When a business deal goes south, it’s easy to feel like you have no recourse. But if you’re a consumer in Florida, you’re armed with some of the most powerful legal protections in the country, designed specifically to shield you from deceptive advertising, high-pressure sales tactics, and subpar products.

Think of these rights less as dense legal codes and more as your personal toolkit for navigating the marketplace.

What Are Your Core Consumer Rights in Florida?

The absolute cornerstone of consumer protection in the Sunshine State is the Florida Deceptive and Unfair Trade Practices Act (FDUTPA). This isn’t some obscure statute; it’s a broad, powerful law that acts as a consumer’s shield in nearly every commercial transaction you can think of, from buying a used car to hiring a home contractor.

At its core, FDUTPA prohibits any business practice that is unfair, unconscionable, or deceptive. Understanding how this law works is the first and most critical step in standing up for yourself. It establishes a clear set of ground rules for fair play in the marketplace, and when a business breaks those rules, you have a direct legal path to seek justice.

Here’s a quick look at the major areas these laws cover.

Key Areas of Florida Consumer Protection

This table provides a high-level overview of the primary laws and the specific protections they offer to Florida consumers, giving you a map of your rights.

| Area of Protection | What It Covers | Primary Governing Law |

|---|---|---|

| Unfair & Deceptive Practices | Prohibits misleading advertising, bait-and-switch tactics, and unconscionable acts in any trade or commerce. | Florida Deceptive and Unfair Trade Practices Act (FDUTPA) |

| Vehicle Sales & Repairs | Regulates “dealer fees,” requires accurate disclosures for used cars, and governs auto repair estimates and work authorizations. | Florida Motor Vehicle Repair Act & FDUTPA |

| Home Solicitation Sales | Provides a three-day “cooling-off” period to cancel contracts signed at your home for services or goods over $25. | Florida’s Home Solicitation Sales Act |

| Telemarketing & Robocalls | Restricts unsolicited sales calls and text messages, requiring clear identification and consent from the consumer. | Florida Telemarketing Act (“Mini-TCPA”) |

| Debt Collection | Prevents harassment, abuse, and deceptive practices by debt collectors trying to collect on consumer debts. | Florida Consumer Collection Practices Act (FCCPA) |

| Landlord-Tenant Issues | Outlines rights and responsibilities for both landlords and tenants regarding security deposits, repairs, and evictions. | Florida Residential Landlord and Tenant Act |

These laws ensure that no matter the industry, there are standards of conduct that businesses must uphold.

Key Protections Under Florida Law

Florida law creates a safety net for a huge range of common consumer headaches. While we’ll dive deeper into specific scenarios, your fundamental rights generally boil down to a few key principles:

- The Right to Truthful Advertising: Businesses simply cannot make false or misleading claims to sell their products or services.

- The Right to Fair Sales Practices: You’re protected from manipulative methods like high-pressure tactics or bait-and-switch schemes.

- The Right to Safe Products: Any goods sold in Florida must be safe for their intended purpose. You shouldn’t have to worry about a product causing harm when used correctly.

- The Right to Dispute Unfair Charges: You have the power to challenge incorrect bills, unauthorized fees, and illegal debt collection practices.

The entire point of these laws is to level the playing field. They exist to ensure that businesses operate with integrity and that you, the consumer, are not taken advantage of, no matter how large or influential the company may be.

These protections aren’t just abstract legal theories—they have teeth and are meant for real-world application. They empower you to hold businesses accountable and, when necessary, recover financial damages for the harm you’ve suffered. Of course, while consumers have these rights, businesses must also understand their legal duties from day one. For a deeper look into the legal side of running a company, you can find excellent information on the important steps for starting a business in Florida. This kind of knowledge helps everyone involved in a transaction understand their respective roles and responsibilities.

How FDUTPA Protects Florida Consumers

In Florida, the single most important consumer protection law you need to know is the Florida Deceptive and Unfair Trade Practices Act, or FDUTPA. Think of it as a universal shield that guards you in nearly any transaction, whether you’re signing a gym contract or buying a new car.

Instead of getting bogged down in dense legal definitions, let’s talk about how it works in the real world. The law’s true power comes from its intentionally broad language, which allows it to adapt to the ever-evolving and creative ways businesses might try to mislead people.

FDUTPA zeroes in on two main kinds of misconduct: deceptive acts and unfair practices. They sound similar, but they protect you from different types of harm.

Understanding Deceptive Acts

A “deceptive” act is anything a business does that is likely to mislead a reasonable consumer. It’s a subtle but crucial distinction. The company doesn’t have to intend to trick you; what matters is whether their statement or action had the potential to create a false impression.

This broad interpretation is a cornerstone of consumer rights in Florida because it covers a lot more ground than just outright lies.

Here are a few classic examples of deceptive acts:

- Bait-and-Switch Advertising: A dealership runs an ad for a car at an unbelievable price. You show up, and suddenly that car is “sold,” but they’re happy to show you a much more expensive model.

- Misrepresenting a Product’s Condition: Selling a refurbished laptop as “brand new” without ever mentioning it was returned and repaired.

- Hidden Fees: You book a hotel room based on a nightly rate, only to get hit with a mandatory “resort fee” at checkout that was buried in the fine print.

In each case, the business created a false narrative that influenced your decision to spend your money.

Identifying Unfair Practices

An “unfair” practice is a different animal. It’s behavior that might not be a direct lie but is immoral, unethical, or causes significant harm that a consumer couldn’t reasonably avoid.

Under FDUTPA, an unfair practice is one that offends established public policy and is substantially injurious to consumers. It targets conduct that is exploitative, even if it’s not an outright lie.

For instance, a payday lender using aggressive, intimidating tactics to collect a debt could be engaging in an unfair practice. The same goes for a company that designs a ridiculously complex cancellation process intended to trap you in a subscription. These tactics are all about exploiting a consumer’s vulnerability.

The need for these robust protections has grown right alongside our economy. Since 1940, consumer credit in Florida has exploded by over 20 times, fundamentally shifting how we buy things. This enjoy-now, pay-later culture unfortunately created new opportunities for deceptive sales tactics—like passing off used goods as new or advertising fake “special prices”—that prey on the most vulnerable among us. You can dive deeper into the history of Florida’s consumer credit and sales practices to see just how these laws came to be.

Navigating Specific Consumer Protection Laws

While the Florida Deceptive and Unfair Trade Practices Act (FDUTPA) casts a wide protective net, the state also has targeted laws to deal with some of the most frustrating and common consumer issues. These statutes provide a clear roadmap for niche problems, giving you an extra layer of defense for your consumer rights in Florida.

Think of FDUTPA as a versatile multi-tool, useful for all sorts of jobs. These specific laws are more like specialized wrenches, engineered for one particular bolt. They’re a perfect fit when you need them most.

They cut through ambiguity and offer direct solutions for well-defined situations. Let’s dig into some of the most critical ones, starting with a law designed to protect one of your biggest investments: a new car.

Florida’s Lemon Law Explained

Buying a brand-new car should be a thrill, but discovering it has a serious, recurring defect can turn that dream into a nightmare. This is exactly why Florida’s Lemon Law exists. It’s a powerful remedy for consumers who buy or lease a new vehicle that just doesn’t meet basic quality and performance standards.

The law covers vehicles during the first 24 months of ownership. To be officially declared a “lemon,” a vehicle must have a significant defect that tanks its use, value, or safety. Crucially, the manufacturer has to be given a reasonable number of chances to fix it first.

Generally, a car qualifies as a lemon if it hits one of these benchmarks:

- The same serious defect has been subject to repair three or more times by the manufacturer or its authorized dealer.

- The vehicle has been out of service for repairs for a cumulative total of 30 or more days.

If your vehicle checks these boxes, you could be entitled to a full refund or a replacement vehicle. It’s a vital protection that holds manufacturers accountable for the products they sell. Dealing with vehicle issues, whether it’s a lemon or something else, is always complicated. Understanding what happens after a car crash can give you valuable context for any vehicle-related legal matter.

Rules for Debt Collectors and Salespeople

Beyond cars, Florida law offers robust protection from aggressive business tactics in other arenas, like debt collection and door-to-door sales. These laws are designed to shield you from harassment and high-pressure scenarios.

The Florida Consumer Collection Practices Act (FCCPA) actually provides even stronger protections than federal law. It strictly forbids debt collectors from using abusive, deceptive, or unfair practices to get you to pay.

The FCCPA explicitly forbids collectors from harassing you with endless phone calls, using profane language, or pretending to be a lawyer or a police officer. They also can’t legally publish your name on a “bad debt” list or call your boss about your debt.

Florida also has a “three-day cooling-off rule” that gives you the power to back out of purchases made outside a seller’s normal place of business. If you agree to buy goods or services worth more than $25 from a door-to-door salesperson, you have the right to cancel the contract for a full refund within three business days. This rule provides a vital escape hatch from the high-pressure sales tactics you might face in your own home.

Your Digital Rights and Data Privacy in Florida

Let’s be honest: in our hyper-connected world, your personal data is one of your most valuable assets. Every click, purchase, and social media post leaves a digital footprint, painting a detailed picture of your life. It’s only natural that understanding your consumer rights in Florida now includes protecting this sensitive information from being exploited or stolen.

Florida law has caught up to this reality, putting rules in place to hold businesses accountable for how they handle your data. The primary shield you have is the Florida Information Protection Act (FIPA), a law that sets a clear standard for data security and what happens when things go wrong.

Think of FIPA as a mandate for businesses to build a secure ‘digital vault’ for the information they collect. They can’t just gather your data and leave the door unlocked; they have a legal duty to put reasonable security measures in place. This proactive requirement is the cornerstone of protecting your privacy.

What Counts as “Personal Information”?

Under FIPA, “personal information” isn’t just your name or email. It’s a specific combination of data points that, if they fell into the wrong hands, could easily lead to identity theft or financial ruin. The law focuses on protecting the keys to your digital and financial life.

This legally protected information includes your first and last name combined with any of the following sensitive details:

- Social Security number

- Driver’s license or state ID card number

- Financial account, credit, or debit card numbers, especially with any required security codes or passwords

- Your medical history, treatment information, or diagnosis

- Health insurance policy numbers

- An email address paired with its password or security questions

If a data set can be used to directly identify you and open the door for someone to impersonate you, FIPA’s protections are triggered.

The Right to Know When Your Data Is Breached

One of the most powerful consumer rights you have under FIPA is the right to be notified—and notified quickly—after a data breach. If a company discovers your personal information has been compromised, they can’t just sweep it under the rug. This transparency is non-negotiable, and it’s what allows you to take immediate steps to protect yourself.

Enacted back in 2014, FIPA was ahead of its time. It forces companies to inform you within 30 days if your sensitive data has been exposed in a security breach. And the state takes this seriously. Non-compliance comes with steep penalties, starting at $1,000 per day and capping out at a massive $500,000. The potential fines alone show just how critical this right is. You can get a deeper look into the specifics of Florida’s consumer privacy laws and what they mean for businesses.

That notification can’t be vague, either. It must clearly explain what happened, what type of information was involved, and what the company is doing about it. Crucially, it must also give you contact information for law enforcement and the major credit reporting agencies, arming you with the resources you need to fight back against potential identity theft and fraud.

A Practical Plan to Enforce Your Consumer Rights

Knowing your rights is one thing; making them work for you is another entirely. When you’re locked in a dispute with a business, having a clear action plan is the difference between spinning your wheels in frustration and getting real results. This is your roadmap for turning knowledge of your consumer rights in Florida into a powerful tool.

The process doesn’t start with a heated phone call or a frustrated email. It begins with something far more potent: documentation. You need to think like a detective building an airtight case.

Start by Documenting Everything

Your very first move, before anything else, is to gather every single piece of paper and digital correspondence related to the transaction. This isn’t just busywork—it’s about building a foundation of facts that a business simply can’t ignore. Without a solid paper trail, your complaint is just your word against theirs.

Your evidence file should be meticulous. Make sure it includes:

- Receipts and Invoices: The non-negotiable proof of purchase.

- Contracts and Agreements: This includes any fine print or terms of service you clicked “agree” on.

- Email Correspondence: Save every single message exchanged with the company. Don’t delete anything.

- Detailed Notes: Log every phone call. Write down the date, the time, the full name of the person you spoke with, and a quick summary of what was said.

This collection of evidence becomes your greatest asset, whether you’re writing a formal letter or, if it comes to it, presenting your case in a courtroom.

Escalate Your Complaint Strategically

With your documentation organized, your next step is to send a formal complaint letter directly to the business. Keep it professional, clear, and to the point. Lay out the facts, mention the documents you have, and state exactly what you want—a refund, a repair, a replacement.

If the business ignores you or their response is unacceptable, it’s time to escalate. You can file an official complaint with the Florida Attorney General’s Office through its Division of Consumer Services. This move often gets a company’s attention when a direct appeal has failed.

Pursuing Legal Action

For smaller disputes, don’t overlook Florida’s small claims court. It’s an excellent and surprisingly accessible option designed specifically for people to use without needing an attorney. It provides a simplified, direct path to resolving conflicts.

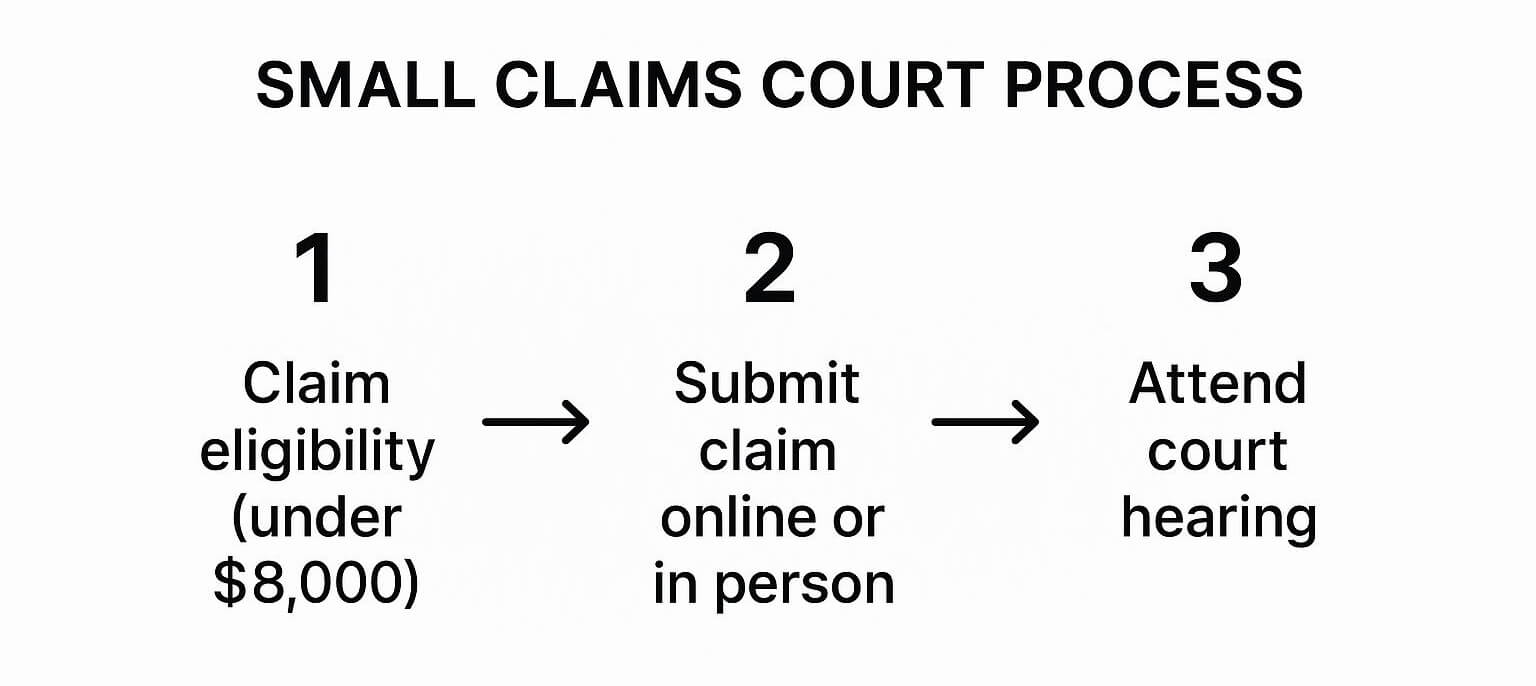

This infographic breaks down the basic steps for navigating Florida’s small claims court system.

As the guide shows, for any claim under $8,000, the process is straightforward, from filing your initial paperwork to your day at the hearing.

However, when you’re dealing with a more complex case—especially one involving a major financial loss or a clear violation under FDUTPA—consulting an attorney is the smartest move you can make. An experienced lawyer knows how to navigate the system and will advocate fiercely on your behalf. Remember, any conversation you have with legal counsel is protected. You can learn more about what is attorney-client privilege to better understand how that critical relationship works. Taking these deliberate steps ensures you are in the strongest possible position to enforce your rights and get what you’re owed.

Your Florida Consumer Rights: Common Questions Answered

Knowing the big picture of your consumer rights in Florida is one thing, but when you’re actually in a dispute, practical questions are what matter most. This section cuts straight to the chase, answering the common concerns that pop up when you’re not sure what to do next.

We’ll cover where to start, how long you have to act, and when it’s time to call in a professional. Getting these answers right can empower you to move forward with confidence, ensuring you don’t miss your chance to protect your interests. Let’s begin with the most critical question: what’s the very first step?

What Is the First Step if My Rights Were Violated?

Before you do anything else, your first move is to gather your documentation. This is non-negotiable. Collect every single receipt, contract, email, and letter connected to the problem. You’ll also want to keep a detailed log of any phone calls—note the date, time, and the name of the person you spoke with.

Once your evidence is organized, contact the business directly, and do it in writing. A formal letter or a clear email that outlines the problem and states your desired resolution (like a refund, repair, or replacement) creates an official paper trail. You’d be surprised how often this simple, professional step resolves the issue without things escalating.

If the business ignores you or refuses to help, that organized file becomes the bedrock of your next move, whether that’s a formal complaint to a state agency or a legal claim.

How Long Do I Have to File a Consumer Complaint?

In the legal world, time is not on your side. The deadline to take legal action is called the statute of limitations, and it varies based on the specifics of your claim. It’s absolutely crucial to know these time limits, because if you wait too long, you could lose your right to a remedy for good.

Here’s a general guide to the timelines for common consumer issues in Florida:

- FDUTPA Claims: For most claims under the Florida Deceptive and Unfair Trade Practices Act, you have four years from the day the violation happened.

- Written Contracts: If your dispute is based on a written agreement, the window is a bit longer, typically five years.

- Specific Laws: Pay close attention here—some laws have much shorter and stricter deadlines. For example, Florida’s Lemon Law has a very specific and much shorter timeframe for taking action.

Because these timelines can get tricky, the best strategy is always to act fast. If you think you’re getting close to a deadline, it’s a smart move to consult with a legal professional.

Do I Always Need a Lawyer to Enforce My Rights?

No, not always. For many smaller issues, you can get a perfectly good outcome on your own. Filing a complaint directly with the business or a state agency like the Florida Division of Consumer Services can often do the trick.

Florida’s small claims court is another powerful resource built for consumers. For disputes involving $8,000 or less, you can file a claim and represent yourself without needing an attorney, making the justice system far more accessible.

However, when things get more complex—especially in cases involving major financial losses or nuanced legal arguments under FDUTPA—hiring an attorney is a strategic advantage. Many consumer protection laws, FDUTPA included, have provisions that could force the losing business to cover your attorney’s fees. This makes getting expert legal help more attainable than most people think. An expert ensures your rights aren’t just acknowledged; they’re fully protected.

When facing a complex consumer rights issue, having an experienced legal advocate on your side can make all the difference. For those seeking top-tier legal representation in Florida and beyond, the Haute Lawyer Network offers a curated directory of the nation’s most respected attorneys. Connect with a legal professional who can protect your interests.