Estate planning law isn’t about preparing for an end—it’s about architecting a fortress around your life’s work. It provides the legal framework to manage your assets during your life and precisely control their distribution after you’re gone, securing your family’s future and cementing your legacy.

Your Ultimate Wealth Protection Strategy

True estate planning goes far beyond simply drafting a will. For high-net-worth individuals, it’s a dynamic, strategic process designed to protect what you’ve built, minimize crushing tax burdens, and ensure your assets are transferred exactly according to your wishes. This legal discipline is non-negotiable, transforming a collection of assets into a lasting, multi-generational legacy.

Without a sophisticated plan, you leave the fate of your wealth to impersonal state laws and the costly, public ordeal of probate court. A proper plan involves creating a set of legal documents that act as a comprehensive instruction manual for your estate. The goal is to create a seamless transition that sidesteps family conflict, protects beneficiaries, and shields your wealth from creditors and unnecessary taxation. It is the ultimate act of control over your financial destiny.

The Core Components of Your Financial Fortress

An effective estate plan is built on several key legal instruments working in concert. Each serves a distinct and vital role in protecting your assets and directives.

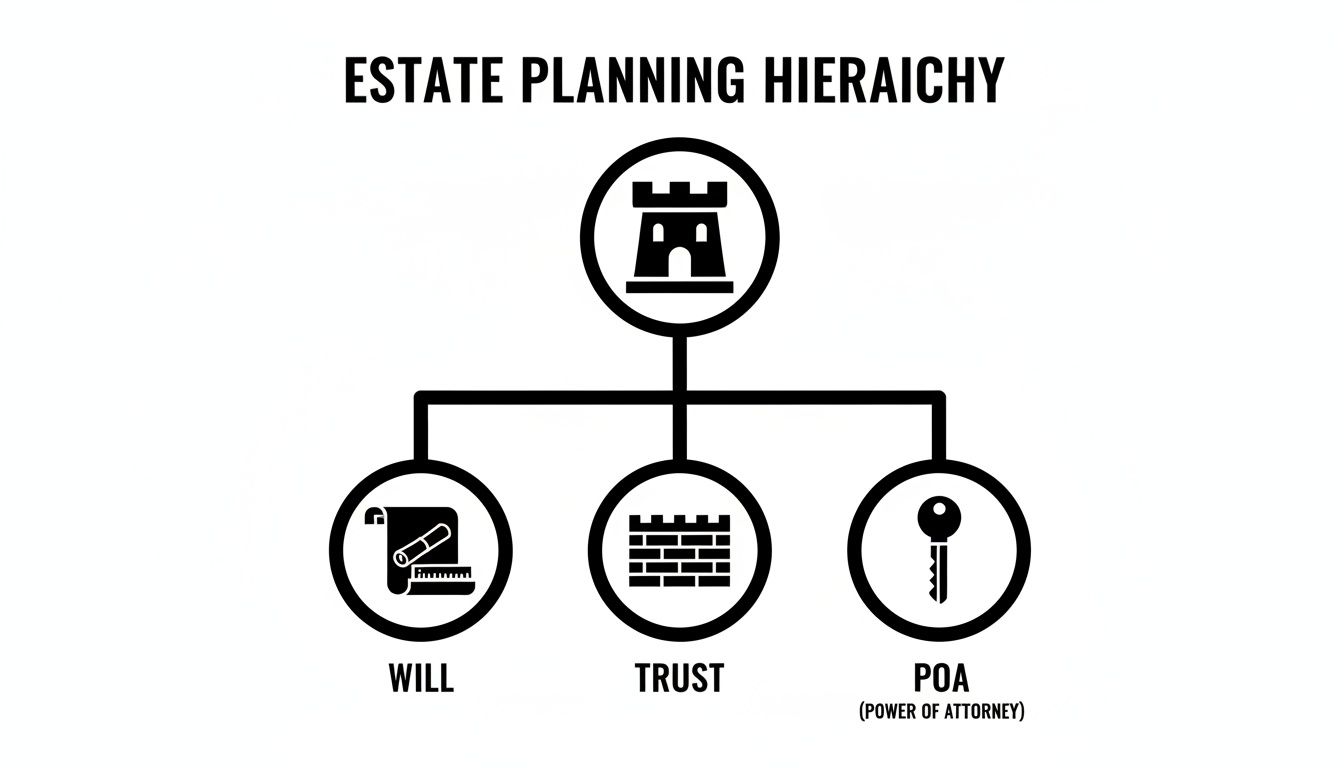

This structure visualizes your estate plan as a fortress: your will is the blueprint, trusts act as reinforced walls, and powers of attorney serve as the gatekeepers who control access.

Despite its importance, there’s a significant gap between awareness and action. While 83% of Americans acknowledge the critical need for estate planning, a mere 31% have a will, and only 11% have established trusts. A comprehensive 2025 report reveals that this means a staggering 55% possess no estate documents at all, leaving their legacies entirely vulnerable.

This guide demystifies the core concepts of estate planning law, shifting the perspective from a daunting task to an essential component of wealth management. For those with substantial assets, understanding these principles is the first step. You can also learn more about why standard strategies often fail ultra-high-net-worth families in our article.

The Essential Tools in Your Estate Planning Toolkit

A sophisticated estate plan isn’t a single document; it’s a carefully constructed collection of legal instruments, each with a specific job. Think of it less like a simple blueprint and more like a high-performance engine, where every component must work in perfect sync to protect your legacy.

Getting a handle on how these individual tools function—and more importantly, how they interact—is the absolute foundation of effective estate planning.

The core components—Wills, Trusts, Powers of Attorney, and Healthcare Directives—form the bedrock of almost every plan we build. Together, they create the legal architecture needed to manage your affairs, shield your assets from unnecessary exposure, and guarantee your wishes are followed to the letter.

The Will: Your Foundational Blueprint

The Last Will and Testament is often the first document people think of, and for good reason. It’s the legal instrument that spells out your final wishes, from how your property should be distributed to who you want to serve as guardian for your minor children.

If you die without a will, the state’s intestacy laws make those critical decisions for you. That’s a gamble most people aren’t willing to take.

But a will has a major limitation: it must go through probate. This is the court-supervised process of validating the will and overseeing asset distribution. It can be public, frustratingly slow, and expensive for your heirs, which is why a will is almost never the only tool we use.

The Trust: A Private Vehicle for Asset Management

This is where things get more powerful. A trust offers a level of control, efficiency, and privacy that a will simply can’t match. In essence, a trust is a private legal arrangement where you (the grantor) give a trustee the authority to manage assets for your chosen beneficiaries.

The single biggest advantage? Assets held inside a trust typically bypass probate entirely, allowing for a seamless and confidential transfer of wealth.

Trusts generally fall into two categories:

- Revocable Living Trusts: You maintain complete control. You can change it, add or remove assets, or even dissolve it entirely during your lifetime. It’s the perfect tool for managing your assets now and ensuring a smooth transition later.

- Irrevocable Trusts: Once you create and fund this type of trust, it’s largely set in stone. Why would you want that? For high-net-worth families, these are indispensable for advanced tax planning and asset protection, as they legally remove assets from your taxable estate.

A classic strategy is to place primary assets like your home and brokerage accounts into a revocable trust for day-to-day flexibility. Meanwhile, a separate irrevocable trust might be used to own a large life insurance policy, ensuring the multi-million-dollar payout is shielded from estate taxes.

Mastering these structures is key, and you can learn more about the specifics of a living trust in our detailed guide.

Powers of Attorney and Healthcare Directives

While wills and trusts kick in after you’re gone, these next two documents are designed to protect you during your lifetime. They are absolutely critical for handling a scenario where you become incapacitated and can’t make decisions for yourself.

A Durable Power of Attorney for Finances empowers a trusted person—your agent—to handle your financial life if you can’t. This includes everything from paying bills and managing investments to running a business. It’s the key to avoiding a court-appointed conservatorship, which is a bureaucratic nightmare.

An Advanced Healthcare Directive (which usually includes a living will and a healthcare proxy) does the same for your medical care. It appoints an agent to make health decisions and clearly states your wishes on end-of-life care, ensuring your values are honored when it matters most.

Comparing Key Estate Planning Instruments

To see how these tools fit together, it helps to compare them side-by-side. Each has a distinct role, and understanding their differences is crucial for building a comprehensive plan.

| Instrument | Primary Purpose | Flexibility (Can it be changed?) | Avoids Probate? | Best For |

|---|---|---|---|---|

| Last Will & Testament | Distributes remaining assets and names guardians for minors. | Fully Revocable | No | Acting as a safety net for any assets left outside a trust. |

| Revocable Living Trust | Manages assets during life and allows for private, efficient transfer after death. | Fully Revocable | Yes | Serving as the central hub for the majority of your assets. |

| Irrevocable Trust | Provides maximum asset protection and minimizes estate & gift taxes. | Generally Not Revocable | Yes | Advanced wealth preservation and tax mitigation strategies. |

| Power of Attorney | Appoints an agent to manage financial affairs during incapacity. | Revocable | Not Applicable | Protecting your financial autonomy while you are alive. |

| Healthcare Directive | Appoints an agent to make medical decisions and outlines care wishes. | Revocable | Not Applicable | Ensuring your medical and end-of-life wishes are followed. |

When properly integrated, these instruments create a resilient, multi-layered strategy. Your will acts as a final backstop, your trust serves as the primary engine for transferring wealth, and your directives stand as a vital shield against life’s uncertainties. This holistic approach is the signature of a truly sophisticated estate plan.

Mastering Tax Strategy and Asset Protection

For affluent families, estate planning isn’t just about deciding who gets what. It’s a sophisticated defense against the two biggest threats to generational wealth: taxes and external risks. A truly effective plan is a fortress, actively shielding your assets from complex tax codes, potential creditors, lawsuits, and other financial predators.

At the core of this defensive strategy is a mastery of the federal wealth transfer taxes. You have the estate tax, which hits your assets at death; the gift tax, which applies to transfers during your lifetime; and the generation-skipping transfer tax (GSTT), a specialized tax designed to prevent wealth from skipping a generation of taxation. Each requires a distinct game plan to minimize its bite.

The Looming Tax Exemption Sunset

There’s a critical deadline on the horizon that’s forcing high-net-worth families to act now. The current U.S. federal estate tax lifetime exemption is at an unprecedented high, but this window of opportunity is closing fast.

The exemption currently stands at a generous $13.99 million per person for 2025, or $27.98 million for a married couple. However, this provision from the 2017 Tax Cuts and Jobs Act is set to “sunset” at the end of 2025. Unless new laws are passed, the exemption will be slashed in half to roughly $7 million in 2026. This isn’t just a minor tweak; it’s a seismic shift that could cost families millions. With 57% of consumers believing the next administration will significantly alter estate tax laws, the incentive to act decisively is stronger than ever.

The current, elevated exemption allows for substantial, tax-free wealth transfers that may become impossible after 2025. Proactively using this exemption now can lock in significant tax savings for future generations, regardless of future legislative changes.

Advanced Strategies for Fortifying Your Wealth

Beyond navigating tax exemptions, true asset protection means building legal structures that can withstand unforeseen attacks. These aren’t just clever tax-saving maneuvers; they are powerful legal fortresses designed to protect your legacy.

Several advanced tools are central to this effort:

- Irrevocable Life Insurance Trusts (ILITs): An ILIT is a specialized trust built for one purpose: to own your life insurance policy. By moving the policy into the trust, the death benefit is kept out of your taxable estate. Better yet, the payout is generally shielded from the creditors of both you and your beneficiaries. It’s a cornerstone strategy for creating tax-free cash to cover estate taxes or provide for your heirs.

- Grantor Retained Annuity Trusts (GRATs): A GRAT is an elegant way to transfer the future growth of an asset to your beneficiaries with little to no gift tax. You place assets into the trust and, in return, receive a fixed annuity payment for a set number of years. Any appreciation above a specific IRS-set interest rate passes to your beneficiaries completely tax-free. This makes it a perfect vehicle for high-growth assets like founder’s stock.

- Family Limited Partnerships (FLPs): An FLP is essentially a family-owned business entity created to hold and manage assets like real estate or investment portfolios. Senior family members typically serve as general partners, maintaining control, while younger generations are given limited partnership interests. This setup not only centralizes management and protects assets from creditors but can also allow for wealth transfers at discounted valuations, further reducing tax exposure.

These strategies serve different, but often complementary, purposes. An ILIT creates liquidity, a GRAT transfers growth, and an FLP consolidates and protects family capital. The right mix depends entirely on your financial picture, family dynamics, and ultimate goals.

Of course, protecting assets also means planning for the high cost of long-term care, which can quickly drain an estate. If this is a concern, you may find valuable insights in our guide on how to protect assets from nursing home costs. By weaving sophisticated tax planning together with robust asset protection, you create a comprehensive defense that ensures your wealth endures for generations.

Avoiding Common and Costly Estate Planning Mistakes

An exceptional estate plan is defined as much by the disasters it avoids as by the strategies it employs. While drafting the right documents is a critical first step, failing to maintain them can dismantle even the most careful planning. The truth is, the most sophisticated estate planning law strategies are worthless if they don’t reflect your current reality.

The landscape of your life changes—families grow, businesses are sold, and laws evolve. An estate plan must be a living document, not a static file collecting dust. Ignoring it can lead to devastating and entirely preventable consequences.

The Peril of Outdated Beneficiary Designations

One of the most frequent and damaging errors involves the beneficiary designations on accounts that pass outside of a will or trust. We’re talking about life insurance policies, 401(k)s, IRAs, and certain bank accounts.

These designations are legally binding contracts with the financial institution, and they override any instructions in your will. For example, if your will leaves everything to your current spouse, but your ex-spouse is still listed on a multi-million-dollar life insurance policy, your ex-spouse gets the money. It’s a simple clerical error with catastrophic results.

This mistake is tragically common after major life events:

- Divorce: Failing to remove a former spouse from key retirement accounts.

- Marriage: Forgetting to add a new spouse to your policies.

- Death of a Beneficiary: Not naming a contingent beneficiary if the primary one passes away.

Forgetting to Fund Your Trust

Creating a revocable living trust is an excellent move to avoid probate, but the trust document itself is just an empty container. For it to work, you must legally transfer your assets—real estate, brokerage accounts, business interests—into it. This is called funding the trust.

If you create a trust but fail to fund it, the assets remain in your personal name. This means they will still have to go through the public, costly, and time-consuming probate process you sought to avoid. The trust becomes a useless, expensive piece of paper.

An unfunded trust is like building a state-of-the-art vault but leaving your valuables sitting on the lawn outside. The structure exists, but it provides zero protection for the assets it was designed to hold.

The Failure to Review and Update Your Plan

Your life isn’t static, and neither is estate planning law. A plan drafted a decade ago is likely dangerously out of sync with your current wishes and financial reality. Failing to conduct periodic reviews is a gamble with your legacy.

Consider the chaos that can erupt from not updating a plan after:

- A major asset sale: Selling a business can drastically change your net worth and tax exposure, demanding new strategies.

- The birth of a child: Your plan must be updated to include new heirs and name guardians.

- Moving to another state: Estate and inheritance tax laws vary dramatically by state. A plan valid in New York may be deeply inefficient in Florida.

A disciplined review process is the only way to ensure your plan remains effective. This transforms it from a historical document into a dynamic tool that protects your family and preserves your wealth exactly as you envision.

How to Select the Right Estate Planning Attorney

Choosing legal counsel is the single most important decision you’ll make in your estate planning journey. For high-net-worth individuals, this isn’t about finding just any lawyer. It’s about partnering with a strategic advisor who truly understands the unique complexities of significant wealth, intricate family dynamics, and sophisticated tax law.

The right attorney acts as both an architect and a guardian of your legacy. They do more than just draft documents; they build a resilient legal framework designed to withstand future tax changes, creditor claims, and unforeseen family challenges. Your selection process should be as rigorous as any other major financial decision you make.

Looking Beyond the Law Degree

When vetting potential attorneys, a basic law degree is merely the ticket to the game. Elite counsel possesses a much deeper set of qualifications that signal true mastery over the nuances of high-net-worth estate planning.

Look for specific credentials and proven experience:

- Board Certifications: Seek out attorneys who are board-certified in Estate Planning and Probate Law or Tax Law. This is a rigorous, peer-reviewed process that demonstrates a profound level of expertise few achieve.

- Tax Law Acumen: A deep understanding of federal estate tax, gift tax, and generation-skipping transfer tax is non-negotiable. They should be fluent in advanced strategies like ILITs, GRATs, and FLPs.

- Experience with Complexity: Ask for real-world examples of their work with clients who have similar financial situations, such as business succession, international assets, or blended family structures.

This specialized skill set is more critical than ever. The global market for estate planning services was valued at USD 297 million in 2024 and is projected to hit USD 503 million by 2032, driven by a 6.7% compound annual growth rate. This growth reflects a rising demand from affluent clients for advanced wealth preservation strategies. You can learn more about the growing estate planning services market.

The Haute Lawyer Network Advantage

Navigating the search for this level of expertise can be daunting. This is where a curated network provides an invaluable advantage. Platforms like Haute Lawyer cut through the noise by pre-vetting attorneys, ensuring every professional in their network meets an exacting standard of excellence.

Partnering with an attorney whose expertise is validated by a trusted luxury authority like Haute Living ensures you’re not just hiring a lawyer, but a strategic advisor recognized as a leader in their field. It provides confidence that your counsel is equipped to handle the most complex challenges.

Instead of spending countless hours vetting credentials, a curated network connects you directly with the top-tier legal talent you need. These are professionals whose reputations are built on successfully guiding affluent families through the complexities of estate planning law.

By using a platform like the Haute Lawyer Network, you gain immediate access to a roster of elite legal minds, simplifying your search and ensuring your legacy is in the most capable hands. This strategic connection provides peace of mind, knowing your chosen counsel is among the best in the nation.

Your Estate Planning Questions, Answered

Even with a well-drafted plan, questions inevitably arise. The world of estate planning law is complex, but understanding the fundamentals is the first step toward true peace of mind. Here are clear, direct answers to some of the most common questions we encounter.

How Often Should I Update My Estate Plan?

Think of your estate plan as a living, breathing document, not something you sign once and file away forever. The best practice is to review it with your attorney every three to five years to catch any changes in the law or your financial picture.

More importantly, you must revisit it immediately after a major life event. These are non-negotiable triggers for an update:

- A marriage, divorce, or the death of a spouse.

- The birth or adoption of a child or grandchild.

- A significant financial shift, like selling a business, receiving a large inheritance, or a major change in asset values.

- The death or incapacitation of a key person named in your plan, such as a trustee, executor, or guardian.

- A move to a different state or country, as tax and property laws vary dramatically.

Staying on top of these updates ensures your plan does what you intend it to do, preventing disastrous and unintended consequences down the line.

What Happens If I Die Without a Will?

Dying without a will is known as dying “intestate.” When this happens, you forfeit your right to decide who gets your assets. Instead, the state steps in and distributes your property according to its own rigid, impersonal intestacy laws.

A court-appointed administrator—often a complete stranger—is put in charge. The entire process unfolds publicly in probate court, which is notoriously slow, expensive, and a source of immense stress for grieving families. The state’s one-size-fits-all formula rarely matches what people actually wanted, and it can lead to ugly conflicts between heirs or even disinherit a long-term partner who isn’t a legal spouse.

A will is your voice when you can no longer speak. Without it, the state gets the final word.

Can a Trust Really Help My Family Avoid Probate?

Absolutely. This is one of the most significant advantages of using a properly funded living trust. When assets are legally titled in the name of your trust, they are no longer considered part of your personal estate for probate purposes.

A trust allows your assets to completely bypass the court-supervised probate process. Your chosen successor trustee can step in immediately to manage and distribute your assets privately, efficiently, and exactly as you’ve instructed. This saves your loved ones an incredible amount of time, money, and emotional energy.

This ability to facilitate a direct, private transfer of wealth is a cornerstone of modern estate planning, offering a level of control and confidentiality that a will simply cannot match.

Are Digital Assets Part of an Estate Plan?

Yes, and in today’s world, it’s a critical component. Your digital footprint—from cryptocurrency and social media accounts to online business assets and sentimental digital photos—is a valuable part of your estate. If you don’t plan for it, these assets can be locked away and lost forever.

A modern estate plan must include a clear digital asset strategy. This means creating a detailed inventory and providing your fiduciaries with explicit instructions on how to access, manage, and distribute these accounts and properties according to your wishes.

Finding the right legal counsel is the single most important decision you’ll make in protecting what you’ve built. The Haute Lawyer Network is an exclusive, invitation-only platform connecting discerning clients with the nation’s most respected, pre-vetted legal experts. Ensure your legacy is secured by the best in the field by exploring our network today at https://hauteliving.com/lawyernetwork.