Before you ever think about leasing an office or registering a business name, the real work of starting a law firm happens on paper. It all boils down to three core elements: defining your vision, hammering out a solid business plan, and taking an honest look at your finances and entrepreneurial grit. This initial blueprint is the foundation for every decision you’ll make, from the clients you target to the services you offer.

Crafting Your Firm’s Blueprint for Success

A well-thought-out business plan is far more than just a document you show to a bank. Think of it as the architectural design for your entire practice. It’s the process that forces you to move beyond the vague dream of “being your own boss” and into a concrete strategy for building a profitable, sustainable law firm.

This is where you get brutally honest with yourself. What are your strengths? What’s your real financial runway? What kind of law do you genuinely want to practice for the next decade? Answering these questions now saves you from costly mistakes later.

Defining Your Niche and Ideal Client

Let’s be blunt: the legal market is saturated. You can’t just hang a shingle and expect clients to show up. To succeed, you have to be specific. The key question is: who are you uniquely positioned to serve better than anyone else?

This means creating an “ideal client avatar”—not just a demographic profile, but a detailed picture of a real person.

- What are their biggest legal headaches? Are they navigating a messy custody battle, or are they a startup founder trying to secure Series A funding?

- Where do they hang out online and offline? Are they on LinkedIn, reading local business journals, or active in specific industry forums?

- What do they expect from a lawyer? Do they want transparent flat-fee pricing and 24/7 access through a client portal, or do they prefer face-to-face meetings?

When you can answer these questions, your niche becomes obvious. You stop being a generic “business lawyer” and become the go-to attorney for tech startups in Austin. You transition from “family law” to specializing in high-asset divorces for entrepreneurs. This sharp focus makes your marketing laser-targeted and your expertise far more valuable.

The Honest Self-Assessment

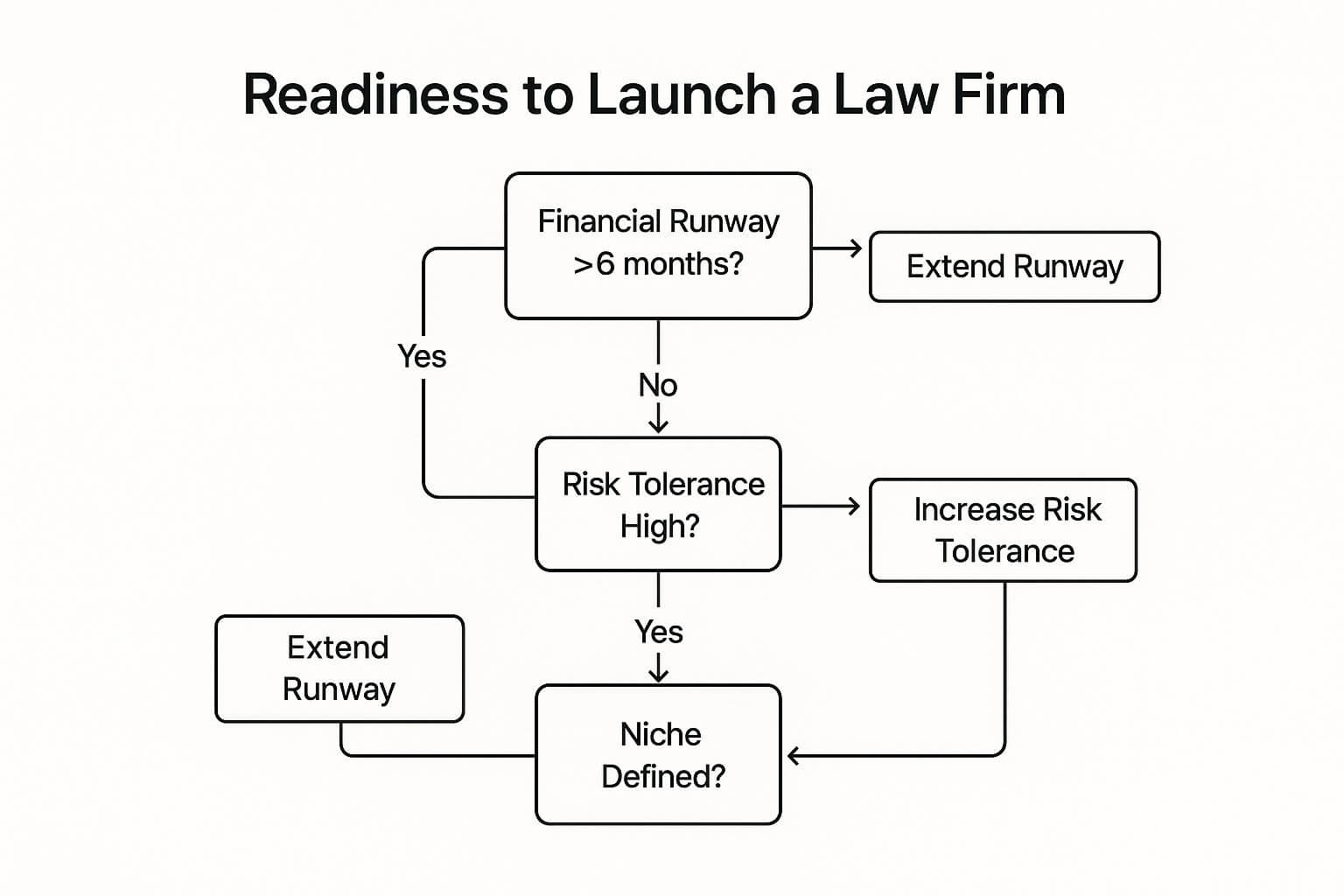

Going solo isn’t for everyone. It demands a particular mindset and a realistic grasp of your personal resources. Before you take the leap, you have to assess your readiness in three crucial areas: your financial runway, your tolerance for risk, and your genuine entrepreneurial drive. This isn’t just a single decision but a series of checkpoints.

As the decision tree shows, financial stability and a clearly defined market are non-negotiable. Without them, even the best legal mind will struggle to build a viable practice.

To help you get started, here’s a quick checklist of the foundational tasks you need to tackle before you open your doors.

Initial Law Firm Startup Checklist

| Task Area | Key Action Items | Why It’s Critical |

|---|---|---|

| Vision & Niche | Define ideal client avatar, select 1-2 core practice areas, draft mission statement. | A clear focus prevents you from being a generalist and makes marketing 10x more effective. |

| Financial Planning | Calculate 12-month personal & business runway, create a detailed startup budget. | Running out of cash is the #1 reason new firms fail. Know your numbers cold. |

| Business Structure | Choose your legal entity (LLC, PC, etc.), research state bar rules for firm names. | This impacts liability, taxes, and compliance from day one. |

| Compliance | Secure malpractice insurance, open IOLTA & operating bank accounts, register your business. | These are non-negotiable legal and ethical requirements to practice law independently. |

This table covers the bare essentials. Once these are in place, you can move on to the more detailed planning stages.

Assembling Your Law Firm Business Plan

Your business plan is where your vision, client focus, and self-assessment all come together into an actionable strategy. Treat it as a living document that you revisit and tweak as your firm grows.

A business plan isn’t just for getting a loan—it’s your firm’s operational playbook. It’s the document you’ll turn to when the daily chaos of running a practice makes you lose sight of your long-term goals.

Your plan needs to detail your firm’s mission, the specific services you’ll provide, and your fee structure. A critical piece of this is a thorough market analysis. You have to know your competition. In 2023, there were roughly 450,000 law firms in the U.S. alone, and the vast majority were solo or small practices. This analysis of lawyer statistics highlights the intense competition, but it also shows a fragmented market where a focused niche firm can absolutely dominate.

Finally, the heart of your plan is the financial projections. You need a detailed startup budget covering everything from malpractice insurance to practice management software. More importantly, you need a 12-month and three-year forecast for revenue, expenses, and profit. This financial discipline is what separates a law practice that’s a business from one that’s just a hobby.

Navigating Legal and Financial Requirements

With a solid business plan in hand, it’s time to tackle the administrative foundation that turns your vision into a legitimate legal entity. This is where you cut through the red tape—choosing a legal structure, setting up your banking, and securing the right insurance.

Getting these details right from the start prevents massive headaches later. It’s about more than just paperwork; it’s about complying with state bar rules, shielding your personal assets, and establishing financial clarity from day one.

Choosing Your Business Entity

Your first big decision is how to structure the firm legally. This choice has direct consequences for your personal liability, tax obligations, and administrative workload. For most solo and small firms, it boils down to three main options.

- Sole Proprietorship: The simplest path forward. There’s no legal distinction between you and your business. While it’s easy to set up, it offers zero liability protection. If the firm gets sued, your personal assets are on the line.

- Professional Limited Liability Company (PLLC): A very popular choice for lawyers, and for good reason. A PLLC creates that critical liability shield, protecting your personal assets from business debts and lawsuits (though not from your own malpractice).

- S-Corporation (S-Corp): This isn’t a business entity itself but a tax classification. You can form a PLLC and then elect to have it taxed as an S-Corp. This move can lead to significant tax savings by letting you pay yourself a “reasonable salary” and take the rest of the profits as distributions, which aren’t subject to self-employment taxes.

Choosing your entity is one of the most consequential decisions you’ll make when you start a law firm. A PLLC electing S-Corp status often provides the best balance of liability protection and tax efficiency for a new solo practice.

Imagine a new family law attorney in Texas. She might form a PLLC to protect her personal savings from business creditors. Once her practice is profitable, she could file for S-Corp status to potentially lower her self-employment tax bill. Every state has its own nuances; for a detailed look at one state’s process, check out this guide on the important steps for starting a business in Florida.

Setting Up Compliant Financial Systems

Once your entity is officially registered, you absolutely must set up separate bank accounts. Mixing personal and business funds isn’t just messy—it’s a serious ethical violation that can get you in hot water with the bar.

You’ll need two accounts at a minimum:

- Business Operating Account: All your firm’s revenue and expenses flow through here. Client payments go in; rent, software, and payroll come out.

- IOLTA (Interest on Lawyers’ Trust Accounts): This is the non-negotiable trust account for holding client funds, like retainers or settlement money. The interest it generates is sent to the state bar to help fund legal aid services.

Mishandling an IOLTA is one of the fastest ways to face disciplinary action. Manage it meticulously.

Securing Essential Insurance and Funding

With your legal and banking structures in place, the final steps are securing insurance and capital. Professional liability insurance, or malpractice insurance, is not optional. It’s your defense against claims of negligence or errors in your work.

Even if your state doesn’t mandate it, practicing law without malpractice coverage is an unacceptable risk. The cost depends on your practice area, location, and desired coverage, but it’s a fundamental business expense.

Next, you’ll need the cash to get off the ground. Common funding sources include:

- Personal Savings: The cleanest option. You have total control and no debt.

- Business Line of Credit: This gives you flexible access to cash to cover uneven expenses in those critical first months.

- SBA Loans: These government-backed loans can have great terms, but the application process is lengthy and requires a highly detailed business plan.

Finally, get an accounting system in place from day one. Tools like QuickBooks or FreshBooks are perfect for tracking income, managing invoices, and staying ready for tax season. This financial discipline is the key to understanding your firm’s health and making smart decisions as you grow.

Building Your Modern Law Firm’s Tech Stack

Let’s be clear: technology isn’t an add-on anymore. For a competitive law practice, it’s the operational core. A smart tech stack is your secret weapon, letting you punch well above your weight and operate with the efficiency of a much larger firm—without the crushing overhead.

Getting this right from day one is everything. The goal isn’t to chase every shiny new tool. It’s about being strategic. You want integrated solutions that solve real problems, from wrangling case files to actually getting paid on time. This is how you free up your most valuable asset—your time—to practice law and bring in new clients.

The Foundation Your Practice Management Software

The single most critical technology decision you’ll make is choosing your Law Practice Management Software (LPMS). Think of it as the central nervous system for your entire operation. It’s the one platform that should handle client intake, contact management, document storage, calendaring, and billing.

For a new solo or small firm, a cloud-based LPMS is non-negotiable. Forget expensive on-site servers and IT consultants. A cloud system gives you secure access to your entire practice from anywhere, on any device. That flexibility is everything when you’re lean and trying to build a business.

A well-chosen LPMS doesn’t just organize your firm; it automates the administrative tasks that drain your billable hours. This is how you compete with established players right out of the gate.

Heavy hitters like Clio, MyCase, and PracticePanther are all built specifically for the way modern law firms work. They pull all your essential functions into one dashboard. No more managing deadlines on one calendar, hunting for documents in another folder, and digging through your inbox for client communications.

Essential Tools for Efficiency and Client Service

Beyond your core LPMS, a few other tools are absolute must-haves for running a modern firm. These aren’t luxuries; they streamline key processes and dramatically improve the client experience.

- Secure Document Management: While your LPMS will have document storage, dedicated solutions like Dropbox Business or Google Drive offer far more robust collaboration and version control features.

- Professional Accounting Software: Tools like QuickBooks Online or Xero are vital for managing your operating account, tracking expenses, and staying sane during tax season. Critically, these need to integrate with your LPMS to avoid tedious double data entry.

- Electronic Signature Platforms: Services like DocuSign or HelloSign are indispensable. They accelerate signing retainer agreements and other documents, creating a seamless, professional experience for your clients from the very first interaction.

This isn’t just about convenience; it’s about meeting client expectations. Law firms are boosting their tech spending by 7.6% year-over-year, a rate that far outpaces general inflation. That trend tells you everything you need to know: clients expect digital efficiency. Firms that don’t invest are already falling behind.

Streamlining Your Billing and Payments

Finally, let’s talk about the most important part: getting paid. Healthy cash flow is the lifeblood of your firm, and modern billing tools are essential to keeping it flowing.

Your LPMS will handle time tracking and invoicing, but you absolutely need a simple way for clients to pay you online. Integrating a payment processor like LawPay with your practice management software is a game-changer. It lets clients pay invoices with a credit card or ACH transfer right from a link in the email you send.

This small step makes you look more professional and, more importantly, drastically cuts down the time it takes to get paid. For a deeper look into this critical area, check out our attorney time tracking software guide for more tips on boosting efficiency.

Attracting Your First High-Value Clients

The biggest fear every lawyer has when hanging their own shingle is a quiet phone and an empty client list. But here’s the good news: you don’t need a huge marketing budget to land your first few clients. What you do need is a smart, targeted strategy that builds trust and gets you seen by the right people.

It all starts with establishing a credible online presence. These days, your first impression is almost always digital. That means building a professional foundation that tells potential clients you’re a serious, trustworthy expert.

Building Your Digital Storefront

Before anyone even thinks about calling you, they’re going to look you up online. Your digital storefront really comes down to two non-negotiable assets: a simple, professional website and a fully built-out Google Business Profile.

A website doesn’t have to be some complex, expensive project. To start, all you need is a clean, mobile-friendly site with a few essential pages.

- Homepage: State clearly who you are, what you do, and the clients you help.

- About Page: This is where you connect. Share your background and your story.

- Services Page: Break down your practice areas and explain the specific problems you solve.

- Contact Page: Make it dead simple for someone to find your phone number, email, and physical address.

Your Google Business Profile (GBP) is just as critical, especially if you want to attract local clients. It’s that info box that pops up in Google Maps and local searches. A complete GBP—with your firm’s name, address, phone number, and a few positive client reviews—is one of the most powerful free marketing tools you have.

Content Marketing That Answers Real Questions

One of the best ways to show off your expertise is to create content that directly answers the questions your ideal clients are already asking. The ABA notes that about a third of all law firms now run a blog, and for good reason—34% of them say a client has hired them specifically because of their blogging.

Stop writing about your firm. Start writing for your clients.

Think about the top five questions you get in every initial consultation. Turn each one into a detailed blog post. For example, a family law attorney could write a post titled, “What Are the First Steps in a Texas Divorce Process?” This simple shift positions you as a helpful authority, not just another lawyer trying to sell their services.

Starting a niche blog is one of the most effective strategies for a new firm. Instead of being a generalist, focus on a specific topic or location. This builds targeted authority and attracts the right kind of clients much faster.

This kind of targeted content doesn’t just help with search rankings; it builds instant trust with potential clients who find your answers genuinely useful. It’s a low-cost, high-impact way to start building a solid reputation.

The Power of Strategic Networking

While a strong online presence is a must, referrals are still the lifeblood of most successful law practices. You have to get out there and actively build a network of people who understand what you do and can send the right clients your way. This isn’t about collecting a stack of business cards; it’s about building real professional relationships.

Targeted Online Networking

LinkedIn is your best friend for professional networking. But don’t just connect with other lawyers. The real magic happens when you connect with professionals who serve your ideal clients in a different capacity.

- Business attorney? Connect with accountants, financial advisors, and commercial real estate brokers.

- Family law attorney? Think therapists, marriage counselors, and even school administrators.

Engage with what they post, share their articles, and offer your own insights. It makes you a visible and valuable member of their professional circle. For more practical tips, check out this guide on how to network effectively with high-value clients.

Offline and Community Engagement

Never underestimate the value of showing up in person. Join local business groups, your chamber of commerce, or industry-specific associations relevant to your practice. Becoming a known, trusted face in your community is a long-term play that pays off with high-quality referrals. The goal is simple: be the first person who comes to mind when someone in your network meets a person with a legal problem you can solve.

Scaling Beyond a Solo Practice

Getting your firm off the ground is a massive win, but the real challenge begins when success starts to overwhelm you. That initial flood of clients is fantastic, but it can quickly expose the limits of a one-person show. This is the moment you have to stop thinking like a lawyer with a job and start acting like an entrepreneur with a business.

Scaling isn’t about grinding out more 18-hour days. That’s a recipe for burnout. It’s about building the infrastructure—the people and the systems—that lets your firm grow whether you’re in the courtroom or on vacation. Making that leap requires a whole new strategy for hiring, workflows, and how you deliver your services.

Knowing When to Make Your First Hire

For most firm owners, hiring that first paralegal or associate is terrifying. It’s a huge financial and emotional commitment. So how do you know the time is right? The signs are usually staring you right in the face.

- You’re Turning Away Good Work: Are you consistently saying “no” to profitable cases simply because you don’t have the hours in the day? That’s not just lost revenue; it’s a giant flashing sign that you need support.

- Admin Is Eating You Alive: If you spend more time chasing invoices, scheduling calls, and filing documents than you do practicing law, you’re misusing your most valuable asset—your legal expertise. Delegating non-billable work is one of the smartest investments you can make.

- You Have No Life Left: When the firm constantly forces you to cancel dinner plans and miss family events, your model is broken. A business that depends entirely on your personal sacrifice isn’t a business; it’s a prison. Hiring is an investment in your own sustainability.

Remember, your first hire does more than just take tasks off your plate; they set the cultural tone for everyone who follows. You need someone who is not just competent, but also resourceful, proactive, and genuinely invested in your vision. They’re not just an employee—they’re a founding member of your team.

Developing Scalable Workflows

The informal, “keep it all in your head” processes that worked when you were flying solo will absolutely crumble under the weight of a growing caseload. You need to build repeatable systems that guarantee every client gets the same high-quality experience, no matter who on the team is handling their file. This is how you remove yourself as the bottleneck.

Start by mapping out a core process from A to Z. Client intake is the perfect place to begin.

- How does a prospect first find and contact you?

- What specific questions do you ask to qualify them?

- How is the initial consultation scheduled, prepared for, and conducted?

- What are the exact steps for signing them on and opening their file?

Building and documenting your workflows is the only way to maintain quality control as you grow. Write everything down, from your script for answering the phone to your checklist for closing a file. This becomes the playbook your new hires can run with from day one.

Once you have a process on paper, you can find all sorts of opportunities to automate pieces of it with your practice management software. Think automated appointment reminders, online intake forms that sync to your system, and templated welcome emails. Every bit of friction you remove frees up more time for strategic, high-value legal work.

Refining Your Services and Pricing for Growth

Scaling also forces you to get brutally honest about what you’re selling and who you’re selling it to. Not all cases—and not all clients—are created equal. As your firm matures, you have to start analyzing your profitability and making tough decisions about where to focus your energy.

The most dominant firms, particularly in high-growth sectors, are masters of specialization. Look at the venture capital space, where elite firms like Cooley have built an empire by focusing exclusively on startups and their investors, ranking them by sheer deal volume. While you might not be playing in that arena, the lesson is the same for every practice: focus breeds expertise, and expertise drives growth. You can find more insights on the top law firms for startups on etonvs.com.

For your firm, this means digging into your numbers. Which case types bring in the most revenue for the least amount of your time? Which ones cause the most headaches for the smallest returns? Double down on what’s working. Be willing to phase out the services that drain your resources. This kind of strategic focus is how you ensure that as you grow, you’re building a business that’s not just bigger, but smarter and more profitable.

Common Questions About Starting a Law Firm

Diving into entrepreneurship always kicks up a lot of questions, especially in a field as complex and regulated as law. While we’ve walked through the major milestones of launching a firm, from the business plan to scaling up, a few specific concerns seem to pop up for almost every lawyer thinking about hanging their own shingle.

Let’s get straight to the point and answer the questions I hear most often from attorneys ready to take the leap.

Can I Start My Firm Part-Time?

Absolutely. In fact, it’s becoming a much more common and frankly, smarter, way to get started. Launching your firm as a side hustle while keeping your day job is a brilliant strategy for minimizing financial risk.

This approach lets you slowly build a client roster and road-test your business model without sacrificing the security of a consistent paycheck. The critical piece here is ethical diligence. You must be almost paranoid about avoiding conflicts of interest with your current employer, never use their resources (not even their fancy printer), and be upfront about your new venture if your employment agreement requires it. It’s a slower burn, for sure, but it makes for a much smoother transition when you’re finally ready to go all-in.

How Much Money Do I Really Need to Start?

There’s no single number that fits everyone, but you can definitely map out a realistic budget. Your initial costs boil down to two buckets: one-time setup fees and your recurring monthly burn rate.

- One-Time Costs: Think business formation fees, getting a professional website designed, and any deposits for an office—if you aren’t starting from your kitchen table.

- Monthly Overhead: This includes your malpractice insurance, subscriptions for practice management software like Clio or MyCase, a business phone line, and marketing tools.

A solid benchmark I always recommend is having at least six months of both your personal and business expenses saved up. This is your “runway.” It’s the financial cushion that gives you the breathing room to actually find clients without panicking about making rent.

For a lean, completely virtual firm, you might get off the ground for as little as $5,000 to $10,000. But if you have your heart set on a physical office with actual furniture, you’ll need to budget for significantly more.

What Is the Biggest Mistake New Firm Owners Make?

Without a doubt, the single biggest mistake is underestimating the “business” side of running a law business. I’ve seen countless brilliant lawyers fail as entrepreneurs because they assumed their legal skills alone would guarantee success.

The hard truth is that being a great lawyer is maybe 50% of the job when you own the firm.

The other 50% is a mix of sales, marketing, accounting, client management, and IT support. You have to carve out real time—every single week—for those non-billable tasks that actually grow the business. Telling yourself you’re “too busy” with casework to do any marketing is a classic trap that leads directly to the feast-or-famine client cycle.

The founders who succeed are the ones who embrace their role as a business owner first and a lawyer second. They understand that building a reliable pipeline of new clients is just as crucial as winning the case in front of them. That mindset shift is everything.

Elevate your new firm’s brand and attract high-value clients with Haute Lawyer Network. We connect top attorneys with an exclusive audience through Haute Living’s powerful media ecosystem, providing unparalleled visibility and credibility. To stand out as a leader in your field from day one, learn more about joining our network.