When someone passes away, their assets don’t just automatically find their way to family members. Instead, the estate typically enters probate—a formal, court-supervised legal process designed to authenticate the deceased’s will and oversee the distribution of their assets.

Think of it as the final, official chapter in a person’s financial life, ensuring everything is settled correctly.

Unpacking the Purpose of Probate

Probate exists to create an orderly transition of wealth from one generation to the next, all under the watchful eye of the court. This structured process is what prevents fraud, settles legitimate debts, and makes sure the right people inherit what they’re supposed to.

Without it, there would be no legal mechanism to validate a will, appoint someone to manage the estate, or provide a clear title to assets like real estate. In the United States, the procedure involves validating the will, appointing an executor, inventorying assets, paying off creditors, and finally, distributing what remains. You can find more insights into estate planning trends and statistics at growlaw.co.

The Financial Audit Analogy

The best way to understand probate is to see it as the ultimate financial audit of a person’s life. The court acts as the lead auditor, verifying that every asset is accounted for and every legitimate debt is settled before any inheritance is distributed.

The executor—the person named in the will to manage this process—acts as the project manager, gathering all the necessary paperwork and carrying out the plan. This methodical approach is fundamental to legally finalizing the deceased’s financial affairs and protecting the interests of both heirs and creditors.

Probate serves as a necessary safeguard, providing a transparent and legally binding framework for settling an estate. It ensures that the decedent’s final wishes are carried out accurately and that all parties, from beneficiaries to creditors, are treated fairly under the law.

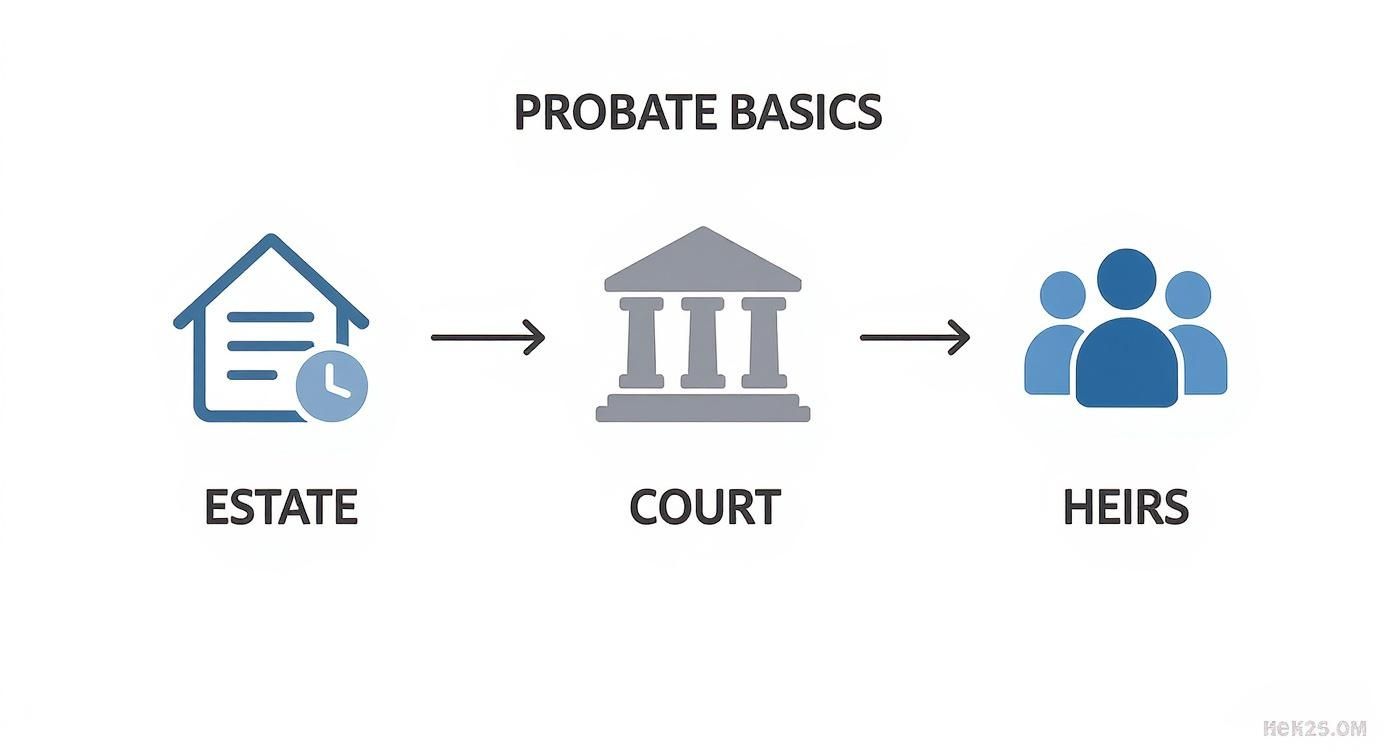

To give you a quick, bird’s-eye view, here’s a breakdown of the core components.

Probate At a Glance

This table summarizes the fundamental components of the probate process, giving you a quick reference for the core concepts.

| Concept | Brief Description |

|---|---|

| Purpose | To legally validate a will, pay the decedent’s debts and taxes, and distribute remaining assets to the correct beneficiaries or heirs. |

| Key Players | The Executor (or Administrator), beneficiaries/heirs, creditors, and the probate court judge. |

| General Timeline | Varies widely by state and estate complexity, typically ranging from six months for simple estates to two years or more for complex ones. |

| Trigger | The process begins when someone, usually the named executor, files the deceased’s will and a petition with the local probate court. |

This framework, while sometimes lengthy, is what brings legal finality to an estate, allowing beneficiaries to securely receive their inheritance.

Navigating the Step by Step Probate Process

At first glance, the probate process can feel like a daunting legal maze. But in reality, it’s a structured, logical sequence of events. Think of it less as a mysterious legal ritual and more as a formal project management plan, overseen by the court to ensure a person’s final affairs are settled correctly and transparently.

Each stage is a building block for the next, moving methodically from validating the will to finally getting assets into the hands of the rightful heirs. This court-supervised framework is designed to provide legal finality and protect everyone involved.

This visual guide breaks down the typical journey of an estate through the court system.

As the infographic shows, the court acts as the central hub, processing the estate’s assets before they can be legally transferred to beneficiaries.

Kicking Off the Process

The journey starts when the person named as the executor in the will files a petition with the local probate court. If there isn’t a will, a close relative usually takes this first step. They’ll need to submit the death certificate and, if one exists, the original will.

The court’s first order of business is to authenticate the will, confirming it meets all state legal requirements and is truly the final testament. This validation is critical—it establishes the legal authority of the document that will steer the entire process. If no will is found, the estate is considered “intestate,” and the court will rely on state law to determine who gets what.

Appointing the Personal Representative

With a validated will, the court formally appoints a personal representative to take charge. If the will names an executor, that person is typically approved unless they’re unable or unwilling to serve. In cases with no will, the court appoints an administrator, often a surviving spouse or adult child.

This individual receives a court document—usually called Letters Testamentary or Letters of Administration—granting them the legal power to act for the estate. They effectively become the estate’s CEO, tasked with gathering assets, paying bills, and keeping everyone informed.

The personal representative is a fiduciary, a role of immense trust and legal responsibility. They must manage the estate with complete diligence and impartiality, always acting in the best interests of the estate and its beneficiaries.

Inventorying and Valuing Estate Assets

Once officially appointed, the representative’s next major job is to conduct a thorough accounting of everything the decedent owned. This means finding, securing, and valuing every single asset.

- Real Estate: Homes, vacation properties, and commercial land.

- Financial Accounts: All bank, brokerage, and retirement accounts.

- Personal Property: Cars, boats, jewelry, art, and other valuables.

- Business Interests: Any ownership stakes in private companies.

Professional appraisers are often needed to determine the fair market value of these assets as of the date of death. This detailed inventory is the foundation for calculating taxes and ensuring a fair distribution. You can find a more detailed breakdown of this phase in this guide on how to probate a will.

Settling Debts and Paying Taxes

Before a single dollar can be passed to the heirs, the estate must pay its bills. The personal representative has to notify all known creditors and usually publishes a public notice to catch any unknown ones. State law gives these creditors a limited time to file a claim against the estate.

The representative carefully reviews each claim, paying off all legitimate debts using estate funds. They are also responsible for filing the decedent’s final income tax returns and, for larger estates, a federal estate tax return. Only when every last valid debt and tax liability has been settled can the remaining assets be distributed.

Distributing Assets and Closing the Estate

This is the final leg of the journey. The personal representative prepares a final accounting that details all the estate’s activities—every dollar in, every dollar out—and outlines the plan for distributing the remaining assets. This report goes to both the court and the beneficiaries for approval.

Once everyone signs off and the court gives its blessing, the representative can finally transfer titles, write checks, and hand over personal property to the heirs. With all assets distributed and receipts filed, the court issues a final order that officially closes the estate and relieves the representative of their duties. The probate process is now complete.

Who Is Involved and What Are Their Roles

The probate process isn’t a one-person show. Think of it more like a stage production with a specific cast of characters, each with a critical part to play in settling the estate. Understanding who these key players are and what they’re responsible for is fundamental to grasping how probate actually works.

Once you can put a name to each role—from the court-appointed manager to the people waiting to inherit—the entire process becomes far less intimidating. This clarity helps sidestep confusion and keeps things moving as they should.

Let’s meet the main participants you’ll encounter on the probate journey.

The Personal Representative: Executor or Administrator

At the heart of the action is the personal representative, the official title for the person legally in charge of managing the estate. You can think of them as the estate’s temporary CEO. If the deceased left a will, this person is the executor. If there was no will, the court steps in and appoints an administrator.

Despite the different titles, their core mission is the same: to act as a fiduciary. This is a legal term with serious weight, meaning they are bound by a duty of the highest care and loyalty to manage the estate’s assets for the sole benefit of the beneficiaries and creditors.

Their job is demanding and comes with a long list of duties, including:

- Securing the Assets: This means locating and safeguarding everything from real estate and bank accounts to personal valuables to prevent any loss.

- Keeping Meticulous Records: They must track every dollar in and every dollar out, creating an airtight financial record for the court and beneficiaries.

- Maintaining Open Communication: Keeping all involved parties in the loop about the estate’s progress is crucial for transparency and trust.

- Settling All Debts and Taxes: Before anyone inherits a dime, the personal representative must ensure all legitimate creditor claims and tax bills are paid in full.

The personal representative’s fiduciary duty is the absolute cornerstone of probate. It’s a legal and ethical mandate to act in good faith, avoid all conflicts of interest, and manage the estate with unwavering diligence.

Beneficiaries and Heirs

Next up are the beneficiaries and heirs—the people or organizations slated to inherit from the estate. A beneficiary is someone specifically named in a will to receive property. An heir, on the other hand, is a person entitled to inherit under state intestacy laws when there is no will, usually the closest living relatives.

While their role is mostly passive, they aren’t powerless. Beneficiaries and heirs have the right to be kept informed about the estate’s administration and can formally object in court if they believe the personal representative is mismanaging funds or failing to perform their duties properly.

Creditors and the Probate Court

You can’t forget the creditors. These are any individuals or companies the deceased owed money to. They have a legal right to file a claim against the estate for payment, and the personal representative is responsible for notifying them, vetting their claims, and paying all valid debts.

Overseeing this entire process is the Probate Court. The judge acts as the ultimate supervisor, resolving any disputes that arise, officially validating the will, and giving the final green light to close the estate. The court is there to ensure every step is followed to the letter of the law, bringing a final, legal conclusion to the decedent’s financial affairs.

Executor vs. Administrator: What’s the Difference?

A common point of confusion is the distinction between an executor and an administrator. While their duties are nearly identical, the key difference lies in how they get the job.

The table below breaks down the primary distinctions between an executor, who is named in a will, and an administrator, who is appointed by the court.

Executor vs Administrator Key Differences

| Aspect | Executor | Administrator |

|---|---|---|

| Source of Authority | Named in the decedent’s will. | Appointed by the probate court. |

| When They Serve | When there is a valid will. | When there is no will (intestacy). |

| Selection Basis | Chosen by the decedent. | Determined by state succession laws. |

| Court Document | Receives “Letters Testamentary”. | Receives “Letters of Administration”. |

Essentially, the executor is the decedent’s hand-picked choice, while the administrator is the court’s appointee, selected based on a legal priority list. Both, however, are granted their official power to act by the probate court.

The Real Story on Probate Costs and Timelines

When a family is grieving, the last thing they want is a long, expensive legal process. Yet, the two questions that inevitably come up are: “How long will this take?” and “What is this going to cost?”

Unfortunately, the answers aren’t simple. A straightforward estate with a clear will and cooperative heirs might wrap up in six months. But add in a few common complexities, and that timeline can easily stretch to a year or more. Setting realistic expectations from the start is crucial.

Why Probate Can Drag On for Years

So, what turns a six-month process into a two-year ordeal? It usually comes down to a few key factors. The biggest one is simply the complexity of the estate. An estate holding a single bank account and a home is worlds apart from one with business interests, properties in different states, and a valuable art collection.

But other issues frequently throw a wrench in the works:

- Will Contests: If a disgruntled family member challenges the will’s validity, everything grinds to a halt. The legal battle over the will must be resolved before anything else can move forward.

- Hard-to-Value Assets: How much is a private business or a portfolio of intellectual property worth? Getting accurate appraisals for unique assets like these takes time and specialized expertise.

- Missing Heirs: When an executor can’t locate a named beneficiary, they have a legal duty to conduct a thorough search, which can add months to the timeline.

- Disputed Debts: If the executor challenges a creditor’s claim against the estate, that dispute often ends up in court, causing significant delays.

The average probate process in the U.S. can take anywhere from six months to over two years. During this entire period, the estate’s assets are typically frozen, meaning beneficiaries can’t access their inheritance until the court gives the final green light.

A Realistic Breakdown of Probate Expenses

Beyond the timeline, the financial toll of probate can be staggering. These aren’t out-of-pocket costs for the family; they’re paid directly from the estate’s assets, shrinking the inheritance pool before it ever reaches the beneficiaries.

While the exact numbers vary by state and the size of the estate, the expenses fall into several predictable buckets.

Common Probate Expenses:

- Court Filing Fees: Just to get the process started, you’ll pay mandatory court fees that can run from a few hundred to well over a thousand dollars.

- Executor or Administrator Compensation: The person managing the estate is legally entitled to a fee for their time and effort, often set as a percentage of the estate’s value.

- Attorney Fees: This is almost always one of the largest expenses. Lawyers might charge a flat fee, an hourly rate, or a statutory percentage based on the estate’s size.

- Appraisal and Valuation Fees: Professionals must be hired to put a formal value on real estate, businesses, jewelry, and other major assets.

- Surety Bond: In many cases, the court will require the executor to purchase a bond to protect the estate against mismanagement or fraud.

- Miscellaneous Costs: Think postage, property maintenance, copying fees, and the cost of ordering official death certificates. It all adds up.

Recent data shows that total probate expenses can easily eat up as much as 10% of an estate’s total value, a massive reduction in what’s ultimately left for your loved ones. You can see more detailed probate statistics from Trust & Will. This makes understanding what is probate and how does it work more than just a legal exercise—it’s a critical financial matter for any family navigating an inheritance.

Strategies to Avoid or Simplify Probate

After understanding the probate process, one question inevitably comes to mind: can you get around it? For those with a well-considered estate plan, the answer is often yes. It’s entirely possible to sidestep the court-supervised process for most, if not all, of your assets.

This isn’t about finding obscure loopholes. It’s about using powerful, established legal tools to transfer assets directly to your beneficiaries, avoiding the delays, costs, and public nature of probate. These strategies ensure you, not the court, dictate how and when your legacy is distributed.

Harnessing the Power of a Living Trust

The revocable living trust stands as the cornerstone strategy for probate avoidance. Think of it as a private entity you create to hold title to your most significant assets—your primary residence, investment portfolios, and business interests. While you’re alive, you act as the trustee, maintaining complete control.

The magic happens upon your passing. Because the trust—not you personally—owns the assets, they fall outside your probate estate. Your successor trustee, whom you’ve pre-selected, steps in to manage and distribute the assets according to your private instructions. No court filings, no public record, just a seamless, private transition of wealth.

A living trust acts as a private rulebook for your estate, allowing assets to pass outside the court system. This saves your family significant time, money, and the stress of a public legal battle.

This method offers a level of privacy and control that a will simply cannot match. To learn more, this guide on what a living trust is and how it functions provides a detailed breakdown.

Utilizing Beneficiary Designations Strategically

Beyond a trust, other highly effective tools can keep key assets out of the probate court. These all revolve around a simple concept: legally designating who receives an asset automatically when you pass away. These are often called “will substitutes” because they operate entirely outside your will.

Effective Beneficiary Designation Tools:

- Payable-on-Death (POD) Accounts: You can add a POD designation to nearly any bank account. The funds are yours to control during your life. Upon death, your beneficiary just needs to present a death certificate and ID to the bank to claim the funds directly.

- Transfer-on-Death (TOD) Registrations: This is the equivalent of a POD designation for securities. By filling out a simple form with your brokerage firm, you name who inherits your stocks, bonds, and other investments without court intervention.

- Life Insurance and Retirement Accounts: Naming specific beneficiaries for life insurance policies, 401(k)s, IRAs, and annuities is fundamental. The proceeds are paid directly to your chosen individuals, completely bypassing the probate process.

It is absolutely critical to review these designations regularly, especially after major life events like a marriage, divorce, or the birth of a child. An outdated beneficiary can create unintended—and irreversible—consequences.

Establishing Joint Ownership of Property

How you hold title to real estate or financial accounts can also be a powerful probate-avoidance tool. The most common method is Joint Tenancy with Right of Survivorship (JTWROS).

When two or more people own property this way, the surviving owner automatically inherits the entire asset upon the death of the other. The transfer is immediate and legally binding, with no need for probate.

This is a very popular choice for married couples buying a home or opening a bank account together. While it offers a seamless transition for that specific asset, it’s vital to understand its limitations. It only covers jointly held property and gives the co-owner immediate rights, which may not be appropriate in all situations.

When to Hire a Probate Attorney

While it’s tempting to try and manage a simple estate yourself to save on legal fees, going it alone in the world of probate can be a costly mistake. The entire process is a minefield of strict deadlines, obscure procedural rules, and financial tripwires. Even one small misstep can lead to major delays, court-imposed penalties, or worse, personal liability for you as the executor.

The decision to hire a probate attorney usually hinges on two things: the estate’s complexity and the potential for family drama. Think of a lawyer as more than just a legal advisor; they are a neutral, experienced guide who ensures every detail is handled by the book—from notifying creditors to filing the final accounts with the court. Their expertise creates a critical buffer, significantly reducing your stress during an already overwhelming time.

Red Flags That Signal You Need an Expert

Some situations are practically guaranteed to complicate probate, making an attorney not just helpful, but absolutely essential. If you recognize any of the following scenarios, you should be on the phone with an experienced lawyer right away.

- Family Disputes: Any hint of conflict among beneficiaries or an outright threat to contest the will is a major red flag. You need a legal professional to manage the dispute and defend the estate’s integrity.

- Complex or Unusual Assets: An estate holding a family business, commercial real estate, or hard-to-value items like art and collectibles demands specialized handling. An attorney can coordinate the professional valuations and navigate the unique legal requirements.

- Significant Debts or Tax Issues: If the estate is saddled with substantial creditor claims or is large enough to trigger estate taxes, you need an expert. An attorney can negotiate with creditors and ensure all tax filings are handled correctly to avoid overpayment or penalties.

- Out-of-State Executor: When the personal representative lives in a different state, the logistical and legal hurdles multiply. A local attorney provides that crucial on-the-ground support to meet local court requirements.

Hiring a probate attorney is an investment in peace of mind. Their role is to shield the executor from liability, ensure legal compliance, and facilitate a smoother, more efficient settlement for all beneficiaries involved.

Understanding Attorney Fee Structures

One of the first questions people ask is, “How much will this cost?” Thankfully, probate attorney fees are paid from the estate’s assets—not out of the executor’s personal bank account. They typically use a few common fee structures.

Common Fee Arrangements:

- Hourly Rate: The attorney bills for the actual time they spend working on your case. This is common when the workload is unpredictable, like in a heated will contest.

- Flat Fee: For straightforward, uncontested estates, many attorneys will quote a single, all-inclusive fee. This gives you cost certainty right from the start.

- Percentage of the Estate: In some states, attorneys are permitted to charge a fee calculated as a percentage of the estate’s total value.

Knowing these options empowers you to ask the right questions during an initial consultation. Making an informed choice here helps protect the estate, sidestep costly errors, and ensure the final wishes of your loved one are honored exactly as they intended.

Common Questions About the Probate Process

As you get more familiar with the probate process, a few key questions always seem to pop up. Let’s tackle some of the most common ones to clear up any lingering confusion you might have.

Do All Assets Go Through Probate?

No, and this is a critical point of relief for many families. Not every single asset owned by the deceased gets pulled into the court-supervised process.

Certain assets are designed to bypass probate entirely, transferring directly to a new owner by legal designation. These are often called non-probate assets and include some usual suspects:

- Assets in a Living Trust: Property titled in the name of a trust is governed by the trust’s own rules, not the will.

- Jointly Owned Property: A house or bank account held as “joint tenants with right of survivorship” automatically belongs to the surviving owner. It’s a seamless transition.

- Payable-on-Death (POD) Accounts: Many bank accounts allow you to name a beneficiary. Upon death, that person can claim the funds directly, usually with just a death certificate.

- Retirement Accounts and Life Insurance: These are classic examples. The funds from IRAs, 401(k)s, and life insurance policies are paid straight to the beneficiaries listed on the account paperwork.

The only assets that must go through probate are those titled exclusively in the deceased’s name, with no beneficiary named.

What Happens if There Is No Will?

When someone passes away without a will, the law refers to this as dying “intestate.” This doesn’t mean the state gets to keep the money, but it does mean the court has to step in and follow a rigid, one-size-fits-all formula for distributing the assets.

Every state has its own specific laws of intestacy that lay out a clear hierarchy of who inherits. It usually starts with the closest relatives—the surviving spouse and children—and then moves outward to parents, siblings, and so on if no immediate family exists. The court will also appoint an administrator to manage the estate, whose job is virtually identical to an executor’s.

Can an Executor Refuse to Serve?

Absolutely. Being named an executor in a will is an honor, but it’s also a serious job with real legal and financial responsibilities. No one can be forced to take it on.

If the first person named as executor decides to decline, the court looks to the will for a successor or alternate. If the will doesn’t name one, or if that person also says no, the court will appoint an administrator, again following a priority list set by state law.

Being named an executor is a huge vote of confidence, but it’s also a massive legal and financial commitment. A person can formally renounce the appointment without penalty, which simply clears the way for the court to appoint someone else.

When family members can’t agree on who should take the reins, it can unfortunately spark disputes. You can get a better sense of how these disagreements play out by understanding what happens when a will is contested.

Is the Probate Process the Same Everywhere?

Not at all. While the core ideas are similar across the country, probate is governed by state law. This means the specific rules, deadlines, court fees, and required procedures can be dramatically different depending on where you are.

The process in Florida won’t look exactly like the one in California, and Texas will have its own unique quirks. It’s a localized affair, through and through.

Navigating complex legal matters requires expertise. For high-net-worth individuals and families seeking premier legal counsel, the Haute Lawyer Network provides a curated directory of the nation’s most respected attorneys. Connect with a top-tier professional who understands your needs at https://hauteliving.com/lawyernetwork.