An investment banker has been sued in a New York state court, with a lawsuit alleging he used his “celebrity status” and lied about having 5.4 million on hand to purchase a cannabis company based across the country.

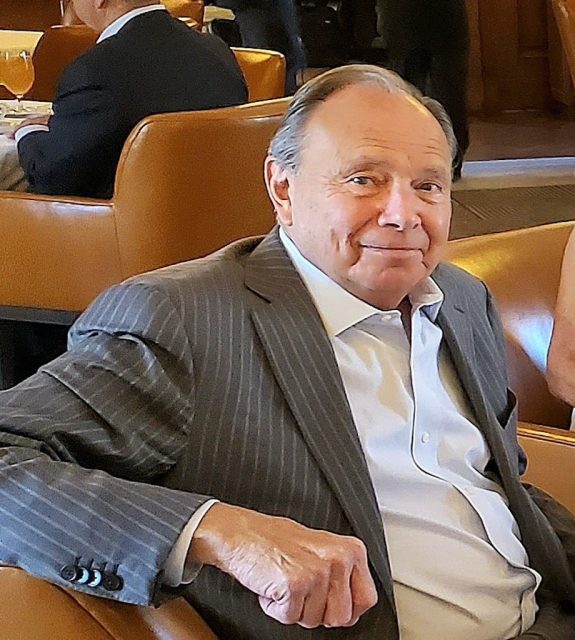

Reid Drescher, husband of Aviva Drescher of “The Real Housewives of New York City” and cousin of “The Nanny” star Fran Drescher, was sued by P&A Ventures LLC, a California-based cannabis company. His companies — Gateway Privileged Fund LLC, Cape One Management LLC, Hudsie Harver LLC and Spencer Clarke LLC — were also named as defendants.

“Touting his relationship with celebrities, including his cousin, Fran Drescher, the star of ‘The Nanny,’ and his wife, Aviva Drescher, of Bravo’s ‘The Real Housewives of New York,’ Reid Drescher claimed to have deep pockets and a roster of powerful business and celebrity connections that would propel [P&S Ventures] to the next level,” the complaint stated.

P&S claims that it refrained from engaging in opportunities with other investment groups based on Drescher’s misrepresentations, ultimately leading to the agreement to sell 15% to Gateway and 5% interest to Hudsie Harver at a “vast discount.”

P&S alleges the deal quickly went sour when Drescher and Gateway were unable to produce the promised $5.4 million.

“As Drescher was forced to admit, Gateway did not — as represented — have a pool of capital on hand sufficient to fund the entire $5.4 million investment. Instead, Gateway needed to go out and solicit capital from outside investors, which was not readily forthcoming,” the complaint stated.

As of the filing of the complaint, P&S says it has only received $1.3 million from Gateway and was forced into receivership. When the company finally emerged from receivership, it found a new investor willing to fund the needed amount, but the complaint says Reid Drescher attempted to block the transaction by claiming he had approval rights.

According to the filing, Drescher refused to grant approval unless Gateway and Hudsie Harver’s collective interest in P&S was increased to 40%, the $1.3 million capital contribution was returned, and P&S paid Gateway 70% of all distributions until it received $4 million. P&S says it refused to give in to such “rank extortion.”

“Although Gateway contributed only $1.3 million of a total $5.4 million in promised capital contributions — and did not come close to providing the company with the benefit of its bargain — Gateway claimed to have the full power and right to veto a critical funding opportunity, contrary to the interests of the company and its other members,” the complaint stated.

P&S says the debacle has been destructive to its reputation and harmed business, causing the loss of several valuable cannabis licenses as well as other growth and development opportunities.

Read more articles from Haute Lawyer, visit https://hauteliving.com/hautelawyer