No one likes to think about bankruptcy. The word itself can feel like a final judgment on your financial life, but that’s a dangerous misconception. In reality, bankruptcy is a powerful legal and financial tool designed for one purpose: to give you a fresh start.

The key is knowing when to use it. Waiting too long can turn a manageable crisis into an irreversible one. If you’re facing imminent foreclosure, the threat of wage garnishment, or find that your total monthly debt payments are eating up more than 40% of your income, you’ve reached a critical tipping point. This is the moment to stop reacting and start acting.

Rethinking Bankruptcy as a Strategic Financial Tool

Too many people put off even thinking about bankruptcy because of fear, shame, or bad information. They see it as a personal failure instead of what it truly is: a planned demolition to clear the way for something stronger. It’s a strategic maneuver, legally sanctioned, to give honest people overwhelmed by debt a path forward.

This shift in perspective is everything. If you wait until every other option is exhausted, you risk losing assets that an experienced attorney could have helped you protect. The goal is to recognize when you’ve crossed the line from simply managing debt to being completely submerged by it.

Identifying the Tipping Point

So, how do you know you’re at that critical juncture? It comes down to an honest look at your finances. Are you just treading water, or are you actively drowning? A few clear signals tell you it’s time to explore your options with an expert.

These are powerful triggers that demand immediate attention:

- Imminent Foreclosure or Repossession: Once you receive formal notices that your home or car is on the line, the clock is ticking. Filing for bankruptcy triggers an “automatic stay,” which instantly halts these collection actions and gives you breathing room to figure out a plan.

- Wage Garnishment: If a creditor has a court order to take money directly out of your paycheck, the situation has already escalated. This is a clear sign your debt has become unmanageable through normal means.

- Lawsuits from Creditors: A summons is not just another letter. It means a creditor is pursuing a legal judgment against you, which can lead to bank account levies and property liens.

- Insolvency: There are two simple tests for this. First, do your total liabilities (what you owe) exceed your total assets (what you own)? Second, and more practically, are your monthly debt payments making it impossible to cover basic living expenses like your mortgage, groceries, and utilities?

It’s fundamental to see bankruptcy not as an endpoint, but as a new starting line. This is the moment you stop the financial bleeding and begin the process of rebuilding. Timing is everything—acting decisively can preserve more of your assets and dramatically accelerate your recovery.

Ultimately, the decision comes down to timing and control. When the financial pressure is constant, you see no realistic way to pay off your debt in the next three to five years, and your quality of life is suffering, that’s your signal. It’s about choosing a structured, legal solution over a slow and chaotic financial decline. Recognizing these signs early allows you to use bankruptcy as intended: as a powerful tool to reclaim your future.

The Critical Warning Signs You Cannot Ignore

Knowing when to think about bankruptcy is a lot like a pilot reading the instrument panel. You can’t ignore the warning lights. Ignoring them doesn’t fix the engine; it just guarantees a much rougher landing down the road. Financial trouble sends its own signals, and learning to spot them is the first step toward regaining control.

These aren’t just signs of a tough month or a minor setback. They are persistent, loud alarms that your entire financial structure is becoming unstable. When you find yourself making decisions based not on what’s best, but on what’s least damaging, you’ve crossed into the danger zone.

Everyday Life as a Financial Barometer

The clearest warning signs often show up in your daily life. Take a hard look at how you pay for necessities. Are you putting groceries, utility bills, or gas on a credit card because your paycheck is gone before it even hits your account? This is a classic symptom of a negative cash-flow spiral.

When high-interest credit cards become a stand-in for income just to cover basic living costs, it’s a direct signal that your debt load is no longer sustainable. It’s like trying to bail out a sinking boat with a thimble—you’re putting in the effort, but the water is rising faster than you can work.

Another critical signal is when you start falling behind on secured debts, like your mortgage or a car loan. These aren’t like credit card bills; they’re tied to your most essential assets. Missing just one or two payments can kickstart the foreclosure or repossession process, putting your home and your car in immediate jeopardy.

The question of when should I file for bankruptcy often finds its answer in these moments. When your debt forces you to risk losing essential assets or to use credit just to survive, the system is fundamentally broken. This isn’t a personal failure; it’s a signal that the financial tools you’ve been using are no longer effective.

When Creditors Escalate Their Actions

The mail you receive can tell you a lot about your financial health. Once the envelopes shift from friendly payment reminders to aggressive, bold-lettered collection notices, the game has changed. Creditors will start calling constantly—not just at home, but at work, creating enormous stress that bleeds into every part of your life.

This pressure is by design, but it’s also your final warning. The most severe alerts are the ones that arrive via certified mail or a process server:

- Lawsuit Summons: This isn’t a threat; it’s a formal legal complaint. A creditor is suing you to get a court judgment, which unlocks a whole new level of collection powers.

- Notice of Wage Garnishment: Once a creditor has that judgment, they can get a court order to take money directly from your paycheck. Your employer is legally required to comply.

- Bank Levy Notices: This is one of the most jarring actions. A creditor can freeze your bank account and seize the funds inside, often without any advance warning.

Once legal actions like these begin, your options become severely limited, and the cost of dealing with the debt explodes. This is the financial equivalent of a five-alarm fire.

Making an Objective Assessment

Fear and anxiety make it impossible to see your situation clearly. To cut through the noise, you need an objective assessment. To help with that, we’ve created a simple checklist.

Financial Distress Warning Signs Checklist

Use this checklist to objectively assess your financial situation and identify the common triggers that suggest bankruptcy may be a strategic option.

| Warning Sign | Are You Experiencing This (Yes/No) | Why This Is a Critical Indicator |

|---|---|---|

| Using Credit for Necessities | Your income no longer covers basic living expenses, forcing you into a debt spiral. | |

| Falling Behind on Mortgage/Car Loan | Puts your most critical assets (home, transportation) at immediate risk of foreclosure or repossession. | |

| Receiving Aggressive Collection Calls | Indicates creditors are escalating their efforts and legal action is likely the next step. | |

| Facing a Lawsuit from a Creditor | A creditor is seeking a court judgment, which enables severe collection actions like garnishment. | |

| Threatened with Wage Garnishment | Signals a creditor has or will soon have the legal right to take a portion of your paycheck. | |

| Bank Account Frozen or Levied | This is a late-stage collection tactic that cuts off access to your available cash. | |

| Debt Exceeds 50% of Annual Income | This debt-to-income ratio is often considered a tipping point toward financial insolvency. | |

| Debt Payments Exceed 40% of Take-Home Pay | Shows that the majority of your discretionary income is being consumed by debt, leaving little for anything else. |

Completing this checklist provides a clear, emotion-free picture. If you answered “Yes” to several of these, it’s a strong sign that your situation requires a powerful legal solution, not just better budgeting.

Recent data reveals a sharp increase in U.S. bankruptcy filings, underscoring the risk of waiting too long in a tough economy. Taking action within 6 to 12 months of recognizing these signs can drastically improve your recovery timeline, with many people rebuilding their credit within one to two years after their debts are discharged. You can explore more about these bankruptcy filing trends to understand why timing is so crucial.

Recognizing these warning signs isn’t about admitting defeat. It’s about acknowledging you need a more powerful tool to secure your financial future.

Choosing Your Path Through Bankruptcy Chapters

Deciding to file for bankruptcy is a monumental step, but it’s not a single destination. Think of it as a critical crossroads, with different paths leading toward your financial recovery. Each path, known as a “chapter” in bankruptcy law, is engineered for a specific set of circumstances. Understanding these options is the first step in ensuring you choose the route that best protects your assets and aligns with your long-term goals.

The two most common routes for individuals are Chapter 7 and Chapter 13. Let’s use a simple analogy: imagine your financial life is a house that’s become structurally unsound.

- Chapter 7 is like a controlled demolition. It’s designed to provide a swift, clean slate by liquidating (selling) certain non-essential assets to pay off creditors. Once that’s done, your remaining eligible debts are wiped away entirely.

- Chapter 13 is more like a strategic renovation. Instead of tearing everything down, you create a detailed blueprint to remodel your finances. You keep your assets, like your home and car, by agreeing to a repayment plan that lasts three to five years.

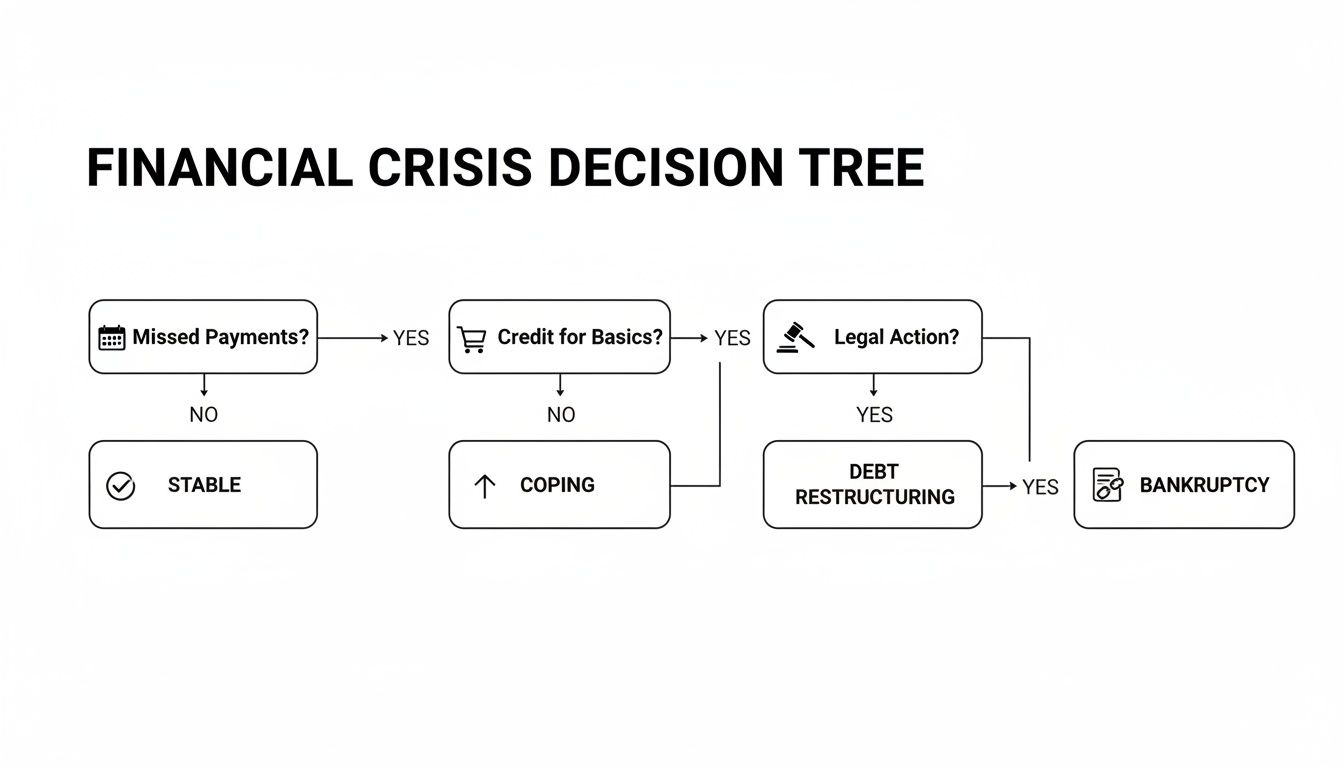

This decision can feel overwhelming, especially when you’re already under immense financial strain. The visual guide below illustrates the common triggers that bring people to this very crossroads.

This decision tree shows how financial pressures—from missed payments to lawsuits—often escalate, making bankruptcy a necessary and strategic response. The journey often begins with common financial strains that grow progressively more serious until action is required.

Understanding Chapter 7 Liquidation

Chapter 7 is often called a “liquidation” or “straight” bankruptcy. It’s what most people picture when they think of filing and is generally the fastest and most direct option, typically wrapping up in just four to six months.

The gatekeeper to Chapter 7 is the means test, a formula designed to see if your income is low enough to qualify. If your household income is below your state’s median, you will likely pass. If it’s higher, a more detailed calculation of your disposable income is needed to determine eligibility.

The ultimate goal of Chapter 7 is to give an honest but unfortunate debtor a true fresh start. It discharges most unsecured debts—like credit card bills, medical debt, and personal loans—freeing you from the legal obligation to pay them.

This doesn’t mean you lose everything. Bankruptcy laws provide exemptions that protect essential property up to a certain value. This often includes your primary home (the homestead exemption), a vehicle, retirement accounts, and personal belongings. Maximizing these exemptions is where a skilled attorney becomes absolutely essential to protect what you’ve worked for.

The Chapter 13 Reorganization Plan

If you don’t pass the means test for Chapter 7, or if you have valuable assets you need to protect from liquidation—like a house facing foreclosure—Chapter 13 is often the better path. This isn’t a liquidation; it’s a reorganization.

Instead of selling assets, you propose a repayment plan to the court. This plan consolidates your debts, allowing you to make a single monthly payment to a bankruptcy trustee. That trustee then distributes the funds to your creditors over a 3-to-5-year period.

This structure is incredibly powerful for a few key reasons:

- Stopping Foreclosure: It gives you a way to catch up on missed mortgage payments over time, allowing you to keep your home.

- Protecting Co-signers: If someone co-signed a loan for you, Chapter 13 can shield them from creditors coming after them.

- Managing Non-Dischargeable Debts: Certain debts that can’t be eliminated in Chapter 7, like some tax obligations or domestic support, can be managed and paid through a Chapter 13 plan.

For individuals with steady income who are fighting to save their homes, Chapter 13 is often the ideal solution. You can dive deeper into the mechanics in our guide on how to file for bankruptcy.

A Glimpse into Chapter 11

While less common for individuals, Chapter 11 deserves a mention. Think of it as the “commercial restructure” option. It’s typically used by businesses to reorganize and continue operating, but it’s also available to individuals whose debts are too large for Chapter 13. This path is far more complex and expensive, reserved for those with uniquely intricate financial situations.

Choosing the right chapter is not a decision to make lightly. It hinges entirely on your income, your assets, the types of debt you hold, and what you want your financial future to look like.

What Life Looks Like After Filing

Let’s tackle the biggest fear about bankruptcy head-on: is your financial life over once you file? The answer is an emphatic no. For many, it’s the day their financial life truly begins again. The common narrative of permanent ruin is a myth; the reality is one of profound relief, deliberate recovery, and rebuilding from a place of stability.

The instant your case is filed, a powerful legal shield called the automatic stay snaps into place. Think of it as a court-ordered restraining order against every single one of your creditors. All collection activities—harassing calls, wage garnishments, foreclosure sales, and repossessions—must stop immediately. For the first time in months, maybe even years, you finally have the breathing room to reset.

That immediate, profound silence from creditors is often the first tangible sign that you’ve taken back control. It isn’t just a pause; it’s the start of your comeback story.

The Immediate Aftermath and Your Fresh Start

Once your debts are officially discharged in Chapter 7 or you’ve started your structured Chapter 13 repayment plan, you are on the road to recovery. Your debt-to-income ratio, a critical metric for any lender, often improves dramatically now that your old unsecured debts have been wiped clean. Paradoxically, you can actually look like a better credit risk than you did before filing.

You might even be surprised to see pre-approved credit card offers landing in your mailbox within months of your case closing. Lenders know you’re barred from filing for Chapter 7 again for another eight years, which can make you an oddly attractive borrower. The key, of course, is to use this new opportunity wisely.

Rebuilding Your Credit Score Step by Step

A bankruptcy will lower your credit score, but it is not a life sentence. With disciplined financial habits, you can see significant improvement within one to two years. Your new goal is simple: create a fresh, positive payment history that proves your reliability going forward.

Here are the essential first steps:

- Get a Secured Credit Card: This is the smartest first move. You provide a small security deposit, say $300, which becomes your credit limit. Use it for a small, planned purchase each month—like gas or a streaming service—and pay the balance in full every single time.

- Become an Authorized User: If you have a trusted family member with a stellar credit history, ask them to add you as an authorized user on one of their accounts. Their long history of on-time payments will start reflecting positively on your own credit report.

- Monitor Your Credit Reports: Regularly pull your reports from all three major bureaus (Equifax, Experian, and TransUnion). You need to verify that the debts discharged in bankruptcy are correctly reported with a zero balance. Mistakes happen, and you need to catch them.

Rebuilding your financial life is a marathon, not a sprint. The bankruptcy filing is the starting pistol, signaling the end of a chaotic race you were losing and the beginning of a structured journey toward a finish line you can actually reach.

Achieving Major Financial Goals After Bankruptcy

Many people assume they’ll never be able to buy a home or a car again. This is another damaging misconception. While you won’t walk out of court and get a mortgage the next day, the path back to major credit is clearer and often shorter than you’d expect.

Timelines for Major Loans

- Car Loans: It’s often possible to get a car loan within a year after your bankruptcy is discharged. Yes, the interest rates will be higher at first, but making consistent on-time payments will help you qualify for much better refinancing terms down the road.

- Mortgages: The waiting period here is longer but well-defined. For an FHA loan, the typical wait is two years after a Chapter 7 discharge. For a conventional loan, it’s usually four years. In a Chapter 13, you might even be able to apply while still in your repayment plan, typically after a year of proven on-time payments.

The critical factor for lenders isn’t just that you filed for bankruptcy; it’s what you did after. They are looking for a stable income, a low debt-to-income ratio, and a consistent history of responsible credit use since your case was discharged. This new track record is what ultimately opens the door to your long-term financial goals. Deciding when you should file for bankruptcy is really about choosing to start this rebuilding process sooner rather than later.

Exploring Your Alternatives to Bankruptcy

Deciding to file for bankruptcy is a serious choice, and it’s smart to understand all your options before pulling that trigger. Think of it as a financial diagnosis: some issues can be treated with less intensive measures, but severe conditions often demand a more powerful, definitive solution. Looking at the alternatives helps clarify why, for many, bankruptcy isn’t just a last resort but the most protective and effective path forward.

These other options generally fall into three buckets: debt consolidation, debt management plans, and debt settlement. Each one works differently and comes with its own set of benefits and, more importantly, significant drawbacks.

Debt Consolidation Loans

The idea behind a debt consolidation loan is straightforward. You take out one new, larger loan to pay off a handful of smaller, high-interest debts like credit cards. The appeal is simplifying everything into a single monthly payment, hopefully at a lower interest rate. If you have good credit and your debt is still manageable, this can work.

But this road is full of potential potholes. If your credit is already hurting, you’re unlikely to qualify for a loan with a good interest rate. It also doesn’t actually reduce what you owe—it just shuffles it around. Without changing your spending habits, it’s dangerously easy to run up those old credit cards again, leaving you with the new loan plus a fresh pile of debt.

Debt Management Plans (DMPs)

A Debt Management Plan (DMP) is a more structured route, usually offered by non-profit credit counseling agencies. The agency negotiates with your creditors to try and lower your interest rates or waive fees. You then make one payment to the agency, and they pay your creditors for you.

These plans typically take three to five years. While they offer a clear path out of debt without taking on a new loan, they have some real downsides.

- Credit Hit: You’ll almost certainly have to close your credit card accounts, which can ding your credit score.

- Not a Complete Fix: Not every creditor will agree to participate, so you may still have to deal with some debts on your own.

- No Legal Shield: This is a big one. Unlike bankruptcy, a DMP provides zero legal protection. Creditors who aren’t in the plan can still sue you, garnish your wages, or pursue other collection actions.

Many people are drawn to these alternatives to avoid the stigma they associate with bankruptcy. But they lack the legal finality and comprehensive protection that federal bankruptcy law offers, which leaves you dangerously exposed if your financial situation gets worse.

Debt Settlement Companies

Debt settlement is, by far, the riskiest play. These for-profit companies promise to negotiate with your creditors to let you pay a fraction of what you owe. The strategy involves you stopping payments to your creditors and putting that money into a savings account instead. Once you’ve saved up a lump sum, the company tries to strike a deal.

This approach is loaded with peril. Your credit score will absolutely tank because you’re intentionally defaulting on your debts. Creditors have no obligation to negotiate and are just as likely to sue you, leading to wage garnishments. On top of that, any forgiven debt over $600 is usually considered taxable income by the IRS, setting you up for a nasty surprise tax bill. You can learn more about the final stages of these negotiations by reading about what a settlement agreement entails.

For business owners, the stakes are even higher. With global business insolvencies projected to climb, the signal is clear: it’s time to consider bankruptcy when cash flow can’t cover operating costs for three to six straight months. This kind of sustained uncertainty is pushing insolvencies to decade highs. Delaying action risks total liquidation, while an early, strategic filing can allow for a structured reorganization.

Ultimately, while these alternatives might work in very specific, less severe cases, they almost always fall short when debt becomes truly overwhelming. They simply can’t offer the immediate, legally binding protection of bankruptcy’s automatic stay or the clean slate provided by a court-ordered discharge.

Why an Elite Attorney Is Your Most Important Asset

Trying to navigate the complexities of bankruptcy on your own is like performing surgery on yourself—it’s incredibly risky, and the chances of a costly, irreversible mistake are dangerously high.

The paperwork is notoriously difficult, deadlines are absolute, and a single misstep can get your entire case thrown out. You’re left right back where you started, only now with even fewer options. This is exactly why the right legal expert isn’t a luxury; it’s an absolute necessity for a successful outcome.

A top-tier bankruptcy attorney does far more than just fill out forms. They are strategic advisors who understand the intricate dance between federal law and state-specific exemptions. Their expertise is what stands between you and the potential loss of your home, car, or retirement savings. They know precisely how to leverage legal protections to your maximum advantage.

Maximizing Your Protections and Ensuring Success

An elite attorney’s value becomes immediately clear when it comes to protecting what you own. They are masters of the exemption laws, meticulously structuring your filing to shield as much of your property as legally possible. This strategic planning is often the difference between keeping your house and watching it head to a foreclosure sale.

They also act as your fierce advocate and negotiator. From handling creditor meetings to responding to trustee inquiries, they manage every communication, shielding you from the stress and pressure. Their deep experience allows them to anticipate challenges before they arise, ensuring a smooth path toward debt discharge.

The decision of when you should file for bankruptcy is immediately followed by a more critical choice: who will guide you through it? An expert attorney transforms bankruptcy from a confusing, high-stakes gamble into a calculated strategy for financial recovery. Your future is too important to leave to chance.

The Strategic Advantage of a Vetted Specialist

Every bankruptcy case is unique, shaped by your specific debts, assets, and financial goals. A premier attorney doesn’t offer a one-size-fits-all solution; they build a personalized roadmap designed for your complete financial recovery. They analyze every detail to determine the optimal filing chapter and timing, ensuring you get the best possible outcome.

This level of specialized knowledge is indispensable. It guarantees that every legal avenue is explored, every protection is maximized, and every form is filed perfectly to avoid dismissal. Choosing the right legal partner is the most critical investment you can make in your financial future. To better understand this process, you can learn more about how to choose the right attorney for your case in our detailed guide.

Consulting a vetted specialist isn’t just a step in the process—it is the cornerstone of your fresh start.

Answering the Tough Questions About Bankruptcy

When you’re facing overwhelming debt, it’s natural to have urgent questions. The process can seem confusing and intimidating, but getting clear answers is the first step toward regaining control. Below, we address the most common concerns we hear from people considering bankruptcy.

Will I Automatically Lose My House and Car?

This is easily the biggest and most damaging myth out there. The short answer is no, not necessarily. The entire bankruptcy system is built on providing a fresh start, not leaving you with nothing.

Both federal and state laws include specific “exemptions” designed to protect your most essential assets, like a primary home and a reliable vehicle, up to a certain value. In a Chapter 13 filing, for instance, the repayment plan is often structured specifically to let you catch up on missed mortgage or car payments, making it a powerful tool for keeping your property. Even in a Chapter 7 liquidation, you can typically keep these assets as long as your equity in them falls within your state’s exemption limits. This is where having a skilled attorney is non-negotiable—they know exactly how to maximize these vital protections.

How Long Will This Really Hurt My Credit Score?

A bankruptcy filing will stay on your credit report for 7 to 10 years, but its impact isn’t a permanent black mark. The negative effect starts to fade almost immediately, and most people are surprised to see new credit offers within a year or two after their debts are discharged.

Think about it from a lender’s perspective: once your old, unmanageable debts are gone, you’re actually a lower risk. The key is what you do next. By demonstrating responsible financial habits—like using a secured credit card for small purchases and paying it off in full every month—you can rebuild your credit score much faster than you might think.

The goal of bankruptcy isn’t to punish you forever; it’s to provide a fresh start. Your post-bankruptcy financial behavior is what lenders will focus on most as you rebuild.

I Have a Good Income—Can I Still File for Bankruptcy?

Yes, absolutely. A high income doesn’t lock you out of bankruptcy relief. While it might mean you don’t pass the “means test” required for a Chapter 7 liquidation—where your non-exempt assets are sold to pay creditors—it often makes you a perfect candidate for Chapter 13.

Chapter 13 bankruptcy isn’t about liquidation; it’s about reorganization. It allows you to restructure your debts into a manageable three-to-five-year repayment plan based on what you can realistically afford, not the crushing total you owe. An experienced attorney can analyze your complete financial picture to map out the most strategic path forward for your specific situation.

Navigating the complexities of bankruptcy requires expert guidance to protect your assets and secure your financial future. The Haute Lawyer Network connects you with a curated selection of the nation’s premier attorneys, ensuring you have a trusted specialist to build a strategic plan for your complete recovery. Find the elite legal representation you deserve and take the first step toward financial freedom.