When you start searching for an “estate planning attorney near me,” you’re doing more than just looking for a lawyer—you’re taking the first real step to protect your family’s future. In almost every case, your best bet is a local professional who lives and breathes your state’s specific laws and can offer guidance face-to-face. This isn’t just about getting documents drafted; it’s about building a long-term, trusted relationship with an advisor who is part of your community.

Why a Local Attorney Is Your Best Ally

Choosing an attorney for something as intensely personal as estate planning is a big deal. While those online document-in-a-box services might seem like a quick and easy fix, they completely miss the nuanced, expert advice you need for real-world situations. Estate law isn’t a one-size-fits-all federal system; it’s a complicated patchwork of state-specific statutes.

A local attorney brings an indispensable understanding of these regional legal details. For instance, the rules around probate, inheritance taxes, and how trusts must be structured can vary dramatically from one state to the next. An expert practicing in your city is navigating these exact legal frameworks every single day.

The Value of an In-Person Connection

Picture this: a blended family with kids from previous marriages, a jointly owned small business, and a few investment properties. This kind of situation demands sophisticated planning to head off potential conflicts and ensure every heir is treated fairly. A generic template from a website simply cannot account for these delicate family dynamics or the specifics of local business succession laws.

The real work of estate planning is ninety percent social work and only ten percent legal. It involves navigating complex family relationships, understanding personal values, and making difficult decisions—tasks best handled through direct, human conversation.

This is where a local professional truly proves their worth. Meeting in person allows you to build genuine rapport and trust, which is absolutely critical when you’re discussing sensitive family matters and laying out your financial life. It’s your chance to see if their communication style clicks with yours and to confirm they’re someone you’d be comfortable confiding in for years.

The table below breaks down the key advantages you get when you work with someone local.

Key Benefits of Hiring a Local Attorney

| Benefit | Why It’s Important for Your Estate Plan |

|---|---|

| State Law Expertise | They have a deep, practical understanding of your state’s specific probate, trust, and tax laws. |

| Personalized Strategy | An in-person meeting allows them to grasp the nuances of your family dynamics and financial situation. |

| Building Trust | Face-to-face interaction is crucial for establishing the long-term, confidential relationship estate planning requires. |

| Community Connections | Local attorneys often have relationships with local financial advisors, accountants, and court officials, which can be invaluable. |

Ultimately, a local attorney offers a level of personalized service and legal precision that remote, template-based services can’t match.

A Fragmented Market Works in Your Favor

The estate planning sector is a massive piece of the legal industry. In fact, projections show the broader estate lawyers and attorneys industry is on track to generate around $18.2 billion in revenue in 2025. What’s interesting is that no single company commands more than a 5% market share, which points to a healthy landscape of small and mid-size local practices.

This fragmentation is actually a huge plus for you. It means you have a wide variety of independent, specialized professionals right in your community to choose from. By understanding the core aspects of estate planning and probate, you can be much more strategic in selecting the right attorney for your specific needs.

Where to Begin Your Attorney Search

Googling “estate planning attorney near me” is a start, but it’s rarely the best way to find elite counsel. The most valuable introductions come from professionals who are already deeply familiar with your financial life.

Your financial advisor, accountant, or even your primary business attorney likely has a curated network of specialists they trust. These professionals have a vested interest in your long-term success and know from experience who is responsive, meticulous, and capable of handling a financial picture as complex as yours. When you ask for a referral, go deeper than just getting a name—ask why they recommend that specific person.

Leveraging Professional Directories and Associations

Beyond your immediate circle, certain legal associations serve as a powerful vetting tool for identifying credentialed experts. Start with your state and local bar associations, which maintain directories you can filter by specialty. This is a baseline check to ensure you’re only considering attorneys in good standing and licensed to practice in your jurisdiction.

For a higher benchmark of expertise, focus on attorneys who are members of highly selective, invitation-only organizations.

- American College of Trust and Estate Counsel (ACTEC): Membership is reserved for attorneys who have shown the absolute highest level of integrity, professional commitment, and expertise in the field. An ACTEC Fellow is a strong signal of top-tier counsel.

- National Association of Estate Planners & Councils (NAEPC): This organization grants the Accredited Estate Planner® (AEP®) designation to professionals who meet rigorous experience and educational standards.

These credentials aren’t just acronyms. They represent a serious, long-term dedication to the nuances of estate law. If you want to broaden your search, you can also find a lawyer who aligns with your needs through a curated professional network.

How to Interpret Online Reviews

Online reviews on platforms like Google, Avvo, and Yelp can offer clues, but you have to read between the lines. A string of perfect five-star ratings is far less insightful than the actual substance of the comments.

Look for recurring themes in the written feedback. Do multiple clients praise the attorney’s communication skills? Do they mention feeling that complex strategies were explained clearly? These specifics paint a much more vivid picture of the client experience than a simple star rating.

Pay special attention to comments about the firm’s process and the responsiveness of their team. Even negative reviews can be instructive—was the complaint about a minor miscommunication, or does it point to a more significant issue with legal competence or billing practices? A critical analysis of this feedback helps you build a shortlist of candidates with the right qualifications and the right approach to service.

Vetting Your Shortlist of Attorneys

You’ve done the initial legwork and have a few promising names. Now it’s time to move past the online profiles and find the right attorney for your family, not just any attorney with a law degree.

This part of the process is all about digging into the specifics. A lawyer who spends most of their days handling real estate closings might be able to draft a basic will, but they probably don’t have the specialized knowledge needed for complex family trusts or business succession.

Your first screening call is your chance to qualify their expertise before you commit to a full-blown consultation.

Asking the Right Screening Questions

This isn’t just about how long they’ve been practicing law. You need to understand where their professional energy is truly focused. Is estate planning their core business, or is it just something they do on the side?

Here are a few sharp questions to get to the heart of their specialty:

- “What percentage of your practice is dedicated exclusively to estate planning?” An answer of 75% or higher is a strong indicator of a true specialist. Anything less might suggest they’re more of a generalist.

- “Could you describe your experience with [mention your specific situation, like special needs trusts, business succession, or minimizing estate taxes]?” You’re listening for a confident, detailed response, not a vague, hand-waving answer.

- “Who will I be working with directly, and who is drafting the actual documents?” This is a crucial question. It tells you whether you’ll have the senior attorney’s attention or if your file will be passed down to a junior associate or paralegal.

A seasoned estate planning lawyer will not only expect these questions but welcome them. It shows you’re serious and have done your homework, which helps them see if you’re a good fit for their firm, too.

This initial chat acts as a powerful filter. It helps you quickly weed out the attorneys who don’t have the specific, relevant experience your family needs, saving you both time and money on consultation fees.

Keep in mind that a true specialist often commands a higher fee, but that’s a direct reflection of their deep expertise. In 2025, experienced estate planning attorneys in the U.S. can earn well over $175,000, with top-tier specialists for high-net-worth clients reporting incomes above $300,000. You can find more details on attorney salary trends and insights on Esquirex.com.

Decoding Fee Structures

Understanding how an attorney bills for their work is critical. Get this wrong, and you could be in for an unpleasant surprise. Most estate planners use one of two models.

| Fee Structure | How It Works | Best For |

|---|---|---|

| Flat Fee | You pay one set price for a defined package of services (e.g., a will, trust, and powers of attorney). | Anyone who wants cost certainty and a clear scope of work. This is the most common model for creating an estate plan. |

| Hourly Rate | You’re billed for the actual time the attorney and their staff spend working on your case, often in increments of an hour. | Complex or ongoing situations like estate administration (probate), where the total time needed is hard to predict upfront. |

When you get flat-fee proposals, make sure you’re comparing apples to apples. Ask for a detailed breakdown of exactly what’s included in the package. Does it cover the final document signing? What about funding the trust or a follow-up review in a year? Getting clarity on these details is the key to avoiding hidden costs later on.

How to Ace Your Initial Consultation

That first meeting with a potential estate planning attorney is much more than a simple meet-and-greet. Think of it as a two-way interview. You’re sizing them up just as much as they’re getting a handle on your situation. If you walk in prepared, you can turn a passive chat into a seriously productive session that gives you the clarity you need.

This is your chance to see if their expertise, communication style, and even the firm’s vibe align with what you’re looking for. A little organization upfront means you’ll walk out knowing exactly what they can do, what it will cost, and if they’re the right fit for your family.

Arriving Prepared with the Right Information

To get the most out of your time, you need to bring more than just a list of questions. Giving the attorney a snapshot of your financial and family life from the get-go allows them to offer specific, relevant advice right away. Don’t worry about perfect, down-to-the-penny figures—a solid overview is all you need.

Start by pulling together a simple inventory of your assets. This should include:

- Real Estate: Addresses and rough values for your home, any vacation properties, or investment real estate.

- Financial Accounts: Ballpark balances for checking, savings, brokerage accounts, and retirement funds like 401(k)s and IRAs.

- Business Interests: Basic details about any businesses you own, including your ownership stake.

- Significant Personal Property: Notes on high-value art, collectibles, or important family heirlooms.

This basic financial picture gives a potential estate planning attorney near me the context they need to start thinking strategically.

You’ll also want a list of key people. Jot down potential beneficiaries and anyone you’re considering for critical roles like executor, trustee, or guardian for your kids. And if you have any existing estate planning documents—no matter how old you think they are—bring them.

The most productive consultations happen when the client has done some preliminary thinking about their goals. It shifts the conversation from basic fact-finding to strategic problem-solving.

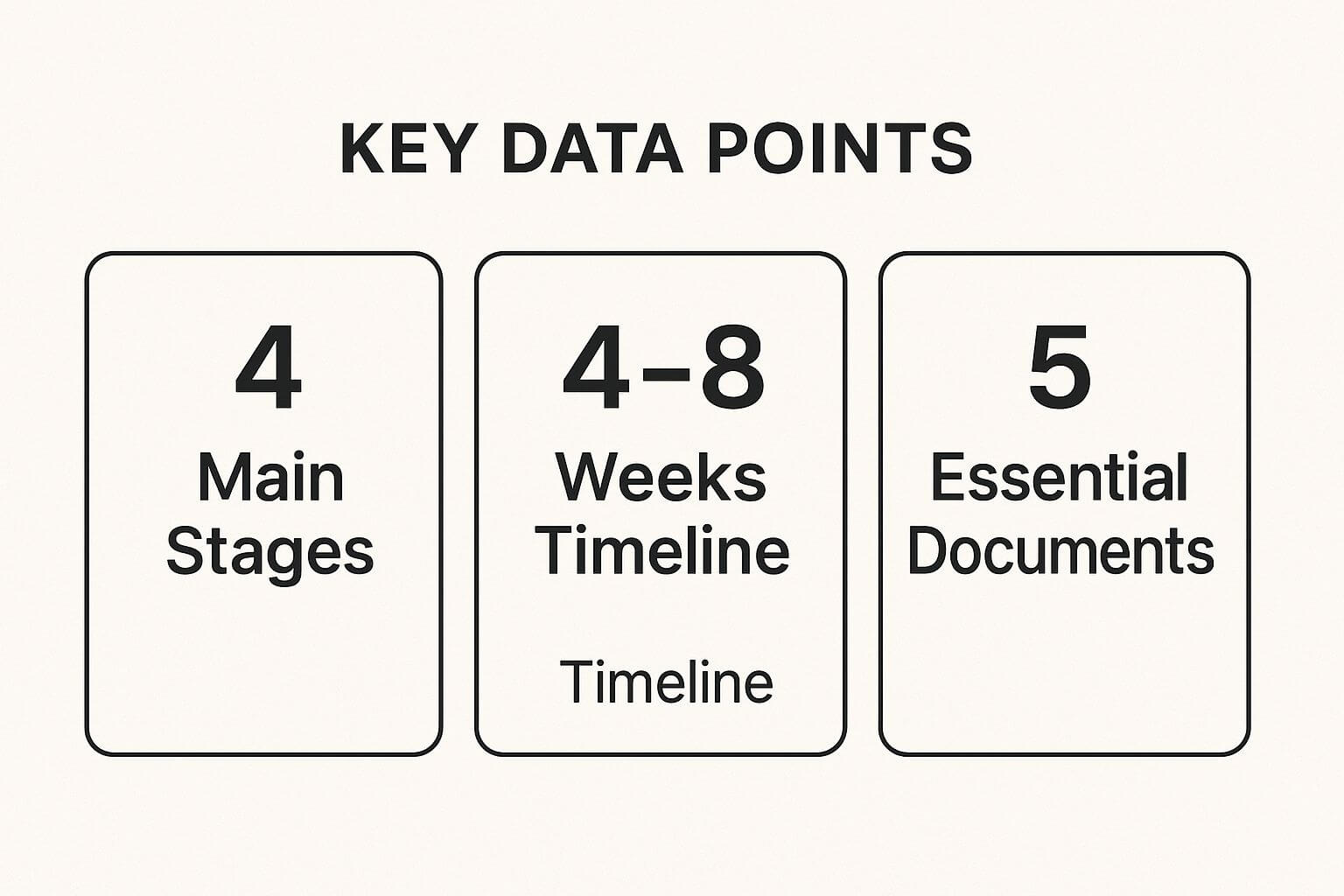

This infographic gives you a great high-level view of what the whole process looks like.

It breaks down the core stages, a typical timeline, and the key documents involved, giving you a clear roadmap from the very start.

To help you get organized, here’s a quick checklist to guide your preparation.

Consultation Preparation Checklist

| Document/Information to Prepare | Key Questions to Ask the Attorney |

|---|---|

| Informal list of major assets (real estate, accounts) | What is your process for keeping my plan current? |

| List of key people (beneficiaries, executor, guardians) | Who will be my main point of contact at the firm? |

| Copies of any existing wills or trusts | Can you describe your firm’s client communication style? |

| Notes on your primary goals (e.g., probate avoidance) | What are your fees, and is it a flat fee or hourly? |

| List of your most pressing questions | How do you handle clients with assets in multiple states? |

Using this checklist will ensure you cover all your bases and walk into the meeting feeling confident and in control.

Asking Insightful Questions That Reveal More

Once you’ve laid out your situation, it’s your turn to dig deeper. Go beyond the obvious questions about fees and credentials. The right questions can tell you a lot about an attorney’s process, how they manage client relationships, and their commitment to making sure your plan actually works long-term.

Try asking a few of these:

- “What is your process for keeping my plan current as laws and my life change?” A top-tier attorney won’t just react to changes; they’ll have a proactive system for regular check-ins.

- “Who will be my primary point of contact at the firm?” This is crucial. You want to know if you’ll be working directly with the senior attorney you’re meeting or if your file will be handed off to a junior associate or paralegal.

- “Can you describe your firm’s philosophy on client communication?” Their answer will tell you if they prefer scheduled calls, frequent emails, or formal in-person meetings. The key is finding a style that matches your own preferences.

By focusing on these areas, you’re not just evaluating their legal knowledge—you’re assessing their commitment to being a true advisor, not just someone who drafts documents and disappears.

Making the Final Choice with Confidence

You’ve done the legwork and met with your shortlist of attorneys. Now comes the most critical step: choosing your long-term legal partner. This decision goes far beyond simply picking the lowest bidder. It’s about synthesizing everything you’ve learned to find the absolute best fit for you and your family.

Think back through your consultations. Did one attorney have a knack for breaking down complex legal jargon into plain English? Who made you feel heard and respected, versus who seemed to be rushing you out the door? Your gut feeling here is incredibly important.

This isn’t a one-and-done transaction. You’re not just buying a stack of legal documents; you’re bringing on a trusted advisor who will guide you through some of the most personal and significant decisions of your life.

Weighing the Intangible Factors

While expertise and fee structures are easy to compare on paper, it’s often the “soft skills” that make or break this professional relationship. As you compare your options, think about these nuances:

- Personal Rapport: Did you genuinely connect with the attorney? This person is going to become intimately familiar with your family dynamics and finances, so a foundation of comfort and trust is non-negotiable.

- Communication Style: Does their way of communicating work for you? Consider how promptly and professionally they handled your first inquiry—it’s often a good indicator of what’s to come.

- Firm Culture: What was the vibe of the office? A welcoming, organized atmosphere matters. The support staff are a huge part of the client experience, so their professionalism counts, too.

Choosing an estate planning attorney near me isn’t just a transaction. It’s the start of a relationship that might span decades, adapting as your family and financial life evolve.

The growing demand for these services really highlights the need to find a dedicated professional. The estate planning market is projected to jump from $14.18 billion to $15.77 billion between 2024 and 2025 alone. This boom, driven by increasing asset ownership and longer lifespans, makes it even more crucial to select a firm that values long-term client relationships. You can explore more about these market trends on NatLawReview.com.

Understanding the Engagement Letter

Once you’ve made your choice, the firm will send over an engagement letter. Think of this as the formal contract that kicks off your professional relationship. Don’t just skim it—read every line carefully before you sign.

This document is the roadmap for your entire journey together. A well-drafted letter should clearly outline:

- Scope of Services: It will specify exactly what the attorney is going to do—drafting a revocable trust, a pour-over will, powers of attorney, etc. No ambiguity.

- Fee Agreement: It confirms the cost structure, whether it’s a flat fee or an hourly rate, and lays out the payment schedule.

- Timeline: It should give you a realistic estimate for how long the process will take from start to finish.

Reviewing this document thoroughly ensures there are no surprises down the line. It gives you the clarity and confidence to move forward, knowing you’ve found the right advisor to protect what matters most.

Common Questions About Hiring an Estate Attorney

Even after you’ve narrowed down your list and had a few initial conversations, some questions probably still linger. It’s completely normal. Diving into this process for the first time often brings up concerns about the investment, whether you really need a specialist, and what happens after the documents are signed.

Getting straight answers is the only way to move forward with real confidence.

A big one I hear all the time is whether a DIY online service is “good enough.” For the absolute simplest situations—maybe a single person with one bank account and no dependents—they might seem adequate. But they fall short where it matters most.

These platforms are tools, not advisors. They can’t legally provide personalized counsel, which is the entire point. They simply can’t account for the unique dynamics of blended families, business ownership, beneficiaries with special needs, or sophisticated tax strategies. A qualified estate planning attorney near me doesn’t just fill out forms; they build a legally sound strategy tailored to your life.

What Does a Typical Estate Plan Cost

It’s the first question on everyone’s mind, and the honest answer is: it depends entirely on your situation. The cost is driven by your location and the complexity of your family and financial picture. A straightforward plan with a basic will and powers of attorney might range from a few hundred to a couple of thousand dollars.

On the other hand, a comprehensive plan involving more sophisticated tools—like irrevocable trusts, business succession planning, or advanced strategies to minimize estate taxes—is a more significant investment. The good news? Most reputable attorneys offer flat-fee packages for the core documents. This gives you total cost clarity from day one, with no hourly surprises. Just make sure to ask for a detailed list of what’s included.

Think of proper estate planning not as an expense, but as an investment in your family’s security. The amount you spend now can save your loved ones exponentially more in potential legal fees, taxes, and heartbreaking family disputes down the road.

This investment is about protecting your assets and ensuring your wishes are carried out exactly as you intend, preventing the very chaos a weak plan can create.

How Often Should I Update My Estate Plan

Creating your estate plan isn’t a “set it and forget it” task. Life happens. Laws change, your finances evolve, and family dynamics shift. A good rule of thumb is to sit down with your attorney for a formal review every three to five years.

However, some events demand an immediate call to your attorney. You’ll want to update your plan right away after any major life transition, such as:

- A marriage or divorce

- The birth or adoption of a child or grandchild

- A significant change in your financial status (like an inheritance or selling a business)

- The death of a spouse, beneficiary, or someone you named as an executor

- Moving to a new state with different inheritance laws

Take a power of attorney, for instance. It’s a critical document if you become incapacitated, but the rules around it can be surprisingly complex. Understanding when a power of attorney expires and how life events can invalidate it is a perfect example of why these check-ins are so vital. Staying proactive ensures your plan actually works when you need it most.

Are you a top-tier attorney looking to elevate your brand and connect with an elite clientele? The Haute Lawyer Network is the premier marketing platform for legal professionals who want to stand out. Join our curated network to gain unparalleled visibility through Haute Living’s powerful media ecosystem. Learn more and apply at https://hauteliving.com/lawyernetwork.