Trying to build a law firm without a business plan is like walking into a trial without a case strategy—you’re leaving success entirely to chance. It’s a common mistake, especially for solo and small firm attorneys, to see it as a one-and-done document just to secure a bank loan.

That thinking is a trap. In reality, a business plan is your living, breathing guide for making smarter, more intentional decisions every single day.

Why Your Law Firm Needs a Real Business Plan

This document is the foundation for a practice that doesn’t just survive—it thrives. It gives you the clarity to navigate the chaos of the modern legal market, from adopting new tech to carving out a profitable niche.

A well-crafted business plan forces you to move from being a lawyer who owns a business to a business owner who practices law. This mindset shift is the single most important factor for achieving sustainable growth and profitability.

The legal industry is changing fast, and strategic planning is no longer optional. Client expectations, technology, and competition are reshaping everything. For instance, solo practices now make up roughly 40% of all law firms, and these smaller, agile firms are often the ones pushing innovation forward.

Consider this: about 40% of solo firms are planning to adopt AI technology soon. That’s a rate nearly 10% higher than their larger counterparts. This is the kind of market shift a good business plan helps you anticipate and act on.

This isn’t about creating a rigid, hundred-page document that gathers dust on a shelf. It’s about building a practical framework that nails down the core pillars of your firm:

- Strategic Direction: What’s your mission? Who is your ideal client? Where are you headed?

- Market Positioning: Who are you up against, and what makes you the obvious choice?

- Financial Health: Where is the money coming from? How will you manage cash flow? What are your real financial targets?

- Operational Efficiency: What tech do you need? Who do you need to hire? What does your client service process look like?

Ultimately, this plan becomes your firm’s north star. It ensures every decision—from hiring a paralegal to launching a marketing campaign—aligns with your ultimate goals. If you’re just starting out, our founder’s guide on how to start a law firm provides the foundational knowledge you’ll need for this journey.

Defining Your Firm’s Mission and Vision

Let’s be honest. The executive summary is the first—and often the only—part of your business plan a potential partner or lender will actually read. This isn’t the place for a dry, boilerplate overview. It’s your firm’s story, distilled into a compelling narrative that proves you have a clear purpose and a real shot at success.

A powerful executive summary is built on something fundamental: your mission and vision. Think of this as your firm’s DNA. It explains why you exist, who you serve, and where you’re headed. This is how you stop being “just another family law firm” and start defining why you’re the only one that matters to your ideal client.

From Core Services to a Compelling Story

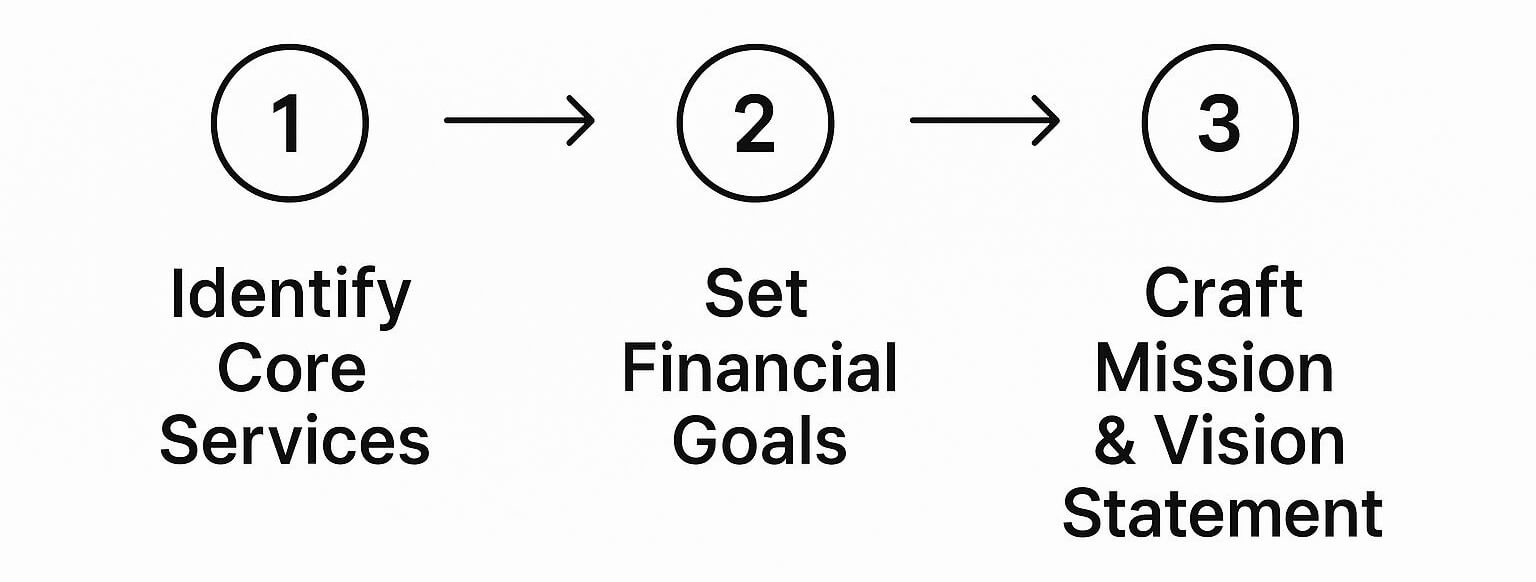

Before you can write an inspiring mission statement, you have to get brutally honest about the fundamentals. This means clearly identifying your core services, setting tangible financial goals, and then weaving those practical elements into a unified, powerful statement.

This process ensures your mission isn’t just a collection of nice-sounding words but a true reflection of your business strategy. It’s about connecting the dots.

As you can see, a strong mission is the result of strategic decisions, not the starting point. It connects the practical realities of your firm—what you sell and how you make money—to your ultimate purpose.

For example, a firm specializing in estate planning for small business owners might define its mission as “preserving entrepreneurial legacies for generations.” This immediately connects their core service (estate planning) with a deeper client pain point, making their value proposition infinitely stronger.

Crafting Statements That Resonate

Your mission statement is your firm’s “why” right now. It defines your purpose and what you do every day for your clients. It needs to be concise, client-focused, and action-oriented.

- Don’t say this: “To provide high-quality legal services.” (This is generic and means nothing.)

- Say this instead: “To empower tech startups with accessible, flat-fee legal counsel, helping them navigate growth and secure funding with confidence.”

Your vision statement, on the other hand, is about the future you want to build. It’s aspirational. It paints a picture of your firm’s long-term impact that gets your team fired up and attracts clients who believe what you believe.

Your vision should be ambitious enough to inspire action but grounded enough to be believable. It answers the question: “If we are wildly successful, what will our firm have accomplished in ten years?”

Imagine a firm that wants to completely overhaul the client experience in family law. Their vision might be: “To become the most client-centric family law firm in the region, known for using technology to create transparent, stress-free resolutions for families in transition.”

That single statement sets a clear direction for every decision the firm makes, from hiring paralegals to investing in new software. When defined properly, your mission and vision become the north star for your culture, branding, and strategy—and the beating heart of your entire business plan.

Finding Your Niche in a Crowded Legal Market

The era of the generalist law firm is fading. In a legal market this saturated, trying to be everything to everyone is a surefire way to be nothing special to anyone. A powerful business plan for attorneys doesn’t start with services—it starts with a razor-sharp analysis of a specific client with a specific problem you are uniquely built to solve.

This deep market understanding is your biggest strategic weapon. It’s what allows you to craft your services, shape your messaging, and focus your client acquisition efforts to attract high-value clients who see your firm as the only logical choice. Without that clarity, you’re just another name in a long directory, left to compete on price alone.

Building Your Ideal Client Profile

First things first, you have to get past broad labels like “family law clients” or “small businesses.” The goal is to build a detailed Ideal Client Profile (ICP), painting a crystal-clear picture of the person or business you can serve better than anyone else. This goes way beyond simple demographics.

Your ICP needs to dive into psychographics—their ambitions, fears, motivations, and the precise legal pain points that keep them awake at night. What event triggers their search for a lawyer? What frustrates them most about the legal system? Answering these questions lets you speak their language.

Think about the difference between a general target and a specific ICP:

- General: Someone who needs estate planning.

- Specific ICP: A dual-income couple in their late 40s with young children and assets over $1 million. They’re worried about protecting their kids’ inheritance and navigating complex estate taxes.

- General: A startup that needs legal help.

- Specific ICP: A bootstrapped SaaS founder, pre-seed, who needs predictable flat-fee services for entity formation, founder agreements, and IP protection to get ready for a first funding round.

This level of detail turns your marketing from a shotgun blast into a laser beam, ensuring every dollar and hour is aimed at exactly the right audience.

To help you get started, we’ve created a simple worksheet. Think of it as a starting point to flesh out the real people behind the legal issues.

Ideal Client Profile (ICP) Worksheet for Attorneys

This worksheet is designed to help you move from broad practice areas to specific, high-value client personas. Fill it out to clarify who you’re targeting, what they need, and how you can reach them effectively.

| Client Attribute | Family Law Example | Estate Planning Example | Corporate Law Example |

|---|---|---|---|

| Demographics | High-net-worth individual (35-55) in a complex marital estate | Dual-income couple (45-60) with minor children and assets >$1M | Bootstrapped tech founder (25-40), pre-seed stage |

| Primary Legal Need | Asset protection in divorce, business valuation disputes | Generational wealth transfer, minimizing estate tax liability | Entity formation, IP protection, founder agreements |

| Key Frustration | Lack of financial transparency from spouse, slow legal process | Fear of probate, complexity of trust instruments | Unpredictable legal fees, lawyers who don’t understand tech |

| Acquisition Channel | Referrals from financial advisors, forensic accountants | Referrals from wealth managers, targeted digital ads | Networking at startup events, referrals from VCs/accelerators |

| Service Preference | Strategic, aggressive representation; clear communication | Flat-fee packages, educational approach | Subscription models, responsive communication via Slack/email |

Completing this exercise forces you to think strategically about your firm’s positioning and value proposition before you spend a single dollar on marketing.

Conducting a Competitive Analysis

Once you know who you’re targeting, you need to know who else is vying for their attention. A competitive analysis isn’t about mimicking other firms—it’s about spotting the gaps in the market that your firm can strategically fill. The goal is to identify their weaknesses and systematically turn them into your strengths.

Start by listing three to five direct competitors going after a similar client base. Now, put on your ideal client’s hat and evaluate them.

- Services and Pricing: Are they stuck in the billable hour? Do they offer flat fees or subscriptions? You might find a huge unmet need for alternative fee arrangements that provide clients with cost certainty.

- Online Presence: How good is their website? Is their content generic and unhelpful? Are they even active on the platforms where your ideal clients hang out? Many established firms have a shockingly poor digital footprint you can easily eclipse.

- Client Reviews: Scour their reviews on Google, Avvo, and other legal directories. What are people consistently praising? More importantly, what are they complaining about? Constant complaints about poor communication or slow response times are gold—they’re opportunities for you to shine.

Identifying a competitor’s weakness is only half the battle. The crucial next step is to build a rock-solid system that guarantees you consistently deliver a superior experience in that specific area. This becomes a cornerstone of your brand.

Performing a SWOT Analysis for Your Firm

With a clear view of your client and your competition, it’s time to look inward. A SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is a non-negotiable exercise for any serious business plan for attorneys. It organizes all your intel into a simple but powerful strategic framework.

Internal Factors (What you control):

- Strengths: What’s your unfair advantage? It could be specialized expertise (like a CIPP certification for privacy law), a powerful personal network, or fluency with modern legal tech that makes you more efficient than the old guard.

- Weaknesses: Be brutally honest. Are you underfunded? Do you have zero marketing experience? Acknowledging weaknesses is the first step to mitigating them, whether that means hiring help, getting training, or forming strategic partnerships.

External Factors (What you don’t control):

- Opportunities: Where are the market gaps you found? Maybe it’s a rising demand for a niche service (like digital asset planning) or a new regulation creating a flood of compliance work for businesses in your target industry.

- Threats: What could sink your firm? This might be new, well-funded competitors entering your space, disruptive changes in the law, or an economic downturn that hits your target clients especially hard.

This SWOT analysis isn’t just an academic exercise; it provides the strategic foundation for your entire business plan. It ensures you’re building a firm that’s not only profitable today but also resilient enough to thrive tomorrow.

Designing Your Firm for Efficiency and Scale

An impressive mission and a killer niche are fantastic, but they don’t mean much without an operational engine to bring them to life. This is the point where your business plan for attorneys pivots from high-level strategy to on-the-ground execution.

A well-designed firm isn’t an accident. It’s built on a foundation of smart systems, the right legal structure, and a technology stack that works for you—not against you. The goal is simple: create scalable, repeatable processes for everything from client intake to final billing. This operational discipline is what frees you from administrative drag, letting you focus on high-value legal work and strategic growth.

Choosing Your Firm’s Legal Structure

Before you can even think about serving your first client, you have to decide on the legal entity for your practice. This is a foundational decision with serious implications for your personal liability, taxation, and day-to-day administrative burden.

Sure, you could operate as a sole proprietorship, but it offers zero liability protection. That means your personal assets are on the line if things go south. Most attorneys wisely opt for a more formal structure to create a legal shield between their personal and professional lives.

Here’s a quick rundown of the most common options:

- Limited Liability Company (LLC): This is a popular choice, offering the liability protection of a corporation but with far less administrative red tape. Profits and losses pass through to your personal tax returns, neatly avoiding the dreaded double taxation.

- Professional Corporation (PC) or S Corp: This structure provides robust liability protection. An S Corp election gives you pass-through taxation similar to an LLC, while a standard PC (or C Corp) is taxed at the corporate level first.

- Partnership (LLP): A Limited Liability Partnership is the go-to for firms with multiple partners. It crucially protects each partner from liability for the malpractice of the other partners—a key distinction from a general partnership.

Selecting your legal structure is not just a box to check. It’s a strategic decision that directly affects your tax burden and risk exposure. Always consult with a tax professional and a corporate attorney to lock in the optimal structure for your specific situation.

Building Your Technology Stack

In today’s legal world, your technology stack is just as critical as your legal library. The right software automates tedious tasks, elevates your client service, and delivers the business insights you need to grow. Skimping on tech is a fast track to inefficiency and burnout.

A solid tech stack for a modern law firm needs to address several core functions. Think of it as building a digital nervous system for your practice.

Essential Tech Categories:

- Case Management Software: This is the heart of your firm’s operations. Tools like Clio, MyCase, or PracticePanther centralize everything—client information, documents, deadlines, and communications—so nothing critical ever falls through the cracks.

- Billing and Accounting Software: Getting paid accurately and on time is non-negotiable. Software like LawPay for payments and QuickBooks for accounting makes invoicing, expense tracking, and trust account management almost effortless.

- Time Tracking Tools: Every minute counts, especially when billable hours are your main source of revenue. For a deep dive, this comprehensive attorney time tracking software guide can help you find a solution that fits your workflow perfectly.

Your tech stack will evolve as your firm grows. Start with the essentials that solve your biggest immediate pain points, then strategically add new tools as your needs change.

Defining Key Roles and Responsibilities

Even if you’re launching solo, your business plan needs to outline the key roles required to run the firm. Thinking in terms of roles—not just people—forces you to build systems that aren’t dependent on any single individual, including yourself.

Start by mapping out the core functions of your firm:

- Legal Production: This is the core legal work—drafting documents, appearing in court, and counseling clients. Initially, this will be 100% you.

- Administration: This covers billing, scheduling, client intake, and general office logistics. You’ll likely handle this at first, but it’s often the first role you should delegate to a virtual assistant or paralegal.

- Marketing and Business Development: This is the engine for client acquisition. It includes managing your website, networking, and creating content.

- Finance and Compliance: This involves bookkeeping, reconciling trust accounts, and ensuring you meet all regulatory requirements.

By defining these roles early, you’re creating a blueprint for future hiring. When it’s time to bring on your first paralegal or marketing coordinator, you’ll already have a clear job description ready. This kind of forward-thinking is what turns a solo practice into a truly scalable business.

Building a Modern Client Acquisition Engine

Your firm’s vision and operational plans are purely academic without a consistent flow of the right clients. This is where you architect the engine that actually drives revenue. It’s not about chasing down every potential lead; it’s about building a systematic, repeatable process to attract the high-value clients you already identified.

Forget the scattergun approach. A modern client acquisition plan is a precision instrument, built on knowing exactly where your ideal clients look for legal help and what they need to see before they’ll trust you. This means moving past old-school advertising and embracing a multi-channel strategy that cements your status as a go-to authority.

The legal market is showing incredible financial strength, but this isn’t happening by accident. The most profitable firms are aggressively rethinking their business models, shifting away from a total reliance on billable hours. A recent report highlighted a “triple threat” of historic demand, rising rates, and tight expense control that is fueling record profits—a trend driven by firms adapting to new competitive pressures. The 2025 State of the U.S. Legal Market report offers a deep dive into how leading firms are pulling ahead.

Defining Your Firm’s Brand Identity

Before you can market your services, you have to know what you’re selling beyond legal counsel. Your brand is your promise. It’s the reputation you build and the client experience you deliver. It answers the crucial question: “Why you?”

Your brand identity needs to be a direct reflection of your firm’s mission and your ideal client profile. For instance, a firm targeting early-stage tech startups will project a completely different voice and style than one serving high-net-worth families with complex estate planning needs.

Key elements of your brand identity include:

- Brand Voice: How do you sound? Are you formal and authoritative, or modern and approachable?

- Unique Value Proposition (UVP): What is the one thing you do better than anyone else for your specific niche?

- Visual Identity: This covers your logo, website design, and professional photography.

Your UVP is the most critical piece. It should be a sharp, concise statement that immediately communicates your value. Instead of “We are an intellectual property law firm,” try something like, “We provide flat-fee IP protection for bootstrapped SaaS founders, so you can build with confidence.” The first is generic; the second is a magnet for the right client.

Choosing Your Core Marketing Channels

You can’t be everywhere at once, especially when you’re starting out. Your business plan must identify two or three core marketing channels where your ideal clients are most active. This is where you’ll concentrate your firepower.

Local SEO for Lawyers If your firm serves a specific geographic area, local SEO is non-negotiable. When a potential client searches for “divorce attorney near me,” you absolutely must appear in Google’s “map pack” and the top organic results. This requires an optimized Google Business Profile, a steady stream of positive client reviews, and a technically sound website.

Content Marketing to Demonstrate Expertise Content marketing involves creating and sharing valuable content—like blog posts, guides, and articles—to attract a clearly defined audience. It’s how you build trust long before a potential client ever considers hiring an attorney. For lawyers, it’s one of the most powerful client acquisition tools available. Our deep dive on content marketing for legal firms offers a complete roadmap.

Your content shouldn’t just explain the law; it must solve your client’s problems. Don’t write “An Overview of Trust Law.” Write “How to Protect Your Children’s Inheritance from Future Creditors.” This client-centric shift makes your content infinitely more compelling.

Building a Referral Network High-quality referrals are still the lifeblood of many successful practices. Your business plan needs a proactive strategy for cultivating relationships with other professionals who serve the same clients but aren’t your competitors.

- For an Estate Planner: This network includes financial advisors, wealth managers, and insurance agents.

- For a Corporate Lawyer: This means accountants, venture capitalists, and business bankers.

Schedule regular check-ins. Offer to co-host a webinar. Always find ways to provide value to your network before you ever ask for a referral in return.

Setting a Realistic Marketing Budget

A marketing plan without a budget is just a wish list. A solid rule of thumb for professional services firms is to allocate between 5% to 15% of your target revenue to marketing, depending on how aggressively you want to grow.

Your budget should be itemized, clearly outlining costs for key activities like website development, SEO services, content creation, and professional association fees. By tying your budget to measurable goals (e.g., generate 10 qualified leads per month), you can track your return on investment and make smarter decisions about where your money goes next.

Getting Your Firm’s Financials Right

This is where the rubber meets the road. Your financial plan is the part that proves your law firm isn’t just a great idea—it’s a viable, profitable business. You’re trading lofty goals for cold, hard numbers on a spreadsheet, showing yourself (and any potential lenders) that you have a clear path to financial stability.

A lot of attorneys get nervous at this stage, but you don’t need a degree in accounting. It’s about building a compelling financial story using three key documents: your startup cost analysis, a 12-month profit and loss projection, and your cash flow statements. Get these right, and you’ll have unshakable confidence in your firm’s future.

Nail Down Your Startup Costs

Before you can dream about profits, you have to get real about your initial investment. This means making a list of every single expense you’ll incur to get the doors open, from one-time purchases to those pesky recurring bills. Underestimating your startup costs is one of the fastest ways to kill a new firm before it even gets started.

Be ruthless with this list. It’s easy to remember big-ticket items like your office lease, but the small stuff adds up faster than you think.

- One-Time Costs: Think business entity formation fees, office furniture, all your computer hardware, and the initial website design.

- Recurring Monthly Costs: This includes rent, malpractice insurance premiums, legal research software like Westlaw or LexisNexis, and your case management software fees.

- Contingency Fund: This is non-negotiable. Add a buffer of at least 15-20% to your total estimate. Unexpected expenses are a guarantee, not a possibility.

Your startup cost analysis isn’t just an expense sheet; it’s the bedrock of your funding request. It proves you’ve thought through every last detail and have a realistic grasp of the capital needed to launch and succeed.

Project Your Revenue and Profitability

Once your costs are pinned down, it’s time to forecast your revenue. This projection is the engine of your financial plan, built on your billing model, how many cases you can realistically handle, and your fee structure. It’s better to be conservative and exceed your goals than to be wildly optimistic and miss them.

For example, if you’re a family law attorney charging $350 per hour and you plan to bill 20 hours a week, that’s your starting point. But don’t stop there. You have to factor in your realization rate (what you actually invoice) and your collection rate (what you actually get paid). A 90% collection rate is a realistic target; 100% is a fantasy.

From there, you’ll build your 12-month Profit and Loss (P&L) statement. This is simple math: take your projected monthly revenue and subtract your projected monthly expenses. The result is your anticipated profit or loss for the first year.

Don’t forget that how you get paid matters. As recent industry data shows, 78% of law firms accepted online card payments in 2023, which led to a 50% increase in invoice recovery compared to waiting for checks. Weaving modern financial tech into your business plan for attorneys isn’t just a nice-to-have; it’s essential. You can see more insights on how tech is changing firm finances in MyCase’s latest lawyer statistics.

This P&L statement becomes your financial roadmap. It helps you set benchmarks and spot potential cash crunches before they turn into full-blown crises, keeping you on track toward your long-term vision.

Common Questions About Attorney Business Plans

Even with a solid framework, building a comprehensive business plan for attorneys is a serious undertaking. It’s completely normal to have a few questions pop up as you get into the weeds. Let’s tackle some of the most common ones we hear from lawyers just like you.

How Often Should I Update My Business Plan?

Think of your business plan as a living GPS, not a framed diploma on the wall. It needs regular course corrections.

As a general rule, set aside time for a major review and update at least once a year. This is your chance to measure progress against your original goals, re-evaluate your financial projections, and make strategic adjustments based on what the market—and your firm—has told you over the last 12 months.

Of course, some events demand an immediate huddle. Don’t wait for the annual review if you’re about to:

- Hire your first paralegal, associate, or partner.

- Seek a significant loan or a new round of funding.

- Make a major pivot in your core practice area.

- Experience a sudden, unexpected downturn or a massive surge in growth.

What KPIs Should I Be Tracking?

Key Performance Indicators (KPIs) are the vital signs for your law firm. While you could track dozens of metrics, you only need a handful to truly understand your firm’s health and make smart, data-driven decisions.

Don’t get lost in a sea of data. The real story of your firm’s success is told by a few key numbers that reflect your financial stability and your ability to attract the right clients.

To get started, focus on these essentials:

- Client Acquisition Cost (CAC): How much do you have to spend on marketing to bring in one new, paying client? This tells you if your marketing dollars are working.

- Average Case Value: What is the average revenue you generate from a single case or client matter? Knowing this helps you forecast revenue accurately.

- Collection Rate: What percentage of the money you bill are you actually collecting? A low number here points to serious cash flow problems.

- Monthly Recurring Revenue (MRR): This is non-negotiable if you’re offering any subscription-based legal services or flat-fee retainers.

Keeping a close eye on these metrics gives you an unbiased, clear-eyed view of what’s working and what isn’t, allowing you to fine-tune your strategy for maximum impact.

Elevate your firm’s visibility and connect with high-value clients through the Haute Lawyer Network. Our exclusive platform showcases top attorneys to a discerning audience, aligning your brand with the prestige of Haute Living. Learn how to join our curated network and enhance your professional reputation.