Getting a prenup is about more than just signing a document. It’s a comprehensive process that starts with open discussions with your partner, involves hiring separate, dedicated attorneys for fair representation, and requires a full, transparent disclosure of all financial information before a single word is drafted.

The Modern Prenup: A Tool for Financial Partnership

Let’s do away with the outdated stigma. A prenuptial agreement today isn’t about planning for failure; it’s about establishing a transparent, well-defined financial partnership from the very beginning. For modern couples, particularly high-net-worth individuals, a prenup is simply a strategic tool for building a stronger marital foundation.

Many of today’s most successful people view this process as a sign of deep mutual respect, not distrust. It creates a dedicated space to align on financial expectations and achieve absolute clarity before you walk down the aisle. By addressing finances with this level of honesty, you eliminate ambiguity and sidestep potential conflicts down the road, freeing you to focus on what truly matters: the relationship itself.

Why Smart Couples Embrace Prenups

The motivations for getting a prenup are as unique as the couple themselves. It’s about crafting a precise financial roadmap that reflects your specific life, assets, and goals. The key drivers almost always fall into a few distinct categories:

- Protecting a Family Business: A prenup is essential to ensure a family-owned enterprise remains separate property, shielding it from being divided or disrupted in a divorce.

- Securing Future Inheritances: If you anticipate receiving a significant inheritance, a prenup can legally designate it as your separate property, protecting generational wealth.

- Defining Debt Responsibility: One partner might enter the marriage with substantial student loans or business debt. An agreement can clarify that this liability remains the sole responsibility of the original debtor.

- Preserving Personal Assets: Real estate, investment portfolios, or intellectual property acquired before the marriage can be explicitly defined as separate property, keeping them entirely yours.

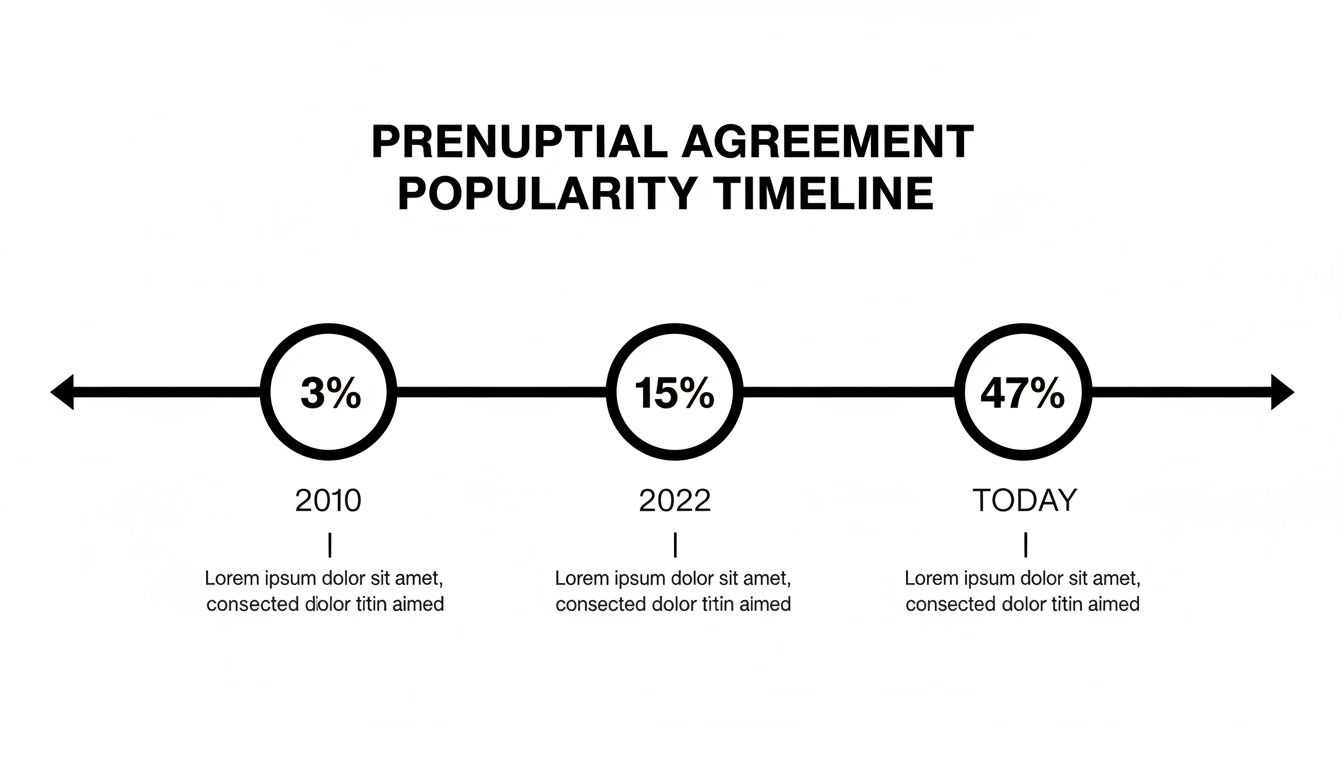

This proactive approach is rapidly becoming the norm, not the exception. The popularity of prenuptial agreements has skyrocketed among millennials, with some surveys indicating nearly half are signing one. Consider the data: back in 2010, only a mere 3% of married or engaged couples had a prenup. By 2022, that figure had jumped to 15%. You can dive deeper into the data behind this ‘Prenup Revolution’ over at HelloPrenup.com.

A well-crafted prenup isn’t a plan to fail; it’s a blueprint for a successful financial partnership. It ensures both parties enter the marriage with a shared understanding and a solid framework for their future together.

Ultimately, getting a prenup is about communication and foresight. It forces you and your partner to have frank, necessary conversations about money, assets, and expectations. By tackling these complex topics head-on, you build a stronger, more transparent union from day one, setting the stage for a secure and mutually respectful marriage. This financial alignment is the true purpose of the modern prenuptial agreement.

Your Prenup Timeline From First Talk to Final Signature

Thinking about a prenup isn’t something you do a month before the wedding. It’s a deliberate, thoughtful process, and rushing it is one of the easiest ways to have the agreement thrown out in court down the road. A well-paced timeline is your best defense, ensuring everything is fair, transparent, and legally sound.

The absolute golden rule? Start the conversation at least six months before your wedding date. This isn’t an arbitrary number. A generous timeframe like this completely removes any hint of duress or coercion, which are classic arguments for invalidating a prenup. An agreement signed just days before walking down the aisle can easily look like it was forced.

Giving yourselves this much time transforms a potentially stressful task into a collaborative financial planning session for your future. It provides the breathing room needed for honest discussions, thorough financial disclosures, and careful negotiations, all without the pressure of last-minute wedding chaos.

The Foundation Phase: The First Few Months

Your first two to three months are all about laying a solid foundation. This starts with having an open, honest conversation with your partner about why a prenup is a smart move for both of you. It’s crucial to frame this as a tool for strengthening your partnership with clarity, not as a sign of distrust.

Once you’re on the same page, the next step is non-negotiable: each of you must hire your own, separate attorney. This is a hard-and-fast legal requirement in most places, and for good reason. It ensures both of your interests are independently represented, a critical factor any court will scrutinize if the prenup is ever challenged.

During this initial phase, you also need to kick off the financial disclosure process. This means gathering all the documents that paint a complete and transparent picture of your financial life.

Key documents to start pulling together include:

- Tax Returns: You’ll typically need the last three to five years.

- Bank and Investment Statements: This includes checking, savings, brokerage, and all retirement accounts.

- Business Valuations: If you’re a business owner, a professional valuation is almost always necessary.

- Real Estate Appraisals: For any property you own individually.

- A Full List of Debts: Think mortgages, student loans, credit card balances, and any other liabilities.

The data here shows a massive cultural shift. With nearly half of millennials now considering prenups a standard part of getting married, this kind of deliberate planning is becoming the norm.

The Drafting and Negotiation Phase: The Middle Months

With your lawyers on board and financial documents exchanged, the next couple of months are dedicated to drafting and negotiation. This is the stage where your attorneys translate your conversations and goals into a formal legal agreement.

Typically, one attorney will prepare an initial draft based on their client’s wishes and the financial information provided. That draft is then sent over to the other attorney for a thorough review, which officially kicks off the negotiation period. This is a back-and-forth process where terms get refined, clarified, and tweaked until both of you are completely satisfied.

Pro Tip: Keep the lines of communication wide open with your partner during this time, but let your attorneys handle the direct legal negotiations. This professional buffer helps keep discussions productive and prevents emotions from running high, maintaining that collaborative spirit you started with.

For those with significant or complex assets—like private equity stakes, intellectual property, or family trusts—this phase is absolutely critical. This is where connecting with a premier legal expert, such as those within the Haute Lawyer network, makes a difference. You need an attorney who has specific, proven experience handling high-value, nuanced assets to ensure your agreement is truly tailored to your unique financial landscape.

The Final Stretch: Review and Signature

The last month or two before the wedding should be reserved for the final review and signing. At this point, all the terms should be locked in, and the document should be a perfect reflection of your mutual agreement.

You’ll have a final, detailed meeting with your attorney to go over the entire document one last time. This is your chance to ask any lingering questions and confirm you understand the implications of every single clause before you sign.

The signing itself is a formal event that must comply with your state’s specific legal requirements. This often involves:

- Signing the document in the presence of a notary public.

- Having witnesses present.

- Ensuring both attorneys are on record confirming their clients understand the agreement and are signing voluntarily.

Once it’s signed and notarized, your prenup is a legally binding contract. By following this kind of structured timeline, you do more than just create a solid legal document; you reinforce the trust and communication that are the bedrock of a strong marriage. It’s a proactive step that buys you peace of mind, letting you walk into your union with absolute financial clarity.

For those getting started, this table breaks down the process into clear, manageable phases.

Prenup Timeline and Key Milestones

A step-by-step guide outlining the essential phases and recommended timing for securing a prenuptial agreement, ensuring a smooth and effective process.

| Phase | Recommended Timing | Key Actions |

|---|---|---|

| 1. The Conversation | 6-12 Months Before Wedding | Broach the topic with your partner. Frame it as a collaborative planning tool for your shared future. |

| 2. Legal Counsel | 5-6 Months Before Wedding | Each partner researches and retains their own independent attorney. This is a non-negotiable step. |

| 3. Financial Disclosure | 4-5 Months Before Wedding | Gather and exchange all financial documents, including assets, debts, income, and business valuations. |

| 4. Drafting | 3-4 Months Before Wedding | One attorney drafts the initial version of the prenuptial agreement based on client goals and financial data. |

| 5. Negotiation | 2-3 Months Before Wedding | Both attorneys review the draft and negotiate terms. Revisions are made until both parties are in full agreement. |

| 6. Final Review & Signing | At Least 1 Month Before Wedding | Both parties and their attorneys conduct a final review. The agreement is formally signed, witnessed, and notarized. |

Following this timeline helps ensure the process is thoughtful and legally sound, preventing the kind of last-minute pressure that can jeopardize an agreement’s enforceability.

Finding an Attorney Who Understands High-Value Assets

When a prenuptial agreement involves significant wealth, your choice of attorney becomes mission-critical. This isn’t a job for just any family lawyer; the financial stakes are simply too high, and the asset structures are far too complex. You need a legal strategist who lives and breathes high-net-worth cases and understands the nuanced world of protecting multifaceted wealth.

A general practitioner might handle a standard divorce with skill, but they often lack the sophisticated experience required to properly structure protections around private equity, intricate family trusts, intellectual property, or international real estate. The gap in expertise isn’t small—it’s the difference between a standard agreement and a truly bulletproof one.

Differentiating a Specialist from a Generalist

An attorney specializing in high-value prenups brings a completely different skill set to the table. They’re not just lawyers; they’re strategic advisors who collaborate with your financial team—from wealth managers to forensic accountants—to build a comprehensive shield around your assets.

Their experience allows them to foresee challenges a generalist would almost certainly miss. They know how to draft clauses that account for the future appreciation of a pre-marital business or the complex distribution rules of a multi-generational trust. This distinction is vital, as a single poorly drafted clause can lead to millions of dollars in unintended consequences down the road.

Questions to Ask During Your Consultation

The initial consultation is your chance to vet potential attorneys. You need to go beyond the basics of fees and years in practice and dig into their specific experience with assets like yours.

Here are a few sharp questions to help you identify a true specialist:

- How do you approach the valuation of unique assets like art collections or startup equity?

- Can you walk me through a complex negotiation you managed involving significant business interests?

- What percentage of your caseload is dedicated to high-net-worth prenuptial agreements?

- How do you stay ahead of tax law changes that could affect how assets are treated in a prenup?

An expert’s answers will be confident and detailed, revealing a clear history of handling similar high-stakes situations. For more ideas, our guide on how to find a good lawyer for high-value cases is an excellent resource.

A great high-net-worth attorney doesn’t just draft a document; they build a fortress. They understand that protecting wealth requires a deep knowledge of business, finance, and tax law, not just family law.

The Advantage of a Curated Legal Network

Trying to find the right specialist on your own can be a frustrating and time-consuming process. This is where a curated expert network like the Haute Lawyer Network becomes invaluable.

Instead of scrolling through endless online directories and hoping for the best, a curated network provides a pre-vetted list of elite attorneys. These are professionals hand-picked for their proven track record and reputation for excellence in complex financial and family law matters. For over 20 years, Haute Living has been a trusted publication for society’s elite, and the lawyers in our network reflect that same standard.

This approach gives you:

- Confidence in Expertise: You’re choosing from a pool of lawyers who specialize in high-stakes cases.

- Discretion and Professionalism: These attorneys are accustomed to working with high-profile clients and value privacy.

- Efficiency: It dramatically shortens your search, connecting you directly with top-tier talent.

When planning the financial future of your marriage, your choice of legal counsel is one of the most critical decisions you’ll make. Investing in an attorney who truly understands the world of high-value assets ensures your prenup is not just a document, but a powerful and enduring safeguard for everything you’ve built.

Essential Clauses for an Ironclad Prenup

While every prenup defines separate versus marital property at its core, an agreement built for high-net-worth individuals must go much, much deeper. The real power is in the details. A generic, off-the-shelf document simply won’t hold up when you’re dealing with complex assets and significant wealth—you need a bespoke shield designed for your specific financial world.

Think of these critical clauses as the steel frame of your agreement. Without them, the whole structure is at risk. They address the tricky nuances of wealth: how it grows, how it’s managed, and how it’s protected, leaving zero room for interpretation if the marriage ends. These are the provisions you and your attorney must get exactly right.

Protecting Your Business and Intellectual Property

For any entrepreneur, their business isn’t just another asset; it’s their legacy. A business interests clause is absolutely non-negotiable. This provision must explicitly state that any ownership you held in a company before the marriage—along with its future growth and profits—remains your separate property.

Let’s say you own a tech startup valued at $5 million when you get married. Five years down the road, it’s worth $50 million. Without a clause that specifically addresses this appreciation, a judge could easily decide that the $45 million increase is marital property, ready to be divided. This clause is what prevents that exact, devastating scenario.

In the same vein, an intellectual property clause is vital for innovators, artists, and authors. It carves out assets like patents, trademarks, royalties, and copyrights, designating them as separate property whether they were generated before or during the marriage. This ensures the income from your creative work remains yours alone.

Addressing Asset Appreciation and Spousal Support

One of the most fiercely contested issues in a high-asset divorce is how to treat the growth of separate property. What happens to a pre-marital investment portfolio that triples in value during the marriage? A thoughtfully drafted prenup tackles this head-on.

You have several ways to approach it:

- All appreciation stays separate: The simplest route. Any growth on your pre-marital assets isn’t shared.

- A portion becomes marital: You might agree that a certain percentage of the growth will be considered marital property.

- Active vs. Passive Appreciation: This is a more sophisticated approach. You can distinguish between growth from your direct efforts and management (which could be deemed marital) versus growth from passive market forces (which would remain separate).

The topic of spousal support, or alimony, is another flashpoint. Your agreement can set clear, predetermined terms. You might choose to waive it entirely, cap the amount or duration, or even establish a specific formula for calculating it. Defining this upfront eliminates one of the most unpredictable and emotionally draining parts of a potential divorce.

An effective prenup anticipates the “what-ifs” of financial growth. It doesn’t just list what you own today; it creates a clear rulebook for how the value of those assets will be treated for the entire duration of the marriage.

If you want to get a feel for the basic structure of these agreements, looking over a simple prenuptial agreement template can be a good starting point before you dive into these more customized clauses with your attorney.

Ensuring Privacy with Confidentiality and Lifestyle Clauses

For high-profile individuals, there’s more to protect than just money; there’s privacy and reputation. That’s why a confidentiality clause, often structured like a non-disclosure agreement (NDA), has become essential in modern, high-net-worth prenups. This is a legally binding term that forbids either spouse from discussing the marriage, its breakdown, or personal finances with the media or on social platforms. Violating it can trigger steep financial penalties.

While less common, some couples also include “lifestyle clauses.” These might address specific behaviors, but their enforceability really depends on the state. More practical, however, are clauses that clearly define financial responsibilities—like who manages household finances, how much is contributed to joint accounts, or who is responsible for debt. For example, a clause can state that any gambling losses or personal shopping debt racked up by one spouse on a private credit card remains their sole liability.

By weaving in these highly specific provisions, you elevate your prenup from a standard legal form into a powerful strategic instrument. It becomes a document that not only protects your assets but also provides the clarity and peace of mind you need to build a true partnership, securing your financial future no matter what comes your way.

Navigating Negotiations and Avoiding Common Pitfalls

This is where the theoretical becomes real. The negotiation phase turns conversations into a concrete, legally binding agreement. While it’s a deeply practical stage, it can also be emotionally loaded. The key is to see it not as a showdown, but as a collaborative final step toward building a secure financial foundation for your marriage.

Success here really comes down to maintaining open dialogue and a team-oriented mindset. You’re not trying to “win”—you’re working together to gain clarity and peace of mind.

Strategies for Healthy Negotiation

Productive negotiations are all about the right approach. Let your attorneys handle the direct legal back-and-forth. This professional buffer is invaluable; it keeps discussions objective and stops things from getting personal between you and your partner. We cover some powerful communication techniques in our guide on how to prepare for mediation, which has some great insights that apply here, too.

Even with lawyers in the lead, you can’t be passive. Make a point to check in with your partner throughout the process. A simple “How are you feeling about everything?” goes a long way in making sure you both feel heard and respected. It’s a constant reminder that you’re a team.

A few tips from experience for a smoother process:

- Pick Your Battles: Know what’s truly non-negotiable for you and where you can be flexible. Not every clause will carry the same weight.

- Stay Future-Focused: Frame discussions around your shared future. Talk about protecting a family business for the next generation or ensuring you’re both financially stable no matter what.

- Take Breaks: If a specific point gets tense, it’s perfectly fine to hit pause for a day or two. Time allows emotions to cool and often brings fresh perspectives.

Common Mistakes That Can Invalidate a Prenup

Even a perfectly negotiated agreement is worthless if it falls into one of several common legal traps. A court can, and will, throw out a prenup if certain conditions aren’t met. Avoiding these pitfalls is everything.

These are the most frequent reasons prenups get invalidated in court:

- Incomplete Financial Disclosure: This is the cardinal sin. Hiding assets or misrepresenting debts is a surefire way to get the agreement voided. Full transparency isn’t just a good idea—it’s a legal requirement.

- Signing Under Duress: An agreement presented and signed just days before the wedding screams coercion to a judge. This is precisely why starting the process at least six months in advance is your best defense against such a claim.

- Grossly Unfair Terms: While a prenup can create an unequal division of assets, it can’t be “unconscionable.” An agreement that leaves one spouse destitute while the other keeps millions is unlikely to be upheld. Courts look for a baseline of fairness.

- Lack of Independent Counsel: Both parties must have their own, separate attorneys. One lawyer for both of you is a conflict of interest that can invalidate the entire document.

A valid prenup is always the product of fairness, transparency, and voluntary consent. Any hint of coercion, hidden assets, or extreme imbalance puts the whole agreement at risk.

For high-net-worth individuals, the stakes are astronomical. Prenups are essential tools to preserve family empires, protect complex business structures, and ensure wealth passes to the next generation as intended. Without one, courts are left to divide assets in a way that can be both financially devastating and painfully public.

This is where a curated resource like the Haute Lawyer Network becomes indispensable. It provides a crucial bridge to elite, pre-vetted attorneys who specialize in protecting significant wealth. For those navigating these complexities, making the right connection is vital—a single misstep can have multi-generational consequences.

Answering Your Lingering Prenup Questions

Even with a solid plan, a few questions inevitably pop up. Getting clear, straightforward answers is the final step to moving forward with confidence, fully understanding the nuances of these powerful legal instruments.

Let’s cut through the common myths and misconceptions that often surround prenuptial agreements and reinforce their value as a strategic planning tool for your marriage.

Can We Change the Prenup After We’re Married?

Absolutely. An agreement signed before the wedding isn’t set in stone. You can modify or even revoke it entirely after you’re married through a document known as a postnuptial agreement.

For any changes to stick, both you and your spouse must willingly agree to the new terms, in writing. The key here is that each of you must have your own separate attorney review the changes. This isn’t just a suggestion—it’s a critical step to ensure the updated agreement is legally sound and fully enforceable down the line.

What Could Make a Prenup Invalid?

A judge can toss out a prenuptial agreement if it fails to meet strict legal standards. It doesn’t happen often with properly drafted documents, but certain mistakes are fatal. Some of the most common reasons an agreement gets invalidated include:

- Signing Under Duress: If one person was coerced, pressured, or ambushed into signing—especially days before the wedding—a court might see it as involuntary.

- Incomplete Financial Disclosure: This is a major one. Hiding assets or failing to give a full, honest picture of your finances can torpedo the entire agreement. Transparency is non-negotiable.

- Grossly Unfair Terms: While prenups don’t have to be perfectly balanced, terms that are considered “unconscionable” or would leave one spouse destitute are rarely upheld by the courts.

- Improper Legal Procedure: Cutting corners is a recipe for disaster. If both parties didn’t have their own independent legal counsel, or other state-specific rules weren’t followed, the document can be rendered void.

Does a Prenup Cover Child Custody or Support?

No, and this is an important distinction. A prenuptial agreement cannot legally dictate anything related to child custody or child support.

These decisions are always made by a court based on the child’s best interests at the time of a potential divorce. Any clauses in a prenup that try to pre-determine these outcomes are simply unenforceable.

It’s a common misconception, but family courts retain ultimate jurisdiction over children’s welfare. Parents cannot contractually waive or set those rights in a prenuptial agreement.

How Much Does a High-Net-Worth Prenup Cost?

For individuals with complex financial portfolios—think business holdings, trusts, or international assets—the cost of a well-crafted prenup will vary. The final price tag hinges on the intricacy of your assets and how much negotiation is needed.

You can generally expect costs to range from several thousand to tens of thousands of dollars. It’s best to view this not as an expense, but as a critical investment. It’s a small price to pay for securing assets worth substantially more and achieving long-term financial clarity.

Navigating the complexities of a high-value prenup requires an attorney with specialized expertise. For direct access to a curated list of elite, pre-vetted legal professionals who understand how to protect significant wealth, explore the Haute Lawyer Network.