When your family’s assets cross a certain threshold, a simple will just doesn’t cut it. It’s like trying to navigate a transatlantic voyage with a tourist map of a single city—completely inadequate for the journey ahead.

High net worth estate planning isn’t about just writing a will. It’s a sophisticated, multi-layered strategy designed to manage, protect, and transfer significant, often complex, wealth across generations.

Why High Net Worth Estate Planning Is A Different League

For affluent families, the stakes are exponentially higher. Standard estate planning strategies, while perfectly fine for the average family, often fail spectacularly when applied to substantial wealth. They simply weren’t designed to handle the unique pressures and complexities that come with it.

Think of it this way: a family doctor is perfect for routine checkups, but you’d never ask them to perform open-heart surgery. That requires a team of specialists with years of focused training and advanced tools. High net worth estate planning operates on that specialist level, moving beyond simple asset distribution and into the realm of strategic, long-term wealth preservation.

This specialized approach is critical because significant wealth is rarely just a pile of cash. It’s often a tangled web of business interests, real estate holdings, private equity, and international assets, each with its own set of rules and risks.

The Unique Minefield Wealthy Families Must Navigate

The sheer complexity of a large estate introduces a minefield of challenges that a basic will is powerless to address. Without a proactive and deeply detailed plan, a lifetime of work can be quickly diminished by taxes, family disputes, or poor management after you’re gone.

Here are the key issues we see time and again:

- Crippling Tax Burdens: The federal estate tax can take a 40% bite out of your estate’s value above the exemption limit. That’s a devastating loss. Strategic use of tools like irrevocable trusts and lifetime gifting is absolutely essential to legally shield your wealth.

- Chaotic Business Succession: If you’ve built a business, what happens the day after you’re gone? Without a concrete succession plan, the company you poured your life into could descend into operational chaos or be forced into a fire sale.

- Asset Protection from Predators: High-net-worth individuals are, unfortunately, attractive targets for lawsuits. A properly structured estate plan creates a fortress around your assets, protecting them from creditors, legal claims, and other financial threats.

- Complex Family Dynamics: Blended families, heirs with dramatically different financial situations, or a desire to prevent wealth from eroding family values—these aren’t problems a simple will can solve. They require custom-tailored, thoughtful solutions.

- Building a Lasting Legacy: Many successful families want their impact to extend beyond their lifetime through philanthropy. Proper planning ensures your charitable vision is executed efficiently, often while generating significant tax benefits.

A well-crafted high net worth estate plan is more than a set of documents. It’s a durable blueprint for your legacy, designed to protect your family, preserve your wealth, and ensure your values echo for generations.

Ultimately, this level of planning delivers something priceless: peace of mind. It transforms your wealth from a potential source of conflict and tax exposure into a secure foundation for your family’s future and a powerful testament to your life’s work.

The Building Blocks of Your Estate Plan

A sophisticated estate plan isn’t just a stack of documents; it’s a carefully engineered structure. Think of it like an architect designing a resilient building—each legal tool is a distinct material with a specific purpose, but they all work together to create a seamless framework that protects your assets and provides for your family.

This kind of strategic assembly is no longer a niche concern. The global market for high-net-worth estate planning services is set to hit $503 million by 2032, a clear sign that wealthy families recognize the immense cost of getting this wrong.

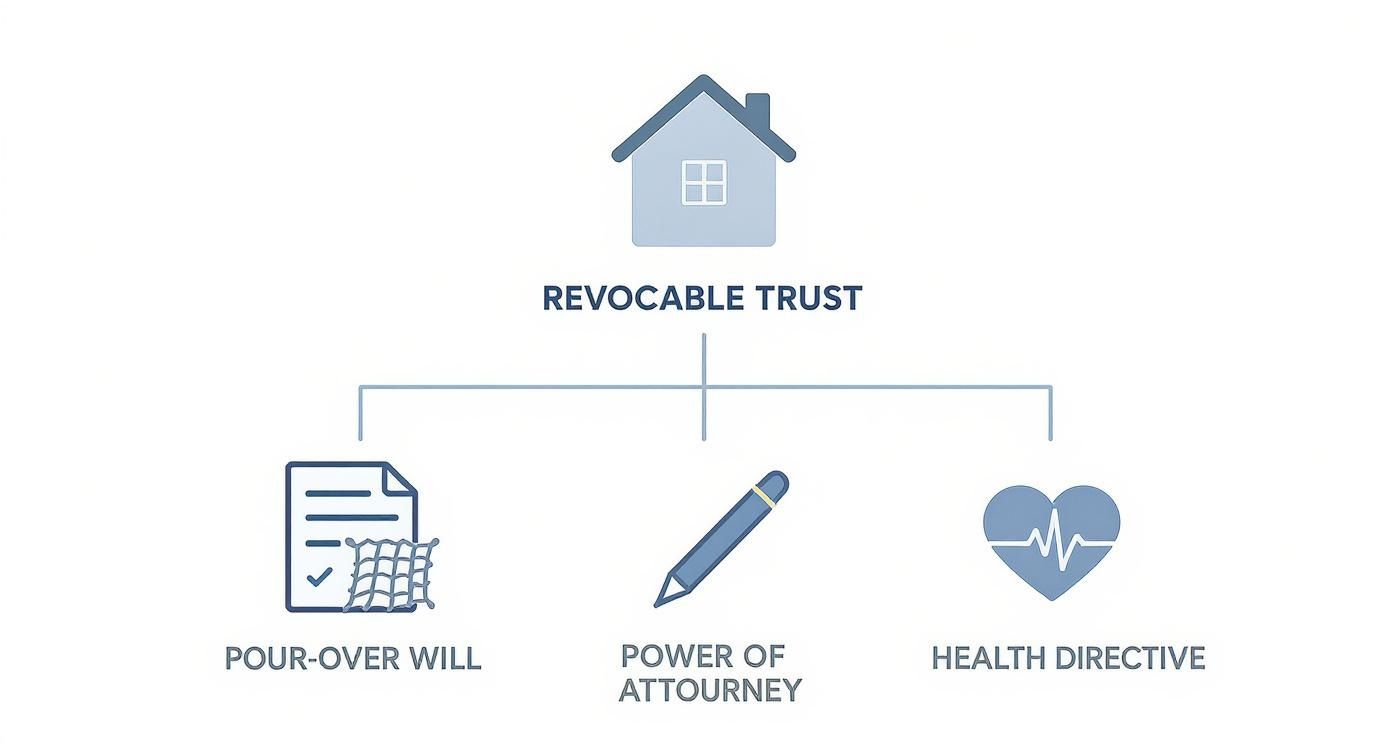

At the center of almost every modern, high-value plan is one indispensable tool: the Revocable Living Trust.

The Revocable Living Trust: Your Central Hub

Imagine your Revocable Living Trust as the central operating headquarters for your entire financial life. While you’re alive, you simply transfer ownership of your key assets—your homes, investment portfolios, and business interests—into this trust. You remain in complete control as the trustee, free to manage, buy, or sell those assets just as you always have. Nothing changes day-to-day.

The magic happens when you pass away. Because the trust legally owns the assets, not you personally, they sidestep the entire public, costly, and often painfully slow probate court process. Your hand-picked successor trustee can then step in and distribute everything privately and efficiently, exactly as you laid out in your instructions.

The Pour-Over Will: A Critical Safety Net

While the trust is the star of the show, the Pour-Over Will is its essential backup. This special type of will is designed to work hand-in-glove with your trust. Its only job is to “catch” any asset you might have forgotten to formally place in the trust’s name and “pour” it back in after your death.

It’s an easy mistake to make—acquiring a new property or opening another brokerage account and forgetting to title it correctly. Without a Pour-Over Will, that forgotten asset gets stuck in probate, undermining the very privacy and efficiency your trust was designed to create. This document ensures everything ends up where it belongs. To see how these pieces come together for families, have a look at this practical guide to estate planning for families.

Planning for Incapacity With Powers of Attorney

A truly comprehensive plan protects you during your lifetime, not just after you’re gone. What happens if an accident or illness leaves you unable to make your own decisions? This is where Durable Powers of Attorney become absolutely vital. They empower people you trust to act for you when you can’t, protecting your autonomy.

There are two distinct types you can’t afford to be without:

- Financial Power of Attorney: This document gives a person you name—your “agent”—the authority to handle your financial life. They can pay your bills, manage your investments, and run your business if you’re incapacitated.

- Medical Power of Attorney (Advance Health Care Directive): This names an agent to make healthcare decisions on your behalf, guided by your specific wishes. It prevents your family from having to make agonizing guesses about your medical care during an already stressful time.

When combined, the trust, the will, and the powers of attorney form a robust and protective framework. They ensure your assets are managed seamlessly, your family is provided for, and your personal wishes are honored, no matter what happens.

Advanced Wealth Transfer and Tax Strategies

Once you have the foundational documents in place, the real work of high-net-worth estate planning begins. This is where we move into a suite of powerful techniques designed to transfer wealth efficiently while shielding it from significant tax erosion. These advanced strategies are the engine room of a sophisticated plan, engineered to protect assets and build a lasting legacy.

Affluent families aren’t just passing down cash; they’re dealing with business succession, complex investment portfolios, and major philanthropic goals. This is all happening in a challenging tax environment where the federal estate tax can claim up to a staggering 40% of an estate’s value above the current exemption.

The infographic below shows how these pieces fit together, with foundational documents supporting a central Revocable Trust.

While the Revocable Trust is the centerpiece, you can see how critical supporting documents like a Pour-Over Will and Powers of Attorney are to creating a truly protective structure.

Using Irrevocable Trusts as a Secure Vault

One of the most potent tools in our arsenal is the Irrevocable Trust. Think of it as a secure vault for your assets. Once you transfer property, investments, or life insurance policies into this trust, you legally relinquish direct control.

That single step removes the assets—and all their future growth—from your taxable estate. They are now completely shielded from federal estate taxes. While giving up control is a big decision, the trade-off is immense: you ensure far more of your wealth passes to your beneficiaries instead of the government.

Freezing Asset Value with GRATs

A Grantor Retained Annuity Trust (GRAT) is a specialized tool, perfect for assets you expect to appreciate significantly, like company stock or prime real estate. Imagine you could “freeze” an asset’s current value for tax purposes and pass all future growth to your heirs, tax-free. A GRAT helps you do just that.

You place the asset into the trust for a set term and receive an annual annuity payment in return. If the asset’s growth outpaces the IRS-mandated interest rate (the hurdle), that excess appreciation passes to your beneficiaries at the end of the term, completely free of gift or estate tax. It’s a calculated move to transfer wealth with remarkable efficiency.

Flexible Planning with Spousal Lifetime Access Trusts

For married couples, the Spousal Lifetime Access Trust (SLAT) offers a unique blend of tax benefits and flexibility. Here, one spouse creates an irrevocable trust for the benefit of the other, using their lifetime gift tax exemption to move assets out of their combined estate.

The genius of a SLAT is that while the assets are gifted away for tax purposes, your spouse can still receive distributions. This creates an indirect financial safety net, allowing the family to benefit from the funds if needed. It’s a smart way for couples to use their exemptions proactively without completely locking away their wealth, a technique often highlighted in discussions on strategic tax strategies for the ultra wealthy.

Building a Generational Legacy with Dynasty Trusts

When the goal is a multi-generational legacy, the Dynasty Trust is the ultimate instrument. Unlike other trusts that eventually terminate, a Dynasty Trust can last for many generations—sometimes indefinitely, depending on state law.

By placing assets in a Dynasty Trust, you create a protected fund that can support your children, grandchildren, and even great-grandchildren. The assets are shielded from estate taxes at each generational transfer and are also protected from beneficiaries’ creditors, divorces, or poor financial decisions. It is an unparalleled tool for preserving family wealth far into the future.

Comparing Key Advanced Estate Planning Trusts

To make sense of these options, it helps to see them side-by-side. The table below breaks down the primary purpose and benefits of each of these powerful trust structures.

| Trust Type | Primary Goal | Key Tax Benefit | Best For |

|---|---|---|---|

| Irrevocable Trust | Remove assets from the taxable estate permanently. | Shields assets and all future appreciation from estate taxes. | High-value assets you are certain you will not need, like life insurance or real estate. |

| GRAT | Transfer future appreciation of an asset tax-free. | “Freezes” the asset’s current value; only growth above the IRS rate is gifted. | Assets expected to appreciate significantly, such as pre-IPO stock or commercial property. |

| SLAT | Use lifetime gift exemption while maintaining indirect access to funds. | Moves assets out of the taxable estate while allowing spousal access. | Married couples who want to reduce their estate tax exposure without losing all access to the wealth. |

| Dynasty Trust | Create a long-term, multi-generational wealth preservation vehicle. | Avoids estate tax for many generations and provides creditor protection. | Families focused on building a lasting legacy and protecting assets for future generations. |

Each of these trusts serves a distinct purpose. Choosing the right one—or the right combination—depends entirely on your specific financial situation, family dynamics, and long-term goals.

Maximizing Your Federal Estate Tax Exemption

One of the most powerful tools in any high-net-worth estate plan is the federal estate tax exemption. Think of it as a government-issued pass that lets you transfer a huge amount of wealth—either now or when you pass—without it being touched by federal estate and gift taxes. Knowing how to use this pass strategically is the cornerstone of preserving your family’s legacy.

For families with significant wealth, this exemption isn’t just a number; it’s the foundation of a sophisticated wealth transfer strategy. Every individual gets their own, and when used correctly, it can shield millions of dollars that would otherwise be hit with a tax rate as high as 40%.

The numbers are significant and constantly shifting, which means timing is everything. As of 2025, the federal estate, gift, and generation-skipping transfer (GST) tax exemptions sit at $13.99 million per person. This is set to increase to $15 million per person in 2026, creating a valuable, but temporary, window of opportunity. You can discover more insights about these global wealth trends and their impact on estate planning.

Understanding Portability for Married Couples

For married couples, the exemption’s power is effectively doubled through a concept called portability. This allows a surviving spouse to inherit and use any unused portion of their deceased spouse’s exemption. In theory, a couple could pass on a combined total of nearly $28 million (based on 2025 figures) to their heirs, tax-free.

But relying on portability alone can be a classic planning mistake. While it’s a decent safety net, it does nothing to protect future asset appreciation. If the assets left to the surviving spouse skyrocket in value, that growth could easily push the estate’s total value far beyond the combined exemption amount, creating a major tax problem no one saw coming.

The Urgency of Strategic Lifetime Gifting

This is exactly why sophisticated high net worth estate planning focuses on using the exemption now, through lifetime gifting. When you gift assets to a properly structured irrevocable trust today, you use your exemption to lock in their current value and shield all future growth from tax.

By making a gift now, you don’t just remove the asset from your taxable estate—you remove all of its future growth, too. This single move can translate into millions of dollars in tax savings for the next generation.

Here’s a simple scenario:

- You gift $5 million worth of stock into a trust for your children, using up part of your exemption.

- Over the next ten years, that stock appreciates to $15 million.

- Because the gift was made today, that entire $10 million of growth happens outside of your taxable estate. It passes to your heirs completely tax-free.

This “estate freezing” strategy is especially critical right now. Today’s historically high exemption amounts are set to be cut roughly in half at the end of 2025. By acting now, you secure the benefit of today’s generous laws, no matter what happens in Washington later. This makes strategic gifting one of the most effective and urgent moves a high-net-worth family can make.

Planning for Business Succession and Philanthropy

For many entrepreneurs, their true wealth isn’t just a portfolio of stocks and bonds. It’s the business they poured their life into and the charitable causes that define their values. A sophisticated high-net-worth estate plan must account for both, creating a clear future for the company and a lasting legacy of impact.

Without a formal strategy, a lifetime of work can unravel overnight. A business can be thrown into a forced sale, a leadership vacuum, or bitter disputes among heirs with conflicting visions. Likewise, philanthropic intentions often fall flat if the right legal and financial scaffolding isn’t in place.

Structuring a Smooth Business Transition

For business owners, succession planning is one of the most consequential—and frequently postponed—parts of their estate plan. The core question is simple: what happens to the company when you’re no longer leading it? A definitive answer is non-negotiable.

The first step is deciding on the business’s future. Will it pass to the next generation, be sold to key employees, or be liquidated? Each path demands a completely different strategy. A buy-sell agreement is indispensable here; think of it as a prenuptial agreement for business partners. It pre-determines the terms of a buyout triggered by events like death or retirement—specifying who can buy, at what price, and how it will be funded, often with life insurance.

This single document ensures a seamless, pre-arranged transfer of ownership, provides crucial liquidity for your heirs, and stops the kind of disruptive feuds that could dismantle the very company you worked so hard to build.

A well-designed succession plan isn’t just an exit strategy. It’s a guarantee for continuity, protecting the financial security of both your family and the employees who helped you succeed.

Making a Lasting Impact Through Philanthropy

Beyond the boardroom, high-net-worth estate planning provides powerful tools for supporting charitable causes with maximum efficiency. This often creates a win-win, benefiting both the charity and your estate’s bottom line. Instead of just writing checks, strategic giving uses specialized vehicles to amplify your impact while slashing tax burdens.

Two of the most effective instruments for this are:

- Charitable Remainder Trusts (CRTs): A CRT is a powerful tool where you place assets into a trust that pays an income stream to you or your beneficiaries for a set time. Once that period ends, the remaining assets go to your designated charity. This strategy can generate an immediate charitable deduction and let you convert highly appreciated assets into income without facing a huge capital gains tax bill.

- Donor-Advised Funds (DAFs): A DAF functions like a dedicated charitable investment account. You contribute assets, get an immediate tax deduction, and then recommend grants from the fund to your favorite non-profits over time. It’s a simpler, more private alternative to launching a private foundation, letting you stay deeply involved in your giving without the administrative headaches.

By weaving these business and philanthropic strategies into your estate plan, you move beyond simple asset distribution. You are actively architecting the future of your enterprise and cementing a legacy of generosity that will resonate for generations.

Building Your Professional Estate Planning Team

You don’t navigate high-net-worth estate planning on your own; it’s a team sport. Pulling together the right circle of specialists is the only way to build a plan that’s legally airtight, financially optimized, and truly reflects your vision. Think of it as assembling a personal board of directors for your legacy.

Each member brings a distinct and critical perspective to the table. Without this collaborative approach, you’re leaving dangerous gaps in your strategy—the kind that can quietly undermine your entire life’s work.

Your Core Advisory Circle

A truly resilient plan requires four key players working in lockstep. Each professional views your estate through a different lens, and it’s the combination of these viewpoints that creates a 360-degree strategy for preserving your wealth.

- The Estate Planning Attorney: This is the architect of your plan. They design the legal framework—the trusts, wills, and foundational documents—that your entire strategy rests on. Sourcing the right legal counsel is your most important first step, and you can learn more about how to find an estate planning attorney near you with the necessary expertise.

- The Certified Public Accountant (CPA): Your CPA is the tax strategist. Their role is to ensure every move, from gifting strategies to trust funding, is structured to minimize income, gift, and estate tax liabilities. Their analysis is what maximizes the wealth that actually reaches your heirs.

- The Financial Advisor: As your investment manager, this professional makes sure your financial portfolio is aligned with the long-term objectives of your estate plan. They manage your assets to support your legacy, whether that means generating growth for future generations or ensuring liquidity is available for major tax obligations.

- The Insurance Professional: This expert is your risk manager. They deploy life insurance as a strategic tool to provide immediate, tax-free liquidity to your estate. This cash can cover estate taxes, equalize inheritances among heirs, or fund business buy-sell agreements, preventing the forced fire-sale of your most valuable assets.

The secret to a successful outcome is understanding how these specialists collaborate. When your attorney, CPA, financial advisor, and insurance professional are working together, they elevate a simple collection of documents into a dynamic, living plan that truly secures your legacy.

Common Questions in High-Net-Worth Estate Planning

Even the most well-informed individuals run into specific questions when it comes to structuring a high-net-worth estate plan. The devil is always in the details, and a few common points of confusion can create serious roadblocks if not addressed correctly.

Let’s clear up some of the most pressing questions we see from affluent families. Getting these answers right is fundamental to ensuring your financial legacy is protected and your wishes are carried out exactly as you intend.

How Often Should My Estate Plan Be Reviewed?

An estate plan is not a document you sign once and file away forever. Think of it as a living blueprint for your wealth—it needs to evolve as your life does. As a general rule, a comprehensive review every three to five years is a smart move.

However, certain life events demand an immediate update. These are non-negotiable moments to call your attorney:

- A marriage, divorce, or the birth of a child or grandchild.

- A significant financial shift, like the sale of a business or a major inheritance.

- The death of anyone named in your plan, such as a beneficiary, executor, or trustee.

- Major changes to tax laws, which can have an outsized impact on high-net-worth estates.

Staying on top of these reviews ensures your plan never becomes obsolete. It remains a powerful tool perfectly aligned with your current reality.

Probate vs. Trust Administration: What’s the Real Difference?

This is one of the most critical distinctions in the world of estate planning. Probate is the court-supervised process of settling an estate. It’s public, which means your financial affairs become a matter of public record. It can also be painfully slow and expensive.

Trust administration, on the other hand, is an entirely private affair. Your hand-picked successor trustee manages and distributes the assets according to the instructions you laid out in the trust. Assets held in a trust completely bypass probate, allowing for a faster, confidential, and far more efficient settlement.

For high-net-worth individuals, the privacy, control, and efficiency offered by trust administration are major advantages that make it the preferred method for wealth transfer.

Can You Ever Change an “Irrevocable” Trust?

The name certainly sounds final, but “irrevocable” doesn’t always mean it’s set in stone forever. While you can’t just unwind the trust on a whim, there are sophisticated legal pathways to modify it when circumstances change.

Depending on state law, changes can sometimes be made if all beneficiaries give their unanimous consent. Modern trusts often include a “trust protector”—an independent third party with the power to make specific amendments. In some cases, a legal maneuver called “decanting” allows a trustee to essentially pour the assets from an old trust into a new one with better terms. Executing any of these strategies, however, requires guidance from highly experienced legal counsel.

At Haute Lawyer Network, we connect you with premier legal professionals who specialize in the complexities of high-net-worth estate planning. To find an expert attorney who can build a resilient and tax-efficient plan for your legacy, explore our curated network.