Think of divorce discovery as the financial “show and tell” of a separation. It’s the formal, court-supervised process where both you and your spouse have to lay all your financial cards on the table. No hiding, no guessing—just a complete, transparent exchange of information.

What Discovery in Divorce Really Means for You

Discovery is the bedrock of any fair divorce settlement. It’s how we move from speculation to certainty, ensuring that every decision about your future is based on hard facts, not assumptions.

Without this structured process, one spouse could easily hide a brokerage account, downplay their business income, or conveniently forget about a significant debt, leaving the other to negotiate in the dark. Discovery turns on the lights. It compels the full disclosure of documents and information, which is critical for making informed decisions on the most important issues:

- Equitable Property Division: You can’t divide what you don’t know exists. Discovery identifies and values every marital asset, from real estate to retirement accounts.

- Spousal and Child Support: Accurate support calculations depend on verified income and a clear understanding of each party’s financial needs.

- Custody Arrangements: In some cases, financial stability or spending habits can become relevant to a child’s best interests.

The Goal is Financial Transparency

Imagine trying to split the value of a company after only seeing a handful of invoices. It would be impossible. A divorce is no different. The entire process is designed to assemble a complete financial puzzle so the final picture is fair and accurate.

This isn’t an honor system; it’s a legal obligation. Information and documents are requested through formal legal tools, and responses must be provided under oath. Lying or intentionally hiding assets during discovery in divorce cases is perjury, and it comes with severe court-imposed penalties, known as sanctions.

The entire discovery framework is built on a simple but powerful principle: a fair outcome is only possible when it is based on facts, not assumptions. It levels the playing field, especially when one spouse has historically managed the family’s finances.

Why Discovery Is So Important Today

Untangling a modern marriage is rarely simple. With complex investments, digital assets, and intricate business structures, a formal discovery process is more essential than ever. The statistics paint a clear picture of why this matters so deeply.

As of 2025, an estimated 41% of first marriages in the United States end in divorce, and that number jumps to over 60% for second marriages. With so many couples needing to divide their commingled lives, a structured, evidence-based approach is the only way to protect both parties’ financial futures. You can review more details about these divorce statistics in the U.S. to see just how common—and complex—this process has become.

Unpacking the Essential Tools of Discovery

Think of discovery in divorce cases as a formal, structured investigation. Your attorney uses a specific set of legal instruments to piece together the complete financial puzzle of your marriage. These aren’t polite requests—they’re legally binding demands for information that must be answered truthfully and completely.

Each tool is designed to uncover a different part of the story. Understanding how they work together is the key to appreciating how your legal team methodically builds your case, fact by verifiable fact.

Requests for Production of Documents

This is the workhorse of discovery, and it’s almost always the starting point. A Request for Production of Documents (RFP) is a formal written demand for tangible proof—everything from paper bank statements to digital investment records. It’s the foundational evidence of a marriage’s financial life.

Imagine trying to value a business without seeing its books. Impossible, right? The same logic applies here. RFPs replace guesswork with hard evidence.

Commonly requested items include:

- Financial Statements: Bank, credit card, and investment portfolio records, typically for the last three to five years.

- Income and Tax Records: Personal and business tax returns, W-2s, 1099s, and recent pay stubs.

- Property and Debt Records: Real estate deeds, mortgage statements, car titles, and loan applications.

- Business Documents: For business owners, this means profit and loss statements, balance sheets, and shareholder agreements.

Interrogatories Answering Questions Under Oath

If document requests get you what exists, Interrogatories tell you what someone knows. These are written questions that your spouse must answer in writing, under oath. Answering falsely is perjury.

Think of it as a detailed, written interview designed to fill in the gaps that documents alone can’t explain. A bank statement might show a huge withdrawal, but an interrogatory can ask, “What was the purpose of the $20,000 withdrawal from the joint savings account on March 15th?”

These questions help your attorney:

- Identify every known asset and debt.

- Trace the source and history of specific funds.

- Clarify employment history and income potential.

- Uncover information about assets that might not have a clear paper trail.

Because the answers are sworn, they lock the other party into a specific set of facts, making it very difficult for them to change their story later.

Requests for Admission Confirming Key Facts

Requests for Admission (RFAs) are a powerful tool for efficiency. They are a series of simple, direct statements that the other side must either admit or deny. If admitted, the fact is considered proven and no longer needs to be argued in court.

For example, an RFA might state: “Admit that the funds in the Vanguard brokerage account, ending in -4567, are marital property.”

By forcing a simple “yes” or “no” answer, Requests for Admission narrow the field of dispute. This saves a tremendous amount of time and money by focusing litigation efforts only on the issues that are truly contested.

If your spouse denies something that is later proven true, the court can order them to pay the legal fees it took you to prove it. This creates a powerful incentive for honesty.

Depositions Live Testimony Before Trial

A deposition is the closest you get to a courtroom experience before the trial actually begins. It’s a formal, question-and-answer session where an attorney questions the other party (or a witness) under oath. A court reporter records every word, creating an official transcript.

Unlike written discovery, depositions allow for real-time follow-up questions, which makes them incredibly effective for:

- Assessing Credibility: You see how someone handles questions under pressure, offering a preview of how they might perform as a witness at trial.

- Uncovering Nuance: An attorney can immediately probe vague answers and dig deeper into inconsistencies.

- Locking in Testimony: The sworn transcript can be used in court to impeach a witness if they try to change their story on the stand.

Depositions are a potent tool for getting to the heart of complex or contentious issues.

Subpoenas Getting Information from Third Parties

So, what happens when critical information is held by a bank, an employer, or a business partner—not your spouse? That’s where a subpoena comes in. A subpoena is a court order compelling a third party to produce documents or provide testimony.

If you suspect a hidden bank account, your lawyer can issue a subpoena directly to the bank for its records. The bank is legally required to comply. This is a vital tool for verifying information or uncovering assets that your spouse won’t disclose willingly.

The use of these tools often becomes more intensive in longer marriages, where finances become deeply entangled over time. Statistical analysis shows that while 20% of first marriages end within five years, nearly half are over by the 20-year mark, often requiring more exhaustive discovery. You can explore global divorce statistics to understand how these trends shape legal processes worldwide.

Comparing the Five Main Discovery Tools

To put it all together, here is a simple breakdown of the primary discovery tools and how they are strategically used in a divorce case. Each serves a distinct purpose, from gathering raw data to confirming specific facts.

| Discovery Tool | What It Is | Format | Common Use in Divorce |

|---|---|---|---|

| Requests for Documents | A formal demand for tangible evidence, like financial records and deeds. | Written Request | Obtaining bank statements, tax returns, and property titles to build a financial baseline. |

| Interrogatories | A list of written questions that must be answered in writing under oath. | Written Questions & Answers | Identifying all assets, clarifying transactions, and understanding income history. |

| Requests for Admission | A series of statements the other party must admit or deny. | Written Statements | Confirming undisputed facts (e.g., “the house is marital property”) to narrow issues for trial. |

| Depositions | A live, in-person or virtual Q&A session conducted under oath. | Oral Testimony & Transcript | Assessing witness credibility and digging into complex or disputed financial matters. |

| Subpoenas | A court order compelling a third party to provide information or testimony. | Court Order | Getting records directly from a bank, employer, or business partner. |

These tools, when used skillfully by an experienced attorney, ensure that all relevant financial information is brought into the light, paving the way for a fair and equitable resolution.

Navigating Common Roadblocks in Divorce Discovery

While discovery is built on the idea of transparency, it’s rarely a smooth ride. Knowing the legal and ethical landmines ahead of time is the best way to prepare for the inevitable bumps in the road.

Understanding these challenges helps you protect your rights, meet your legal obligations, and spot when the other side is crossing a line. The entire process of discovery in divorce cases is governed by strict rules, and breaking them can lead to serious penalties. Three concepts are absolutely critical to understand: privilege, spoliation, and sanctions.

Protecting Your Confidential Communications

One of the cornerstones of our legal system is attorney-client privilege. This rule shields the confidential conversations between you and your lawyer from ever being revealed to your spouse or the court.

Think of it as a cone of silence. You need to be able to speak freely and honestly with your attorney about everything—the good, the bad, and the ugly—without fearing your words will be weaponized against you. This protection is what allows your lawyer to give you the best possible advice.

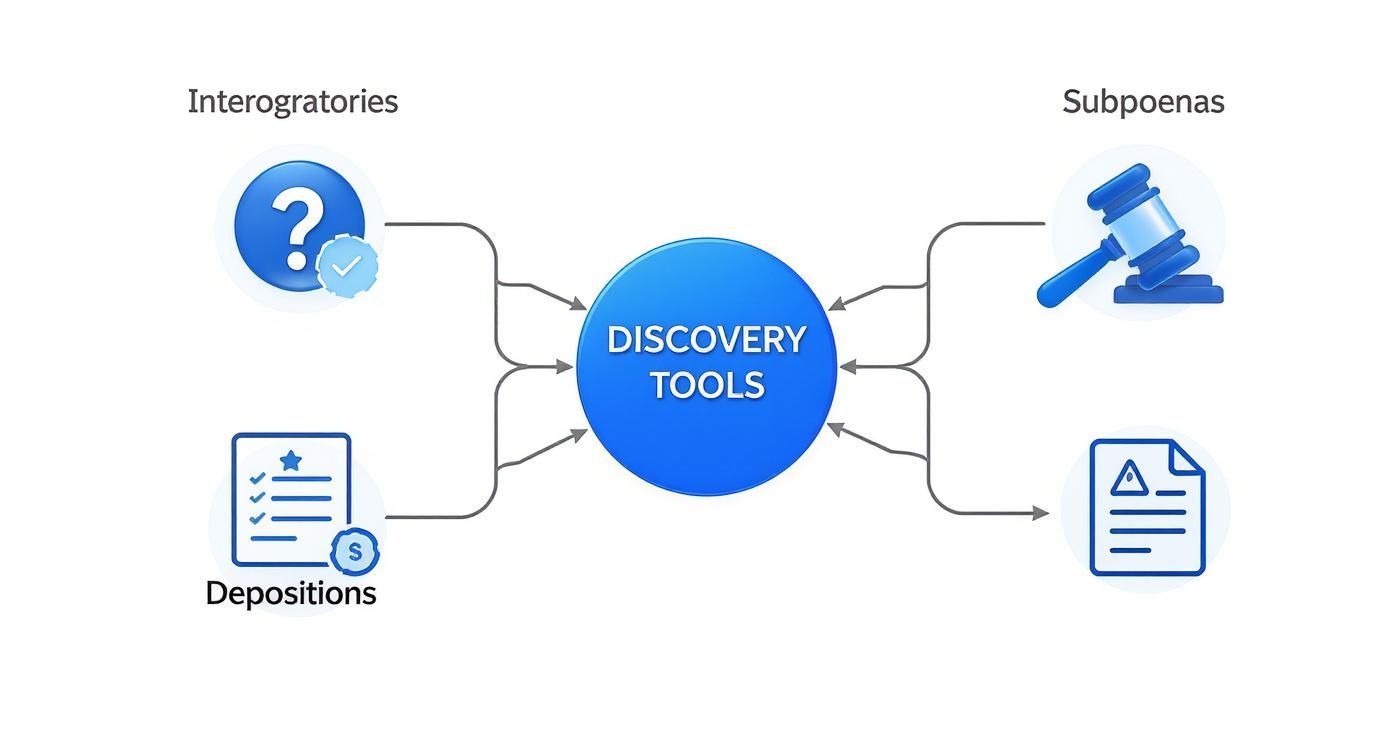

This visual gives a clear overview of the primary tools used to gather information during discovery, forming the backbone of the entire process.

As the diagram shows, each tool—from written questions to formal subpoenas—serves a unique purpose in compelling the disclosure of information to build a comprehensive financial picture.

However, this privilege isn’t unlimited. It only covers communication for the purpose of getting legal advice. A casual chat or cc’ing your attorney on an email to a friend doesn’t automatically make the whole conversation privileged. Always be mindful of who is included in your discussions.

The Serious Offense of Spoliation of Evidence

One of the most severe violations that can happen during discovery is spoliation of evidence. That’s the legal term for intentionally destroying, changing, or hiding documents or information that are relevant to the case.

Imagine your spouse learns you’re filing for divorce and immediately deletes years of emails with their financial advisor about an undeclared offshore account. That act of deletion is spoliation. It’s a blatant attempt to obstruct the truth.

Common examples of spoliation include:

- Deleting Electronic Data: Erasing emails, text messages, or financial files from a computer.

- Shredding Documents: Destroying paper records like bank statements or business ledgers.

- Concealing Assets: Moving money to a secret account and “forgetting” to disclose it.

Spoliation is far more than just being uncooperative; it’s an illegal act that strikes at the very heart of the judicial process. Courts have almost zero tolerance for parties who try to win by hiding the ball.

The consequences for spoliation can be devastating. A judge has the power to issue sanctions to punish the offending party and correct the damage done.

Understanding Sanctions for Non-Compliance

When one party refuses to play by the rules of discovery, a judge can impose sanctions. These are penalties designed to force compliance, compensate the wronged party for their wasted time and money, and punish misconduct.

Sanctions aren’t handed out for minor mistakes. They become necessary when a party repeatedly ignores deadlines, gives dishonest answers, or, as mentioned, engages in spoliation. The penalties get more severe depending on the offense.

Possible sanctions include:

- Monetary Fines: The judge can order the non-compliant spouse to pay the other party’s attorney’s fees for the time spent chasing down the missing information.

- Adverse Inference: The court can instruct a jury (or decide for itself) that whatever evidence was destroyed would have been damaging to the party who hid it.

- Striking Pleadings: In extreme cases, a judge can simply refuse to consider the offending party’s claims, which can lead to a default judgment on key issues.

The unfortunate reality is that some people will go to incredible lengths to hide money from their spouse. To learn more, you can read about why hidden assets are more common than you think and the massive financial mistakes this behavior causes. Uncovering and proving this misconduct is exactly what sanctions are for.

Advanced Discovery for High-Net-Worth Divorces

When significant wealth is on the table, the discovery process isn’t just an exchange of information—it becomes a full-blown financial investigation. Standard requests for bank statements and tax returns are merely the opening act. In a high-net-worth divorce, assets are often intentionally layered within complex legal structures, making them incredibly difficult to find, let alone value and divide.

The stakes are enormous, and the tactics used to hide wealth can be shockingly elaborate. This is where advanced discovery in divorce cases is absolutely critical. It’s less about what’s being willingly disclosed and more about what is being actively concealed. This kind of work requires a specialized team and a meticulous, investigative mindset to ensure a truly fair split of a substantial marital estate.

The Role of Forensic Accountants

In these complex cases, your most valuable player—aside from your attorney—is often a forensic accountant. Think of them as financial detectives. They are specifically trained to follow the money, no matter how convoluted the trail gets.

A forensic accountant doesn’t just review documents; they dissect them, looking for inconsistencies, red flags, and patterns that point to hidden assets or understated income. Their role is multi-faceted and absolutely crucial.

- Asset Tracing: They can meticulously trace funds moved through a web of accounts, businesses, or even offshore entities designed to obscure true ownership.

- Business Valuation: If a family business is involved, a forensic accountant provides an independent, objective valuation, preventing one spouse from lowballing the value of a key marital asset.

- Lifestyle Analysis: By comparing stated income with documented spending (think luxury travel, expensive hobbies, and large purchases), they can expose huge discrepancies and prove an actual income far higher than what’s on the books.

- Uncovering Hidden Income: They are experts at identifying deferred compensation, stock options, and other non-traditional income sources that are frequently overlooked.

Uncovering Sophisticated Financial Structures

High-net-worth individuals often use complex legal and financial instruments to manage and grow their wealth. During a divorce, those same tools can be weaponized to hide it. An advanced discovery strategy is designed to penetrate these structures.

In a high-stakes divorce, discovery is less about asking for what you know and more about finding what you don’t. It requires a proactive, investigative approach that assumes information is being concealed until proven otherwise.

Your legal team will focus on identifying and pulling apart the common hiding places for wealth:

- Shell Corporations and LLCs: Businesses that exist only on paper can be used to hold assets or funnel money. Discovery targets their formation documents, bank records, and transaction histories to expose them.

- Offshore Accounts: Subpoenas and letters rogatory (which are formal requests to foreign courts) may be used to obtain records from financial institutions in other countries, though this can be a long and expensive fight.

- Trusts: Assets placed in certain types of trusts can be difficult to access, but a deep dive into discovery can reveal who truly controls and benefits from them.

- Deferred Compensation Plans: A key objective is uncovering future bonuses, stock options, or retirement benefits that were earned during the marriage but haven’t been paid out yet.

The complexity of divorce discovery is a global issue, often shaped by local laws and culture. For instance, countries with extremely high divorce rates, like Portugal at nearly 94% and Spain over 85%, have developed robust legal frameworks for this process. Likewise, in Russia and Ukraine, where divorce rates exceed 70%, asset disputes are so common that thorough discovery has become critical for reaching fair outcomes.

Protecting Legitimate Privacy and Business Interests

While transparency is the goal, high-net-worth divorces often involve sensitive business information, proprietary data, or trade secrets. The other party doesn’t get a free pass to disrupt a business or access confidential client lists under the guise of discovery.

To strike the right balance, attorneys use what’s called a Protective Order. This is a court-approved agreement that strictly limits who can see sensitive information and how it can be used. For example, it might stipulate that only the attorneys and their financial experts can review proprietary business records, and that the information can’t be used for any purpose outside the divorce litigation itself.

Ultimately, navigating these complexities is precisely why a specialized team is non-negotiable. For a deeper look into the specific steps involved, you can check out our guide on the high-net-worth divorce process for more detailed information.

Your Action Plan for Discovery Preparation

The discovery process can feel like a full-blown audit of your financial life, and frankly, it’s intimidating. But the single most effective way to cut down on the stress, save a small fortune in legal fees, and truly empower your attorney is to get organized before the formal requests start flying.

When you gather your key documents ahead of time, you shift from a defensive, reactive position to one of control. This isn’t just about collecting paperwork—it’s about building the factual foundation of your case. The less time your legal team spends chasing down bank statements, the more time they have to focus on winning strategy.

Start with a Five-Year Financial Snapshot

First things first: you need to create a comprehensive financial history of your marriage. Courts typically want to see the last three to five years to get a clear, unobstructed view of the marital estate.

Start pulling together these essentials:

- Tax Returns: Get complete federal and state returns, with all schedules and attachments, for the past five years.

- Income Verification: Collect your last 12 months of pay stubs, plus all W-2s and 1099s. If you own a business, you’ll need profit and loss statements and balance sheets, too.

- Bank Statements: Download monthly statements for every single bank account (checking, savings, money market) going back three to five years.

- Credit Card Statements: Do the same for all credit cards you or your spouse held, whether joint or individual, during the marriage.

Think of this initial document dump as creating your own financial archive. You’re handing your attorney the raw data needed to analyze income, track spending, and understand how money moved through your marriage.

This groundwork is absolutely fundamental. Your thoroughness here can dramatically streamline the entire discovery in divorce cases and prevent costly, frustrating delays down the line.

To help you get started, here is a checklist of the most common documents requested in divorce discovery.

Essential Document Checklist for Divorce Discovery

Gathering these documents early on gives your legal team a significant head start. Organize them by category and year in a secure digital folder or a physical binder.

| Category | Specific Documents to Collect (Examples) |

|---|---|

| Income & Employment | Pay stubs (last 12 months), W-2s, 1099s, K-1s, employment contracts, bonus/commission statements. |

| Tax Information | Federal & state income tax returns (last 5 years), including all schedules (A, B, C, D, E). |

| Banking & Cash | Checking, savings, and money market account statements (last 3-5 years); records of any cash on hand. |

| Real Estate | Deeds, mortgages, HELOC statements, property tax bills, appraisals, closing statements. |

| Investments | Brokerage account statements (last 3-5 years), 401(k), IRA, pension, and other retirement account statements. |

| Business Interests | Business tax returns, balance sheets, profit & loss statements, shareholder agreements, partnership agreements. |

| Debt & Liabilities | Credit card statements (last 3-5 years), car loan documents, student loan statements, personal loan agreements. |

| Insurance & Benefits | Life insurance policies, health insurance statements, summary plan descriptions for employee benefits. |

| Major Purchases | Receipts or appraisals for significant assets like art, jewelry, vehicles, or collectibles purchased during the marriage. |

This list might seem exhaustive, but every document helps paint a clearer picture and reduces the chance of surprises later.

Catalog Your Assets and Debts

With the historical data in hand, your next move is to create a detailed inventory of everything you own and everything you owe right now. This snapshot, often formalized into a document called a financial affidavit or statement of net worth, is a cornerstone of your divorce case.

Create a simple spreadsheet with two columns: Assets and Liabilities.

Assets to List:

- Real Estate: Include the property address, estimated current market value, and any outstanding mortgage balance for all homes, vacation properties, or investment real estate.

- Vehicles: List every car, boat, or recreational vehicle with its year, make, model, and current loan balance.

- Financial Accounts: Detail all bank accounts, brokerage funds, retirement plans (401k, IRA), and pensions with their most recent balances.

- Valuable Personal Property: Don’t forget significant items like fine jewelry, art collections, or antiques.

Liabilities to List:

- Mortgages and Home Equity Lines of Credit (HELOCs)

- Car Loans

- Credit Card Debt

- Student Loans

- Any Personal or Family Loans

Being meticulous prevents “forgotten” assets or debts from popping up and complicating your settlement negotiations. This preparation is a crucial first step, but remember, it’s just one piece of a much larger puzzle. Choosing the right legal partner to guide you through this journey is just as critical. When you’re ready, learning how to choose the right divorce lawyer will be the most important decision you make.

Answering Your Questions About Divorce Discovery

Even after understanding the tools and tactics of discovery in divorce cases, it’s natural to wonder how this will all play out in your own life. The process can feel invasive and overwhelming. Here, we tackle some of the most common questions to give you straightforward answers and help you face this stage with more confidence.

How Long Does the Discovery Process Usually Take?

This is the million-dollar question, and the honest answer is: it depends. There’s simply no one-size-fits-all timeline. The length is dictated entirely by your case’s complexity and, frankly, how cooperative your spouse decides to be.

In a straightforward divorce where both sides are transparent and the estate is simple, discovery might wrap up in a few months. But things can get drawn out.

Several factors can stretch the timeline significantly:

- A High-Conflict Spouse: If one party is intentionally dragging their feet, being evasive, or just refusing to cooperate, your attorney has to file motions with the court to force compliance. Each step adds weeks or months.

- Complex Assets: Valuing a family business, tracing money through a web of LLCs, or figuring out deferred compensation packages isn’t quick. It requires forensic accountants and other experts, and their work takes time.

- Hidden Assets: If you suspect your spouse is hiding something, the investigation to uncover it can easily prolong the discovery phase for many months, if not longer.

In these more complicated scenarios, it’s not unusual for discovery to last a year or more. Your lawyer can give you a much better estimate based on the specific facts of your situation.

What if My Spouse Hides Assets or Lies During Discovery?

Let’s be clear: intentionally hiding assets or lying under oath isn’t a savvy move—it’s a serious legal violation. Courts have almost no patience for this kind of behavior, which is legally known as perjury or fraud on the court.

If your spouse gets caught playing games with the truth, a judge has sweeping power to impose harsh penalties, called sanctions.

Lying during discovery isn’t just a strategic mistake; it’s a direct challenge to the authority of the court. The consequences are designed to be punitive enough to deter this behavior and rectify the harm it causes.

The fallout for your spouse could be severe:

- Financial Penalties: The court can—and often will—order your spouse to pay every dollar you spent on attorney’s fees and expert costs to expose their deception.

- Unequal Asset Division: A judge might award you a significantly larger share of the marital estate specifically to punish your spouse for their misconduct.

- Adverse Judgments: In the most extreme cases, a judge can simply refuse to listen to your spouse’s financial arguments at all, effectively handing you a win on those issues by default.

This is exactly why a meticulous discovery process is so critical. It creates a formal, sworn record that makes it possible to prove dishonesty and hold the other side accountable.

Can I Refuse to Provide Personal Financial Documents?

Generally, no. You can’t refuse to turn over relevant financial documents just because they feel private. The law demands full financial transparency from both sides to ensure a fair outcome. This means disclosing all information about marital assets, debts, income, and spending.

However, that obligation isn’t a blank check for your spouse’s attorney. Certain information is legally protected, most importantly the attorney-client privilege. Your confidential conversations with your lawyer are completely off-limits.

Your attorney can also object to requests that are completely irrelevant, designed purely to harass you, or are excessively burdensome. For example, a demand for your private medical records from a decade ago would likely be objectionable if it has no bearing on financial matters. Your lawyer files a formal objection, and if the other side insists, a judge makes the final call.

How Important Is Electronic Discovery in a Divorce?

In today’s world, electronic discovery (or e-discovery) isn’t just important—it’s absolutely essential. So much of our financial and personal lives are documented digitally that ignoring this data means you’re almost certainly missing a huge piece of the puzzle.

Think about all the information that now lives exclusively in digital form:

- Emails exchanged with a financial advisor or secret business partner.

- Text messages about major financial moves.

- Social media posts showing a lavish lifestyle that doesn’t match a stated income.

- Documents stashed in the cloud on Google Drive or Dropbox.

- Transaction histories from Venmo, PayPal, or Zelle.

E-discovery is the formal process for getting your hands on this electronic data. It’s how you find the digital breadcrumbs that can lead directly to hidden bank accounts, undisclosed income streams, or proof of marital waste. Sometimes, a single deleted email thread is the smoking gun that proves an offshore account exists. In any modern divorce, a strong discovery strategy has to include e-discovery.

Navigating a complex divorce requires an attorney with the skill and experience to handle every facet of the discovery process. For professionals and high-net-worth individuals, finding legal representation that understands the stakes is crucial. Haute Lawyer Network is a curated directory of the nation’s most respected legal professionals, connecting you with attorneys who are leaders in their field. Find the elite-level legal counsel you deserve by exploring our network.