Filing for bankruptcy is a powerful legal tool. It’s a formal process that can give you a fresh start, either by liquidating assets to satisfy debts (Chapter 7) or by structuring a formal repayment plan (Chapter 13 or 11). The right path forward depends entirely on your income, the assets you hold, and whether you’re filing as an individual or for a business.

Deciding if Bankruptcy Is Your Best Option

Confronting overwhelming debt can feel like a dead end. Before getting into the mechanics of filing, the first crucial step is a brutally honest assessment of your situation. Is this the right strategic move for you? This goes beyond spreadsheets and creditor calls—it’s about understanding the real-world impact that crushing financial distress is having on your life, your family, or your company’s future.

When you can no longer keep up with routine bills and the collection calls are relentless, it’s a clear signal that something needs to change. Constant financial stress takes a serious toll, and bankruptcy exists as a legal mechanism to bring it to a definitive end.

Key Indicators It Might Be Time to File

Consider filing if these financial pressures have become your new normal:

- Using credit to pay for necessities: Swiping a credit card for groceries, utilities, or rent isn’t a long-term solution. It’s an unsustainable cycle.

- Facing lawsuits or wage garnishment: Once creditors take legal action, it’s a serious escalation. It means informal solutions are likely off the table.

- Draining retirement accounts to pay debts: Sacrificing your future to patch up the present is a classic sign of a much deeper problem that needs a structural fix.

- Having no realistic path to repayment: If your total debt is so large that you can’t imagine paying it off within five years, even on the strictest budget, a reset may be the only way forward.

It’s also important to recognize the broader economic climate. The U.S. is experiencing a major uptick in corporate bankruptcies, hitting a pace we haven’t seen since 2010. S&P Global Market Intelligence reported a staggering 371 corporate filings in the first half of the year alone. This trend underscores the need for struggling businesses to be decisive. You can get more context on these bankruptcy trends from S&P Global to see how the market is shifting.

A First Look at Bankruptcy Chapters

Bankruptcy isn’t one-size-fits-all. The U.S. Bankruptcy Code is broken down into several distinct “chapters,” each engineered for different financial realities and strategic goals.

Understanding which chapter aligns with your circumstances is the foundation of a successful filing. The choice between liquidating assets, reorganizing personal finances, or restructuring a business will dictate every subsequent step.

Here’s a high-level snapshot:

- Chapter 7 (Liquidation): Often called “straight bankruptcy,” this is for individuals and businesses that need to wipe the slate clean. A court-appointed trustee sells non-exempt assets to pay creditors, and in return, most of your unsecured debts (think credit cards and medical bills) are completely discharged.

- Chapter 13 (Personal Reorganization): This path is for individuals with a regular income who want to protect key assets, like their home or car. You’ll create a court-approved plan to repay a portion of your debts over a three- to five-year period.

- Chapter 11 (Business Reorganization): Primarily for businesses (though some high-net-worth individuals can use it), this chapter lets a company stay open and continue operating while it reorganizes its finances and develops a formal plan to repay creditors over time.

Before you make any move, it’s also smart to understand how much time your creditors legally have to come after you. You can learn more about the statute of limitations by state in our guide, which can be a key factor in your strategic timing. This initial gut check is about making sure the benefits of bankruptcy truly line up with your long-term financial recovery.

Choosing The Right Bankruptcy Chapter

Picking the right bankruptcy chapter isn’t just a box to check on a form; it’s the most critical strategic decision you’ll make, dictating the entire trajectory of your financial recovery. The path for a high-earning consultant drowning in unsecured debt is worlds apart from that of a real estate developer looking to restructure and save a portfolio of properties.

Each chapter is a different tool designed for a specific job. Understanding their fundamental differences is the first step. It’s about matching the legal machinery to your end goal, whether that’s a clean slate or a meticulously planned reorganization.

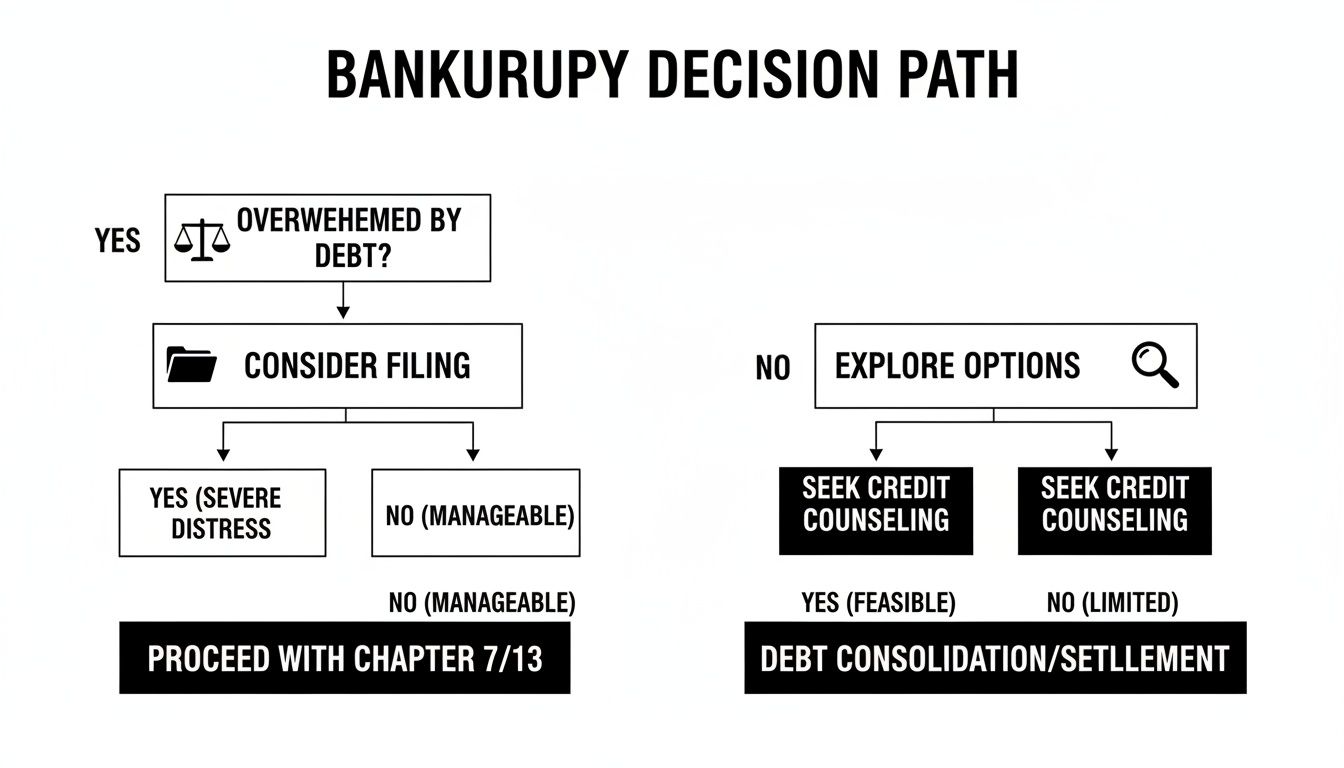

This decision tree shows the initial forks in the road. The key isn’t just the amount of debt you have, but the nature of your assets, your income, and what you hope to achieve on the other side.

Chapter 7: The Liquidation Path

Known as “straight bankruptcy,” Chapter 7 offers a clean break. It’s the most common route for individuals because it aims to wipe out unsecured debts—think credit cards and medical bills—in a relatively short timeframe, often just four to six months.

Imagine a freelance graphic designer with $80,000 in credit card debt but few assets beyond his professional equipment. For him, Chapter 7 could be a perfect fit. A trustee reviews his assets, but legal exemptions typically protect essential property. The unsecured debt gets discharged, giving him a genuine financial reset.

There’s a catch, however: the means test. This is the gatekeeper to Chapter 7. It compares your household income against your state’s median for a family of your size. If you’re below the median, you’ll likely qualify. If you’re above it, a more complex formula determines if you have enough disposable income to repay a portion of your debts, pushing you towards Chapter 13.

The means test isn’t just a formality. It’s the core determinant of Chapter 7 eligibility, and failing it simply means your case is better suited for a repayment plan.

Chapter 13: The Repayment Strategy

Now, what if that same designer owned a home with significant equity—an asset he’d lose in Chapter 7? This is where Chapter 13 becomes the smarter play. It allows individuals with steady income to reorganize their financial affairs while keeping their valuable assets.

Under Chapter 13, you propose a repayment plan to the court that lasts three to five years. You make one consolidated monthly payment to a trustee, who then pays your creditors. It’s an incredibly powerful tool for:

- Stopping a foreclosure, giving you a structured way to get current on your mortgage.

- Protecting valuable assets that would otherwise be sold off in a Chapter 7.

- Managing priority debts, like certain tax obligations, that bankruptcy can’t erase.

The demand for this kind of relief is soaring. Individual bankruptcy filings in the U.S. jumped to 517,308 in 2024, a 14.2% increase year-over-year. While Chapter 7 led the way with 320,571 filings, the rising numbers underscore how vital it is to choose the right strategy. You can find more granular data on these bankruptcy filing trends from the experts at Debt.org.

Chapter 11: The Business Reorganization

Let’s shift focus to a restaurant owner. The business is viable, but a perfect storm of vendor debt and a bad lease has pushed it to the brink. Shutting down isn’t the goal; survival and recovery are. This is the classic scenario for Chapter 11.

Used primarily by businesses—and occasionally by high-net-worth individuals with intricate finances—Chapter 11 allows an enterprise to keep operating while it creates a plan to reorganize and pay its creditors over time. It is far more complex and costly, but its flexibility is unmatched.

The business owner typically stays in control as the “debtor-in-possession,” running daily operations under court supervision. The endgame is to emerge as a leaner, healthier company. Because the process involves intense negotiations, detailed financial disclosures, and creditor committees, having elite bankruptcy counsel isn’t a luxury; it’s an absolute necessity.

To make this clearer, let’s break down the core differences between these chapters side-by-side.

Bankruptcy Chapters At A Glance

This table simplifies the key distinctions to help you see which path might align with your circumstances.

| Feature | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) | Chapter 11 (Business Reorganization) |

|---|---|---|---|

| Primary Filer | Individuals and businesses | Individuals with regular income | Businesses, corporations, and high-net-worth individuals |

| Main Goal | Discharge unsecured debts quickly | Create a repayment plan to keep assets | Reorganize the business to remain operational |

| Timeline | Typically 4-6 months | 3-5 years | Can take years; highly variable |

| Asset Treatment | Non-exempt assets are sold by a trustee | Filer keeps assets while repaying debts | Business retains assets while reorganizing |

| Eligibility | Must pass the means test | Must have regular income and be under debt limits | No specific income or debt limits |

| Cost & Complexity | Lowest cost, least complex | More complex and costly than Chapter 7 | Highest cost, most complex |

Ultimately, the choice between Chapter 7, 13, and 11 is the foundational decision that will shape every subsequent step of your bankruptcy case.

Navigating the Bankruptcy Filing Process

Once you’ve settled on the right chapter, the real work begins. The filing process itself is a highly structured journey, and while it might look like a mountain of paperwork from the outside, it’s best viewed as a clear roadmap. Each step has a purpose, moving your case from petition to discharge. Knowing what’s coming demystifies the entire experience.

The journey doesn’t start at the courthouse. It begins with a mandatory educational step designed to ensure this is truly the right path for you.

The Mandatory Credit Counseling Course

Before your attorney can even think about filing your petition, federal law demands you complete a credit counseling course from a government-approved agency. This isn’t optional. The session, which typically takes 60-90 minutes online or over the phone, is designed to be a final review of your finances and any possible alternatives to bankruptcy.

Think of it as a final gut check. You’ll get a certificate upon completion that is an essential part of your filing package. Without it, the court will simply reject your case.

A word of caution: Stick to the list of agencies approved by the U.S. Trustee Program. An unapproved provider will give you a worthless certificate, costing you time and money. Your counsel will provide a list of reputable, low-cost options.

Assembling the Bankruptcy Petition and Schedules

Here comes the most labor-intensive part of the entire process—the paperwork. The bankruptcy petition is far more than a simple form; it’s a comprehensive legal document that gives the court a complete x-ray of your financial life. It demands a meticulous disclosure of everything you own, owe, earn, and spend.

You’ll be working closely with your legal team to gather and organize core documents, including:

- A complete list of all creditors: This means every single entity you owe, from mortgage lenders down to the last credit card, along with their addresses and account numbers.

- Schedules of assets and liabilities: A detailed inventory of what you own (real estate, vehicles, investments) and the corresponding debts against them.

- A schedule of current income and expenditures: A snapshot of your monthly budget, showing the court exactly where your money goes.

- A statement of financial affairs: This is a questionnaire about your recent financial history, covering everything from property sales to large payments made to creditors.

Getting this right is paramount. Any omissions or errors, even unintentional ones, can lead to severe complications, including the potential denial of your discharge.

This level of financial disclosure is standard practice globally, where a significant surge in filings is underway. A global bankruptcy wave is building, with 65% of tracked economies reporting increases in corporate bankruptcies in 2024. In the U.S., total filings hit 529,080 by March, a 13.1% increase. This trend underscores why courts demand such precision. You can explore the full report on global bankruptcy trends to understand the larger context.

The 341 Meeting of Creditors

Roughly 30 to 45 days after filing, you’ll attend a mandatory hearing known as the 341 meeting of creditors. The name sounds far more intimidating than the reality. This isn’t held in a formal courtroom, and there’s no judge. It’s a brief, administrative meeting conducted by your court-appointed bankruptcy trustee.

Your attorney will be right there with you. You’ll be placed under oath, and the trustee will ask a series of routine questions to verify the information in your petition is accurate. They’ll ask if you’ve listed all your assets and debts, if you’ve read the documents you signed, and other straightforward questions.

While creditors are invited, they rarely show up, especially in consumer cases. For most people, the entire event is over in less than 10 minutes. The trustee’s only goal is to ensure your filing is accurate and to administer the case fairly. As long as you’re honest and prepared, it’s a simple, procedural step on the path to discharge.

Protecting Your Assets During Bankruptcy

One of the most persistent myths surrounding bankruptcy is that you’ll be forced to hand over everything you own. That’s simply not the reality. The system is designed to provide a financial reset, not to strip you of your foundation. At the heart of a sophisticated bankruptcy filing is strategic asset protection, accomplished using powerful legal tools called exemptions.

Think of exemptions as a legal shield. They are specific laws that protect certain kinds of property—up to a certain value—from being sold off by the trustee in a Chapter 7 liquidation.

Understanding Bankruptcy Exemptions

Every state has its own unique set of exemptions, and a federal list exists as well. Some states mandate that you use their list, while others offer a choice between state and federal options. This isn’t a minor detail; it’s a critical strategic decision that hinges entirely on the nature and value of your assets.

An elite bankruptcy attorney will meticulously analyze your portfolio to select the exemption framework that provides the strongest possible shield. For example, Texas is famous for its unlimited homestead exemption, which can protect the entire value of your primary residence. Another state, however, might have a very modest homestead cap but offer far better protections for vehicles, investment accounts, or cash.

Common categories of property you can often protect include:

- Your primary residence (homestead): The amount of equity you can shield varies dramatically from one state to another.

- Retirement accounts: Funds in 401(k)s, IRAs, and other qualified retirement plans are almost always 100% protected up to a very high limit.

- Vehicles: There’s usually a cap on the amount of equity in a vehicle you can exempt.

- Tools of the trade: Items essential for your profession or business are often protected so you can continue to earn a living.

- Personal property: This covers your household goods, furniture, clothing, and other essentials, again, up to a specific value.

The entire goal is to legally classify and shield as much of your property as possible within these established frameworks.

Strategic Considerations for Businesses

For entrepreneurs and business owners, the stakes are significantly higher. Protecting a viable business through a personal bankruptcy—or guiding the business itself through a restructuring—demands an entirely different playbook.

In a Chapter 13, you keep your assets, including your business, provided you can fund a repayment plan that meets court approval. The central challenge is proving that your creditors will get at least as much under your plan as they would if the business were liquidated in a Chapter 7.

Chapter 11 offers the most powerful tools for preserving a business. You remain in control as the “debtor-in-possession,” managing daily operations while you renegotiate debt and restructure the company’s finances. It’s a complex process designed to keep the business alive, preserving its value and the jobs it creates.

Critical Insight: The most catastrophic mistakes in asset protection are almost always made before the bankruptcy case is ever filed. Panicked decisions can have permanent, devastating consequences, including the outright denial of your bankruptcy discharge.

Pre-Filing Mistakes You Must Avoid

Under immense financial pressure, it can be tempting to start moving assets out of your name to shield them from the court. This is a disastrous misstep. The bankruptcy trustee has far-reaching powers to scrutinize every financial transaction you’ve made for months, and sometimes years, before your filing.

These actions will put your entire case in jeopardy:

- Transferring property to family or friends: Gifting your luxury car to your son or deeding your vacation home to a sibling right before filing is a textbook fraudulent transfer. The trustee has the authority to sue the recipient and claw back that asset for your creditors.

- Making preferential payments: Paying back a large loan to a relative or a favored business partner while stiffing other creditors is a major red flag. The trustee can often recover those funds to ensure all creditors are treated fairly.

- Hiding assets: Deliberately failing to list property on your bankruptcy schedules isn’t just a mistake; it’s perjury. The fallout can include criminal charges and a complete denial of your case, leaving you stuck with your debt and a ruined reputation.

True asset protection is about skillfully using the law, not trying to evade it. Sophisticated strategies like trusts can be effective, but only if they are established correctly and well in advance of any financial trouble. Understanding the benefits of a revocable living trust is essential for long-term wealth planning, but creating one to hide assets on the eve of bankruptcy is a strategy destined to fail.

The bottom line is that complete transparency is non-negotiable. An expert attorney will guide you through the rules, using the right legal exemptions to build a fortress around your core assets and ensure your financial foundation survives for your fresh start.

Finding the Right Legal Counsel

Attempting to navigate a high-net-worth bankruptcy without elite legal counsel is an unforced error with devastating, often irreversible, consequences. The process is simply too nuanced for a do-it-yourself approach, especially when significant assets, business continuity, or a public reputation are hanging in the balance.

Assembling the right legal team isn’t just a step in the process; it is the single most critical investment you will make in securing your financial future. Your choice of attorney will directly dictate the outcome. A general practitioner simply won’t do. You need a specialist—a seasoned bankruptcy attorney whose entire practice is dedicated to the intricacies of the U.S. Bankruptcy Code and who intimately understands the local court system and its key players.

Vetting Your Potential Attorney

When you schedule initial consultations, remember that you are conducting the interview, not the other way around. Your goal is to find a professional with not only the technical expertise but also the strategic foresight to pilot you through the storm.

Come prepared with a list of pointed questions that cut to the heart of their experience. Go beyond basic qualifications. Ask about their direct experience with cases of your scale and complexity. For a business owner, this means drilling down on their track record with Chapter 11 reorganizations. For a public figure, it means asking about their experience managing media exposure and creditor communications.

During your consultation, consider asking these specific questions:

- How much of your practice is dedicated exclusively to bankruptcy law?

- What is your experience with cases involving assets or businesses of my size?

- Who on your team will handle the day-to-day work on my case?

- What is your strategy for communicating with creditors and other stakeholders?

- Based on what you’ve heard, what are the primary challenges you foresee?

This line of questioning reveals their depth of knowledge and strategic thinking. You can find more insights on this critical selection process by reading about how to choose the right attorney for your case, which offers a broader framework for making this vital decision.

Understanding the Costs Involved

Top-tier legal representation is not an expense; it’s an investment in a successful outcome. The costs can be significant, but they pale in comparison to the value of assets preserved. The fees vary dramatically depending on the chapter you file and the complexity of your situation.

Pro Tip: Always demand a clear, written fee agreement. It should detail the attorney’s hourly rate or flat fee, the required retainer, and a transparent breakdown of anticipated court costs and administrative expenses. Financial surprises are the last thing you need.

Here’s a general overview of what to expect:

- Attorney Fees: This is the largest component. Chapter 7 cases are often handled on a flat-fee basis. Complex Chapter 13 and Chapter 11 cases are almost always billed hourly against a substantial retainer.

- Court Filing Fees: The federal court system charges standard fees to initiate a case. As of late 2024, these are $338 for Chapter 7, $313 for Chapter 13, and a much more substantial $1,738 for Chapter 11.

- Administrative Costs: These cover essentials like pulling credit reports, document retrieval, and the two mandatory credit counseling and debtor education courses.

Managing Public Perception and Stakeholders

For high-profile individuals or prominent business owners, filing the petition is only half the battle. Managing the narrative with the media, reassuring key employees, and communicating effectively with vendors and customers are all mission-critical tasks.

An experienced bankruptcy attorney does far more than just file paperwork; they serve as a strategic crisis management advisor. Your legal team should help you develop a robust communication plan to manage public perception and maintain stakeholder confidence. This proactive approach ensures the entire process is handled with the discretion and professionalism required to safeguard your reputation and preserve the relationships vital for your fresh start.

Answering The Tough Questions On Bankruptcy

Even with the best guidance, making the decision to file for bankruptcy brings up some hard questions. Let’s tackle the most common concerns head-on, cutting through the noise to give you the clarity needed to move forward.

The answers often challenge the myths you hear about what life looks like after a filing.

How Long Does Bankruptcy Stay On My Credit Report?

A bankruptcy filing isn’t a permanent mark on your record, but it does have a shelf life. A Chapter 7 bankruptcy can remain on your credit report for up to 10 years, while a Chapter 13 filing typically drops off after 7 years.

But here’s what most people don’t realize: its impact fades dramatically over time. You can start rebuilding your credit almost immediately after your case is finalized.

Many of our clients are genuinely surprised at how quickly they start receiving new credit offers. By smartly using tools like secured credit cards and proving your reliability with on-time payments, you can begin writing a new financial chapter much sooner than you think.

Can I Keep My House and Car if I File?

For most people, the answer is a resounding yes. Protecting your home and primary vehicle is a central goal in almost every bankruptcy case, and the law is specifically designed to allow for it.

- In Chapter 7: We use state or federal exemption laws to shield the equity you have in your property. As long as your equity is within the legal limits and you’re up-to-date on your payments, you can reaffirm the debt and keep your asset. It’s a routine part of the process.

- In Chapter 13: You almost always keep your property. This Chapter is structured to let you catch up on any past-due payments over three to five years, all while maintaining your regular monthly loan payments. It’s one of the most powerful tools for preventing foreclosure or repossession.

Success hinges on a sophisticated strategy developed with your attorney to maximize your exemptions.

What Debts Can Bankruptcy Not Eliminate?

Bankruptcy is an incredibly powerful tool for a fresh start, but it doesn’t erase every single financial obligation. Certain debts are classified as non-dischargeable, and you’ll still be responsible for them after the case is closed.

Understanding which debts will remain is critical for effective planning.

Here are the most common debts that bankruptcy won’t touch:

- Certain Tax Debts: Don’t expect to wipe out recent income tax liabilities, especially from the last few years.

- Domestic Support Obligations: Child support and alimony are never dischargeable. Period.

- Student Loans: This is the big one. Getting rid of student loans in bankruptcy is notoriously difficult and requires proving an extreme “undue hardship” standard that very few can meet.

- Debts from Fraud or Malicious Acts: If a creditor can prove a debt was incurred through fraud or resulted from an act like a DUI, it’s not going away.

A detailed review of your liabilities with elite counsel is non-negotiable. This ensures you have a crystal-clear picture of your financial situation post-bankruptcy, so you can plan for the future without any unwelcome surprises.

When significant assets and business interests are on the line, navigating bankruptcy demands a legal team with proven, high-stakes experience. The Haute Lawyer Network is a curated directory of the nation’s premier attorneys, vetted for their professional excellence. Find elite counsel who can protect your future by visiting https://hauteliving.com/lawyernetwork.