The SEC announced they are moving forward with a complaint accusing a Massachusetts man of illegally selling $18 million in unregistered securities in the form of a useless crypto coin, then using the money to fund a lavish lifestyle.

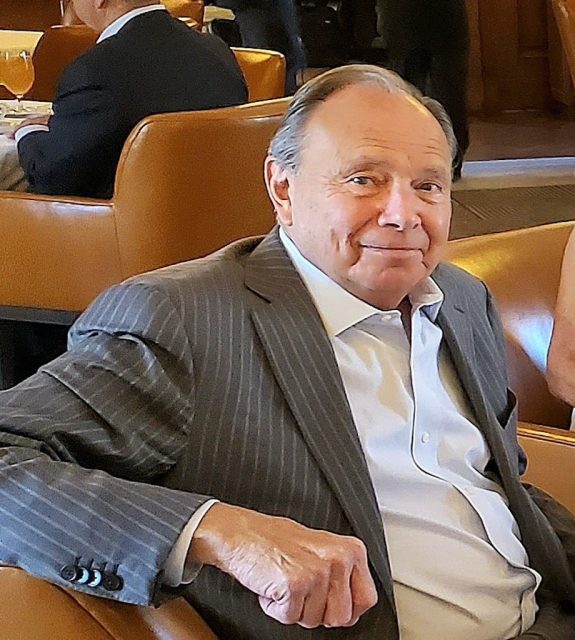

Steven K. Sprague allegedly persuaded more than 7,200 people to purchase his RvT token between June 2017 and September 2017. According to the unsealed civil complaint in Massachusetts federal court, Sprague did all of this without registering with the SEC or providing required disclosures to those investors.

Sprague claimed the offering would help scale the efforts of a tech company he was building called Rivetz, which aimed to use the tokens for identity authentication, and also promoted them as investments that would appreciate and could be resold as Rivetz grew, the SEC said.

“At the time of the offering, however, Rivetz did not have an operational product and the RvT token had no use,” the federal complaint says. “Token buyers could not purchase any goods and services using RvT tokens, and the tokens had no other use in any Rivetz product or service.”

According to cryptocurrency exchange Coinbase, there were more than 26 million RvT tokens in circulation worth a little over a penny apiece as of Wednesday.

Sprague argued the tokens were solely operational in nature, needed to record transactional metadata intended to figure into Rivetz’s larger system as it grew — noting it was never intended as a security.

“We believe there was functionality on day one,” he said. “And we also very strongly believe that if you take the sale agreement and read it, that there is no expectation of a profit. It’s articulated in the token sale agreement that it’s not a security.”

According to Sprague, when the SEC approached him about RvT in 2018, they were never able to reach a solution. This in turn resulted in his potential business partners fleeing and his company ultimately failing.

“They effectively put us out of business,” he said of the SEC, which he accused of “bullying” crypto firms.

Sprague did acknowledge that “he loaned” himself $2.5 million in Rivetz funds to buy a Cayman Islands home that dually served as a company headquarters. He cited high U.S. taxes as a reason for basing his business there, purchasing the property to fulfill the territory’s requirements that he demonstrate a substantial stake there.

He did not address the claims that he paid himself a $1 million bonus from company reserves.

“I appreciate the concern that everyone has that we’re on a lark on vacation in the Cayman Islands,” he told Law360.

The complaint is seeking a jury trial and wants Sprague to refrain from future violations of Securities Act prohibitions on selling unregistered securities, pay civil penalties and relinquish any ill-gotten gains.

Read more articles from Haute Lawyer, visit https://hauteliving.com/hautelawyer

Source: https://www.law360.com/articles/1419943/sec-says-crypto-startup-sold-18m-in-useless-tokens