When people ask how much a divorce costs, they’re looking for a number. The reality is, there isn’t just one. The national average divorce cost sits somewhere between $11,300 to $20,000, but that’s just a starting point. An amicable, straightforward split might wrap up for a few thousand dollars. A high-conflict, contested battle, however, can easily skyrocket past $50,000.

The single biggest factor dictating your final bill? The level of conflict between you and your spouse.

The True Cost Of Divorce Explained

Think of your divorce like a home renovation project. A fresh coat of paint is a relatively small, predictable expense. But if you start knocking down walls, rerouting plumbing, and bringing in architects, the budget and timeline expand dramatically. Your divorce works the same way—the final cost is directly tied to the amount of professional time and intervention required to resolve every issue.

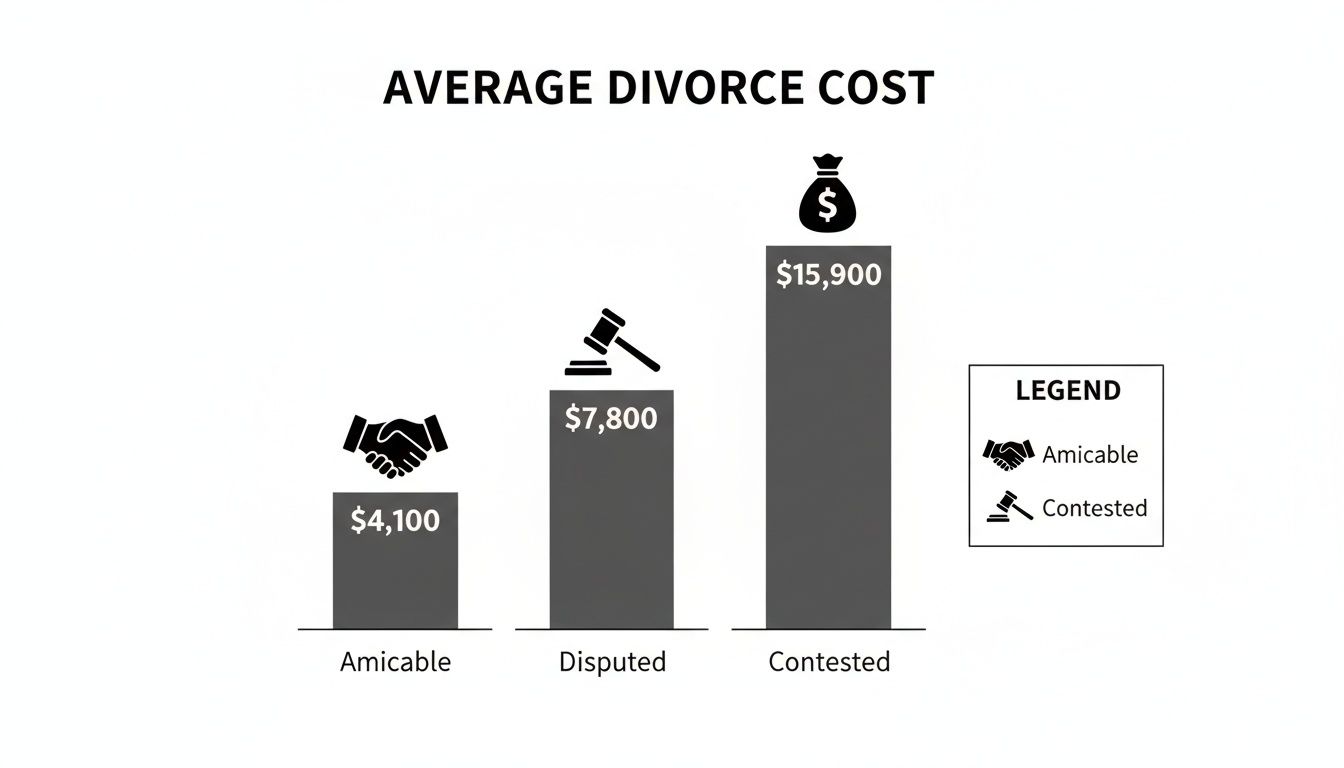

The more you can agree on outside of a courtroom, the less you’ll spend. The chart below shows just how quickly costs escalate as disagreements mount.

As you can see, the jump from a simple agreed-upon divorce to a fully contested one isn’t small. The cost nearly quadruples.

Breaking Down The Averages

To get a bit more granular, the numbers tell a clear story about how specific disputes drive up expenses. Let’s look at the data in a more structured way.

The table below summarizes the typical costs based on how much disagreement exists between the parties.

| Average Divorce Costs By Conflict Level |

|---|

| Divorce Scenario |

| No-Contest Divorce (Full Agreement) |

| Disputed Issues (Excluding Alimony) |

| Disputed Issues (Including Alimony) |

These figures, based on detailed findings about divorce cost breakdowns, highlight how each contested issue adds another layer of professional work—and another set of fees—to the process.

The core takeaway is simple: Conflict is expensive. Every argument that requires an attorney to negotiate, file a motion, or hire an expert adds directly to your final invoice.

Understanding these baseline figures gives you a realistic financial framework. It empowers you to make smarter decisions as we dig into the specific factors—like attorney billing models and asset complexity—that drive these numbers. The goal is to separate your lives, not to drain your shared resources getting there.

What Really Drives Up The Cost Of Divorce

While national averages offer a starting point, they rarely tell the whole story. The final number on your legal invoice is a direct result of specific choices and circumstances you and your spouse make along the way.

Understanding these key cost drivers is the first step toward controlling your budget and achieving a fair outcome without draining your financial future.

Think of it like hiring a contractor. You can agree to a fixed price for a defined job, or you can pay by the hour for ongoing work. Legal services are structured in a surprisingly similar way, and the model you choose has a massive impact on your total expense.

How Your Attorney Bills You

Your attorney’s fee structure is the engine of your divorce costs. Most family lawyers use one of a few common billing models, and the way you are billed can influence your final cost as much as the issues themselves.

Here’s how the most common models break down:

- Hourly Rate: This is the most common model, especially in contested cases. You pay for every minute your lawyer works—from drafting emails to appearing in court. Rates can vary dramatically, from $250 to over $600 per hour, depending on the attorney’s experience and location.

- Retainer Fee: A retainer is an upfront payment your lawyer holds in a trust account. They bill their hourly rate against this amount. Once that initial retainer is used up, you will need to replenish it.

- Flat Fee: Often used for simple, uncontested divorces, a flat fee covers the entire process for a single, agreed-upon price. This gives you cost certainty but is only suitable for cases with no major disagreements.

With an hourly model, every phone call, email, and negotiation adds to your bill. It’s crucial to understand how to communicate efficiently with your legal team. For a deeper look into this, you can learn more about how to choose a divorce lawyer who aligns with both your financial and personal goals.

The True Cost Of Conflict

By far, the single largest driver of divorce costs is conflict. Every disagreement that can’t be resolved amicably requires professional intervention, which translates directly into billable hours. A heated dispute over a single piece of furniture can easily cost thousands of dollars in legal fees.

Imagine two paths. On one, you and your spouse sit down with a neutral mediator to divide your assets. This process might take a few sessions and cost a few thousand dollars.

On the other path, you both hire separate attorneys to fight over those same assets in court. This triggers a cascade of expensive actions:

- Filing motions with the court

- Engaging in a lengthy “discovery” process to exchange financial documents

- Hiring expert witnesses

- Making multiple court appearances

This litigation path can drag on for months or even years, with legal fees easily soaring into the tens of thousands.

The most expensive decision in a divorce is often choosing confrontation over cooperation. The more you fight, the more you pay—not just in money, but also in time and emotional energy.

Complicating Factors That Add Up

Beyond general conflict, certain specific issues inherently increase the complexity—and therefore the cost—of a divorce. These situations require specialized knowledge and often involve bringing in outside experts, each with their own fees.

- Custody Disputes: When parents can’t agree on a custody arrangement, the court may require a custody evaluation. A child psychologist or social worker is appointed to interview the family and make a recommendation, a process that can add $5,000 to $15,000 or more to your total.

- Complex Financial Portfolios: Dividing a simple bank account is straightforward. Dividing businesses, investment properties, stock options, and intricate retirement accounts is not. This often requires hiring a forensic accountant to trace assets or a business valuator to determine a company’s worth.

- Hidden or High-Value Assets: If one spouse suspects the other is hiding assets, the legal team must launch a detailed investigation. This can involve issuing subpoenas and analyzing years of financial records, which significantly increases legal fees.

Ultimately, the cost of a divorce is less about national averages and more about the specific decisions you make. By understanding that conflict, complexity, and communication are the primary cost drivers, you can begin to make strategic choices that protect both your interests and your wallet.

Hidden Costs That Emerge After The Divorce

When the last legal invoice is finally paid, most people feel an overwhelming sense of relief, thinking the financial bleeding has stopped. But the truth is, the full financial impact of a divorce rarely ends with the final decree. A whole new wave of “hidden” costs often surfaces after the ink on the settlement is dry, catching many people by surprise and putting serious strain on their new single-income budgets.

These aren’t just minor annoyances; they are significant financial hurdles that come from the messy but necessary work of untangling two deeply intertwined lives. If you truly want to know how much a divorce costs in the long run, you have to look past the lawyer’s bills. Ignoring these post-divorce expenses can quickly turn a thoughtfully negotiated settlement into a financial nightmare.

The Financial Realities Of Untangling Assets

Dividing major assets like the family home or retirement accounts is never as clean as just drawing a line down the middle. Every major transaction triggers its own set of fees and tax implications that can seriously chip away at the net value you thought you were getting. These aren’t optional—they are required steps to execute the division of assets your divorce decree legally mandates.

Think of your settlement as the blueprint for your new financial life. These hidden costs are the lumber, nails, and labor required to actually build it.

- Mortgage Refinancing Fees: When one spouse keeps the family home, they almost always have to refinance the mortgage to get the other spouse’s name off the loan. That process comes with closing costs, which typically run between 2% and 5% of the loan amount. On a $300,000 mortgage, that’s an immediate post-divorce hit of $6,000 to $15,000.

- Capital Gains Tax on a Home Sale: If you and your ex decide to sell the house, a hefty tax bill could be waiting. The IRS gives individuals a $250,000 capital gains exclusion ($500,000 for a married couple), but the timing of the sale is everything. If you wait and sell years after the divorce is final, you may only qualify for the individual exclusion, leaving thousands of dollars in profit exposed to taxes.

These expenses reveal a crucial truth: The value of an asset on paper is not the same as the cash you will have in hand after it’s divided. Factoring in these transactional costs is vital for a realistic financial plan.

The Cost Of Dividing Retirement Funds

For many couples, retirement accounts like a 401(k) or pension represent one of their most significant assets. Splitting them requires a special court order known as a Qualified Domestic Relations Order (QDRO), a process that is neither simple nor free.

A QDRO is a complex legal document that directs the plan administrator on how to divide the retirement account without triggering massive early withdrawal penalties and taxes. Drafting one correctly is a specialized skill. An attorney will typically charge a flat fee, often from $750 to $1,500 or more, just for preparing the QDRO itself.

On top of that, the financial institution that manages the retirement plan will often charge its own administrative fees to execute the split. These costs add up, making the simple act of accessing your share of the retirement funds more expensive than most people budget for. To get the full picture, it pays to understand the specifics of how to split a 401(k) in a divorce, because a misstep can have severe tax consequences.

Fees For Essential Third-Party Experts

During your divorce, you likely relied on experts to value property and assets. Well, after the divorce, you’ll probably need to hire them—or others like them—all over again to actually execute the division of those assets. These aren’t legal fees, but they are absolutely necessary costs to comply with your settlement agreement.

Here are a few common examples:

- Real Estate Appraisers: To figure out a fair buyout price or set a listing price for the marital home, you need a professional appraisal. This usually costs between $400 and $700.

- Financial Planners: Building a brand new financial plan from scratch is one of the most critical steps to take post-divorce. A good planner can help you create a realistic budget, set new investment goals, and make sure your settlement is actually working for you. Consultation fees vary widely.

- Accountants: Your tax situation gets a lot more complicated after a divorce. An accountant can be invaluable for navigating new filing statuses, understanding alimony tax rules, and figuring out who gets to claim the kids as dependents.

Each of these professional services represents a real, out-of-pocket expense. By anticipating these costs, you can move beyond just knowing what a divorce costs in legal fees and start to truly understand the price of launching your new financial life.

High Profile Divorces And What They Teach Us

While most people grapple with the costs of dividing a family home and a 401(k), the divorces of the ultra-wealthy exist on an entirely different financial planet. These cases, involving titans of industry and media moguls, offer a fascinating—and instructive—look into what happens when the financial stakes become astronomical.

The settlements are often difficult to comprehend. Harold and Sue Ann Hamm’s 2014 split, for example, involved a staggering $5.3 billion settlement. Rupert Murdoch’s payout to his former wife Anna in 1999 was $1.7 billion, and Bernie Ecclestone’s 2009 settlement reached $1.2 billion.

These figures stand in stark contrast to the national average divorce cost of around $11,300, a number highlighted in recent divorce statistics and facts. The gap isn’t just large; it’s a chasm.

What Makes These Cases So Expensive

So why the massive price tag? The astronomical figures in high-net-worth divorces aren’t arbitrary. They’re the direct result of the monumental task of disentangling profoundly complex financial empires built over decades. This isn’t about who gets the house; it’s an intricate battle over global assets.

Key drivers include:

- Business Valuations: Determining the true value of a privately held, multinational corporation is a monumental task. It requires teams of forensic accountants and business valuators who can spend years analyzing financial records.

- Complex Trusts and Holdings: Wealth is rarely sitting in a simple bank account. It’s often spread across a web of international trusts, shell corporations, and investment vehicles that require specialized expertise to trace.

- Lifestyle and Alimony Calculations: When a couple’s lifestyle includes private jets, multiple estates, and massive annual spending, calculating appropriate spousal support becomes a highly contentious and expensive process in itself.

These cases underscore a critical principle: The cost of a divorce scales with the complexity of the assets being divided. Protecting generational wealth requires an investment in elite-level legal and financial strategy.

Ultimately, these high-profile divorces are more than just tabloid fodder. They are extreme examples that teach a valuable lesson for anyone facing a complex separation. They highlight why investing in top-tier expertise—from seasoned attorneys to forensic accountants—is not a luxury but an absolute necessity when significant assets are on the table.

Smart Strategies To Control Your Divorce Costs

Knowing what drives up the cost of divorce is one thing. Actually doing something about it is another entirely. The good news is that you have far more control over the final legal bill than you might think. By making smart, strategic decisions right from the start, you can protect your financial future without having to accept an unfair outcome.

This isn’t about cutting corners or settling for less than you deserve. It’s about working smarter, minimizing conflict wherever possible, and focusing your resources on the issues that truly matter. Think of it like planning a cross-country road trip—the destination is the same, but the path you choose will dramatically change how much time, money, and stress you spend getting there.

Choose Your Path Wisely: Alternative Dispute Resolution

The single biggest move you can make to control costs is to stay out of a courtroom. Alternative Dispute Resolution (ADR) methods like mediation and collaborative divorce were specifically designed to resolve disputes privately, efficiently, and with a lot less animosity than traditional litigation. These approaches are built on cooperation, not confrontation, which directly translates to fewer billable hours for your attorney.

Instead of two opposing lawyers battling it out in a public courtroom, ADR places you and your spouse in a structured, problem-solving environment. It keeps you in the driver’s seat, rather than handing over critical decisions about your life to a judge who doesn’t know you. You can read a more detailed comparison of the differences between divorce mediation vs litigation to get a better feel for which approach aligns with your goals.

To put the financial impact in perspective, here’s a high-level look at the most common options.

Comparing Divorce Methods Cost And Control

The table below breaks down the typical costs and control you can expect from each divorce process. The financial incentive to avoid a lengthy court battle is immediately clear.

| Method | Typical Cost Range | Key Advantage | Best For |

|---|---|---|---|

| Litigation | $15,000 – $50,000+ | Court-enforced decisions. | High-conflict cases, situations involving abuse, or when one party is completely unreasonable. |

| Mediation | $3,000 – $8,000 | Cost-effective and confidential. | Couples who can communicate civilly and are willing to compromise to reach an agreement. |

| Collaborative Divorce | $10,000 – $25,000 | Team-based support with legal, financial, and emotional experts. | Couples who need more structure than mediation but are committed to avoiding court. |

As you can see, choosing mediation or a collaborative process isn’t just a small savings—it can literally leave tens of thousands of dollars in your pocket.

Work Efficiently With Your Attorney

Even if litigation is unavoidable, the way you work with your attorney can drastically impact your final invoice. When you’re being billed by the hour, time is literally money. Every email, every phone call, and every meeting adds up.

Your lawyer is your strategic advisor, not your therapist. Using your paid time for emotional venting is one of the quickest ways to inflate your legal fees.

To keep your costs down and ensure your attorney is focused on high-value work, adopt these practices:

- Be Prepared and Organized: Before any call or meeting, gather all your financial documents. Write down your questions and goals ahead of time. This prevents your attorney from spending billable hours sorting through a messy pile of papers or trying to decipher your objectives on the fly.

- Bundle Your Communications: Instead of firing off five separate emails as questions pop into your head, consolidate them. Keep a running list and send one organized message at the end of the day. This is far more efficient for your lawyer to review and respond to.

- Focus on the Goal: While the emotional toll of divorce is very real, your attorney’s job is to provide legal guidance. Keep your conversations centered on strategy and resolution.

Treating your attorney’s time as the valuable resource it is empowers them to focus on the legal work that will actually move your case forward and, ultimately, lower your final bill.

Answering Your Top Questions About Divorce Costs

Once you start looking past the national averages and digging into the details, a flood of specific, practical questions always comes up. It’s one thing to understand the cost drivers in theory, but another to know how they apply to your actual situation.

Here, we’ll address some of the most common—and critical—questions that people ask when trying to get a real handle on what their divorce will cost.

Think of this as a final checkpoint. It’s about getting direct answers to clear up any lingering uncertainty so you can move forward with confidence.

Can I Make My Spouse Pay My Attorney Fees?

In some circumstances, yes. Courts can order one spouse to pay for or contribute to the other’s legal fees. This isn’t a given, though. It’s typically granted when there’s a major gap in income or if one party’s bad-faith actions unnecessarily drove up costs for everyone.

The entire point is to level the playing field, ensuring both spouses have access to proper legal counsel, especially when one person controls the majority of the financial resources. To make it happen, your attorney has to file a formal motion with the court, and the final decision is up to the judge.

Is A DIY Or Online Divorce A Good Way To Save Money?

Going the DIY route can absolutely save you money on legal fees, but it’s a strategy only suitable for the simplest, 100% uncontested divorces. We’re talking no kids, no real estate, and no significant assets to divide.

For almost everyone else, the risk of a costly mistake completely overshadows the initial savings.

A seemingly minor error in a DIY agreement—like an improperly worded clause for dividing a 401(k)—can trigger huge tax penalties down the road or cause you to unknowingly forfeit your rights to an asset you were legally entitled to. At a minimum, have an experienced attorney review any agreement before you sign it.

How Do I Find The Right Attorney For A High-Net-Worth Divorce?

When significant wealth is on the table, you need more than just a standard family lawyer—you need a financial strategist who specializes in complex marital estates. Look for attorneys who focus their practice on high-net-worth divorce and have a proven network of forensic accountants, business valuators, and wealth managers.

Vetted legal directories that cater to affluent clients are a great place to start. You should also ask for referrals from your CPA or financial advisor. The key is to interview several candidates. You aren’t just hiring a lawyer; you’re bringing on a strategic partner to protect a substantial and complex portfolio of assets.

Securing the right legal representation is the single most important decision you’ll make, particularly when sophisticated finances are at stake. The Haute Lawyer Network is a curated directory of premier attorneys, each selected for their professional excellence and deep experience with high-net-worth clientele. To connect with a top-tier legal professional who can protect your interests, explore the network at Haute Lawyer.