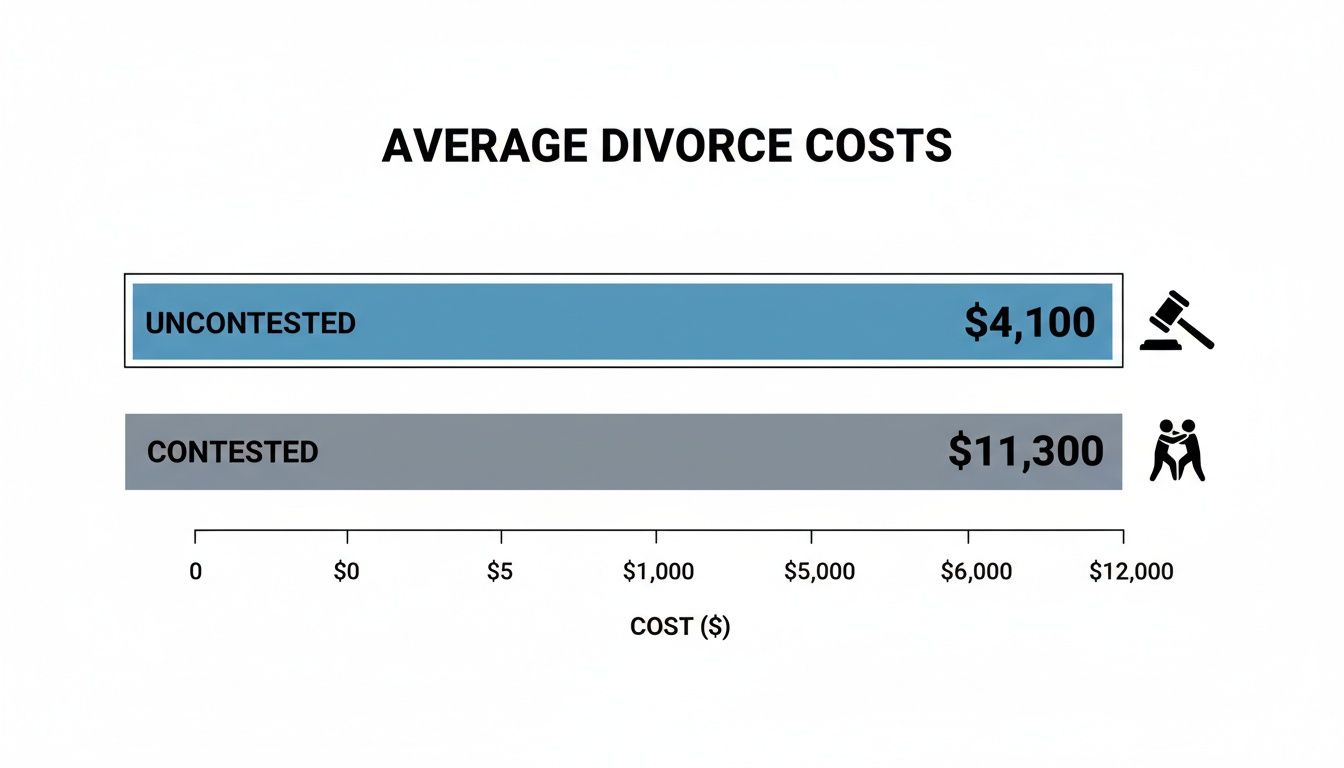

You’ve probably seen the headline figure: the average cost of a divorce in the United States is around $11,300. But that number, on its own, is practically useless. It’s like quoting the average price of a car without specifying if it’s a used sedan or a new Ferrari. For couples who agree on everything, the final bill can be as low as $4,100. For those facing complex, high-conflict battles, costs can easily skyrocket into the tens of thousands.

The final price tag hinges almost entirely on the level of conflict and complexity you and your spouse bring to the table.

The Real Price of Parting Ways

Think of your divorce like a road trip. An uncontested divorce is a straight shot down the highway—the signs are clear, traffic is light, and you get to your destination quickly and with minimal expense. A contested divorce, on the other hand, is like navigating winding mountain roads in a storm. It requires detours, expert navigation, and a whole lot more time and fuel. The path you take directly determines the final cost.

The single biggest factor is whether you and your spouse can agree on the major issues before ever stepping into a courtroom. An uncontested divorce means you’ve already worked out asset division, spousal support, and child custody. This cooperative approach keeps attorneys in a limited, advisory role, which keeps costs way down.

Understanding the Financial Landscape

In stark contrast, a contested divorce means there’s a stalemate on at least one critical issue. This is where the clock starts running. Every disagreement requires attorneys to negotiate, mediate, or, in the worst-case scenario, litigate. Each point of contention adds billable hours and potentially brings in expensive experts, causing the final bill to climb rapidly.

The level of cooperation between spouses is the primary lever that controls divorce expenses. The more you can agree on outside of the courtroom, the more you will save.

To get a clearer picture, it’s helpful to see how these different scenarios impact the bottom line. Research from Martindale-Nolo reveals a massive financial gap between amicable splits and contentious ones. These figures, detailed in the latest divorce cost statistics from 2025, confirm that while averages provide a benchmark, your personal circumstances will ultimately shape your experience.

It’s also important to differentiate these costs from other legal options. For instance, understanding the cost of a legal separation provides another perspective, as the process and financial outcomes can differ significantly.

To help you anticipate what lies ahead, here’s a breakdown of what you can expect to pay based on the level of conflict in your case.

Estimated Divorce Costs by Case Type

The table below summarizes the average costs associated with different divorce scenarios, from simple, amicable agreements to full-blown court battles.

| Divorce Type | Average Estimated Cost | Key Characteristics |

|---|---|---|

| Uncontested / Amicable | $4,100 | Both parties agree on all major issues; minimal legal intervention required. |

| Contested (National Average) | $11,300 | Disputes over one or more issues require negotiation or mediation. |

| Contested with Trial | $20,000+ | Major disagreements require litigation and a judge’s decision. |

Ultimately, these numbers aren’t just statistics; they represent the real-world financial consequences of how a divorce is handled. The more cooperative the process, the more manageable the cost.

Decoding the Bill: Where Your Money Actually Goes

When a legal invoice lands on your desk, it can feel like you need a translator. The line items and unfamiliar terms can be overwhelming, but understanding where your money is going is the first step toward controlling the cost of a divorce. Think of it less as just a bill and more as a detailed map for untangling your financial and personal life from your spouse’s.

Hiring an attorney isn’t just about paying for their time in a courtroom. You’re investing in their strategic expertise, their team’s support, and a whole range of services required to move your case forward and protect your interests.

Attorney Fees: The Engine of Your Divorce Case

The biggest slice of your divorce budget will almost always be attorney fees. Most family law attorneys bill on an hourly basis for their time spent on phone calls, drafting documents, negotiating settlements, and making court appearances. It all starts with a retainer.

A retainer is an upfront payment your lawyer holds in a trust account. It works like a down payment; as your attorney works, they deduct their hourly fees from that fund. Once it runs out, you’ll either need to replenish it or start paying monthly invoices. To truly understand how much a lawyer costs, you have to look at both this initial fee and their ongoing hourly rate.

And it’s not just the lead attorney. This expense also covers the crucial work done by their paralegals and legal assistants, who handle essential prep work and administrative tasks at a lower hourly rate.

This chart makes it crystal clear how quickly costs can skyrocket when conflict enters the equation. A contested divorce can easily cost nearly three times as much as an amicable one.

The data speaks for itself: litigation is the primary driver of high divorce costs. That makes cooperation the single most effective cost-saving strategy you have.

Essential Third-Party and Court-Related Costs

Your attorney’s invoice is only part of the financial picture. The legal system itself, along with the potential need for outside specialists, introduces several other necessary expenses. These aren’t legal fees, but they are unavoidable costs of the process.

These third-party costs can add up and typically include:

- Court Filing Fees: Every divorce starts with a filing fee to open a case with the court. This varies by state and county but usually runs a few hundred dollars.

- Service Fees: After you file, your spouse has to be formally “served” with the divorce papers. This is usually handled by a sheriff’s deputy or a private process server, and it comes with a fee.

- Mediation Costs: If you and your spouse use a mediator to work through disagreements, you’ll split the cost of that neutral third party. While it’s an extra expense, it is almost always far cheaper than battling it out in court.

Hiring an expert isn’t an admission of weakness; it’s a strategic move to ensure fairness and accuracy. When significant assets or the well-being of children are at stake, expert analysis provides the objective data needed for a just resolution.

Calling in the Experts: When Specialized Knowledge is Needed

For more complex cases, your legal team might need to bring in outside experts for specialized analysis. Think of them like specialist contractors you’d hire for a home renovation—they come in for specific, critical jobs that demand a unique skill set.

Common experts in a divorce often include:

- Forensic Accountants: These are the financial detectives of the legal world. They’re essential when you suspect hidden assets, need a business valuation, or have complex investment portfolios to untangle. They trace the money and paint a clear picture of the true marital estate.

- Child Custody Evaluators: In heated custody disputes, the court may appoint a neutral psychologist or social worker. They conduct interviews and observations to recommend a custody arrangement that serves the best interests of the children.

- Appraisers: These professionals determine the fair market value of assets like real estate, art collections, or valuable jewelry to ensure property is divided equitably.

Each of these experts has their own fee structure, which can add thousands of dollars to your total cost. But in high-net-worth or high-conflict situations, their involvement is often a critical investment to secure a fair and legally sound outcome.

The Financial Factors That Drive Up Divorce Costs

Why does one couple’s divorce cost a few thousand dollars while another’s spirals into a six-figure legal battle? The answer isn’t the initial filing fee—it’s the complexity and conflict that flare up along the way. The cost of a divorce isn’t a fixed price; it’s a dynamic figure directly tied to the decisions you and your spouse make.

Think of it like a fire. A small, contained campfire is easy to manage. But when you start adding fuel—anger, mistrust, disagreements over money—it can quickly become an uncontrollable blaze that consumes immense resources. In a divorce, unresolved conflict is the fuel that burns through your finances.

The Impact of High-Conflict Disputes

Conflict is the single biggest driver of divorce costs. Every argument, every refusal to compromise, and every emotional battle translates directly into billable hours for your attorney. A simple disagreement over who keeps the living room furniture can generate hours of back-and-forth emails and negotiations, each adding to your final bill.

When emotions are running high, rational decision-making often takes a backseat. Spouses may dig in their heels on minor points out of principle or spite, forgetting that every hour spent fighting costs them real money. This is where costs can escalate exponentially, turning a manageable legal process into a financially draining ordeal.

These disputes often demand a formal discovery process, where lawyers must legally compel the other party to share financial information or answer questions under oath. This is a necessary but often lengthy process and a primary reason high-conflict cases become so expensive. You can learn more about how this works by reading our detailed guide on discovery in divorce cases.

Complex Marital Assets and Finances

Beyond emotional conflict, the sheer complexity of a couple’s financial life plays a huge role. Untangling a simple financial portfolio with one house, two cars, and a few bank accounts is relatively straightforward. But the situation changes dramatically when significant or complex assets are involved.

This financial complexity almost always requires bringing in outside experts, adding another layer of expense. These situations typically involve:

- Business Valuations: If one or both spouses own a business, a forensic accountant must be hired to determine its true value for equitable division.

- Executive Compensation: Dividing assets like stock options, deferred compensation, or complex retirement plans requires specialized financial and legal knowledge.

- Hidden Assets: If one spouse suspects the other is hiding money, a forensic accountant may be needed to trace financial records and uncover the full marital estate.

- Real Estate Portfolios: Valuing and dividing multiple properties, including vacation homes or rental units, adds significant time and appraisal costs.

The more intricate your financial picture, the more specialized expertise is required to ensure a fair and equitable settlement. This expertise is a necessary investment to protect your long-term financial health.

Battles Over Children and Support

Finally, disputes over child custody and spousal support are major cost drivers. These issues are deeply personal, making them ripe for prolonged and expensive legal fights. When parents can’t agree on a custody arrangement, the court may order a custody evaluation.

A custody evaluator, usually a psychologist, conducts an in-depth investigation to recommend what is in the children’s best interests. This process is both time-consuming and expensive, often adding $5,000 to $15,000 or more to the total cost of a divorce.

Similarly, disagreements over spousal support (alimony) can lead to protracted litigation. Attorneys must analyze incomes, earning potential, and marital lifestyle, which becomes incredibly contentious if the parties are far apart in their expectations. Each of these factors adds more fuel to the financial fire, underscoring the value of finding common ground wherever possible.

Strategic Pathways to a More Affordable Divorce

Knowing what drives up the cost of a divorce is the first step. The next is choosing a path that actively protects your finances and sanity. Fortunately, the traditional courtroom slugfest isn’t your only option. Smarter alternatives like mediation and collaborative divorce offer a more controlled, cooperative, and cost-effective way forward.

These aren’t just “cheaper” routes; they are fundamentally better choices for many couples. By committing to resolve your issues outside of a courtroom, you and your spouse keep control over the outcome, prevent legal fees from draining your assets, and often craft more stable, agreeable settlements.

Embrace Mediation for Guided Negotiation

Mediation is one of the most powerful tools for lowering divorce costs. In this process, you and your spouse hire a single, neutral third-party mediator to help you negotiate the terms of your agreement. The mediator doesn’t impose decisions—they facilitate productive conversations and help you find common ground.

Think of a mediator as a skilled mountain guide. They know the treacherous terrain, can point out the hazards, and keep both parties focused on reaching the summit together, safely.

The financial upside is clear. You’re splitting the cost of one professional instead of paying two opposing attorneys to battle it out. Successful mediation completely sidesteps the staggering expense of trial preparation and court appearances.

Consider Collaborative Divorce for a Team-Based Approach

Collaborative divorce elevates cooperation to the next level. In this highly structured process, both you and your spouse hire specially trained collaborative attorneys. Critically, everyone signs a formal agreement not to go to court. This single commitment shifts the entire dynamic from adversarial to solution-focused.

The process feels more like a boardroom negotiation than a courtroom fight. You assemble a team of professionals—often including a neutral financial expert and a family specialist—who work together to find the best possible outcome for everyone involved. It’s particularly effective for divorces with complex finances or where children’s well-being is the top priority.

The bedrock of collaborative divorce is a commitment to transparency and creative problem-solving. By taking litigation off the table, both sides are motivated to negotiate in good faith, which drastically cuts down on conflict and, by extension, cost.

While it involves more professionals than mediation, the collaborative process is still far less expensive than traditional litigation. It provides a supportive framework designed to resolve disputes respectfully and efficiently.

Key Differences in Approach

The right path depends entirely on your specific situation and, frankly, the level of communication you still have with your spouse. Here’s a quick breakdown.

| Feature | Mediation | Collaborative Divorce | Traditional Litigation |

|---|---|---|---|

| Primary Goal | Facilitate agreement | Jointly create a settlement | “Win” in court |

| Control Level | You and your spouse | You and your spouse | The judge decides |

| Team Structure | One neutral mediator | A team of professionals | Opposing legal teams |

| Cost | Low to moderate | Moderate | High to very high |

Unbundled Services for Targeted Legal Help

Even if a fully cooperative approach isn’t in the cards, you can still rein in costs with unbundled legal services. Sometimes called limited-scope representation, this lets you hire an attorney for specific, well-defined tasks.

Need someone to draft your settlement agreement? Review documents your spouse’s attorney prepared? You can hire a lawyer just for that. This à la carte approach ensures you get expert legal guidance precisely where you need it most, without signing a blank check for full representation. It’s a practical way to keep the final cost of a divorce under control.

The Hidden and Long-Term Financial Impact of Divorce

Getting the final legal bill for your divorce might feel like crossing the finish line, but it’s really just the end of the first lap. The true cost of a divorce goes far beyond what you pay your attorney, revealing itself slowly over the following months and even years. These hidden financial impacts are often the most jarring, permanently shifting your financial reality in ways most people never see coming.

It’s a common and costly mistake to think that final invoice closes the book on divorce expenses. In reality, untangling a shared life creates a ripple effect of new costs that touch everything from housing and taxes to retirement planning. Getting ahead of these downstream expenses is absolutely critical if you want to find genuine financial stability after the legal battle is over.

The Immediate Shock of a New Financial Reality

One of the first and most significant changes is the sticker shock of setting up and running two separate households on an income that once supported just one. This isn’t just about finding a new apartment; it’s about taking on a whole new set of bills that never go away.

This duplication of costs is a primary reason the financial aftermath of a divorce can feel so brutal. All of a sudden, you’re on the hook for:

- Housing Costs: This means a new mortgage or rent payment, but don’t forget the security deposit, utility setup fees, and the cost of furnishing an entire home from scratch.

- Duplicate Bills: You’ll now have your own bills for utilities, internet, insurance, and dozens of other services that were once shared.

- Refinancing Debt: If one spouse keeps the family home, they will almost certainly have to refinance the mortgage to remove the other’s name. That comes with closing costs and, often, a higher interest rate.

The most profound financial shift in a divorce is moving from a two-person economic unit to a single-income household. This change requires a complete re-evaluation of your budget, spending habits, and long-term financial goals to avoid unexpected hardship.

For families with kids, the impact of this income split is particularly severe. Research shows that families with children who were not poor before a divorce can see their income plummet by as much as 50%. In fact, nearly half of parents with children fall into poverty after their marriage ends, a burden that disproportionately falls on women. You can learn more about the economic consequences of divorce from these statistics.

Unseen Tax Consequences and Asset Division

On paper, dividing assets seems simple enough. But the tax implications can create enormous financial surprises down the road. Not all assets are created equal from a tax perspective, and ignoring this fact can lead to a settlement that feels fair but is anything but.

For instance, receiving $200,000 from a pre-tax retirement account is not the same as getting a $200,000 house. Those retirement funds will be taxed when you withdraw them, slashing their real-world value. Meanwhile, the house comes with its own property taxes and potential capital gains taxes if you decide to sell. A sharp financial advisor is essential for navigating these minefields.

The Long Shadow on Retirement and Future Earnings

Perhaps the biggest long-term financial casualty of divorce is retirement savings. When you split a 401(k) or pension, both spouses are left with a smaller nest egg and far less time to rebuild it. For many, this means pushing back their retirement date or drastically adjusting their vision for their golden years.

Dividing retirement assets usually requires a Qualified Domestic Relations Order (QDRO), which is a special legal document that tells the plan administrator how to split the funds. Just preparing this document comes with its own fees, adding yet another layer to the overall cost of divorce.

On top of all this, a divorce can completely derail a career, especially for a spouse who stepped out of the workforce to raise children. Getting back into the job market is tough. It might require going back to school or getting new training, which further delays their ability to save and invest for the future. Understanding and planning for these long-term financial hurdles is every bit as important as managing the immediate legal fees.

Building Your Financial Future with Confidence

Trying to get a handle on the complexities of a divorce can feel like navigating a storm, particularly when your financial future is on the line. The cost of a divorce isn’t a single line item on an invoice. It’s an accumulation of legal bills, expert consultations, and long-term financial shifts that will define your life for years to come.

But understanding this landscape is the first step toward taking back control.

Knowledge and strategic preparation are your greatest allies. Once you recognize what drives expenses—from high-conflict custody battles to the intricate division of a business—you can start making choices that protect your financial health. Every decision, whether it’s choosing mediation over litigation or simply preparing your financial documents meticulously, puts you back in the driver’s seat.

Investing in Your New Beginning

Hiring the right legal counsel isn’t just another expense. It’s arguably the single most critical investment you’ll make in your post-divorce future. A top-tier attorney does far more than file paperwork; they deliver the strategic guidance needed to shield your assets, champion your interests, and build a stable foundation for the next chapter of your life.

Their experience helps you sidestep the expensive blunders that can plague a divorce, ensuring the final settlement is not only fair but sustainable. This professional partnership is what transforms a potentially chaotic and destructive process into a structured, manageable transition.

Viewing your legal representation as an investment rather than a cost is a critical mindset shift. It focuses on the long-term value of securing a stable financial future, not just the short-term expense of the divorce itself.

Ultimately, the goal is to move forward with security and confidence. The journey might be challenging, but it doesn’t have to be financially devastating. By taking deliberate, actionable steps now, you can protect what you’ve built and set the stage for a prosperous future.

The most important step you can take today is to seek an expert consultation to map out a clear course toward the best possible outcome for your specific circumstances.

Common Questions About the Cost of Divorce

When you’re facing a divorce, the financial unknowns can feel overwhelming. People often have very specific questions about where the money goes and what they can expect. Let’s clear up a few of the most common concerns.

Does Filing First Make It More Expensive?

It’s a persistent myth that the person who files for divorce—the petitioner—ends up paying more. The reality is that filing first has almost no impact on the total cost.

The petitioner does pay the initial court filing fee, but that’s a minor administrative cost in the grand scheme of things. The real drivers of expense are conflict and complexity, not who started the paperwork. Each spouse is responsible for their own attorney, and the costs for shared experts are typically divided.

Can a Judge Force My Spouse to Pay My Legal Fees?

It can happen, but it’s not the default. A court has the power to order one spouse to cover the other’s attorney fees, but this is usually reserved for situations where there’s a clear imbalance.

This typically occurs when one spouse has significantly more income or controls all the marital assets, leaving the other without the resources for proper legal representation. A judge might also do it to penalize a spouse who acts in bad faith—for instance, by hiding assets or intentionally dragging out the proceedings. Your attorney has to make a formal request, and the judge makes the final call.

Ordering one spouse to pay the other’s legal fees is a tool the court uses to level the playing field and ensure both parties have fair access to legal counsel, particularly when one spouse controls the couple’s finances.

Is Mediation Guaranteed to Be Cheaper?

Mediation is almost always a more cost-effective path than a full-blown trial. It swaps the courtroom battlefield for a structured negotiation, which can save you tens of thousands in legal fees by cutting out lengthy preparations and multiple hearings.

But there’s a catch: its success hinges entirely on both people being willing to negotiate honestly. If mediation breaks down because one person refuses to compromise, you’ll end up in court anyway. In that case, you’ve paid for the failed mediation and the expensive litigation that follows, making it the worst of both worlds financially.

The single most important investment you can make in your financial security is hiring the right legal expert. The Haute Lawyer Network provides access to a curated selection of the nation’s premier attorneys, ensuring you get sophisticated guidance to protect what matters most. Explore the network and find the right counsel for your needs.