The reality is, a typical legal separation runs between $5,000 and $15,000. The final number, however, is almost entirely dictated by how well you and your partner can cooperate. Think of it less like demolishing your marriage and more like hitting a structured ‘pause’—a financially savvy first step for many couples.

What Does a Legal Separation Typically Cost?

When you’re facing the difficult decision to live apart, one of the first questions that comes to mind is almost always financial. The cost of a legal separation isn’t some fixed number; it’s a spectrum controlled by a single, powerful factor: conflict.

An amicable process, where both parties see eye-to-eye on the big issues, will always be more affordable than a contentious fight that drags out in legal battles.

A legal separation creates a formal, court-recognized framework for living apart while you remain legally married. This distinction is critical for a few key reasons:

- Preserving benefits: It often allows one spouse to stay on the other’s health insurance plan, a massive financial advantage that disappears with divorce.

- Religious considerations: For some, divorce simply isn’t an option due to deeply held religious beliefs, making separation a practical and respectful alternative.

- Time for reflection: It offers a structured “trial run” for couples who aren’t quite ready to permanently end their marriage and need space to decide what’s next.

Understanding the Price Tag

The process looks a lot like a divorce on paper—you still have to sort out property division, child custody, and support payments. But because the emotional stakes can be lower and the end goal isn’t a final dissolution, negotiations are often far simpler and quicker.

This dynamic frequently makes legal separation a much more cost-effective path than a full-blown divorce. In the United States, the average cost of a separation is significantly less than the $11,000 to $25,000 often seen in a contested divorce. You can dig deeper into these figures by reviewing recent divorce cost statistics from recent data analysis.

The most important principle to remember is this: every hour spent arguing is an hour you are paying for. Your ability to collaborate directly controls the final bill.

To give you a clearer picture, let’s break down the main expenses you should anticipate. While the exact numbers will shift based on your location and the complexity of your finances, this gives you a solid starting point for budgeting and making informed decisions.

Quick Look at Legal Separation Cost Components

Here’s a summary of the primary expenses you can expect. Understanding these elements from the start helps you budget effectively and make smarter decisions as you move forward.

| Expense Category | Typical Cost Range (USD) | Key Influencing Factor |

|---|---|---|

| Attorney Fees | $3,000 – $12,000+ | Level of conflict and negotiation required |

| Court Filing Fees | $200 – $500 | State and county jurisdiction |

| Mediation Services | $1,000 – $5,000 | Number of sessions needed to reach an agreement |

| Expert Fees | $500 – $10,000+ | Complexity of assets (e.g., business valuation) |

These are the building blocks of your total separation cost. The more you can agree on outside of a courtroom, the more you keep these figures on the lower end of the spectrum.

An Itemized Breakdown of Separation Expenses

Trying to figure out the total cost of a legal separation can feel like assembling a complex puzzle without the box top. The final price isn’t a single number; it’s a combination of several distinct expenses, each playing a critical role. Let’s break down exactly where your money goes.

The biggest piece of the puzzle, almost without exception, will be your legal representation. Your attorney is your strategist, your advocate, and your guide through this process—their expertise is the most significant investment you’ll make.

Attorney Fees: The Main Expense

Think of your lawyer’s time as a valuable resource you’re purchasing. Most family law attorneys bill by the hour, meaning every phone call, every document drafted, and every negotiation is tracked and charged.

Some lawyers might offer a flat-rate retainer, an upfront payment covering a defined set of services. While this offers some predictability, it may not cover unexpected disputes or complications that draw the process out. It’s absolutely critical to understand the fee structure before you sign anything.

Just how dominant is this expense? Recent family law statistics show that attorney fees often account for a staggering 70% of the total costs in family law cases. With hourly rates for family lawyers typically falling between $260 and $450—and many clients paying even more—it’s easy to see how quickly the meter can run, especially if the separation is contentious. You can see a full analysis of these family law financial trends on Clio’s blog.

Court Filing Fees: The Unavoidable Cost

No matter how smoothly you and your spouse handle things, you can’t sidestep court filing fees. These are the administrative costs required to formally open your case and get it into the legal system. It’s the price of admission to make your separation agreement legally recognized and enforceable.

These fees are set by the state or county, so there’s no room for negotiation. They usually range from $200 to $500. While it’s a smaller part of the overall budget, it’s a mandatory first step.

Mediation: A Smart Financial Move

Opting for mediation isn’t about giving in; it’s a strategic financial choice. Instead of paying two separate lawyers to battle back and forth, you and your spouse hire a single, neutral mediator.

A mediator’s job is to facilitate a productive conversation and guide you toward an agreement you can both live with. This collaborative route almost always saves a tremendous amount of money and emotional energy by keeping you out of a contested courtroom showdown.

A mediator helps you build a bridge to an agreement. Litigation often requires both sides to dig trenches, an expensive and emotionally draining process.

The Role of Financial Experts

Sometimes, a financial picture is too complicated for lawyers to handle alone. This is where specialized experts come in, providing objective valuations and clarity that are essential for a fair and durable settlement.

You may need to budget for:

- Property Appraisers: If you own a home or other real estate, a professional appraiser is needed to determine its true market value for a fair division.

- Forensic Accountants: Essential when one spouse owns a business, or if you suspect assets are being hidden. They trace the money to paint an accurate financial picture.

- Tax Advisors: A CPA can offer critical advice on the tax consequences of splitting retirement accounts or selling a shared property, preventing costly future surprises from the IRS.

Hiring these professionals adds an upfront cost, but their input can prevent massive financial mistakes and future legal battles that would ultimately cost far more. To get a better handle on legal billing, check out our guide on what determines a lawyer’s cost. Each of these components adds to the final number, but the choices you make—especially regarding cooperation—will determine whether they remain manageable costs or spiral out of control.

Legal Separation vs. Divorce: A Financial Showdown

When a marriage is on the rocks, one of the first questions couples ask is a practical one: is a legal separation actually cheaper than a divorce? The answer isn’t always simple, but here’s the bottom line: a separation is often a financial sprint, while a contested divorce can easily become a costly marathon.

Think of it this way. A legal separation tackles the same core issues as a divorce—dividing assets, figuring out child custody, and setting support payments. The key difference? It often sidesteps the finality and emotional intensity that drives up costs. Because the goal isn’t to completely dissolve the marriage, negotiations can feel more focused and less like a battle.

That collaborative spirit is the main reason the cost of legal separation is frequently much lower.

Comparing the Financial Paths

A divorce, especially one that turns contentious, gets expensive fast. The discovery process alone can be a major financial drain. Lawyers on both sides might spend hundreds of hours digging through financial records, deposing witnesses, and gearing up for a potential trial. Each one of those steps adds another layer of legal fees and court costs, turning the whole affair into a war of financial attrition.

Separation, on the other hand, often allows couples to bypass those high-conflict, high-cost stages. You can create a legally binding agreement that works just like a divorce decree but keeps the marriage legally intact. This can be a smart, strategic move for preserving benefits like health insurance or hitting the 10-year mark for Social Security spousal benefits.

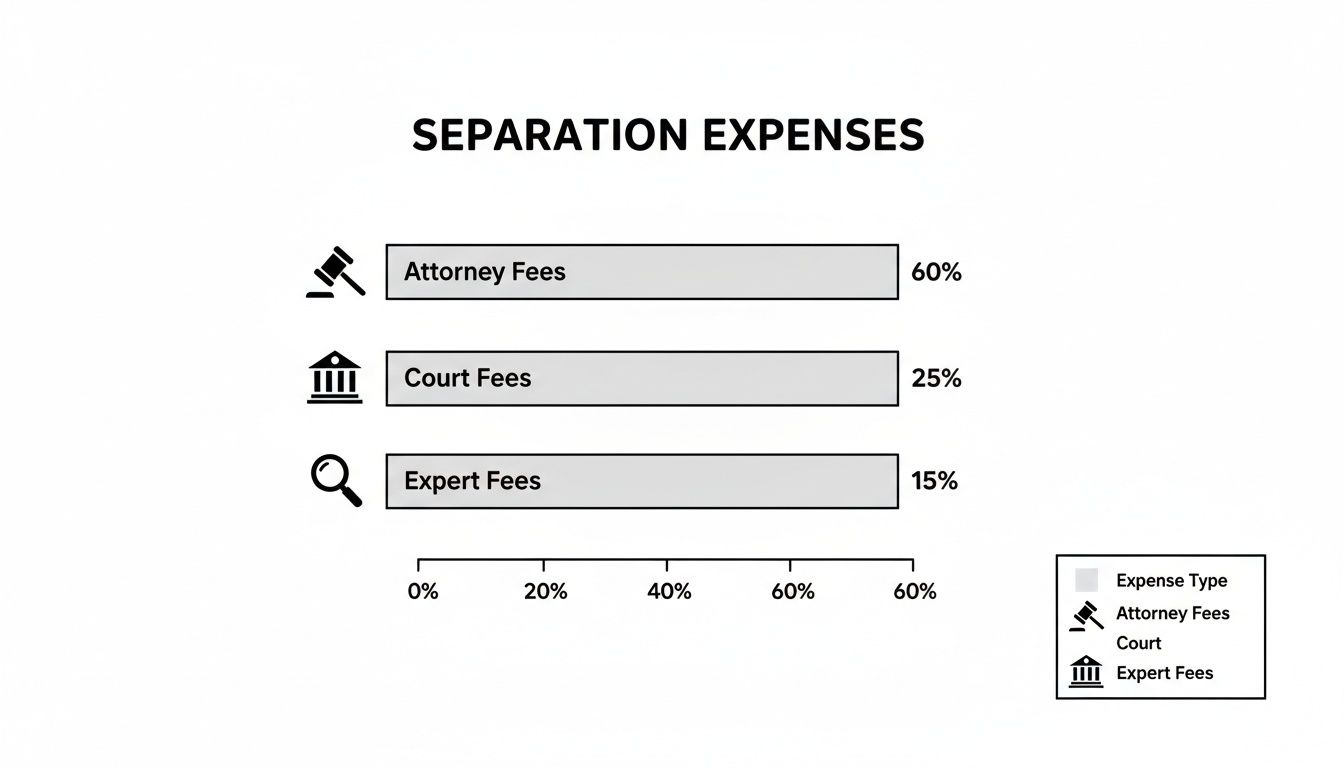

This chart breaks down where the money typically goes in a separation, giving you a clear picture of the major expenses.

As you can see, attorney fees eat up the biggest piece of the pie. It’s a stark reminder that minimizing conflict is the single most effective strategy for keeping costs under control.

A Head-to-Head Cost Analysis

The financial gap between separation and divorce widens dramatically as soon as conflict enters the picture. An amicable, uncontested separation might only run you a few thousand dollars. A litigated divorce? That can easily rocket into the tens of thousands, or even more.

The data paints a clear picture. While the average divorce can cost anywhere from $15,000 to $20,000, a legal separation often lands closer to the cost of an uncontested divorce, typically between $5,000 and $10,000. But when a divorce goes all the way to trial, the average cost jumps to $23,300—and that’s just the average.

To really see how these numbers play out, let’s compare the costs side-by-side in a few different scenarios.

Cost Scenario: Legal Separation vs. Divorce

This table illustrates how quickly costs can escalate based on the level of disagreement between spouses.

| Scenario | Estimated Legal Separation Cost | Estimated Divorce Cost | Primary Cost Driver |

|---|---|---|---|

| Amicable / Uncontested | $3,000 – $7,000 | $4,000 – $8,000 | Document preparation and filing fees |

| Moderately Contested | $8,000 – $15,000 | $11,000 – $25,000 | Lengthy negotiations and mediation |

| Highly Contested / Trial | N/A (often converts to divorce) | $25,000 – $75,000+ | Expert witnesses, discovery, court time |

What this shows is that as the conflict intensifies, the financial edge of a separation starts to disappear. Why? Because high-conflict cases almost always end up heading toward a full-blown divorce anyway.

Why Divorce Costs Escalate

That higher price tag on divorce isn’t random; it’s fueled by specific legal procedures that are common in contested cases but often completely avoided in separations.

These escalating costs are almost always driven by:

- Formal Discovery: This is the official legal process of gathering evidence. It involves depositions, subpoenas, and formal requests for documents, all of which burn through a staggering number of attorney hours.

- Expert Witnesses: When there are arguments over things like the value of a business or child custody arrangements, you bring in the experts. Testimony from forensic accountants or psychologists can cost thousands of dollars per day.

- Multiple Court Appearances: Every single motion, hearing, and conference adds to the final bill. A trial is, by far, the most expensive part of the entire process.

A legal separation is often the path of least financial resistance. It solves the immediate need to live apart and formalize finances without kicking off the most expensive and draining phases of a marital dissolution.

Ultimately, every couple’s situation is unique. But for those who need space and legal clarity, a separation provides a structured and often far more affordable off-ramp from the marriage. If you’re weighing all your options, you may want to review our comprehensive guide on the full cost of divorce for an even deeper comparison.

What Drives Your Separation Costs Up or Down

The final bill for your legal separation isn’t a fixed price tag—it’s a dynamic figure that you and your spouse directly influence. Your choices and behaviors are the single greatest factor in whether the process is straightforward and affordable or a long, expensive ordeal.

Understanding the key variables that inflate or reduce your costs empowers you to make strategic decisions that protect both your financial future and your peace of mind.

The Biggest Cost Driver: High-Conflict Negotiations

The single greatest factor that inflates legal separation costs is conflict. When every decision becomes a battle, from dividing furniture to co-parenting schedules, you are essentially paying for every hour of disagreement.

Attorneys bill for their time. Protracted arguments mean more emails, phone calls, legal motions, and court appearances—all of which drive your bill higher and higher.

A simple dispute over a $5,000 asset can easily cost $7,500 in legal fees to resolve in a high-conflict setting. The financial logic is clear: cooperation is an investment, while conflict is a pure expense.

Common areas where conflict spirals out of control include:

- Child Custody and Support: Disagreements over parenting time, decision-making, or support calculations can lead to expensive expert evaluations and court hearings.

- Complex Asset Division: Splitting a family business, investment portfolios, or unique assets like art collections requires extensive negotiation and expert valuations, adding significant layers of cost.

- Spousal Support (Alimony): Debates over the amount and duration of spousal support are often emotionally charged and can dramatically extend the negotiation process.

How Cooperation Slashes Your Bill

Conversely, proactive cooperation is the most effective cost-reduction strategy available. When you and your spouse can approach the separation as a logistical challenge rather than a personal war, you sidestep the most expensive parts of the legal process.

An amicable approach keeps you out of the courtroom, which is where costs escalate most dramatically. Choosing a collaborative path like mediation over litigation is a prime example. To see the financial benefits, you can explore the differences between divorce mediation and litigation in our detailed comparison. This approach allows you and your spouse to work with a neutral professional to find common ground, saving immense time and money.

Other Key Factors Influencing Your Final Cost

Beyond the level of conflict, several other elements play a significant role in determining your final expenses. Being aware of these can help you plan and budget far more effectively.

Factors That Increase Costs:

- Disorganized Financials: If your attorney has to spend hours sorting through messy bank statements and investment records, you are paying a premium for administrative work that you could have done yourself.

- Hiding Assets or Income: Any attempt to conceal financial information will almost certainly be discovered, leading to expensive forensic accounting and potential court sanctions.

- Complex Financial Portfolios: High-net-worth couples with multiple properties, trusts, or business interests will naturally incur higher costs for valuations and expert analysis.

Factors That Decrease Costs:

- Pre-Separation Planning: Coming to the table with a clear grasp of your finances and a list of agreed-upon terms significantly streamlines the entire process.

- Using a Mediator: Hiring one neutral professional instead of two opposing lawyers is inherently more cost-effective for resolving any disputes that arise.

- Clear Communication: Being direct, honest, and responsive with your spouse and legal counsel reduces back-and-forth and prevents costly misunderstandings.

Ultimately, navigating the cost of a legal separation comes down to making smart, strategic choices. By focusing on cooperation and preparation, you can steer the process toward a resolution that is not only fair but also financially sensible.

Proven Strategies to Lower Your Legal Separation Bill

Understanding what drives up legal separation costs is one thing. Actually controlling them is another. The good news is you have significant power to lower the final bill without giving up your rights.

The secret is to stop thinking of it as an emotional battle and start treating it like a business negotiation. The strategies below are practical, actionable, and can save you thousands by focusing on smart preparation and communication.

Embrace Alternative Dispute Resolution

The single most expensive place to resolve your separation is a courtroom. It follows that the most effective way to cut costs is to stay out of one. This means making a serious commitment to methods like mediation or collaborative law.

In mediation, you and your spouse hire one neutral professional to help you find a middle ground. This mediator doesn’t make decisions for you; they facilitate a productive, guided conversation so you can reach an agreement yourselves.

Collaborative law is another powerful option. Here, you and your spouse each hire specially trained attorneys who sign an agreement not to go to court. The entire process is built on cooperation and creative problem-solving from day one.

Choosing mediation isn’t a sign of weakness—it’s a strategic financial decision. You’re choosing a controlled negotiation over an unpredictable and costly court fight.

Do Your Financial Homework First

Your attorney’s time is, by far, your biggest expense. Don’t pay their premium hourly rate to sort through shoeboxes of receipts or track down bank statements. The simplest way to save hundreds—or even thousands—is to gather and organize all your financial documents before your first meeting.

This preparation lets your attorney immediately grasp your financial landscape and jump straight into high-value strategic work.

Your Financial Document Checklist:

- Income Proof: Recent pay stubs, W-2s, and the last three years of tax returns.

- Asset Records: Statements for all bank, investment, and retirement accounts, plus property deeds.

- Debt Statements: Records for mortgages, auto loans, credit cards, and any other liabilities.

- Household Expenses: A clear breakdown of your monthly budget.

Walking in organized sends a powerful signal that you’re serious and prepared, setting a more efficient tone for the entire process.

Explore Unbundled and Flat-Fee Legal Services

The traditional “pay-a-huge-retainer” model isn’t your only choice. Many modern law firms now offer flexible fee structures that give you far more control over the cost of legal separation.

These alternative models provide cost certainty from the outset:

- Unbundled Services: Also called “limited scope representation,” this lets you hire an attorney for specific, isolated tasks. You might handle negotiations yourself but pay an expert to draft the final agreement or review a document from your spouse’s lawyer.

- Flat-Fee Arrangements: For less complex cases, some attorneys will charge a single, fixed price for the entire process or for completing a specific milestone. This completely removes the anxiety of the ticking clock and helps you budget with confidence.

Negotiate Smartly and Communicate Directly

Finally, your personal communication style can have a massive impact on your legal bill. Every email and phone call between lawyers adds up.

If you and your spouse can manage to communicate directly and respectfully about smaller issues—like who gets the Peloton—you can save your legal budget for the complex financial matters that actually require an expert. Avoid the temptation to use your attorney as an expensive messenger. Treating this like a business deal is the key to keeping your legal separation costs firmly under control.

Your Financial Preparation Checklist for Separation

It’s completely normal to feel overwhelmed right now. The best antidote to that anxiety is taking control, and that starts with getting organized. This checklist isn’t just a to-do list; it’s a strategic roadmap to turn uncertainty into purposeful action as you prepare your finances.

When you approach this process methodically, you’re not just giving yourself peace of mind—you’re actively working to lower the cost of legal separation. Handing your attorney a well-organized file instead of a shoebox full of papers saves them hours of work, which directly translates into money saved for you.

Step 1: Gather Your Essential Financial Records

Think of yourself as an archaeologist assembling the complete financial story of your marriage. Having these key documents ready from the very beginning will make every other step, from hiring your lawyer to negotiating terms, run smoother and faster.

- Income Documentation: Pull together the last three years of your federal and state tax returns, plus recent pay stubs for both you and your spouse.

- Asset Statements: Collect the most current statements for every financial account—checking, savings, 401(k)s, IRAs, brokerage accounts, you name it.

- Property Records: Find the deeds to any real estate, titles for all vehicles, and any professional appraisals you have for valuable items like art, antiques, or jewelry.

- Debt Information: Compile a list of every outstanding debt with recent statements. This includes mortgages, car loans, student debt, and all credit card balances.

Step 2: Create a Comprehensive Inventory

With your documents in hand, it’s time to build a master list of everything you own and everything you owe as a couple. This inventory is the absolute foundation for every property division discussion to come.

Your goal here is transparency and accuracy. A detailed and honest inventory prevents disputes down the road, which are one of the biggest drivers of high legal costs.

As you build your inventory, make sure you clearly distinguish between marital property (anything acquired during the marriage) and separate property (assets you owned before the marriage or received as a gift or inheritance). This distinction is a critical component of a fair settlement.

Step 3: Plan Your Post-Separation Budget

This is the moment you shift your focus from the past to the future. Creating a realistic budget for your new, single-household life is one of the most empowering things you can do for yourself right now.

- Estimate Your New Income: Start by calculating what your individual income will be without your spouse’s contribution.

- Project Your Expenses: Make a thorough list of all anticipated monthly costs: housing, utilities, transportation, food, insurance, everything. Be brutally realistic.

- Identify Financial Gaps: Compare your projected income with your projected expenses. This simple analysis is crucial for understanding what, if any, spousal or child support might be necessary.

- Set Aside Funds: Begin building an emergency fund specifically to cover your legal retainer and any unexpected costs that pop up during the separation.

By following this checklist, you’re doing more than just getting organized. You are taking strategic control of your financial future and setting yourself up for a far more efficient and less costly legal separation.

Common Questions About the Cost of Legal Separation

Even after breaking down the primary expenses, specific questions inevitably come up when you’re facing the financial reality of a legal separation. We’ve compiled direct answers to some of the most common concerns to help clarify the road ahead.

| Can I get a legal separation without a lawyer? | Does the cost of legal separation vary by state? | Is mediation always cheaper than hiring lawyers? | Are there hidden costs I should be aware of? |

|---|---|---|---|

| Technically, yes. This is called pro se representation. However, it’s only advisable for extremely simple cases—think a short marriage with zero shared assets and no children. For most, the risk of a poorly drafted agreement leading to future legal battles far outweighs the initial savings. | Absolutely. Geography is a major factor. Court filing fees are set at the state or county level and can differ by hundreds of dollars. More importantly, attorney rates in major cities like Los Angeles or New York are substantially higher than in smaller, rural communities. | Usually, yes. In mediation, you split the cost of one neutral professional instead of paying two separate attorneys to negotiate. The process keeps you out of the courtroom, where fees escalate quickly. But it only works if both parties are willing to cooperate in good faith. | Yes, several. Beyond attorney and court fees, be prepared for costs like refinancing the mortgage to remove a spouse’s name, preparing a QDRO ($500-$1,500) to divide retirement accounts, and the practical expenses of setting up a new household. |

Ultimately, being prepared for these variables is the key to navigating the process without costly surprises. Understanding both the obvious and the hidden expenses empowers you to make smarter financial decisions from the start.

Can I Get a Legal Separation Without a Lawyer?

Technically, yes, you can represent yourself—a path known as pro se. But this is a viable option only in the absolute simplest scenarios, like a very brief marriage with no children and no commingled assets or debts to divide.

For nearly everyone else, the risks are just too high. Family law is deceptively complex, and a flawed separation agreement can trigger major financial losses and future legal fights that end up costing far more than what you would have paid an attorney in the first place.

Does the Cost Vary Significantly by State?

Absolutely. The total cost of legal separation is heavily dictated by your zip code. Court filing fees are set locally and can easily vary by hundreds of dollars between different jurisdictions.

The bigger factor, though, is the cost of legal talent. An experienced family law attorney in a major metropolitan hub like New York or San Francisco will command a much higher hourly rate than a lawyer in a smaller, more rural town. This regional rate difference is one of the single biggest variables in your final bill.

Is Mediation Always Cheaper Than Hiring Lawyers?

Generally speaking, mediation is the more cost-effective route. It makes sense—you’re splitting the fee for one neutral professional rather than paying two separate legal teams to negotiate (and potentially litigate) on your behalf. This collaborative approach is designed to keep you out of court, which is where legal fees truly skyrocket.

However, mediation’s success hinges on good-faith cooperation. If both parties are committed to finding a middle ground, it’s an excellent way to save money. But if one spouse is uncooperative or the issues are just too contentious, mediation can fail. You’ll then have to hire lawyers anyway, having already spent time and money on a process that didn’t work.

While mediation is almost always less expensive than litigation, its ultimate cost depends on cooperation. A few productive sessions will be a bargain; multiple deadlocked meetings can still become a significant expense.

Are There Hidden Costs I Should Be Aware Of?

Beyond the big-ticket items like attorney retainers and court fees, a number of other expenses can—and often do—surface. It’s smart to budget for these potential “hidden” costs to avoid being caught off guard.

A few common examples include:

- Refinancing Costs: If one spouse keeps the family home, they will almost certainly need to refinance the mortgage to get the other’s name off the loan. This process comes with its own set of closing costs.

- QDRO Preparation: To divide retirement funds like a 401(k) or pension without incurring massive tax penalties, you need a special court order called a Qualified Domestic Relations Order (QDRO). Getting one drafted by a specialist can cost anywhere from $500 to $1,500.

- Post-Separation Expenses: Don’t overlook the very real costs of starting over. This includes everything from security deposits and utility connection fees to furnishing a new home from scratch.

Navigating the complexities of family law requires expert guidance. The Haute Lawyer Network connects you with premier attorneys across the country, selected for their professional excellence. Find the right legal partner to protect your interests by exploring our curated network.