When it comes to budgeting for a high-end renovation, your first step isn’t opening a spreadsheet. It’s about translating your vision into a rock-solid plan. This process is your best defense against the two things that sink projects: scope creep and unexpected costs. A well-thought-out plan turns vague ideas like a “chef’s kitchen” into a detailed brief that your design and build team can actually execute.

Before you can put a price tag on anything, you have to get crystal clear on what you truly want and need. This is less about picking out faucets and more about defining how you live. Will your new kitchen be the hub for large dinner parties? That points toward professional-grade appliances and maybe dual dishwashers. Is your primary bathroom meant to be a private sanctuary? Then a steam shower and radiant heat floors might be at the top of your list.

This clarity is the foundation of a realistic budget.

From Dreams to Tiers: Defining Your Priorities

This is where you’ll lean heavily on your architect or designer. A great professional will help you move beyond a simple wishlist and categorize every single element of your project into three practical tiers. This exercise isn’t just about organization; it’s about building a strategic framework for the tough decisions that inevitably come up.

Here’s how we break it down:

- Non-Negotiables: These are the absolute cornerstones of your project. Think big-picture items you won’t compromise on, like removing a structural wall to create an open floor plan, installing custom floor-to-ceiling windows, or integrating a sophisticated home automation system.

- Must-Haves: These are the high-priority features that give the project its luxurious feel. There might be some wiggle room here, though. For instance, natural stone countertops are a must, but you might be open to a stunning slab of high-end quartzite if the Calacatta marble you initially wanted pushes the budget too far.

- Nice-to-Haves: This is the fun stuff—the elements that would be wonderful but aren’t critical to the home’s function or core design. This could be a built-in wine fridge, a secondary prep sink in the island, or elaborate decorative millwork.

By defining these tiers upfront, you’re not just making a list; you’re creating a decision-making tool. When an unforeseen issue pops up (and it will), you won’t be making panicked choices. You’ll simply consult your plan and decide to sacrifice a ‘nice-to-have’ to protect a ‘non-negotiable.’

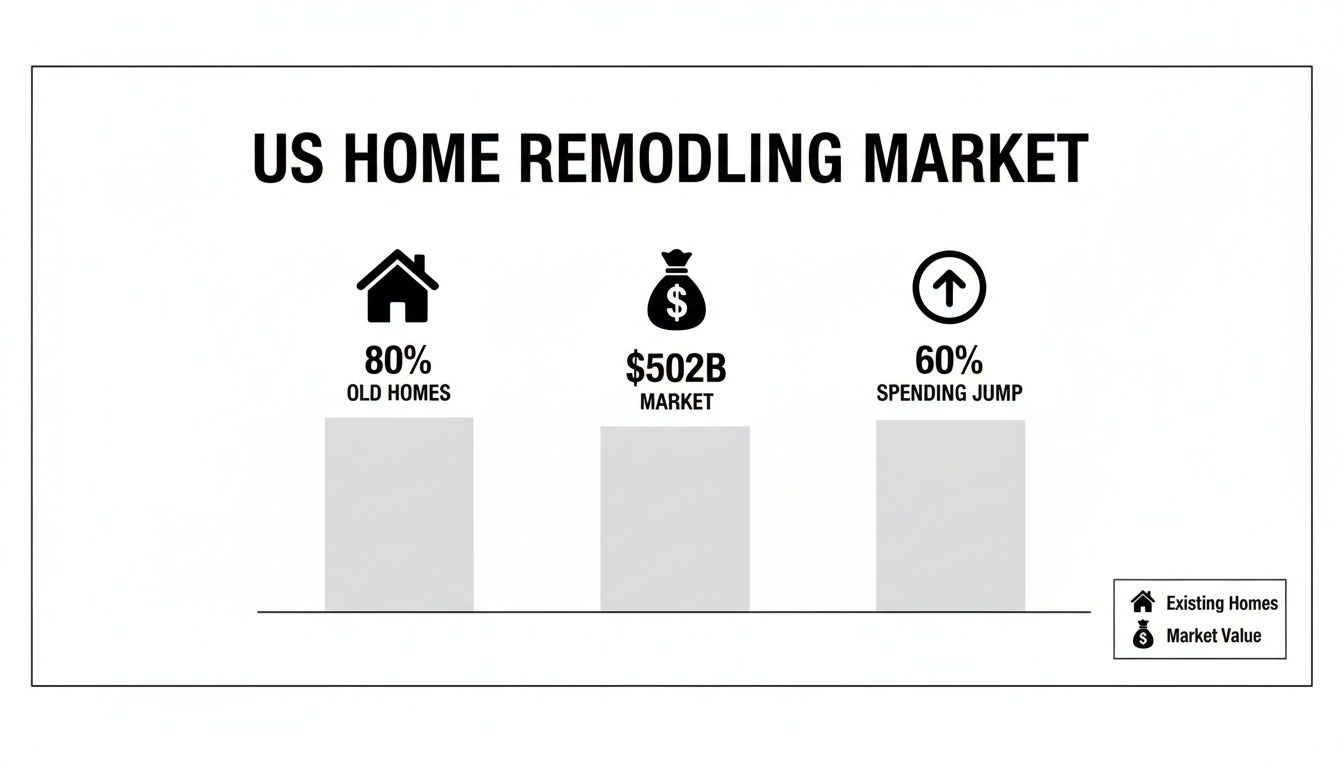

A Reality Check on the Market

It’s also crucial to understand the economic environment you’re building in. The U.S. home remodeling market has absolutely exploded, jumping from $277 billion in 2015 to $502 billion today. That’s an 82% increase.

A big driver is that over 80% of U.S. homes are now more than 20 years old, meaning many are due for major systems overhauls alongside aesthetic upgrades. In the luxury segment specifically, median annual spending has shot up 60% in just the last few years. This reflects the soaring costs for both high-end materials and the skilled labor required to install them.

This isn’t meant to be discouraging—it’s meant to reinforce why your initial planning is so vital. A meticulously defined scope gives you control and confidence in a competitive market. When you finally sit down to plan a remodel with your chosen professionals, this clarity ensures every dollar is spent on what matters most to you, turning your investment into a home you’ll love.

Developing a Detailed Line-Item Budget

Once you have a rough idea of the scope, it’s time to get granular. A ballpark figure is great for initial conversations, but a detailed, line-item budget is what gives you true command over your project’s finances. This is where you move from a wish list to a real, actionable plan, and it’s single-handedly the most empowering step in the process.

Think of it as the financial blueprint for your renovation. Every high-end project generally breaks down into five core cost centers. Knowing the typical weight of each one is the first step to building a budget that won’t fall apart under pressure.

- Professional Fees (10-20%): This is for your “brains trust”—the architect, interior designer, and engineers. Their expertise is an investment, not an expense, that saves you from far costlier mistakes down the line.

- Permits & Administrative Fees (1-3%): The necessary red tape. This covers municipal approvals, inspections, and other official costs you can’t avoid.

- Materials & Fixtures (30-40%): Often the biggest slice of the pie. This is everything from the studs behind the walls to the custom light fixture that becomes the room’s centerpiece.

- Labor (30-40%): The skilled hands that bring the vision to life. This includes your carpenters, electricians, plumbers, tilers, and painters.

- Contingency (15-20%): Your non-negotiable safety net. We’ll get into this more, but never, ever skip it.

Decoding the Cost of Quality Materials

In a luxury project, the “materials” line is where a budget can really take flight. The difference between a good result and an exceptional one is almost always in the quality and specificity of the finishes you choose, and your budget needs to reflect that reality.

Take kitchen countertops, for example. A beautiful, high-grade quartzite slab might run you $120-$180 per square foot, installed. But if your heart is set on a premium slab of Calacatta Gold marble with its dramatic, book-matched veining, you could easily be looking at over $250 per square foot. On a large kitchen island, that decision alone can swing the budget by $10,000 or more.

It’s the same story with cabinetry. High-quality semi-custom cabinets are fantastic, but true bespoke millwork—crafted by a local artisan to fit your space perfectly—can easily cost two or three times as much. You get a flawless fit and a one-of-a-kind finish, but it has to be accounted for, line by line.

To give you a clearer picture, here’s how the costs for a high-end kitchen renovation might break down.

Sample Line-Item Budget for a Luxury Kitchen Remodel ($150,000)

| Category | Item/Service | Estimated Cost | Percentage of Total |

|---|---|---|---|

| Professional Services | Interior Designer & Architect Fees | $22,500 | 15% |

| Structural Engineer (if needed) | $2,000 | 1.3% | |

| Cabinetry & Millwork | Custom, full-height cabinetry | $40,000 | 26.7% |

| Countertops | Premium Marble/Quartzite Slabs | $15,000 | 10% |

| Appliances | Pro-grade Range, Refrigerator, etc. | $25,000 | 16.7% |

| Plumbing & Fixtures | High-end Faucet, Sink, Pot Filler | $5,000 | 3.3% |

| Electrical & Lighting | Pendants, Under-cabinet, Sconces | $7,500 | 5% |

| Flooring | Hardwood or High-end Tile | $6,000 | 4% |

| Labor | GC, Demo, Install, Trades | $27,000 | 18% |

| Total | $150,000 | 100% |

This table illustrates how quickly costs add up when specifying premium materials and custom work, reinforcing the need for a detailed plan from the outset.

The Hidden Costs in Labor and Finishes

Specialized labor is another area where a detailed budget saves you from sticker shock. The more intricate the work, the more skill and time it requires—and that directly translates to higher labor costs.

A classic mistake I see is clients budgeting for the cost of the tile but not for the complexity of the installation. A simple running bond subway tile pattern is one thing. A detailed herringbone or mosaic pattern, on the other hand, can easily double the labor cost because of the precision, time, and waste involved in the cuts and layout.

As this infographic shows, the entire home remodeling market is heating up, which puts even more pressure on accurate and forward-thinking financial planning.

With a market this active, driven by an aging housing stock and a surge in homeowner investment, meticulous budgeting isn’t just a good idea—it’s essential for survival.

Smart home integration is another perfect example. Sure, installing a few smart thermostats is a fairly simple electrical task. But creating a fully integrated Crestron or Control4 system that manages your lighting, security, HVAC, and audiovisuals from a single interface? That requires a specialized technician and can add tens of thousands of dollars to both the labor and materials columns. You can learn more by exploring this comprehensive guide to estimating renovation costs.

Creating a line-item budget isn’t about limiting your vision. It’s about grounding it in reality so you can bring it to life without chaos. This financial map is what turns your abstract dreams into a concrete, executable plan, protecting your investment from start to finish.

Building a Financial Safety Net for Your Project

Here’s a truth I’ve learned from countless projects: no matter how airtight your plans seem, renovations always have surprises. This is doubly true for luxury remodels. The moment you open up a wall in an older home, you could find anything from faulty wiring to hidden structural damage.

Facing this reality isn’t about being pessimistic—it’s about being a savvy homeowner. Acknowledging the unknown is the first step in building a smart financial strategy. This is where your financial safety net comes in, which is actually two different tools: a contingency fund and project allowances. Knowing how to wield both is what separates a smooth project from a stressful one.

The Power of a Contingency Fund

First, let’s talk about the contingency fund. This is money you set aside exclusively for unforeseen problems. It is not a slush fund for upgrading your countertops at the last minute. Think of it as a disciplined reserve to handle the issues no one could have possibly predicted.

The rule of thumb in the industry is to budget 10-20% of your total construction cost for contingency. However, for a high-end renovation, especially in a historic or older home, I strongly advise aiming for the higher end of that range. I’ve even recommended 25% on complex projects. You’re just far more likely to unearth challenges like old knob-and-tube wiring or dry rot that has to be fixed before the beautiful new work can even begin.

Think of your contingency fund as project insurance. You hope you never have to use it, but you will be incredibly grateful it’s there when a problem pops up. Without it, one surprise discovery could force you to compromise on the very finishes you’ve been dreaming of.

Using Allowances to Control Finish Selections

While your contingency fund covers the unknowns, project allowances are for the undecideds. These are essentially budget placeholders for fixtures and finishes you haven’t chosen when you first sign the contract.

Your contractor will build allowances into the budget for items where costs can swing wildly depending on your final choice. It’s a way to keep the project moving forward while you finalize selections.

- Lighting Fixtures: Your budget might include a $5,000 allowance for all decorative lighting in the kitchen.

- Plumbing Fixtures: A $3,000 allowance could be set for the master bath faucets and shower system.

- Cabinet Hardware: A smaller $1,000 allowance might be planned for all the pulls and knobs on your custom cabinets.

The secret to making allowances work is ensuring they’re realistic from the start. This is where your designer is invaluable. Have them help you research the costs for the level of quality you actually want. Setting a low, unrealistic allowance is just kicking a budget problem down the road. It creates a false sense of security and leads to major sticker shock later. In fact, a recent survey found that 43% of homeowners who blew their budget pointed to the higher-than-expected cost of finishes as the culprit.

By combining a robust contingency fund with realistic allowances, you turn financial guesswork into managed risk. This two-part strategy gives you the structure and the breathing room needed to navigate the inevitable curves of a luxury remodel, protecting both your vision and your investment.

Getting Smart About Financing and Payments

Figuring out how to fund your luxury renovation is just as important as the design itself. While paying cash is straightforward and avoids interest, it’s not always the smartest move. Smart financing can be a powerful wealth management tool, preserving your liquidity and letting your capital continue working for you elsewhere.

For high-end projects, there are a few go-to financing vehicles. Each one serves a different purpose, and the best choice really hinges on your personal financial picture, the project’s timeline, and your comfort level with risk. Let’s break down the most common options so you can manage your cash flow like a pro.

Exploring Your Financing Options

When you’re looking at a substantial renovation, tapping into your home’s equity is usually the most effective route. The two most popular ways to do this are a Home Equity Line of Credit (HELOC) or a cash-out refinance.

- Home Equity Line of Credit (HELOC): Think of this like a credit card secured by your home. You get approved for a set amount and can draw funds as you need them during a “draw period,” only paying interest on what you actually use. Its flexibility is perfect for renovations where costs unfold over several months. The main thing to watch for is that most HELOCs have variable interest rates, which can add a bit of uncertainty.

- Cash-Out Refinance: With this, you replace your current mortgage with a new, larger one and pocket the difference in a lump sum. This can be a brilliant move if you’re able to lock in a lower interest rate than you have now. You get a large chunk of cash upfront at a predictable fixed rate.

For a completely new build or a major addition, a construction loan is another path. These are short-term loans specifically designed to cover building costs. The funds are typically released in stages, or “draws,” as the work hits key milestones.

How to Structure Payments with Your Contractor

Once you’ve got the funding sorted, you need to nail down the payment schedule with your team. I can’t stress this enough: never pay for the entire project upfront. A professional payment structure is always tied to project milestones. It protects you, and it protects your build team.

This schedule is a non-negotiable part of your contract. It ensures you’re only paying for work that has been completed to your satisfaction, which gives your team a powerful incentive to stay on schedule and deliver top-notch quality. A typical payment plan for a major renovation often looks something like this:

- 10% Initial Deposit: Paid when you sign the contract. This books your spot on their calendar and covers initial material orders.

- 25% After Rough-Ins: Due after demolition is done and the core work—framing, plumbing, electrical—has passed inspection.

- 25% After Drywall: Paid once the drywall is up, taped, and primed.

- 30% After Major Installations: Due after big-ticket items like cabinetry, flooring, and countertops are in place.

- 10% Final Payment: The last bit is held back until the final walkthrough is done and every single item on the “punch list” is completed to your satisfaction.

This structured approach is your best defense against project stalls and financial headaches. It creates a transparent system of accountability and ties your cash flow directly to real, tangible progress you can see and touch.

This kind of careful financial planning is more critical now than ever. Even with a shifting economy, U.S. homeowners spent a staggering $513 billion on home improvements in just the first quarter of this year. With median project spending hitting $24,000—a 60% jump since 2020—having a solid financing and payment plan is non-negotiable. The home improvement financing market itself has ballooned beyond $450 billion, showing just how many homeowners are using these tools to bring their visions to life. Read more about recent homeowner spending trends on AP News.

Keeping Your Budget in Check Once Construction Begins

The moment the first hammer swings, your budget shifts from a well-laid plan to a living, breathing thing. It’s no longer about forecasting; it’s about active management. The real success of a luxury renovation isn’t just in the numbers you start with, but in how you steward those funds throughout the chaos of construction. This is what separates a project that finishes on budget from one that becomes a cautionary tale.

This requires diligent expense tracking. It’s more than just logging receipts—it’s about real-time financial command. Whether you use a detailed spreadsheet or project management software, every invoice needs to be logged and checked against your original line items.

This constant vigilance is your early warning system. It flags where costs are starting to creep up, giving you the chance to make adjustments before a small overage snowballs into a major problem.

How to Handle Change Orders Without Blowing Your Budget

If there’s one thing that can derail a renovation budget, it’s the dreaded change order. A change order is just a formal amendment to the original contract, spelling out any new work or materials. They’re pretty much unavoidable in a complex project, but they don’t have to be budget-killers.

The trick is to have a disciplined process. Whenever a change is proposed—whether it’s your idea or your contractor’s—you must get it in writing. Insist on a document that details the exact cost and any schedule impacts before any work is approved. This simple step avoids those dangerous “we’ll sort it out later” conversations that almost always end in sticker shock.

A change order isn’t just a simple request; it’s a mini-negotiation. Don’t just sign off on it. Review it carefully with your designer to understand the full scope. I’ve seen a seemingly minor change to a wall location trigger major plumbing and electrical rerouting, adding thousands in unexpected costs.

To keep things under control, I always advise clients to bundle non-essential changes. Address them together at key milestones rather than one by one. This cuts down on the constant stop-and-start that inflates labor costs. If you want to really sharpen your skills here, this guide on how to negotiate with contractors and save thousands is an excellent resource.

Smart Spending for Maximum Return on Investment

While you’re managing the day-to-day spending, don’t lose sight of the long game: value. A luxury renovation is a significant investment in your property, and the smartest homeowners know where their money will work hardest to boost their home’s worth.

You’ll want to focus your premium spending on the projects with a proven history of delivering a high return on investment (ROI). Not every upgrade carries the same weight with future buyers.

- Elevated Curb Appeal: You never get a second chance to make a first impression. High-end landscaping, a custom front door, or professionally designed architectural lighting can deliver a surprising return.

- Seamless Outdoor Living: A beautifully designed deck, a covered patio with a fireplace, or a full outdoor kitchen is no longer a bonus—it’s an expectation in the luxury market. It extends your home’s functional living space.

- Next-Generation Efficiency: Think high-performance windows, modern HVAC systems, or top-tier insulation. These upgrades lower your carrying costs and are a huge draw for discerning buyers.

The following table provides a snapshot of where your investment can really pay off in the luxury space.

High-ROI Renovation Projects Comparison

A look at where your renovation dollars can create the most value upon resale.

| Project Type | Average Luxury Cost | Estimated ROI (%) | Key Value Drivers |

|---|---|---|---|

| Kitchen Remodel | $80,000 – $150,000+ | 60-75% | Pro-grade appliances, custom cabinetry, natural stone |

| Primary Bathroom Suite | $60,000 – $100,000+ | 55-65% | Spa-like features, large walk-in shower, luxury materials |

| Outdoor Living Space | $25,000 – $75,000+ | 50-70% | Functionality, integration with indoor space, premium finishes |

| Window Replacement | $15,000 – $40,000+ | 65-80% | Energy efficiency, improved aesthetics, noise reduction |

This data really highlights the value of strategic thinking. While a new coat of paint in a trendy color feels good in the moment, it’s the timeless, quality-driven upgrades that truly build long-term value. By actively steering your budget during the build and focusing on these high-impact areas, you ensure your project isn’t just beautiful, but also a sound financial decision.

Answering Your Top Renovation Budgeting Questions

Even the most meticulously planned budget is going to spark a few questions along the way. That’s perfectly normal. Getting comfortable with these financial nuances is what separates a stressful renovation from a successful one. Here are some of the most common questions we hear from clients embarking on a high-end project, along with some straightforward, practical answers.

What’s a Realistic Contingency Fund?

For luxury renovations, you really want to set aside 15-20% of your total construction cost for a contingency fund. I know the standard advice you often hear is 10%, but high-end projects are a different animal entirely. You’re dealing with custom materials that have long lead times, highly specialized labor, and often, older homes that are full of surprises.

Think of that larger buffer as your project’s insurance policy. It’s what keeps a discovery—like old wiring that’s not up to code or a hidden structural issue—from forcing you to compromise on the custom cabinetry or marble countertops you’ve set your heart on. In fact, if you’re renovating a historic home or a project with a lot of intricate details, don’t be surprised if your designer recommends pushing that contingency up to 25%. It’s just smart planning.

Where Do Hidden Costs Usually Come From?

Aside from the structural issues that are impossible to predict, the biggest budget-busters almost always stem from two things: change orders and what I call the “while we’re at it” effect.

A change order is any official deviation from the original blueprint, and every single one comes with added costs for materials, labor, and almost always, a delay in the timeline. The other culprit, that “while we’re at it” thinking, is more insidious. It starts with a small thought—”while we have the floors torn up, let’s just replace the ones in the hallway, too.” One-off decisions like that seem minor, but they can add thousands of dollars to your final bill before you even realize it. A hyper-detailed initial plan and the discipline to stick to it are your best defense.

How Do I Budget for Design Fees?

Your architect and interior designer fees are a crucial line item that needs to be in your budget from day one. These aren’t part of the construction costs, but they are a fundamental investment in getting the project right. Designers typically structure their fees in one of a few ways:

- Percentage of Project Cost: This is common for full-service design, usually falling between 10-20%.

- Fixed or Flat Fee: You agree on a set price for the entire scope of design work upfront.

- Hourly Rate: The designer bills for their time, which is often used for smaller-scale consultations.

Make sure you understand exactly how this is structured in your contract. It’s a significant figure, but a top-tier design professional pays for themselves by preventing expensive mistakes, opening up access to trade discounts, and ensuring the final result is cohesive and adds real value to your home.

Don’t think of design fees as a cost—think of them as risk mitigation. An expert is there to steer you away from a high-maintenance material you’ll regret or a fleeting trend. Those are exactly the kinds of mistakes nearly 45% of renovating homeowners report making.

Should I Pay with Cash or Finance the Project?

This is a deeply personal decision that comes down to your unique financial picture and long-term goals. Paying with cash is obviously the most straightforward route—no interest, no debt. Simple.

However, financing with a HELOC or a cash-out refinance can be a very strategic financial move. It allows you to keep your capital working for you in other investments that might be generating higher returns than the interest rate on your loan. This approach also keeps you liquid, which is always a good thing. Before you decide, have a serious conversation with your financial advisor to see which path aligns best with your overall wealth strategy.

At Haute Design, we connect discerning homeowners with the industry’s most esteemed design and build professionals. If you’re ready to create an extraordinary living space, explore our network of vetted experts. Find the perfect design professional for your project on Haute Design.