Yes, you can absolutely have two power of attorneys. In fact, for anyone managing significant assets or navigating complex family dynamics, appointing multiple agents isn’t just possible—it’s often the smartest strategy.

The Quick Answer: Yes, You Can Have Multiple Power of Attorneys

Many people mistakenly believe a power of attorney (POA) means one person gets the keys to the kingdom. But the law is far more flexible, allowing you to create multiple POA documents or name more than one agent to gain precise control over your affairs.

Think of it as assembling a personal board of directors. You wouldn’t ask your doctor to manage a stock portfolio, and you wouldn’t ask your accountant to perform surgery. The same logic applies here. By assigning different roles to different people, you ensure the most qualified individual is handling each specific responsibility.

This “divide and conquer” approach is about more than just having a backup; it’s about strategic delegation. It eases the immense burden on any single person and minimizes the risk of burnout or costly mistakes.

Two Primary Ways to Appoint Multiple Agents

When you decide to grant decision-making authority to more than one person, there are two main ways to structure the arrangement. Each serves a different purpose and comes with its own set of rules.

You can set this up using either separate documents for distinct roles or by naming multiple agents within a single document.

Before diving into the specifics, it’s helpful to see these structures side-by-side.

Common Structures for Appointing Multiple Agents

This table outlines the primary legal structures for appointing more than one agent, either in a single document or across multiple documents.

| Structure Type | How It Works | Best Suited For |

|---|---|---|

| Separate Documents | Create one POA for financial matters and a separate one for healthcare. Each document names the ideal agent for that specific domain. | Aligning specialized expertise with the role (e.g., a CPA for finances, a trusted sibling for healthcare). This is the most common approach. |

| Co-Agents (Joint) | Name two or more agents in one document who must act together and agree on all decisions. Unanimous consent is required. | Situations requiring maximum oversight and accountability, where you want a built-in “checks and balances” system. |

| Co-Agents (Several) | Name two or more agents in one document who can act independently of each other. Either agent can make decisions alone. | Providing flexibility and convenience, especially if agents live in different locations. It avoids delays if one agent is unavailable. |

| Successor Agents | Name a primary agent and then one or more backup agents who only step in if the primary agent is unable or unwilling to serve. | Creating a clear line of succession and ensuring there’s always someone ready to act without interruption. |

Each of these methods provides a different level of control and flexibility, making it critical to choose the one that best fits your family’s dynamics and financial situation.

Let’s break down the two most fundamental approaches:

- Separate Documents for Separate Roles: This is the cleanest and most widely recommended method. You can create one POA for your finances and a completely separate one for your healthcare decisions, a practice endorsed across the US and UK. We’ll explore the benefits of multiple POA documents in more detail later.

- Multiple Agents in a Single Document: You can also name two or more individuals, known as co-agents, within a single POA. Your document must then spell out how they can act—either jointly (requiring them to agree on everything) or severally (allowing each to act alone).

The core benefit of having two power of attorneys is aligning expertise with responsibility. It lets you put your complex financial life in the hands of a savvy professional while entrusting deeply personal health decisions to a compassionate family member who knows you best.

This foundational understanding sets the stage for a deeper dive into how to implement this powerful strategy effectively, ensuring every aspect of your life is protected by the most capable hands.

Why Appointing Multiple Agents Is a Smart Strategy

Naming more than one agent isn’t just a matter of what the law allows; it’s a sophisticated strategic decision. Consider the immense responsibility you’re handing over. You’re effectively asking one person to be your financial guru, a clear-headed healthcare advocate, and a logistical wizard all at once.

Let’s be realistic. Finding a single person who excels in all those domains is a tall order. The family member who brilliantly manages a complex stock portfolio might not be the one you’d trust to make nuanced, deeply personal medical decisions. This is precisely where a multi-agent approach proves its worth, letting you assemble a team of specialists.

Leveraging Expertise for Better Outcomes

The core advantage of appointing multiple agents is simple: you can align specific duties with specialized skills. This division of labor becomes mission-critical for high-net-worth individuals and business owners, whose personal and professional lives are often layered with complexity.

Think about these common scenarios:

- Business vs. Personal: You could appoint your business partner—the one who knows your company’s operations inside and out—to manage corporate assets under a limited POA. At the same time, a trusted family member could be empowered with a separate durable POA to handle personal finances, from paying household bills to managing liquid assets.

- Financial vs. Healthcare: You might name your financially-astute child to oversee your investment accounts and real estate holdings, while your other child, a nurse, is designated as your healthcare agent. Each one operates squarely in their zone of genius.

This structure doesn’t just produce better, more informed decisions. It also creates a powerful system of checks and balances. When duties are clearly segregated, you inherently reduce the risk of mismanagement or simple oversight in any one area.

Appointing multiple agents elevates a power of attorney from a simple delegation of authority into a sophisticated management plan. It ensures every facet of your life is protected by someone with the right expertise for the task.

Preventing Agent Burnout and Reducing Risk

Placing the entire weight of your financial and medical life on one person’s shoulders is a recipe for burnout. The pressure can be immense, leading to stress, indecision, and even costly mistakes. By distributing these duties, you lighten the load for everyone involved.

This strategy also acts as a crucial safeguard against potential conflicts of interest or abuse of power. With separate agents for finance and healthcare, for example, neither one can make a decision in their domain that’s improperly influenced by the other. It’s a clean separation that protects both your well-being and your assets.

This isn’t just a niche strategy; public awareness is growing. In 2023, the United Kingdom saw a record-breaking surge in Lasting Power of Attorney registrations, with over 1.1 million applications filed. This 37% increase underscores a rising public understanding that having two distinct POAs—one for finances and another for health—offers far more comprehensive protection. You can explore more about these record-breaking statistics and their implications for modern estate planning.

Understanding Co-Agents Versus Successor Agents

Deciding you want multiple agents is a major step. The next critical choice determines how they will work: together at the same time, or one after another? This distinction separates co-agents from successor agents, and your choice has massive practical consequences for how your affairs are managed down the road.

Think of co-agents as business partners you appoint to serve simultaneously, sharing the authority from day one. In contrast, successor agents are like a chain of command. You name a primary agent, then a backup (or several backups) who only step in if the person before them is unable to serve.

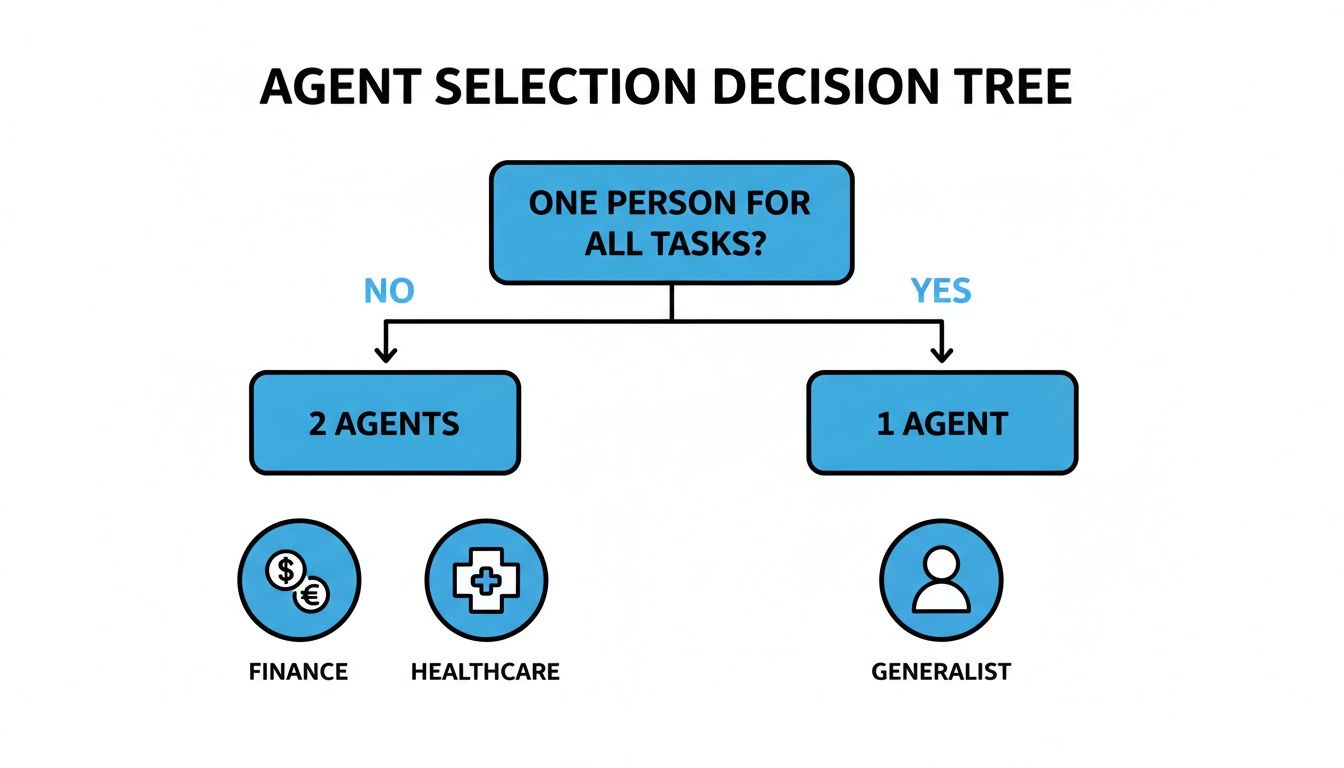

This decision tree helps visualize that initial choice between a single, trusted agent and a specialized two-agent team.

As the graphic illustrates, the fundamental split is between appointing one person for everything versus creating a specialized team for financial and healthcare matters.

The Role Of Co-Agents

When you appoint co-agents, you introduce a collaborative element into your power of attorney. However, the document must be crystal clear about how that collaboration works. There are two primary ways co-agents can be instructed to act:

- Acting Jointly: This requires all co-agents to agree and act in perfect unison. Think of it like a board of directors needing a unanimous vote for every decision. This provides a powerful layer of checks and balances but can lead to frustrating delays or complete gridlock if your agents disagree.

- Acting Jointly and Severally: This structure offers maximum flexibility. It empowers each co-agent to act independently without needing the other’s approval. If one agent is traveling, the other can still pay the bills or handle an emergency. While convenient, it does reduce oversight.

Appointing co-agents to act “jointly” prioritizes security and consensus, while “jointly and severally” prioritizes efficiency and convenience. The right choice depends entirely on your family dynamics and personal tolerance for risk.

The Role Of Successor Agents

Choosing successor agents is a much more linear, straightforward approach. It creates a clear line of succession, ensuring there is no gap in coverage if your first choice can no longer serve due to death, disability, or resignation.

For example, you might name your spouse as your primary agent and your adult child as the first successor agent. Your child would have zero authority unless and until your spouse is formally unable to fulfill their duties. This structure avoids the potential for conflict between co-agents but relies heavily on the availability of that single primary agent. It’s a vital safety net.

A Comparison Of Co-Agents And Successor Agents

To make the distinction even clearer, let’s break down how these two approaches compare in practice. The table below outlines the key operational differences and the strategic pros and cons of each.

| Feature | Co-Agents (Acting Jointly & Severally) | Successor Agents |

|---|---|---|

| Authority | All agents have power simultaneously. | Only the primary agent has power; successors are on standby. |

| Decision-Making | Can be required to act together (jointly) or independently (severally). | The acting agent makes decisions alone. |

| Best For… | Situations requiring multiple skill sets (e.g., finance and healthcare). | Ensuring continuity if the primary agent becomes unavailable. |

| Primary Advantage | Collaboration, shared workload, and built-in oversight (if acting jointly). | Simplicity, clarity, and avoidance of potential agent conflicts. |

| Potential Drawback | Risk of disagreement, deadlock (jointly), or uncoordinated actions (severally). | A single point of failure if the primary agent is unavailable and the successor transition isn’t smooth. |

Ultimately, successor agents provide a backup plan, while co-agents create a team. Your family’s unique situation and the complexity of your assets will determine which structure provides the best protection.

Navigating the Common Pitfalls of Multiple POAs

Appointing multiple agents can be a brilliant strategic move, but it’s a double-edged sword. Without meticulous planning, you risk creating legal landmines instead of safeguards, turning a well-intentioned plan into a recipe for disaster.

The single biggest risk? Agent disputes. Imagine appointing your two children as co-agents, requiring them to act jointly on financial matters. What happens when one wants to sell a family property during a market high, but the other refuses, citing sentimental value? You’ve just created a stalemate, paralyzing your entire estate plan when you need it to function most.

Avoiding Decision-Making Gridlock

A poorly drafted document is almost always the culprit behind these conflicts. Vague language or conflicting instructions can leave your agents unable to act, and banks or hospitals may outright reject the document if their authority isn’t crystal clear. This can cause dangerous delays in critical moments.

The solution lies in precision. Your Power of Attorney must explicitly define each agent’s authority and, more importantly, provide a clear mechanism for resolving disagreements before they start.

Don’t let ambiguity undermine your intentions. The most effective power of attorney documents anticipate conflict and include clear, legally enforceable instructions to overcome it, ensuring your wishes are always carried out.

The Power of Precise Drafting

To head off these issues, your attorney can include specific clauses that serve as a roadmap for your agents. These aren’t just suggestions; they are legally binding instructions designed to eliminate confusion and prevent conflict from derailing your plan.

Key drafting solutions include:

- Tie-Breaker Clauses: Designate a trusted third party—like a family friend, accountant, or attorney—who has the final say if your co-agents reach an impasse.

- Clearly Defined Roles: If you’re using separate POAs for finance and healthcare, make sure the documents don’t have overlapping or conflicting powers. The lines must be sharp.

- Independent Authority: Consider appointing co-agents to act “jointly and severally.” This allows one agent to proceed if the other is unavailable or uncooperative, preventing a single person from holding the entire process hostage.

Appointing multiple agents across two or more POAs is a legally sound strategy in the US, UK, and beyond, offering layered protection when planned correctly. You can learn more about how these designations provide diverse input on nolo.com.

Knowing when a POA becomes active is also crucial; find out more by reading our guide about when a power of attorney expires. Armed with this knowledge, you can have a much more effective conversation with your attorney to build a truly resilient plan.

How to Choose and Appoint Your Agents

Selecting your agent is arguably the most critical decision in this entire process. You are entrusting someone with immense power over your life and assets. This choice must be about unwavering trust, not just a title or family obligation.

This isn’t a simple legal formality; it’s a deeply personal decision. The right individual will act as your loyal advocate, stepping into your shoes to execute your wishes with integrity and care when you no longer can.

The Non-Negotiable Qualities of a Great Agent

Before you start naming names, you need to evaluate potential candidates against a clear set of standards. A truly effective agent embodies a unique combination of character, skill, and assertiveness.

Look for these core qualities:

- Unwavering Integrity: This is the bedrock of the relationship. Your agent must be someone you trust implicitly to act in your best interests, without exception.

- Financial Savvy: For a financial POA, your agent should be organized, responsible with their own money, and capable of understanding financial documents. They don’t need to be a Wall Street trader, but competence is non-negotiable.

- Assertiveness and Advocacy: A healthcare agent must be a champion for your medical wishes. They need the confidence to speak with doctors, ask tough questions, and ensure your directives are followed, even under intense pressure.

Choosing the right person involves more than a gut feeling. It requires a thoughtful assessment of their skills, location, and willingness to take on this significant role. Finding a qualified professional is often the best first step, and you can learn more about how to find an estate planning attorney near me to guide you through this complex process.

The Critical Conversation Before Appointment

Once you have a shortlist of candidates, the next step is absolutely vital: you must have an open and honest conversation with each of them. Naming someone as your agent without their full consent is a recipe for disaster.

Your agent’s role is not a surprise honor; it is a profound responsibility that requires their explicit and willing acceptance. An informed agent is an effective agent.

In this discussion, clearly explain the duties they would be undertaking. Give them a chance to ask questions and express any reservations. This conversation ensures they understand the scope of the role and are genuinely prepared to accept the responsibility. By securing their agreement beforehand, you build a foundation of mutual understanding that will prove invaluable in the years to come.

Drafting Your POA Documents with Precision

The true power of your multiple-agent strategy lies in the specific words used in your legal documents. A generic, off-the-shelf power of attorney form is a recipe for conflict. Precision in drafting is what elevates your POA from a simple document into an ironclad shield for your legacy.

Vague language creates ambiguity, and ambiguity is the breeding ground for disputes. The goal is to leave absolutely no room for interpretation, ensuring banks, hospitals, and your agents understand their roles perfectly. It starts with a clean separation of powers, preventing any overlap between your financial and healthcare directives.

For instance, your financial POA should grant specific authority over banking and investments, while the healthcare POA must focus exclusively on medical decisions. Without this crisp distinction, you risk an agent overstepping their bounds or, worse, having an institution reject the document because of conflicting instructions.

Defining How Your Agents Must Act

One of the most critical decisions you’ll make is how your co-agents must function. Your document must state explicitly whether they can act severally (independently) or must act jointly (requiring unanimous agreement).

- Sample Language for “Severally”: “My agents, Jane Doe and John Smith, may act severally. The authority of one agent is not dependent on the consent of the other, and either may act alone on my behalf.”

- Sample Language for “Jointly”: “My agents, Jane Doe and John Smith, must act jointly. Any action taken on my behalf requires the written consent of both agents.”

The difference between “jointly” and “severally” is monumental. “Severally” offers flexibility and speed, while “jointly” provides a powerful check and balance but risks total gridlock if your agents disagree.

This is precisely where a skilled attorney proves their worth. To prevent such a deadlock, they will often build in a dispute resolution mechanism. This could involve naming a trusted third-party tie-breaker—like a family lawyer or accountant—who can make the final call when your agents can’t agree. Provisions for agent compensation and removal are also essential for creating a comprehensive and resilient plan that truly protects your interests.

Frequently Asked Questions About Appointing Multiple Agents

Even with a clear strategy, bringing multiple agents into your power of attorney plan can raise some practical questions. Here are straightforward answers to the issues that come up most often.

What Happens If My Two Co-Agents Disagree?

This is a critical risk you have to plan for. If your document requires co-agents to act jointly, a disagreement means everything grinds to a halt. No action can be taken, which could be disastrous during a crisis.

To prevent this deadlock, most experienced attorneys recommend one of two solutions. You can either let them act jointly and severally (meaning either can act alone) or build in a tie-breaker clause. This clause names a trusted third party who gets the final say, ensuring a dispute doesn’t paralyze your financial or medical affairs.

Can I Have One POA for My Business and Another for Personal Finances?

Absolutely, and for business owners, this is often the smartest approach. You can draft a specific, limited power of attorney just for your business operations and name your partner or a key executive as the agent. They’ll have the authority to handle things like payroll, vendor contracts, and other daily management tasks.

At the same time, you can have a completely separate, comprehensive durable power of attorney for your personal finances, naming a spouse or trusted family member. This compartmentalizes responsibilities, putting the right people with the right expertise in charge of each domain.

How Do I Revoke One Power of Attorney If I Have Two?

Revoking a power of attorney is a formal process. You must create a signed, written document called a “Revocation of Power of Attorney,” and it’s crucial that you are legally competent (of sound mind) when you do so.

Next, you have to deliver a copy of that revocation to the agent you’re removing. You also need to send it to every institution—banks, brokerage firms, hospitals—that has the original POA on file. If you have two distinct POA documents, you can revoke one without affecting the other, as long as your revocation notice clearly identifies which specific document is being terminated. For certain specialized POAs, like those used by service members, it’s wise to look at the specific rules for how a military power of attorney is created and dismantled.

Sophisticated estate planning is the cornerstone of protecting your assets and legacy. The Haute Lawyer Network provides direct access to elite attorneys who specialize in crafting customized, resilient plans for high-net-worth clients. To find a legal expert who can build an effective power of attorney strategy tailored to your unique needs, visit https://hauteliving.com/lawyernetwork.