding Solutions

Putting assets into a trust is a powerful legal move, but it’s rarely the complete picture. The most robust plans I’ve seen over the years weave these legal structures together with smart financial solutions. Think of it as creating multiple layers of defense—a safety net that gives you flexibility and ready cash when you need it most.

A common first thought for many is Long-Term Care Insurance (LTCI). In a perfect world, a good LTCI policy is fantastic. It provides a dedicated pot of money to pay for a nursing home or home health aide, allowing you to keep your other assets untouched and giving you far more say in your care.

But let’s be realistic. The premiums for these policies can be sky-high, particularly if you’re buying one later in life. On top of that, the underwriting can be brutal. If you have pre-existing health issues, you might find you don’t even qualify.

Exploring VA Aid and Attendance Benefits

For those who served our country, there’s a valuable resource that too often flies under the radar: the Department of Veterans Affairs. Specifically, the Aid & Attendance benefit can be a game-changer. It’s a monthly pension supplement for wartime veterans and their surviving spouses who meet specific medical and financial thresholds.

This benefit is designed to help shoulder the costs of long-term care, whether that’s at home, in assisted living, or in a full-time nursing facility. While the monthly payments probably won’t cover the entire bill, they can provide a significant, steady income stream to ease the financial burden.

Just know that qualifying for VA benefits comes with its own set of rules on income, assets, and look-back periods that are completely separate from Medicaid’s. You’ll want to work with an attorney who is well-versed in both elder law and VA benefits to see if this is a viable piece of your puzzle.

A common misconception is that you have to choose between legal strategies like trusts and financial products like insurance. The reality is they work best together. Insurance provides the cash flow, while the trust protects the underlying principal assets from being counted by Medicaid.

This two-pronged approach ensures you have immediate funds for care without being forced to sell off the very assets you worked so hard to preserve for your family. It perfectly bridges the gap between the day care begins and the day Medicaid eligibility is finally established.

A Critical Warning on Strategic Gifting

Many people have heard of the annual federal gift tax exclusion. It’s the rule that allows you to give up to $18,000 per person in 2024 to as many people as you want without having to file a gift tax return. Over time, it can be a great tool for chipping away at a large, taxable estate.

Here’s where a dangerous—and costly—misunderstanding comes in.

It is absolutely crucial to understand that IRS gift tax rules have nothing to do with Medicaid eligibility rules. That $18,000 you legally gifted your son for tax purposes? From Medicaid’s perspective, it’s a disqualifying transfer of assets, fully subject to the five-year look-back period.

Let’s break down the two different mindsets:

- The IRS: The government is concerned with collecting tax on massive transfers of wealth. Small annual gifts don’t move the needle for them.

- Medicaid: This is a needs-based program. The government sees any gift, no matter the size, as an attempt to artificially impoverish yourself to qualify for benefits you wouldn’t otherwise get.

This is why relying on the annual gift tax exclusion as a way to spend down your assets for Medicaid is a recipe for disaster. Every single dollar you give away inside that 60-month window will be tallied up and used to calculate a penalty period—a stretch of time when you are completely ineligible for benefits, yet still have to pay for care.

A properly structured irrevocable trust remains the far superior and safer strategy for getting assets out of your name.

Why a Certified Elder Law Attorney Is Non-Negotiable

When you’re trying to navigate the maze of Medicaid rules and asset protection, this is absolutely not the time for a do-it-yourself approach. Even a fantastic general estate planner who handles wills and basic trusts all day might not have the niche expertise required for this specific challenge.

This is the world of a Certified Elder Law Attorney (CELA), and the difference is night and day.

CELAs live and breathe the ever-shifting, state-specific Medicaid regulations. It’s one thing to know the law; it’s another thing entirely to know how the local Medicaid office in your county actually interprets and applies those rules on a daily basis. That kind of on-the-ground knowledge is precisely what’s needed when you’re dealing with a high-net-worth estate.

Think of hiring a CELA not as an expense, but as a critical investment in protecting everything you’ve worked for. A true specialist makes sure your asset protection strategy is built correctly from day one, preventing devastating mistakes that could wipe out a lifetime of savings.

Finding the Right Legal Partner

When you’re meeting with potential attorneys, you need to go beyond their basic credentials. The goal is to drill down and see if they have the specific, battle-tested experience your situation demands.

Here are the kinds of questions that will tell you what you need to know:

- How many Medicaid Asset Protection Trusts have you actually drafted and seen through the entire five-year look-back period?

- What’s your experience with “crisis planning” for a family that needs care right now?

- What are your thoughts on planning well in advance versus waiting until a health issue forces the decision?

- How do you keep up with our state’s constant changes to Medicaid rules and the penalty calculations?

A general estate attorney might draft a trust that looks perfectly fine, but it could easily fall apart under the microscope of a Medicaid application. A CELA, however, is building a legal fortress specifically designed to withstand that very scrutiny, ensuring your legacy is protected and giving you true peace of mind.

The distinction couldn’t be more important. A poorly structured plan can literally cost you your entire estate. Bringing a CELA onto your team means you have an expert who is completely immersed in this area of law, providing the sophisticated guidance you need to get this right.

Answering Your Asset Protection Questions

When you start digging into asset protection, a lot of questions pop up. It’s a complex area, and it’s easy to get turned around. Let’s tackle some of the most common concerns I hear from families.

Can I Just Give My House to My Kids?

It’s a thought that crosses almost every parent’s mind, but just deeding your house to your children is usually a bad move. While it seems simple, this transfer is considered a gift, which puts it squarely in the sights of Medicaid’s five-year look-back period. If you need care within those five years, you’ll face a harsh penalty.

But the problems don’t stop there. This seemingly simple gift can create huge headaches for your children, too:

- You lose all control. Once the deed is in their name, it’s their house. A divorce, a lawsuit, or a simple decision to sell could leave you scrambling to find a new place to live.

- A big tax bill is waiting. Your kids will inherit your original cost basis in the home, meaning they could owe a massive amount in capital gains taxes when they sell. This is a tax nightmare that a well-structured trust can easily sidestep.

Bottom line: an irrevocable trust is nearly always the smarter, safer, and more tax-savvy way to protect your home.

Is It Too Late to Plan If a Crisis Hits?

Absolutely not. It’s a common myth that if you haven’t planned five years in advance, all is lost. While pre-planning opens up more options, you can still take powerful steps even when a loved one needs immediate care. This is where an expert in “crisis planning” becomes invaluable.

A skilled elder law attorney can use specific legal tools, like a Medicaid-Compliant Annuity, to immediately convert assets into an income stream for the spouse who is still at home. This strategy can help the spouse needing care qualify for Medicaid right away, protecting a significant portion of a couple’s nest egg from being wiped out.

Will My Will Protect My Assets from a Nursing Home?

This is a critical point that many people miss: a will does absolutely nothing for you while you’re alive. A will is a document that only kicks in after you die to direct where your assets go.

It has zero power to shield your money from nursing home bills or Medicaid’s spend-down rules during your lifetime. As long as you’re living, the assets are in your name and are fully on the table.

Finding the right legal expert is the most important step in creating a successful asset protection plan. The Haute Lawyer Network connects you with a curated selection of the nation’s top attorneys, vetted for their professional excellence. Elevate your search and ensure your family’s legacy is in the hands of a true specialist. Discover your ideal legal partner at https://hauteliving.com/lawyernetwork.